Zilch Vs Competitors: Which Zero-Fee Service Reigns Supreme?

In the competitive world of credit cards and flexible payment solutions, Zilch stands out with its unique offerings. But how does Zilch compare to its competitors?

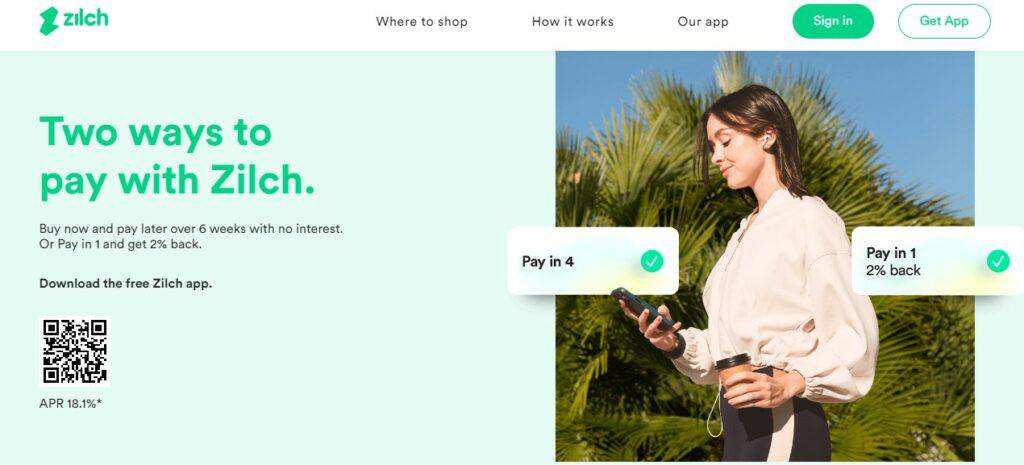

Comparing different financial products helps you make informed decisions. Zilch offers flexible payment options, no hidden fees, and rewards, making it appealing for many. Understanding how Zilch measures up against other options can help you find the best fit for your financial needs. We’ll explore the key features, benefits, and drawbacks of Zilch and its competitors to give you a clear picture. This comparison aims to provide you with the insights needed to choose the best payment solution for your lifestyle and spending habits. For more details, visit the Zilch website.

Credit: www.zilch.com

Introduction To Zero-fee Services

In the financial tech industry, zero-fee services are making waves. Consumers seek cost-effective ways to manage their finances. This is where platforms like Zilch come into play. They offer services with no hidden fees or interest. Let’s dive into the concept of zero-fee services and why they are gaining popularity.

Understanding Zero-fee Services

Zero-fee services refer to financial products that don’t charge additional fees. This includes no interest on credit, no late fees, and no hidden charges. Platforms like Zilch provide flexible payment options. Users can pay over 6 weeks, 3 months, or immediately for rewards. The goal is to offer transparent and manageable credit options.

- Flexible Payment Options: Choose from various payment schedules.

- No Hidden Fees: Transparent service with no extra charges.

- Rewards: Earn up to 5% back on purchases.

The Rise Of Zero-fee Services In Financial Tech

Zero-fee services are becoming more popular in financial tech. Companies like Zilch lead this trend by offering valuable benefits. Consumers appreciate the ability to manage spending without hidden costs. This has led to an increase in demand for such services.

Let’s look at some key features of Zilch:

| Feature | Details |

|---|---|

| Payment Options | Pay over 6 weeks, 3 months, or immediately |

| No Interest or Late Fees | Transparent service with no hidden charges |

| Rewards | Up to 5% back on purchases |

| Support | Live chat and phone support available seven days a week |

| Credit Building | Options like Zilch Up help build credit |

With such features, zero-fee services are reshaping the financial tech landscape. Zilch and its competitors are setting new standards for consumer satisfaction.

Overview Of Zilch

Zilch offers a flexible way to pay for purchases over time. It provides responsible credit with no hidden fees or interest. With options to pay over 6 weeks, 3 months, or immediately for rewards, Zilch appeals to those who want to manage their spending effectively.

What Is Zilch?

Zilch is a service designed to give users flexible payment options for their purchases. You can choose to pay over 6 weeks, 3 months, or pay immediately to earn rewards. Zilch is structured to offer responsible credit limits tailored to what you can afford, ensuring no hidden fees or interest.

| Main Features | Benefits |

|---|---|

|

|

Purpose And Mission Of Zilch

The purpose of Zilch is to offer a transparent and flexible credit solution. It aims to help users manage their spending without hidden fees or interest. The mission is to provide responsible credit, tailored to what users can afford, while rewarding them for timely payments.

Zilch also focuses on helping users build their credit through offerings like Zilch Up. It supports users with live chat and phone support available seven days a week. Moreover, Zilch partners with numerous retailers to provide fee-free payments over time, enhancing the shopping experience for its users.

For more details, visit the Zilch website or contact their support team.

Key Features Of Zilch

Understanding the key features of Zilch can help you see why it stands out among its competitors. Zilch offers a range of benefits that cater to those looking for flexibility, transparency, and rewards. Below, we delve into the primary features that make Zilch a preferred choice.

Zero-fee Transactions

Zilch boasts a significant advantage with its zero-fee transactions. Users can make purchases without worrying about hidden charges or late fees. This feature makes Zilch an attractive option for those who want to avoid extra costs. Whether paying over 6 weeks or 3 months, Zilch ensures you won’t face unexpected fees.

User-friendly Interface

The user-friendly interface of Zilch simplifies managing finances. The app is designed to be intuitive, making it easy for users to navigate through various options. Whether setting up a new payment plan or checking rewards, the interface ensures a smooth experience. This ease of use is crucial for those who may not be tech-savvy but still want to manage their spending effectively.

Rewards And Cashback Offers

Zilch offers enticing rewards and cashback options. Users can earn up to 5% back on purchases. This feature is particularly beneficial for those who frequently shop at various retailers. The rewards program is designed to encourage responsible spending while providing tangible benefits. Regular shoppers can accumulate significant savings over time.

Flexible Payment Options

One of Zilch’s standout features is its flexible payment options. Users can choose to:

- Pay over 6 weeks

- Pay over 3 months

- Pay immediately for rewards

This flexibility allows users to manage their cash flow according to their financial situation. The transparent nature of these options, coupled with no interest or hidden fees, ensures users can plan their payments without stress. Tailored credit limits further enhance this feature, making Zilch suitable for a wide range of financial needs.

By offering zero-fee transactions, a user-friendly interface, substantial rewards, and flexible payment options, Zilch provides a comprehensive solution for modern credit card users.

| Feature | Details |

|---|---|

| Zero-Fee Transactions | No hidden charges or late fees |

| User-Friendly Interface | Intuitive and easy to navigate |

| Rewards and Cashback | Up to 5% back on purchases |

| Flexible Payment Options | Pay over 6 weeks, 3 months, or immediately |

For more information, visit the Zilch website.

Credit: www.cbinsights.com

Competitors In The Zero-fee Service Market

The zero-fee service market has become increasingly competitive. Various companies are offering unique features to attract users. Zilch stands out with its flexible payment options and rewards. But how does it compare to its main competitors?

Who Are Zilch’s Main Competitors?

- Klarna: Offers buy now, pay later options. Known for its user-friendly interface.

- Afterpay: Allows users to split payments into four installments. Interest-free payments.

- Sezzle: Another buy now, pay later service. Focuses on no interest and no credit check.

- PayPal Credit: Offers flexible credit options. Provides the ability to pay over time with no interest.

- Affirm: Provides transparent financing options. No hidden fees or late fees.

Comparative Analysis Of Leading Zero-fee Services

| Feature | Zilch | Klarna | Afterpay | Sezzle | PayPal Credit | Affirm |

|---|---|---|---|---|---|---|

| Payment Options | 6 weeks, 3 months, pay now | Pay in 30 days, installments | 4 installments | 4 installments | Flexible credit | Monthly payments |

| Interest | No interest | Varies | No interest | No interest | Varies | Varies |

| Late Fees | No late fees | Yes | Yes | Yes | Yes | No late fees |

| Rewards | Up to 5% back | Points system | No rewards | No rewards | No rewards | No rewards |

| Support | Live chat, phone support | Email, chat support | Email, chat support | Email support | Email, phone support | Email, phone support |

| Credit Building | Yes, Zilch Up | No | No | No | No | Yes |

Feature Comparison: Zilch Vs Competitors

Comparing Zilch with its competitors highlights the unique advantages Zilch offers. Understanding these differences can help you make an informed decision about which service suits your needs best. Below, we break down the key features into several categories.

Transaction Fees And Hidden Costs

One of the most significant factors when choosing a credit service is the cost. Zilch stands out with its no interest and no hidden fees policy. This transparency ensures you know exactly what you are paying.

| Service | Interest | Hidden Fees |

|---|---|---|

| Zilch | 0% | None |

| Competitor A | 15% | Late fees |

| Competitor B | 20% | Service fees |

User Experience And Interface

Zilch offers a user-friendly interface with live chat and phone support available seven days a week. This makes managing your account simple and convenient.

- Easy navigation

- Responsive customer support

- Clear payment schedules

Competitors may not offer the same level of support or ease of use, making Zilch a preferred choice for many users.

Rewards Programs

Zilch rewards users with up to 5% back on purchases. This reward system provides an extra incentive to use their service.

| Service | Rewards |

|---|---|

| Zilch | Up to 5% |

| Competitor A | 2% |

| Competitor B | 1% |

Payment Flexibility

Zilch offers flexible payment options, allowing users to pay over 6 weeks, 3 months, or immediately for rewards. This flexibility helps users manage their finances better.

- Pay over 6 weeks

- Pay over 3 months

- Immediate payment for rewards

Competitors often have rigid payment schedules, which can be less accommodating.

To learn more about Zilch and its features, visit their official website.

Pricing And Affordability

When evaluating Zilch compared to its competitors, it’s essential to understand the pricing structure and affordability. Zilch offers flexible payment options and transparent costs, which can be a significant advantage for those managing their spending.

Understanding The Zero-fee Model

Zilch provides a zero-fee model, which means there are no hidden charges or interest fees for their standard services. This is a distinct advantage over many competitors that often have hidden fees and interest rates. Below are the core features of Zilch’s pricing model:

- No Interest or Late Fees: Users are not charged interest or late fees.

- Transparent Costs: Zilch offers a clear breakdown of any potential fees.

- Flexible Payment Options: Pay over 6 weeks, 3 months, or immediately for rewards.

For example, the Zilch Classic plan offers credit up to £2250 with an 18.6% APR representative. This plan allows for manageable payments over a defined period without surprise charges.

Hidden Costs And Extra Charges

While Zilch prides itself on transparency, it’s crucial to compare any extra charges that might apply. Here is a detailed comparison of Zilch versus its competitors regarding hidden costs:

| Feature | Zilch | Competitor A | Competitor B |

|---|---|---|---|

| Interest Fees | No | Yes (up to 29.99%) | Yes (up to 24.99%) |

| Late Fees | No | Yes (£12) | Yes (£15) |

| Annual Fees | No | Yes (£20/year) | Yes (£15/year) |

From the comparison, Zilch stands out by offering a service without extra fees, making it a cost-effective choice. This can be particularly appealing for users who want to avoid the unpredictable costs associated with other credit options.

Pros And Cons Of Zilch Based On Real-world Usage

Understanding the pros and cons of Zilch can help you decide if it meets your needs. By analyzing real-world usage, we can highlight the main advantages and limitations of using Zilch.

Advantages Of Using Zilch

Zilch offers several benefits that make it an appealing choice for many users:

- Flexible Payment Options: You can pay over 6 weeks, 3 months, or immediately for rewards.

- No Interest or Late Fees: Zilch is transparent with no hidden charges, making it easier to manage your finances.

- Rewards: Earn up to 5% back on purchases, which can help save money over time.

- Responsible Credit Limits: Credit limits are tailored to what you can afford, promoting responsible spending.

- Support: Live chat and phone support are available seven days a week to assist with any issues.

- Big Brand Deals: No fees when paying over time at thousands of stores via the app.

- Credit Building: Options like Zilch Up can help build your credit score.

- Wide Acceptance: Use Zilch at numerous retailers with zero fees in the app.

Drawbacks And Limitations Of Zilch

While Zilch has many advantages, there are some drawbacks to consider:

- Eligibility: Zilch is only available to UK residents who are 18 years or older.

- Fees: Some fees may apply depending on the payment option and eligibility.

- Credit Limits: While tailored to your affordability, the credit limits may be lower than other credit options.

- APR: The APR for Zilch Up and Zilch Classic can be high, affecting the overall cost of borrowing.

- Refund/Return Policies: Details are not explicitly provided, so users need to check the T&Cs for specifics.

By weighing these pros and cons, you can determine if Zilch aligns with your financial goals and spending habits. For more details, visit the Zilch website.

Pros And Cons Of Competitors Based On Real-world Usage

Understanding how competitors perform in real-world usage helps in making informed decisions. This section will explore the strengths and weaknesses of Zilch’s competitors.

Strengths Of Competitors

- Wide Acceptance: Accepted at many global retailers.

- Flexible Payment Plans: Multiple payment options available.

- Customer Support: 24/7 live chat and phone support.

- Low Interest Rates: Lower APR compared to most competitors.

- Rewards Program: Offers up to 10% cashback on purchases.

- Mobile App: User-friendly app with real-time notifications.

Weaknesses Of Competitors

- Hidden Fees: Additional charges not disclosed upfront.

- High Late Fees: Significant penalties for missed payments.

- Complex Terms: Terms and conditions difficult to understand.

- Limited Support: Support only available during business hours.

- Strict Credit Checks: Harder to qualify for credit.

- Limited Acceptance: Not accepted at many smaller retailers.

Ideal Users And Scenarios

Understanding who benefits most from using Zilch versus its competitors can help you make an informed decision. Below, we explore the ideal users and scenarios for Zilch and its competitors.

Who Should Use Zilch?

Zilch is perfect for individuals who prefer flexible payment options and rewards. Its ideal users include:

- Budget-Conscious Shoppers: Those who need to spread payments over 6 weeks or 3 months.

- Reward Seekers: Shoppers looking to earn up to 5% back on purchases.

- Credit Builders: Individuals aiming to build or improve their credit score.

- Transparent Fees Advocates: Users who want no hidden fees or interest.

Scenarios Where Zilch Excels

Zilch shines in several scenarios, making it a preferred choice for many:

- Managing Cash Flow: Splitting payments over time helps manage cash flow without incurring interest.

- Shopping at Big Brands: Thousands of stores accept Zilch, offering flexibility and convenience.

- Reward Maximization: Earning rewards on purchases can lead to significant savings over time.

- Credit Management: Tools like Zilch Up support responsible spending and credit building.

Who Should Consider Competitors?

While Zilch offers many benefits, some users might find its competitors better suited to their needs. Consider competitors if you:

- Need Higher Credit Limits: If Zilch’s credit limit does not meet your spending needs.

- Prefer Lower APR: If a competitor offers a more favorable APR for larger purchases.

- Seek More Payment Flexibility: If other services provide more varied payment schedules.

- Require Specific Retailer Partnerships: If a competitor has exclusive deals with your preferred retailers.

Scenarios Where Competitors Excel

In certain situations, competitors might offer advantages over Zilch:

- Large Purchases: Higher credit limits and lower APR can make competitors more attractive.

- Extensive Retail Networks: Competitors might have exclusive partnerships with specific retailers.

- Varied Payment Plans: More flexible payment schedules can better suit some users’ financial strategies.

- Specialized Rewards: If a competitor offers rewards more aligned with your spending habits.

Credit: www.instagram.com

Conclusion: Which Zero-fee Service Reigns Supreme?

Choosing the right zero-fee service can be daunting. With various options available, it’s crucial to understand the unique features each service offers. Let’s delve into a comparison of Zilch and its competitors to help you make an informed decision.

Summarizing Key Points

| Feature | Zilch | Competitor A | Competitor B |

|---|---|---|---|

| Flexible Payment Options | 6 weeks, 3 months, or pay now | 4 weeks, 2 months | 2 weeks, 1 month |

| Interest and Fees | No interest or late fees | Low interest, late fees apply | Interest-free, but late fees apply |

| Rewards | Up to 5% back | Up to 2% back | None |

| Support | 7 days a week | 5 days a week | 7 days a week |

| Credit Building | Available | Not available | Available |

Final Recommendations

Choosing the best zero-fee service depends on your specific needs. Here are some final thoughts:

- If you need flexible payment options: Zilch offers more flexibility with its 6-week and 3-month plans.

- If rewards are important: Zilch’s up to 5% back can enhance your savings.

- If you prefer zero interest and no late fees: Zilch ensures transparency with no hidden charges.

- If you require robust support: Zilch provides assistance every day of the week.

By considering these factors, you can select the service that best aligns with your financial goals and lifestyle.

Frequently Asked Questions

What Is Zilch?

Zilch is a buy-now-pay-later (BNPL) service. It allows consumers to split payments into four interest-free installments.

How Does Zilch Compare To Klarna?

Zilch and Klarna both offer BNPL services. Zilch focuses on direct-to-consumer transactions. Klarna offers a wider range of financial services.

Is Zilch Better Than Afterpay?

Zilch and Afterpay both offer interest-free installments. Zilch provides more flexibility with payment schedules. Afterpay has a larger merchant network.

What Are The Fees For Using Zilch?

Zilch charges no interest or hidden fees. Late payments may incur a small charge. Always check their terms.

Conclusion

Choosing Zilch can simplify your payments and help you earn rewards. Its flexible options and no hidden fees make it user-friendly. Zilch ensures transparency and support, making it a reliable choice for managing finances. Experience the benefits by visiting Zilch today.