Zilch Credit Card Benefits: Unlock Financial Freedom Today

Credit cards can offer a range of benefits, from rewards to flexible payment options. The Zilch credit card stands out by offering unique features tailored for UK residents.

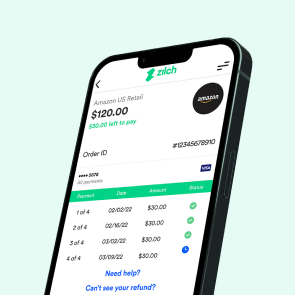

Zilch provides flexible payment plans, allowing customers to pay over time without interest or late fees. Users can choose from different plans to manage their finances responsibly. With Zilch, you can earn up to 5% in rewards on purchases, making it a smart choice for savvy shoppers. Additionally, Zilch offers credit limits based on what you can afford, ensuring responsible spending. To learn more about Zilch and its benefits, visit the official Zilch website. Discover how Zilch can help you manage your finances while earning rewards.

Credit: www.zilch.com

Introduction To Zilch Credit Card

The Zilch Credit Card provides UK residents with flexible payment options. It allows users to manage their finances responsibly and earn rewards with no interest or late fees. Below, we will explore the Zilch Credit Card in greater detail.

What Is Zilch Credit Card?

The Zilch Credit Card is a financial tool designed for UK residents. It offers flexible payment plans and helps users manage their spending. With Zilch, users can pay over time with no interest or late fees. The card also provides rewards on purchases, making it a beneficial option for many.

Purpose And Overview

The primary purpose of the Zilch Credit Card is to provide flexible payment options. It aims to support responsible financial management while offering rewards. Here is an overview of its main features:

- Flexible Payment Options: Pay over 6 weeks, over 3 months, or pay now to earn up to 5% in rewards.

- Responsible Credit Limits: Limits tailored to what you can afford.

- No Interest or Late Fees: No interest on payments and no late fees, though some fees may apply.

- Rewards: Earn up to 5% back in rewards on your purchases.

- Support: Customer service available via live chat or phone, seven days a week.

Let’s take a closer look at the benefits of the Zilch Credit Card:

| Plan | Credit Limit | APR |

|---|---|---|

| Zilch Up | Up to £600 | 25.2% APR Representative |

| Zilch Classic | Up to £2250 | 18.6% APR Representative |

| Zilch X (Coming Soon) | Up to £2250 | 14.99% APR Representative |

In addition to flexible payment plans, Zilch offers other advantages:

- Build Credit: Use Zilch Up to build credit with a limit up to £600.

- Higher Credit Limits: Zilch Classic provides a higher limit up to £2250.

- Extra Benefits: The upcoming Zilch X plan promises additional benefits.

- Hassle-Free Service: No hidden charges and easy to manage.

- Big Brands: Pay over time at thousands of stores with zero fees (fees may apply at other retailers).

Users can also rely on Zilch’s customer service, available via live chat or phone, seven days a week. To learn more about Zilch’s offerings, visit their website.

Credit: www.zilch.com

Key Features Of Zilch Credit Card

The Zilch Credit Card comes with several features designed to make your financial life easier. Below are the key features that make the Zilch Credit Card stand out.

No Annual Fees

The Zilch Credit Card has no annual fees, helping you save money each year. This is a great benefit for those who want to avoid extra costs associated with maintaining a credit card.

High Credit Limits

With the Zilch Credit Card, you can access high credit limits tailored to what you can afford. The Zilch Classic card offers a limit up to £2250, while the Zilch Up card provides a limit up to £600. This flexibility helps you manage your finances effectively.

Cashback And Rewards Program

Zilch offers an attractive cashback and rewards program. Earn up to 5% back in rewards on your purchases. This allows you to get more value for every pound spent, making it easier to save on future purchases.

Zero Foreign Transaction Fees

Travel with confidence using the Zilch Credit Card, which has zero foreign transaction fees. This feature is perfect for those who frequently travel abroad, ensuring you don’t incur extra costs when using your card internationally.

Robust Fraud Protection

The Zilch Credit Card comes with robust fraud protection measures to keep your financial information safe. These measures include monitoring for suspicious activities and providing customer support seven days a week to address any concerns.

Pricing And Affordability Of Zilch Credit Card

Zilch Credit Card offers a range of flexible payment options designed to meet various financial needs. Customers can manage their finances responsibly and avoid interest or late fees. Here, we will explore the costs associated with Zilch and how it compares to competitors.

Breakdown Of Costs

Understanding the different plans and associated costs is crucial for making informed decisions. Zilch offers three primary plans:

| Plan | Credit Limit | APR Representative |

|---|---|---|

| Zilch Up | Up to £600 | 25.2% |

| Zilch Classic | Up to £2250 | 18.6% |

| Zilch X | Up to £2250 | 14.99% (coming soon) |

All plans offer no interest on payments and no late fees, though some fees may apply depending on the retailer.

Comparison With Competitors

To understand the value of the Zilch Credit Card, let’s compare it with other popular options:

| Credit Card | Credit Limit | APR Representative | Interest Fees | Late Fees |

|---|---|---|---|---|

| Zilch | Up to £2250 | 14.99% – 25.2% | None | None |

| Competitor A | Up to £2000 | 19.9% | Applicable | Applicable |

| Competitor B | Up to £1500 | 22.4% | Applicable | Applicable |

As shown, Zilch offers competitive credit limits and lower APR rates. The absence of interest and late fees makes it more affordable for users. Zilch’s rewards program also adds extra value for customers.

Overall, Zilch stands out for its affordable pricing and flexible payment options, making it a viable choice for many.

Pros And Cons Of Zilch Credit Card

The Zilch Credit Card offers several features that make it a popular choice. But like any financial product, it has its advantages and drawbacks. Below, we explore these aspects in detail.

Pros: Benefits And Advantages

- Flexible Payment Options: Zilch allows you to pay over 6 weeks, 3 months, or immediately to earn up to 5% in rewards.

- No Interest or Late Fees: Enjoy interest-free payments and no late fees, though some fees may apply under certain conditions.

- Rewards: Earn up to 5% back on your purchases, making every transaction more rewarding.

- Responsible Credit Limits: Credit limits are tailored to what you can afford, promoting responsible spending.

- Build Credit: The Zilch Up plan helps build your credit, with limits up to £600.

- Higher Credit Limits: Zilch Classic offers higher credit limits up to £2250.

- Support: Customer service is available via live chat or phone, seven days a week.

- Big Brands: Use Zilch at thousands of stores with zero fees (some fees may apply at other retailers).

Cons: Potential Drawbacks

- Fees at Some Retailers: While many stores offer zero fees, some may charge additional fees.

- APR Variability: The APR varies across different plans – 25.2% for Zilch Up, 18.6% for Zilch Classic, and 14.99% for the upcoming Zilch X plan.

- Limited Availability: Zilch is available only to UK residents, limiting its reach to a global audience.

- No Detailed Refund Policies: There are no detailed refund or return policies provided, which could be a concern for some users.

Ideal Users For Zilch Credit Card

The Zilch Credit Card offers a range of benefits that make it ideal for various users. This card is designed to cater to those who seek flexible payment options, responsible credit limits, and rewarding benefits. Let’s explore who will benefit most from using the Zilch Credit Card and the best scenarios for its use.

Who Will Benefit Most?

- Young Adults: Young adults looking to build credit responsibly will find Zilch Up with its limit up to £600 beneficial. This plan helps manage finances without the risk of high debt.

- Shoppers: Frequent shoppers can benefit from the rewards program, earning up to 5% back on their purchases. This makes everyday spending more rewarding.

- Budget-Conscious Individuals: Those who prefer to avoid interest and late fees will appreciate Zilch’s no-interest payment plans and absence of late fees.

- Professionals: Professionals seeking higher credit limits can opt for Zilch Classic or the upcoming Zilch X plan. These plans offer limits up to £2250, suitable for managing larger expenses.

Best Scenarios For Use

The Zilch Credit Card can be particularly useful in several scenarios:

- Making Large Purchases: Use the card to pay for large items over time without interest, easing the burden on your monthly budget.

- Regular Shopping: Earn rewards on everyday purchases, making your spending work for you.

- Building Credit: Zilch Up is perfect for those starting to build their credit history. Manageable limits and responsible lending practices help you build a solid credit foundation.

- Managing Finances: With no hidden fees and clear terms, Zilch helps you keep track of your finances easily and avoid unexpected costs.

In conclusion, the Zilch Credit Card is a versatile tool for a wide range of users, offering flexible payment options, rewards, and responsible credit limits to suit different financial needs.

Credit: scrimpr.co.uk

Frequently Asked Questions

What Are The Key Benefits Of Zilch Credit Card?

Zilch Credit Card offers zero interest rates on purchases. It provides cashback rewards on every transaction. The card has no annual fees.

How Does Zilch Credit Card Cashback Work?

Zilch Credit Card provides cashback on every purchase. Cashback rewards can be redeemed as statement credits. It’s simple and straightforward.

Can Zilch Credit Card Improve My Credit Score?

Yes, using Zilch Credit Card responsibly can improve your credit score. Timely payments are crucial. It helps build a positive credit history.

Does Zilch Credit Card Have Any Hidden Fees?

No, Zilch Credit Card has no hidden fees. There are no annual fees or foreign transaction charges. Transparency is prioritized.

Conclusion

Choosing Zilch can be a smart financial move. It offers flexible payment options. Enjoy no interest or late fees with responsible credit limits. Earn rewards while managing purchases over time. Zilch caters to various needs with its different plans. From building credit to enjoying higher limits, it covers all. Customers receive support via live chat or phone, seven days a week. Experience hassle-free service with Zilch. Learn more about its benefits by visiting the official Zilch website. Start managing your finances better today.