Zilch Features And Benefits: Unlocking Zero-Fee Advantages

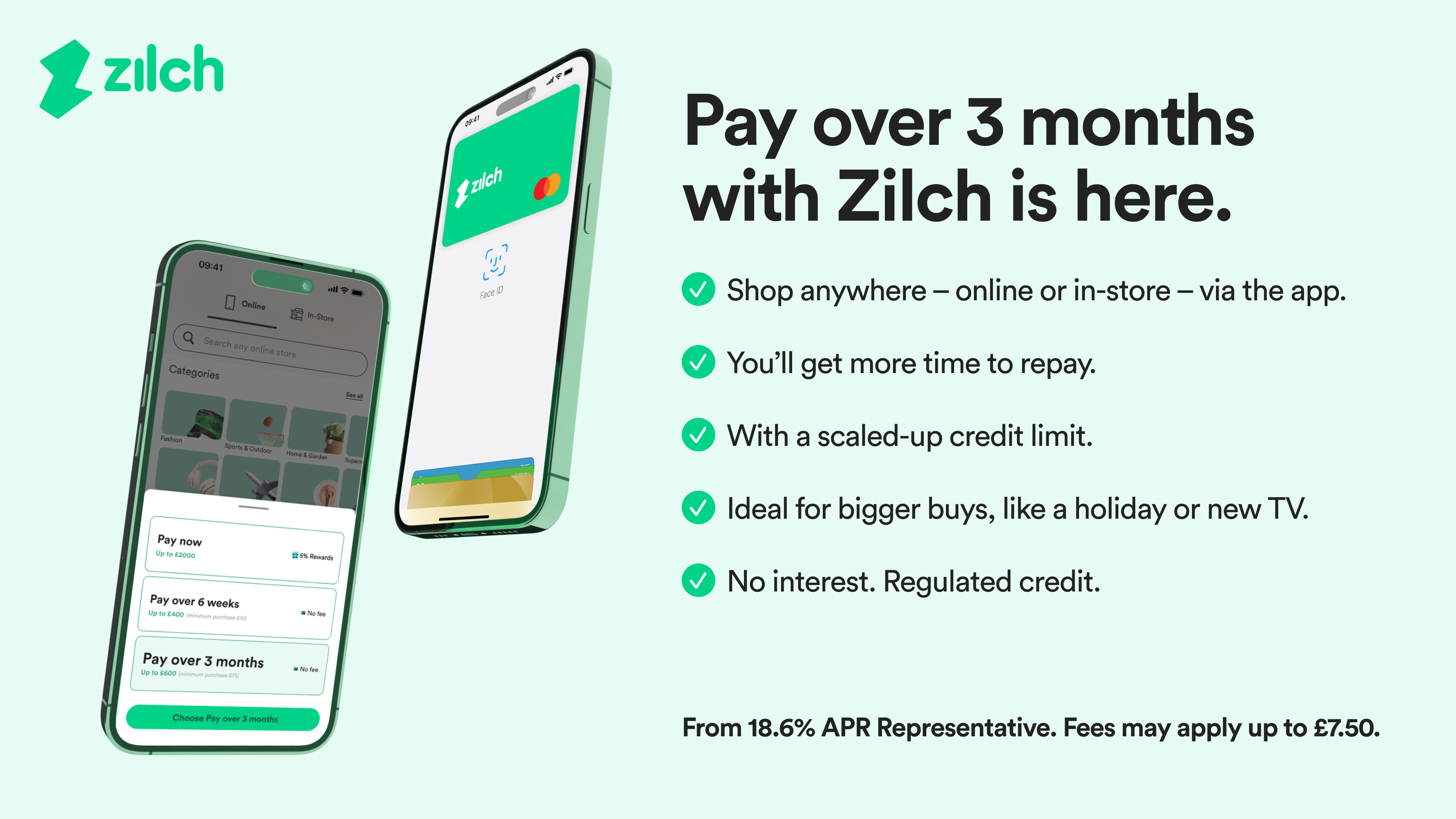

Zilch offers a flexible and innovative way to manage payments. It allows users to spread the cost of purchases over time while earning rewards and building credit.

Understanding the features and benefits of Zilch can help you make informed financial decisions. With no interest or late fees, you can choose from flexible payment plans tailored to your needs. Zilch’s transparent fee structure ensures you know exactly what to expect. You can earn up to 5% back in rewards on your purchases, adding value to every transaction. The customer support is readily available to assist you seven days a week, ensuring a seamless experience. Whether you aim to manage your spending or improve your credit, Zilch offers a responsible and rewarding solution. For more details, visit the Zilch website.

Introduction To Zilch

Welcome to the world of Zilch, where flexible payment solutions meet responsible credit management. Zilch offers customers the chance to spread the cost of purchases, earn rewards, and manage their credit with ease. Let’s delve deeper into what makes Zilch unique.

What Is Zilch?

Zilch is a platform that provides flexible payment options. Customers can choose to pay over 6 weeks, 3 months, or pay now for up to 5% rewards. The focus is on transparent, interest-free payments with no hidden fees or late charges.

Purpose And Vision Of Zilch

Zilch aims to empower customers with tools to manage their finances responsibly. By offering flexible payment plans and rewards, Zilch supports responsible lending and helps build credit. Their vision is to create a seamless shopping experience with financial flexibility and transparency at its core.

| Feature | Description |

|---|---|

| Flexible Payment Options | Pay over 6 weeks, 3 months, or upfront for up to 5% rewards. |

| No Interest or Late Fees | No hidden charges, though fees may apply. |

| Credit Building | Tools to manage purchases and build credit responsibly. |

| Customer Support | Available via live chat or phone, seven days a week. |

| Rewards | Up to 5% back in rewards on purchases. |

By understanding the core features and benefits, users can make informed decisions. For more information, visit the Zilch website.

Key Features Of Zilch

Zilch offers innovative features that make it a standout choice for managing purchases and credit responsibly. Here are the key features that make Zilch unique:

Zilch provides zero-fee transactions. This means no hidden charges, interest, or late fees. You can shop without worrying about unexpected costs.

With Zilch, you get interest-free credit options. Spread your payments over 6 weeks or 3 months without paying any interest. This helps in managing your finances effectively.

Zilch offers flexible payment plans. You can choose to pay over 6 weeks, 3 months, or pay now to earn up to 5% in rewards. This flexibility allows you to tailor your payment plan to your financial situation.

The user-friendly interface of Zilch makes it easy to navigate and manage your payments. Whether you are using the app or the website, the experience is seamless and intuitive.

Zilch ensures that all transactions are secure and private. Your financial information is protected, giving you peace of mind while you shop.

Zero-fee Transactions

One standout feature of Zilch is its Zero-Fee Transactions. This means you can make purchases without incurring any additional fees. Let’s delve deeper into how this feature works and its benefits.

How Zero-fee Transactions Work

Zilch offers a unique payment method that allows you to spread the cost of your purchases over time. You can choose to pay over 6 weeks, 3 months, or pay now for up to 5% rewards. The best part? There are no hidden charges. You can manage your payments through the Zilch app, ensuring you stay on top of your finances.

| Payment Option | Duration | Rewards |

|---|---|---|

| Pay Now | Instant | Up to 5% rewards |

| Pay Over 6 Weeks | 6 Weeks | Up to 5% rewards |

| Pay Over 3 Months | 3 Months | Up to 5% rewards |

Benefits Of Zero-fee Transactions

- No Interest or Late Fees: Avoid paying extra charges.

- Flexible Payment Options: Choose a plan that suits your needs.

- Rewards Program: Earn up to 5% back on purchases.

- Credit Building: Use tools to manage purchases and build credit.

- Transparent Fee Structure: No hidden fees, making it easier to budget.

Comparison With Traditional Credit Cards

Traditional credit cards often come with interest rates and late fees. Zilch, on the other hand, offers a more transparent and flexible approach. Let’s compare:

| Feature | Zilch | Traditional Credit Cards |

|---|---|---|

| Interest Rates | None | Varies (Often high) |

| Late Fees | None | Yes |

| Payment Options | Flexible (6 weeks, 3 months) | Monthly |

| Rewards | Up to 5% | Varies |

As seen, Zilch provides a more customer-friendly alternative. You can enjoy Zero-Fee Transactions while managing your finances responsibly. For more details, visit the Zilch website.

Interest-free Credit

Interest-free credit can be a valuable tool for managing your finances. Zilch offers flexible payment options without the burden of interest or late fees. Learn how this feature can benefit you and how to manage your finances effectively.

Understanding Interest-free Credit

Interest-free credit allows you to make purchases without paying interest. Zilch offers several plans:

- Pay over 6 weeks

- Pay over 3 months

- Pay now for up to 5% rewards

With these plans, you can manage your payments without worrying about hidden charges or late fees. This makes it easier to budget and plan your spending.

Advantages Of Interest-free Credit

Using interest-free credit has many benefits:

- No Interest or Late Fees: Enjoy peace of mind with no hidden charges.

- Flexible Payment Options: Choose a plan that suits your financial situation.

- Rewards Program: Earn up to 5% back in rewards on purchases.

- Credit Building: Tools to manage purchases and build credit responsibly.

These advantages help you save money and manage your credit effectively.

Managing Your Finances With Interest-free Credit

Here are some tips to manage your finances using interest-free credit:

- Plan Your Purchases: Before you buy, decide how you will pay.

- Track Your Spending: Keep an eye on your payments and rewards.

- Pay On Time: Avoid fees by paying according to your chosen plan.

- Use Customer Support: Reach out for help if you have questions or issues.

By following these tips, you can make the most of Zilch’s interest-free credit options.

Flexible Payment Options

Zilch provides a variety of flexible payment options that cater to your needs. Whether you prefer to spread costs over time or pay upfront for rewards, Zilch offers solutions to suit your financial situation.

Various Payment Plans

Zilch offers multiple payment plans to make shopping stress-free:

- Pay over 6 weeks – Spread the cost over six weeks with manageable payments.

- Pay over 3 months – Opt for a longer duration and pay over three months.

- Pay now – Pay upfront and earn up to 5% back in rewards.

These options provide the flexibility needed to manage your budget effectively.

Customizing Your Payment Schedule

With Zilch, you can customize your payment schedule to fit your financial situation. Simply select the plan that works best for you and adjust your payments accordingly.

| Plan | Duration | Benefits |

|---|---|---|

| 6 Weeks | Short-term | Manageable payments |

| 3 Months | Medium-term | Longer duration for larger purchases |

| Pay Now | Immediate | Up to 5% rewards |

Avoiding Late Fees And Penalties

One of the standout features of Zilch is the absence of late fees and penalties. This transparent fee structure ensures no hidden charges, making it easier to manage your finances without unexpected costs.

By choosing Zilch, you enjoy peace of mind and focus on making timely payments without the worry of additional fees.

Credit: www.zilch.com

User-friendly Interface

The Zilch app’s user-friendly interface ensures a seamless experience for all users. Its design focuses on simplicity and ease of navigation, making it accessible for everyone.

Navigating The Zilch App

The Zilch app features a clean and intuitive layout. The main menu is easily accessible, providing quick links to essential functions. Users can find payment options, rewards, and account details without hassle.

The app’s dashboard displays a summary of your account. This includes available credit, upcoming payments, and rewards. Navigation tabs at the bottom of the screen ensure smooth transitions between sections.

Features That Enhance User Experience

Zilch offers several features that enhance user experience. These include:

- Flexible Payment Options: Users can choose to pay over 6 weeks, 3 months, or pay now for up to 5% rewards.

- No Interest or Late Fees: Transparent fee structure ensures no hidden charges.

- Credit Building Tools: Helps manage purchases and build credit responsibly.

- Customer Support: Available via live chat or phone, seven days a week.

- Rewards Program: Earn up to 5% back in rewards on purchases.

Accessibility And Ease Of Use

The Zilch app is designed for accessibility and ease of use. It is available for download on Google Play and the Apple Store. The app supports various screen readers, ensuring usability for visually impaired users.

Additionally, Zilch provides customer support via live chat or phone. This ensures users can get help with any queries they might have. The app’s responsive design ensures it works well on different devices, enhancing overall user experience.

Secure And Private Transactions

In the digital age, security and privacy are paramount. Zilch ensures that every transaction is secure and private, providing peace of mind for its users. Let’s explore how Zilch keeps your data safe.

Data Encryption And Security

Zilch employs state-of-the-art data encryption techniques. This ensures that your personal and financial information stays secure. Encryption transforms your data into a code. Only authorized parties can access it.

Advanced security protocols further protect your information. These protocols guard against unauthorized access. Your data remains safe from potential breaches.

Protecting Your Personal Information

Zilch is committed to protecting your personal information. The platform uses stringent security measures. This ensures that your data is handled with the utmost care.

Strict privacy policies are in place. Zilch does not share your information with third parties. Your data is used solely to provide you with better services.

Peace Of Mind With Secure Transactions

Zilch provides peace of mind with its secure transactions. Each transaction undergoes rigorous security checks. This minimizes the risk of fraud and unauthorized activity.

Real-time monitoring helps detect any suspicious activity. You are promptly alerted if any unusual activity is detected. This allows you to take swift action and secure your account.

With Zilch, you can confidently manage your finances. Knowing your transactions are secure provides peace of mind. Choose Zilch for secure and private transactions.

Pricing And Affordability Of Zilch

Zilch offers a range of credit options to suit different needs. Whether you prefer to pay upfront or spread the cost over time, Zilch provides transparent and flexible solutions.

Cost Comparison With Competitors

Zilch stands out with its transparent pricing and no hidden fees. Let’s compare Zilch with other popular credit solutions:

| Product | Credit Limit | APR | Interest Fees | Late Fees |

|---|---|---|---|---|

| Zilch Up | £600 | 25.2% | None | None |

| Zilch Classic | £2250 | 18.6% | None | None |

| Zilch X | £2250 | 14.99% | None | None |

| Competitor A | £1000 | 24.9% | £20 per month | £12 per missed payment |

| Competitor B | £1500 | 21.5% | £15 per month | £10 per missed payment |

Analyzing The Value For Money

Zilch provides excellent value for money with no hidden fees and flexible payment options. Users can manage their purchases and build credit responsibly while earning rewards.

- Flexible Payment Plans: Choose between paying over 6 weeks or 3 months.

- No Interest or Late Fees: Transparent fee structure ensures no surprises.

- Rewards Program: Earn up to 5% back on purchases.

Compare this with other credit options that often have interest and late fees. Zilch’s approach is designed to be more affordable and user-friendly.

Affordable For All Users

Zilch caters to a wide range of users with its various credit plans:

- Zilch Up: Ideal for those starting with a credit limit up to £600.

- Zilch Classic: Suitable for moderate spenders with a limit up to £2250.

- Zilch X: Coming soon, offering competitive rates and higher limits.

These plans ensure that users from different financial backgrounds can access affordable credit. The responsible lending approach also helps in managing spending effectively.

Pros And Cons Of Zilch

Discover the pros and cons of using Zilch, a flexible payment solution that offers a range of benefits and features to help customers manage their finances more effectively.

Advantages Of Using Zilch

- Flexible Payment Options: Customers can choose to pay over 6 weeks or 3 months, or pay now for up to 5% rewards.

- No Interest or Late Fees: Zilch charges no hidden fees, making it easier to manage costs.

- Credit Building: Tools are available to help manage purchases and build credit responsibly.

- Customer Support: Support is accessible via live chat or phone, seven days a week.

- Rewards: Earn up to 5% back in rewards on purchases, providing added value for regular use.

Potential Drawbacks And Limitations

| Drawback | Description |

|---|---|

| Availability: | Only available to UK residents aged 18 and above. |

| Credit Limits: | Zilch Up offers up to £600 credit, which may be limited for some users. |

| APR: | APR rates vary, with Zilch Classic at 18.6% and Zilch X at 14.99% (coming soon). |

| Refund and Return Policies: | Not explicitly mentioned; typically follows the retailer’s policy. |

User Reviews And Feedback

Users have shared positive experiences with Zilch, highlighting the following:

- Convenient Payment Plans: Many appreciate the flexibility to choose payment plans that suit their needs.

- No Hidden Fees: Users are pleased with the transparent fee structure and absence of interest or late fees.

- Excellent Customer Support: The availability of support via live chat or phone is frequently praised.

- Rewards Program: Earning rewards for on-time payments is a significant benefit for many users.

However, some users have noted limitations, such as:

- Limited Availability: The service is restricted to UK residents only.

- Credit Limits: Some find the initial credit limits to be lower than expected.

Credit: www.zilch.com

Ideal Users And Scenarios For Zilch

Zilch offers flexible payment solutions designed to cater to a diverse range of users. Understanding who can benefit from Zilch and the best use cases can help potential users make informed decisions. Below, we outline the ideal users and scenarios where Zilch shines.

Who Can Benefit From Zilch?

Zilch is suitable for individuals and businesses looking for flexible payment options and rewards. Here are some groups that can benefit:

- Students: Students can manage their expenses with flexible payment plans without worrying about interest or late fees.

- Young Professionals: Ideal for those starting their careers and needing to build credit responsibly.

- Small Business Owners: Businesses can use Zilch to manage cash flow and earn rewards on purchases.

- Frequent Shoppers: Shoppers who want to earn rewards on their purchases and manage payments efficiently.

Best Use Cases For Zilch

Zilch’s features make it versatile for various scenarios. Here are some of the best use cases:

- Online Shopping: Spread the cost of purchases over weeks or months while earning rewards.

- Budget Management: Use Zilch’s tools to manage purchases and avoid hidden fees.

- Credit Building: Build credit responsibly with manageable credit limits based on affordability.

- Customer Support: Access support via live chat or phone for any queries, available seven days a week.

Recommendations For Different User Needs

Different users have unique needs. Here are our recommendations based on various requirements:

| User Type | Recommended Zilch Plan | Benefits |

|---|---|---|

| Students | Zilch Classic | Manageable credit limits, no hidden fees, flexible payments. |

| Young Professionals | Zilch Up | Credit building tools, rewards program, customer support. |

| Small Business Owners | Zilch X (Coming Soon) | Higher credit limit, lower APR, rewards on purchases. |

| Frequent Shoppers | Zilch Up | Up to 5% rewards, flexible payment options, no late fees. |

Credit: www.businesswire.com

Frequently Asked Questions

What Are The Key Features Of Zilch?

Zilch offers interest-free credit, virtual cards for online shopping, and flexible repayment options. The app integrates with major retailers and provides easy spending tracking.

How Does Zilch Benefit Users?

Zilch benefits users by offering interest-free payments, increasing purchasing power, and providing a seamless online shopping experience. Users can manage their finances better.

Is Zilch Safe To Use?

Yes, Zilch is safe to use. It employs advanced security measures and encryption to protect user data. The platform is regulated.

Can I Use Zilch For All Online Purchases?

Zilch can be used for many online purchases. It partners with numerous major retailers to provide a wide range of shopping options.

Conclusion

Zilch provides flexible payment solutions that suit your needs. You can spread the cost of purchases and earn rewards. With no hidden fees, managing your credit becomes easier. Zilch’s customer support is always there to help. Choose Zilch for a transparent and rewarding payment experience. Explore Zilch now and start managing your credit responsibly.