Wirex Virtual Card: Revolutionizing Online Payments

The Wirex Virtual Card is a modern banking tool for the digital age. It seamlessly integrates crypto and traditional currencies for everyday use.

Imagine a card that rewards you for every transaction, with up to 8% back in crypto. The Wirex Virtual Card offers this and much more. It eliminates foreign exchange fees and supports high limits, making it ideal for global use. With free ATM withdrawals and no monthly fees, it’s perfect for everyday transactions. Plus, you can manage your money securely, whether you’re dealing with crypto or traditional currencies. Want to learn more? Discover the benefits and features of the Wirex Virtual Card by visiting their official site. This card is not just about spending; it’s about earning and saving too.

Introduction To Wirex Virtual Card

The Wirex Virtual Card offers a modern solution for managing both crypto and traditional currencies. It bridges the gap between digital assets and everyday financial needs, providing a secure and easy-to-use platform.

What Is Wirex Virtual Card?

The Wirex Virtual Card is a versatile banking alternative designed for the Web3 era. It supports seamless transactions for both crypto and traditional currencies, all within a single account. Users can take advantage of free and secure debit card services for everyday spending.

Purpose And Benefits Of Using Wirex

The Wirex Virtual Card serves multiple purposes and offers numerous benefits to its users:

- Cryptoback™ Rewards: Earn up to 8% in crypto rewards on every transaction.

- No Foreign Exchange Fees: Enjoy 0% fees on global foreign exchanges.

- High Limits and No Fees: Benefit from free ATM withdrawals and unlimited spending.

- Stablecoin Support: Supports top stablecoins like USDC and USDT with deposits on various blockchains.

- Earn Interest: Earn up to 16% Variable AER on selected currencies with X-Accounts.

- Generate Passive Earnings: Achieve up to 360% APR with DUO passive earnings.

- Institutional Pricing: Buy digital assets at the same prices as institutions.

- Borrowing: Borrow stablecoins starting at 0% APR with collateral deposits and no credit checks.

Wirex Virtual Card is available in three plans to suit different needs:

| Plan | Monthly Fee | Benefits |

|---|---|---|

| Standard Plan | Free | Up to 1% Cryptoback™ rewards, merchant offers |

| Premium Plan | $9.99/month | Up to 3% Cryptoback™ rewards, up to 6% annual savings bonus, merchant offers |

| Elite Plan | $29.99/month | Up to 8% Cryptoback™ rewards, up to 16% annual savings bonus, up to 20% APR on X-accounts, merchant offers |

The Wirex Virtual Card is trusted by over 6 million customers worldwide, having processed over $20 billion in crypto transactions. With $30 million insurance on digital assets, it is a secure and reliable choice for managing your digital and traditional currencies.

Key Features Of Wirex Virtual Card

The Wirex Virtual Card offers a range of features designed for convenience, security, and rewards. With this card, managing both crypto and traditional currencies becomes seamless. Below are the key features that make the Wirex Virtual Card stand out.

Instant Issuance And Activation

With the Wirex Virtual Card, you can get your card issued and activated instantly. There is no waiting period. You can start using your card as soon as it’s issued. This feature ensures you can make transactions immediately.

Multi-currency Support

The Wirex Virtual Card supports multiple currencies, including both traditional and cryptocurrencies. This feature makes it easy to manage and transact with different currencies. You can switch between currencies without hassle.

Enhanced Security Measures

The Wirex Virtual Card comes with enhanced security measures. These include extra secure debit card features and $30 million insurance on digital assets. Your transactions and funds are protected with high-level security protocols.

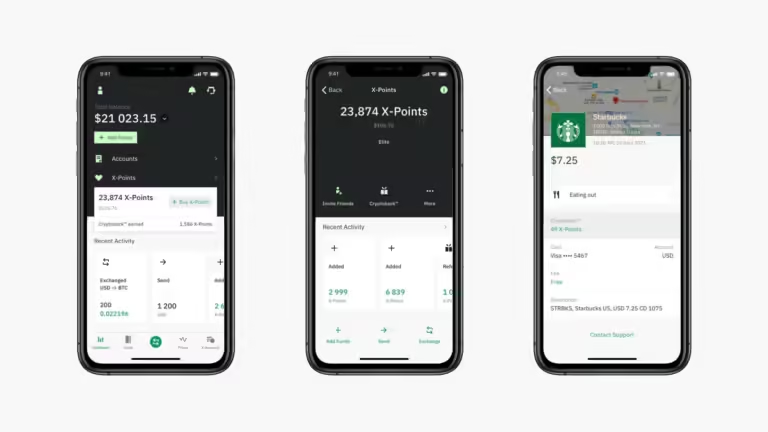

Seamless Integration With Wirex App

The Wirex Virtual Card integrates seamlessly with the Wirex app. This integration allows you to manage your card, track transactions, and access other features. The app provides a user-friendly interface for all your financial needs.

Cashback And Reward Programs

| Plan | Cryptoback™ Rewards | Monthly Fee |

|---|---|---|

| Standard Plan | Up to 1% | Free |

| Premium Plan | Up to 3% | $9.99 |

| Elite Plan | Up to 8%</td | $29.99 |

Earn up to 8% in crypto rewards on every card transaction. The more you spend, the more you earn. This reward program is designed to benefit frequent users. Choose a plan that best fits your spending habits.

The Wirex Virtual Card is an excellent choice for managing both crypto and traditional currencies. Its features are designed to offer convenience, security, and rewards, making it a versatile financial tool.

Pricing And Affordability

Wirex Virtual Card offers a range of pricing options tailored to meet different needs. Understanding the cost and fees is crucial for making an informed decision. Let’s break down the pricing structure and compare it with other virtual cards.

Cost Of Getting A Wirex Virtual Card

The Wirex Virtual Card comes with different plans:

| Plan | Monthly Fee | Cryptoback™ Rewards |

|---|---|---|

| Standard Plan | Free | Up to 1% |

| Premium Plan | $9.99 | Up to 3% |

| Elite Plan | $29.99 | Up to 8% |

Transaction Fees And Charges

Wirex Virtual Card boasts no foreign exchange fees, which can save a lot on international transactions.

- ATM Withdrawals: Free

- Spending Limits: Unlimited

- Cross-Chain Bridge: Free and instant

Comparison With Other Virtual Cards

When comparing Wirex Virtual Card with other virtual cards, consider the following:

- Free ATM Withdrawals: Many competitors charge fees.

- Unlimited Spending: Other cards often have spending limits.

- Cryptoback™ Rewards: Up to 8% rewards, higher than many other cards.

- No Monthly Fees on Standard Plan: Some cards charge monthly fees regardless of usage.

Wirex Virtual Card stands out for its affordability and benefits, making it a top choice for many users.

Pros And Cons Of Wirex Virtual Card

The Wirex Virtual Card offers a unique blend of features for crypto enthusiasts and everyday users. Let’s explore its advantages and limitations to understand its value better.

Advantages Of Using Wirex Virtual Card

- Cryptoback™ Rewards: Earn up to 8% in crypto rewards on every card transaction.

- No Foreign Exchange Fees: Enjoy 0% fees on foreign exchanges globally.

- Google Pay™ Integration: Available in Australia, making payments convenient.

- High Limits and No Fees: Free ATM withdrawals, unlimited spending, and no monthly fee.

- Cross-Chain Bridge: Free and instant cross-chain bridge for stablecoins and crypto.

- Stablecoin Support: Supports top stablecoins like USDC and USDT on various blockchains.

Limitations And Drawbacks

- Geographical Restrictions: Availability of products and services may vary by region due to regulatory limitations.

- Premium Plans: Higher Cryptoback™ rewards and benefits require subscription to premium plans which may not be suitable for all users.

- Complex Features: Some features like cross-chain bridge and DUO passive earnings might be complex for beginners.

Here’s a quick comparison of the pricing plans:

| Plan | Cost | Cryptoback™ Rewards | Other Benefits |

|---|---|---|---|

| Standard Plan | Free | Up to 1% | Merchant offers |

| Premium Plan | $9.99/month | Up to 3% | Up to 6% annual savings bonus, merchant offers |

| Elite Plan | $29.99/month | Up to 8% | Up to 16% annual savings bonus, up to 20% APR on X-accounts, merchant offers |

The Wirex Virtual Card is a versatile tool for both crypto and fiat currency users, but it comes with its own set of pros and cons. Understanding these can help you make an informed decision.

Ideal Users And Use Cases

The Wirex Virtual Card is a versatile tool for managing both crypto and traditional currencies. It offers unique features that cater to various user needs. This section explores who should use the Wirex Virtual Card and the best scenarios for its use.

Who Should Use Wirex Virtual Card?

- Crypto Enthusiasts: Those who actively trade and spend cryptocurrencies.

- Frequent Travelers: Benefit from 0% foreign exchange fees globally.

- Investors: Earn up to 16% interest on selected currencies.

- High Spenders: No limits on spending and free ATM withdrawals.

- DeFi Users: Seamless cross-chain transactions and stablecoin support.

Best Scenarios For Using Wirex

The Wirex Virtual Card shines in many scenarios. Here are some ideal use cases:

| Scenario | Benefits |

|---|---|

| Online Shopping | Earn up to 8% Cryptoback™ rewards on purchases. |

| Traveling | Enjoy no foreign exchange fees and free ATM withdrawals. |

| Bill Payments | Manage your bills with both crypto and traditional currencies. |

| Investing | Access institutional pricing and earn up to 360% APR with DUO. |

| Everyday Purchases | Unlimited spending with a secure and easy-to-use virtual card. |

Frequently Asked Questions

What Is A Wirex Virtual Card?

A Wirex Virtual Card is a digital card for online purchases. It allows secure transactions without a physical card.

How To Get A Wirex Virtual Card?

You can obtain a Wirex Virtual Card by signing up on the Wirex app. Follow the instructions to create your virtual card.

Can I Use Wirex Virtual Card Internationally?

Yes, the Wirex Virtual Card can be used internationally. It supports multiple currencies for global transactions.

Is Wirex Virtual Card Safe?

Yes, Wirex Virtual Card is safe. It uses advanced security measures to protect your transactions and personal information.

Conclusion

Wirex Card offers a seamless way to manage crypto and traditional currencies. Enjoy high rewards, no foreign exchange fees, and free ATM withdrawals. Wirex provides a secure and easy-to-use platform for all your financial needs. Ready to start? Explore more at Wirex today.