Zilch Mobile App: Revolutionizing Your Financial Management

Are you looking for a flexible credit option without the burden of interest or late fees? Meet the Zilch Mobile App, designed to provide UK residents with a hassle-free way to manage their finances.

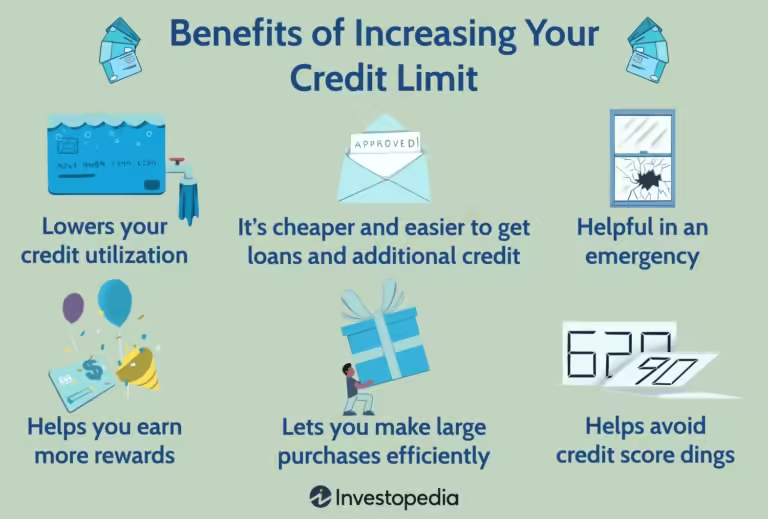

With credit limits up to £2250, Zilch offers various payment plans to suit your needs and even rewards you for spending. Zilch stands out in the crowded credit card market by offering no interest charges and no late fees. Whether you prefer to pay over six weeks, three months, or instantly for rewards, Zilch has you covered. Plus, with up to 5% back in rewards and the ability to “Hit Snooze” for extra days to pay, Zilch ensures flexibility and convenience. Support is available seven days a week, making financial management simpler than ever. Learn more about Zilch and how it can benefit you today by visiting Zilch.

Credit: ideausher.com

Introduction To Zilch Mobile App

The Zilch Mobile App offers a modern solution for managing credit with flexibility and rewards. Designed for UK residents aged 18 and over, Zilch stands out with its user-friendly interface and customer-centric features.

Overview Of Zilch Mobile App

The Zilch Mobile App provides flexible credit options and various payment plans. Users can choose to pay over six weeks, three months, or immediately to earn rewards. The app ensures no interest charges or late fees, making it a hassle-free experience.

| Feature | Details |

|---|---|

| Flexible Payment Options | Pay over 6 weeks, 3 months, or now for rewards |

| Credit Limits | Up to £2250 |

| Interest Charges | None |

| Late Fees | None |

| Rewards | Up to 5% back |

Purpose And Vision Of Zilch

Zilch aims to simplify credit management for its users. Its purpose is to offer a transparent and flexible credit service. By providing various payment plans, Zilch caters to different financial needs without hidden charges.

The vision of Zilch is clear: to empower users with better control over their finances. The app ensures that checking eligibility has no impact on credit scores. Additionally, users can access support seven days a week via live chat or phone.

In essence, Zilch strives to offer a seamless credit experience. With big deals and no fees at thousands of stores, Zilch is dedicated to making financial management easy and rewarding for its users.

Key Features Of Zilch Mobile App

The Zilch Mobile App is designed to help users manage their finances effortlessly. With its user-friendly interface and advanced features, Zilch makes financial management simple and effective. Let’s explore the key features that make Zilch stand out.

Expense Tracking: Keeping Your Finances In Check

The Zilch Mobile App offers a robust expense tracking feature. Users can track their spending habits in real-time. This helps to keep an eye on where every penny goes. The app categorizes expenses automatically, providing insights into spending patterns. Users can view detailed reports and summaries, making it easier to identify areas where they can save.

Budget Planning: Achieving Financial Goals

Setting and sticking to a budget is crucial. The Zilch Mobile App makes budget planning simple. Users can create customized budgets for different categories such as groceries, entertainment, and bills. The app provides visual aids such as graphs and charts to track budget progress. This helps users stay on track with their financial goals.

Real-time Notifications: Staying Informed

Staying up-to-date with your finances is essential. The Zilch Mobile App sends real-time notifications for various activities. Users receive alerts for transactions, due payments, and budget updates. This feature ensures that users are always informed about their financial status, helping them avoid overspending and missed payments.

Customizable Categories: Personalizing Your Financial Management

Everyone’s financial management needs are different. The Zilch Mobile App allows users to create customizable categories. Users can add, remove, or modify categories to suit their personal financial management style. This flexibility makes the app adaptable to individual preferences and needs.

Secure Data Encryption: Ensuring Privacy And Security

Security is a top priority for Zilch. The app uses secure data encryption to protect user information. All financial data is encrypted and stored securely, ensuring that user privacy is maintained. This feature provides peace of mind, knowing that personal and financial information is safe from unauthorized access.

Experience the convenience and security of managing your finances with the Zilch Mobile App. Whether you’re tracking expenses, planning a budget, or staying informed with real-time notifications, Zilch has got you covered.

Pricing And Affordability

Understanding the pricing and affordability of the Zilch mobile app is essential for making an informed decision. Zilch offers a range of credit options with no interest or late fees, making it an attractive choice for many. Let’s delve into the specific features and costs associated with Zilch.

Free Vs. Premium Features

Zilch provides a basic set of features that are available for free to all users. These include:

- Flexible payment options: pay over 6 weeks, pay over 3 months, or pay now for rewards

- No interest charges or late fees

- Up to 5% back in rewards

- Support available seven days a week via live chat or phone

In addition to the free features, Zilch offers premium features, which include:

- “Hit Snooze” option for extra days to pay (fees may apply)

- Higher credit limits up to £2250

- Exclusive deals and no fees for payments at thousands of stores through the app

Subscription Plans And Costs

Zilch offers three main subscription plans, each with different credit limits and APR rates:

| Plan | Credit Limit | APR Representative |

|---|---|---|

| Zilch Up | Up to £600 | 25.2% |

| Zilch Classic | Up to £2250 | 18.6% |

| Zilch X (Coming Soon) | Up to £2250 | 14.99% |

For example, with the Zilch Classic plan, a total spend of £495 with a 18.6% APR results in a total repayable amount of £500.30 over 6 weeks or 3 months. This transparency helps users make better financial decisions.

With its flexible credit options and no hidden charges, Zilch ensures customers have an affordable and hassle-free experience. Whether you choose the free features or opt for the premium plans, Zilch offers a solution that meets your needs.

Pros And Cons Of Zilch Mobile App

The Zilch Mobile App provides flexible credit options and payment plans without interest or late fees. Below, we explore the advantages and areas for improvement of using the Zilch Mobile App.

Advantages Of Using Zilch

- No interest charges or late fees: Users can enjoy the flexibility of credit without the burden of extra costs.

- Flexible payment options: Choose between paying over 6 weeks, 3 months, or immediately for rewards.

- Rewards: Earn up to 5% back on purchases, adding extra value to spending.

- Credit limits: Access up to £2250, offering substantial spending power.

- Support availability: Customer support is accessible seven days a week through live chat or phone.

- No impact on credit score: Checking eligibility does not affect your credit score, promoting a hassle-free experience.

- Big deals and no fees: Enjoy exclusive deals and no fees at thousands of stores via the app.

Areas For Improvement

- Limited to UK residents: Currently, only available to residents aged 18 and over in the UK.

- Fees for “Hit Snooze” option: Extra days to pay may incur fees, reducing flexibility.

- High APR on Zilch Up: The 25.2% APR for Zilch Up can be costly for higher credit limits.

- Upcoming features: Zilch X, offering a lower 14.99% APR, is not yet available.

- No clear refund policies: Lacks specific refund or return policies, placing responsibility on users to spend wisely.

| Feature | Details |

|---|---|

| Flexible Payment Options | Pay over 6 weeks, 3 months, or now for rewards |

| Credit Limits | Up to £2250 |

| Interest and Fees | No interest charges or late fees |

| Rewards | Up to 5% back on purchases |

| Support | Available seven days a week via live chat or phone |

Ideal Users And Usage Scenarios

The Zilch mobile app provides flexible credit options and payment plans. It is designed to help a variety of users manage their finances effectively. Below, we explore who can benefit from Zilch and the best scenarios for using this app.

Who Can Benefit From Zilch?

Zilch is ideal for UK residents aged 18 and over who need flexible credit options. The app suits individuals looking for hassle-free service with no hidden charges. Here are some groups who can benefit:

- Young Adults: Those starting their financial journey.

- Students: Need small, flexible credit with no interest.

- Small Business Owners: Require quick, short-term credit.

- Frequent Shoppers: Enjoy rewards and payment flexibility.

Overall, Zilch users can enjoy a credit limit up to £2250, with no interest charges or late fees, making it a versatile tool for many.

Best Scenarios For Using Zilch

The Zilch app is versatile and can be used in various scenarios. Here are some of the best scenarios for its use:

| Scenario | Description |

|---|---|

| Short-term Purchases | Split payments over 6 weeks or 3 months for ease. |

| Reward Maximization | Get up to 5% back on purchases, making spending rewarding. |

| Emergency Expenses | Utilize the “Hit Snooze” option for extra payment days. |

| Shopping at Partner Stores | No fees at thousands of stores through the app. |

Each scenario showcases the flexibility and benefits of using the Zilch app for various financial needs. Whether it’s for short-term purchases or maximizing rewards, Zilch offers a tailored solution for many situations.

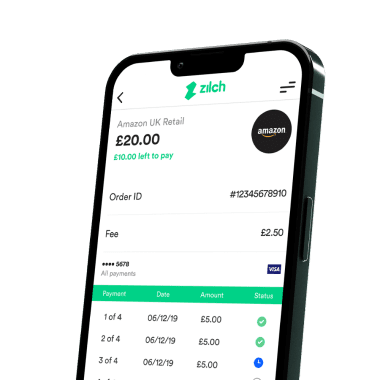

Credit: www.zilch.com

Credit: www.zilch.com

Frequently Asked Questions

What Is The Zilch Mobile App?

The Zilch Mobile App is a financial tool. It offers users a way to manage spending. You can buy now and pay later.

How Does Zilch Mobile App Work?

Zilch Mobile App allows users to shop online. You can split payments into four installments. It makes managing finances easier.

Is Zilch Mobile App Safe To Use?

Yes, Zilch Mobile App is safe. It uses secure encryption technology. Your personal and financial data is protected.

Can I Use Zilch Mobile App Internationally?

No, Zilch Mobile App is currently available in specific regions. Check their website for availability. They may expand soon.

Conclusion

Zilch makes managing finances easy and rewarding. With flexible payment plans, no interest charges, and up to 5% rewards, Zilch provides a hassle-free experience for UK residents. Whether you need to pay over six weeks or three months, Zilch offers options to suit your needs. Their support team is available seven days a week. Ready to explore Zilch’s benefits? Visit their official website for more information. Simplify your payments and enjoy rewards with Zilch.