Zable Credit Repair Reviews: Transform Your Financial Future

Are you struggling with your credit score? Want an efficient solution to manage and build your credit?

Look no further. Zable Credit Repair Reviews offer insights into how Zable’s services can help you. Zable provides credit cards and personal loans designed to improve your credit score. With features like free credit score access, rent reporting, and spending tracking, Zable stands out in personal finance. Curious to know how Zable can aid your financial journey? Dive into the reviews to discover real user experiences and understand why Zable might be the perfect choice for your credit needs. For more information, visit Zable’s official website here.

Introduction To Zable Credit Repair

Zable Credit Repair is a comprehensive service aimed at helping individuals build and manage their credit scores. With a range of products including credit cards and personal loans, Zable provides tools to improve financial health.

What Is Zable Credit Repair?

Zable Credit Repair offers credit cards and personal loans designed to assist users in building and managing their credit scores. Their services include:

- Free credit score access

- Rent reporting

- Spending tracking through the Zable app

These features help users monitor their financial activities and maintain a healthy credit profile.

Purpose And Mission Of Zable Credit Repair

The purpose of Zable Credit Repair is to provide individuals with the tools they need to improve their credit scores and achieve financial stability. Their mission includes:

- Offering credit-building opportunities through timely payments with the Zable Credit Card.

- Providing quick personal loans without impacting credit scores.

- Enabling users to track spending and report rent to build credit history.

With over 123,000 customer reviews, Zable is dedicated to delivering excellent service and support.

| Feature | Details |

|---|---|

| Credit Card Interest Rate | 48.9% APR (variable) |

| Personal Loan Interest Rate | 9.9% to 49.9% APR |

| Loan Amounts | £1,000 to £25,000 over 1-5 years |

| Customer Support | Available seven days a week via online chat, email, or phone |

Zable is regulated by the FCA and ensures privacy compliance, making it a reliable choice for credit repair.

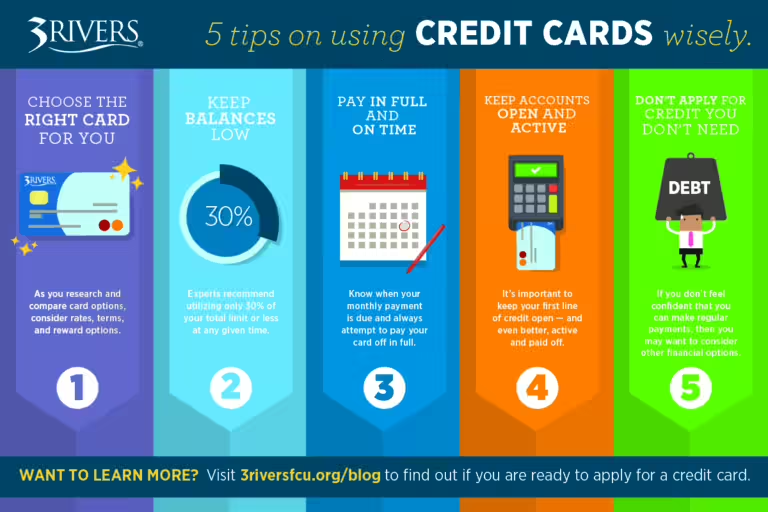

Key Features Of Zable Credit Repair

Zable Credit Repair offers a variety of features designed to help individuals improve their credit scores. From personalized repair plans to educational resources, Zable provides a comprehensive suite of services. Below, we explore the key features of Zable Credit Repair.

Personalized Credit Repair Plans

Zable offers personalized credit repair plans tailored to each user’s unique financial situation. These plans help individuals target specific areas that need improvement. The customized approach ensures that users receive the most effective strategies for their credit repair journey.

Credit Score Monitoring

With Zable, users get access to credit score monitoring. This feature allows individuals to track their credit score progress over time. The service includes regular updates and alerts about any significant changes to the credit score. Monitoring helps users stay informed and take timely actions to maintain or improve their credit.

Debt Negotiation Services

Zable provides debt negotiation services to help users manage and reduce their debt. These services involve negotiating with creditors to secure better terms or settlements. Effective debt negotiation can lead to lower interest rates, reduced monthly payments, and an overall decrease in total debt owed.

Credit Education Resources

Education is a crucial part of credit repair, and Zable offers a range of credit education resources. These resources include articles, guides, and tools that teach users about credit management. Understanding the principles of credit can empower users to make better financial decisions and avoid future credit issues.

How Zable Credit Repair Benefits Users

Zable Credit Repair offers numerous benefits to its users. By utilizing Zable’s services, users can experience improved credit scores, access to better financial products, reduction of debt and financial stress, and enhanced financial literacy. Below, we delve into each of these advantages in detail.

Improved Credit Scores

One of the main benefits of Zable Credit Repair is the potential for improved credit scores. Zable’s credit cards are designed to help users build their credit scores by making timely payments. Additionally, the service includes free access to Equifax credit scores and insights, allowing users to track their progress and make informed decisions.

Access To Better Financial Products

With a better credit score, users can gain access to a wider range of financial products. Zable’s services include personal loans with competitive interest rates, ranging from 9.9% to 49.9% APR. The quick processing time, often less than an hour, ensures that users can access funds when needed. Furthermore, checking eligibility for these products does not impact the user’s credit score.

Reduction Of Debt And Financial Stress

Zable Credit Repair can help users manage and reduce their debt. By offering tools like spending tracking through the Zable app, users can monitor their accounts in one place and make better financial decisions. The ability to report rent payments to build credit history is another feature that can assist in reducing financial stress.

Enhanced Financial Literacy

Through Zable’s services, users can enhance their financial literacy. The app provides valuable insights into users’ credit scores and spending habits. By understanding these aspects better, users can make more informed financial decisions. Additionally, Zable offers customer support seven days a week, helping users navigate any financial challenges they may face.

These benefits make Zable Credit Repair a valuable tool for anyone looking to improve their financial health and creditworthiness.

Pricing And Affordability

Understanding the pricing structure of Zable Credit Repair is vital. Let’s explore the Pricing Tiers, compare Affordability with competitors, and assess the overall Value for Money.

Pricing Tiers And Packages

Zable Credit Repair offers various pricing tiers to suit different budgets. Here is a breakdown:

| Tier | Features | Cost |

|---|---|---|

| Basic | Credit Score Access, Rent Reporting, Spending Tracking | £9.99/month |

| Standard | All Basic Features + Eligibility Check, Instant Use | £14.99/month |

| Premium | All Standard Features + Enhanced Approval Odds, Quick Processing | £19.99/month |

Affordability Compared To Competitors

When evaluating affordability, Zable Credit Repair stands out for its competitive pricing. Many competitors charge higher fees for similar services.

- Lower Monthly Fees: Zable’s basic plan starts at £9.99/month, which is lower than many other credit repair services.

- Comprehensive Features: Even the basic tier includes crucial features like free credit score access and rent reporting.

Value For Money

Zable Credit Repair offers exceptional value for money. Let’s consider the benefits:

- Free Credit Score Access: Helps users monitor their credit health.

- Rent Reporting: Builds credit history by reporting rent payments.

- Spending Tracking: Users can manage their finances better.

- Instant Use: Virtual card available for immediate use.

These features provide significant value, helping users improve their credit scores effectively.

Pros And Cons Of Zable Credit Repair

Before opting for Zable Credit Repair services, it is essential to understand the pros and cons. These insights will help you make an informed decision about using their credit cards and personal loans.

Pros Of Using Zable Credit Repair

- Credit Building: Zable credit cards help improve your credit score when payments are made on time.

- Instant Use: Eligible users can use their virtual card with Apple Pay or Google Pay immediately.

- Approval Odds: Approval chances can increase by up to 35% based on banking history.

- Eligibility Check: Checking your eligibility does not impact your credit score.

- Quick Processing: Personal loans are processed quickly, often within an hour.

- No Credit Impact: Checking your loan rate does not affect your credit score.

- Free Credit Score: Access your Equifax credit score and insights for free.

- Spending Tracking: Monitor all your accounts in one place.

- Rent Reporting: Report rent payments to build your credit history.

- Customer Support: Available seven days a week via chat, email, or phone.

Cons Of Using Zable Credit Repair

- High Interest Rates: Credit card APR is variable at 48.9%, and personal loan APR ranges from 9.9% to 49.9%.

- Eligibility Requirements: Not everyone may be eligible for a credit card or loan.

- Potential Debt Risk: High-interest rates can lead to more debt if not managed properly.

Real-world User Experiences

Many users have shared their experiences with Zable Credit Repair, providing valuable insights:

| User | Feedback |

|---|---|

| John D. | “The application process was easy and quick. I received my loan within an hour.” |

| Mary S. | “The credit card helped me build my credit score. The free credit score access is a bonus.” |

| Ali K. | “Interest rates are high, but the service is efficient. The app is user-friendly.” |

| Lisa T. | “Customer support is very responsive. They helped me understand my credit report.” |

These experiences highlight the efficiency of Zable’s services, despite some concerns about high-interest rates.

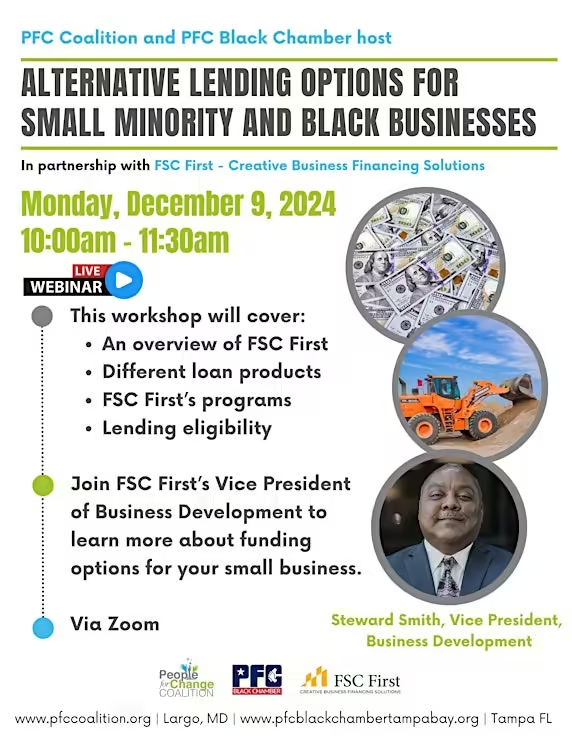

Ideal Users And Scenarios For Zable Credit Repair

Zable Credit Repair services cater to individuals seeking to rebuild their credit scores and improve their financial health. The platform offers various tools and features to assist users in managing their credit effectively.

Who Should Use Zable Credit Repair?

Zable Credit Repair is ideal for:

- Individuals with poor or limited credit history.

- Those looking to rebuild their credit scores.

- People who want to monitor their credit and spending.

- Renters who want to report rent payments to build credit history.

Best Scenarios For Zable Credit Repair

Zable Credit Repair shines in various scenarios:

- Users needing quick approval for credit cards or personal loans.

- Individuals seeking to improve approval odds using banking history.

- Those interested in tracking their spending through a single app.

- Renters looking to leverage rent payments for credit building.

Customer Success Stories

Many users have successfully improved their credit scores with Zable Credit Repair. Here are a few examples:

- A user improved their credit score by making timely payments with a Zable credit card.

- Another customer received a personal loan quickly, helping them consolidate debt.

- One renter reported their rent payments, significantly boosting their credit history.

With over 123,000 reviews on Trustpilot, the App Store, and Google Play, many customers praise Zable for its ease of use and effectiveness in credit building.

Frequently Asked Questions

What Is Zable Credit Repair?

Zable Credit Repair is a service that helps improve your credit score. They work by disputing inaccuracies and negotiating with creditors. Their goal is to help you achieve a better financial standing.

How Does Zable Credit Repair Work?

Zable Credit Repair reviews your credit report for errors. They dispute any inaccuracies they find. They also negotiate with creditors to remove negative items. Their process helps improve your credit score over time.

Is Zable Credit Repair Legitimate?

Yes, Zable Credit Repair is a legitimate service. They have a track record of helping clients improve their credit scores. Many customers have reported positive results and better financial health.

How Much Does Zable Credit Repair Cost?

The cost of Zable Credit Repair varies depending on the services needed. They offer different plans to fit various budgets. It’s best to contact them directly for a detailed pricing structure.

Conclusion

Zable Credit Repair services offer effective solutions for managing your credit score. Their credit card and personal loan options cater to different financial needs. With features like free credit score access and rent reporting, Zable helps users build credit responsibly. User-friendly app and positive reviews highlight their reliability. Explore Zable UK for more details: Zable Credit Repair. Enhance your financial health with Zable’s trusted services.