Wirex Credit Card: Revolutionize Your Spending with Crypto

In today’s digital age, managing finances has become more innovative. The Wirex Credit Card offers a fresh approach.

Designed for Web3 users, it blends traditional banking with the benefits of cryptocurrency. Imagine a card that lets you earn crypto rewards on every purchase. With Wirex, you can enjoy up to 8% back in crypto rewards. No foreign exchange fees, high limits, and secure transactions make it a standout. Plus, you can earn high interest on your crypto savings. Wirex is not just a card; it’s a gateway to a new financial world. Trusted by millions globally, it offers both security and ease of use. Discover more about the Wirex Credit Card and its benefits by clicking here.

Introduction To Wirex Credit Card

The Wirex Credit Card is a modern solution for those who regularly engage in cryptocurrency transactions. It offers a range of features designed to make crypto spending simple and rewarding. Trusted by millions globally, it presents a secure and versatile way to manage digital assets.

Overview Of Wirex Credit Card

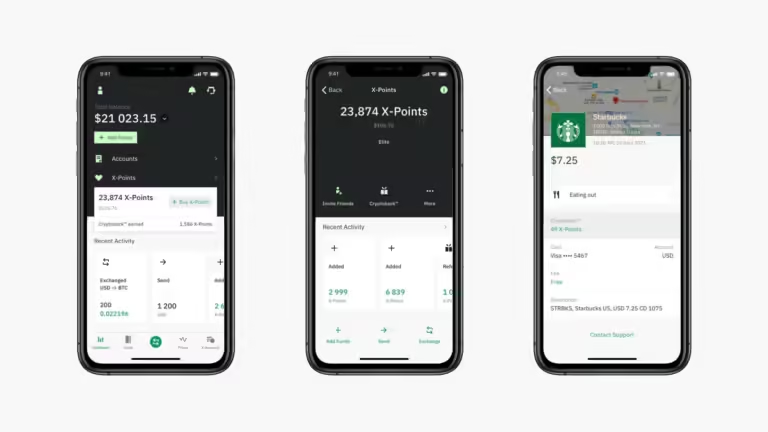

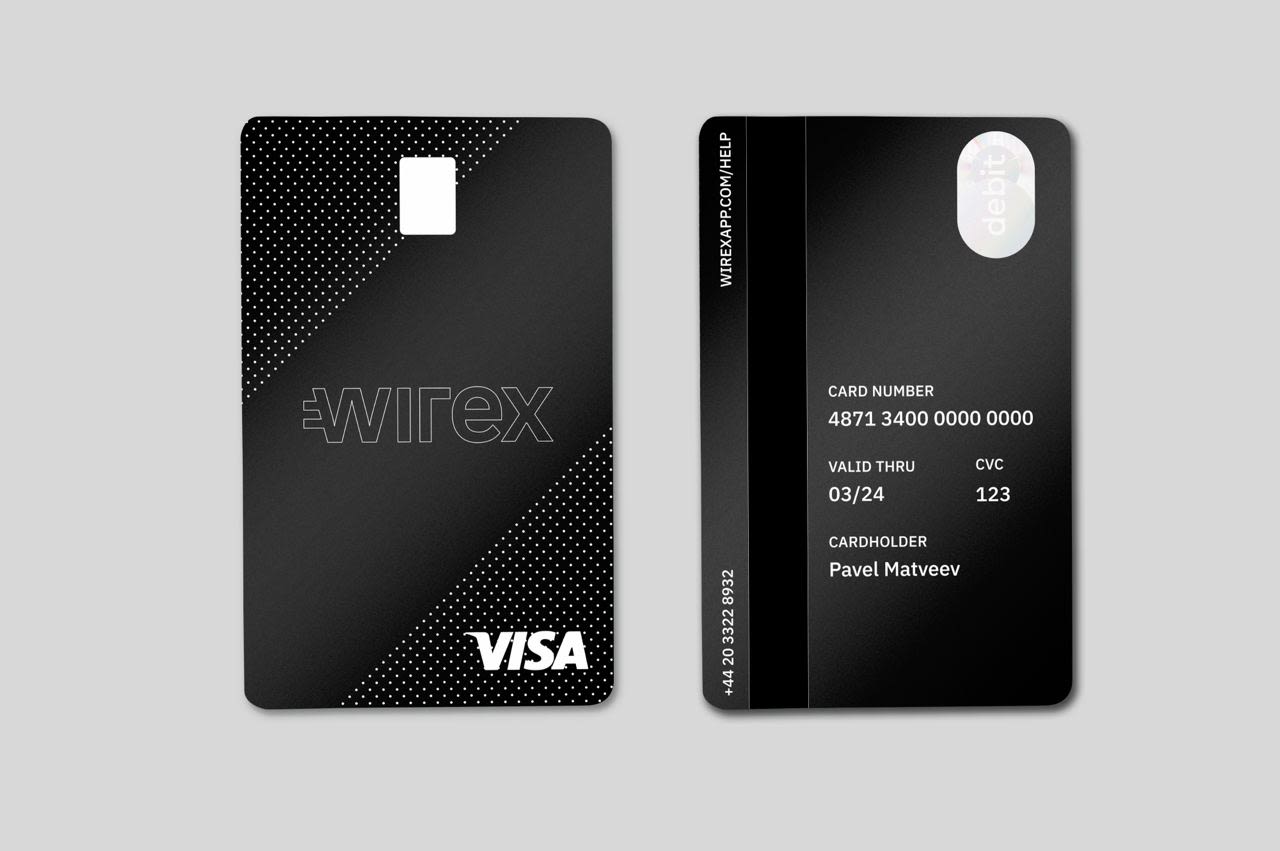

The Wirex Credit Card is a secure debit card aimed at Web3 users. It enables everyday crypto transactions with ease. Here are some of its standout features:

- Cryptoback™ Rewards: Earn up to 8% in crypto rewards on every card transaction.

- 0% Foreign Exchange Fees: No fees for foreign exchanges globally.

- X-Accounts: Earn up to 16% Variable AER on selected currencies.

- DUO: Generate up to 360% APR through passive earnings.

- High Limits and No Fees: Free ATM withdrawals, unlimited spending, and no monthly fees.

- Cross-Chain Bridge: Free and instant transfers between stablecoins and crypto across different blockchains.

- Stablecoin Support: Supports top stablecoins like USDC and USDT on various blockchains.

- Crypto Rewards: Exclusive rewards through Wirex Tokens.

Purpose And Vision Of Wirex Credit Card

The vision behind the Wirex Credit Card is to offer a secure and simple platform for cryptocurrency management. It aims to provide institutional pricing for digital assets and ensure global trust through extensive security measures. Key benefits include:

- Secure and Simple: Easy on and off-ramp for crypto needs.

- Institutional Pricing: Buy digital assets at the same price as institutions.

- Global Trust: Trusted by 6 million people since 2014 with $20 billion+ in crypto transactions.

- Insurance: $30 million insurance on digital assets.

- No Credit Checks: Borrow stablecoins starting at 0% APR without credit checks.

- Seamless Integration: Available with Google Pay™ in Australia.

Key Features Of Wirex Credit Card

The Wirex Credit Card offers a range of features that cater to the needs of Web3 users. This card provides a seamless and secure way to manage your crypto transactions while enjoying various benefits. Let’s dive into the key features that make the Wirex Credit Card stand out.

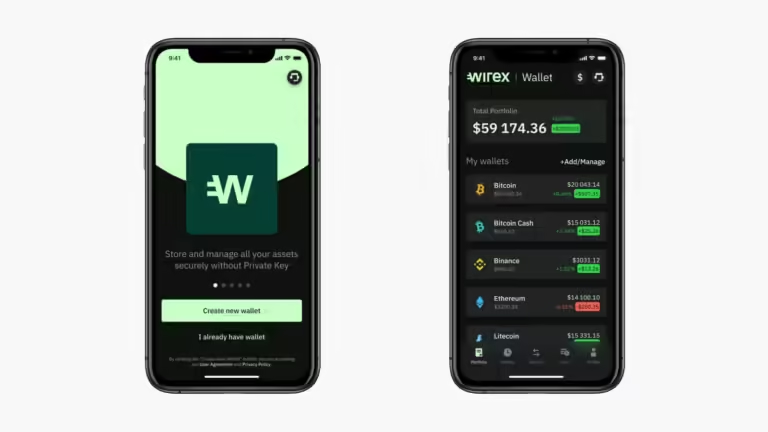

Multi-currency Support

The Wirex Credit Card supports multiple currencies, including major stablecoins like USDC and USDT on various blockchains such as Ethereum, Polygon, Solana, and Tron. This multi-currency support ensures that users can handle their crypto transactions with ease and flexibility.

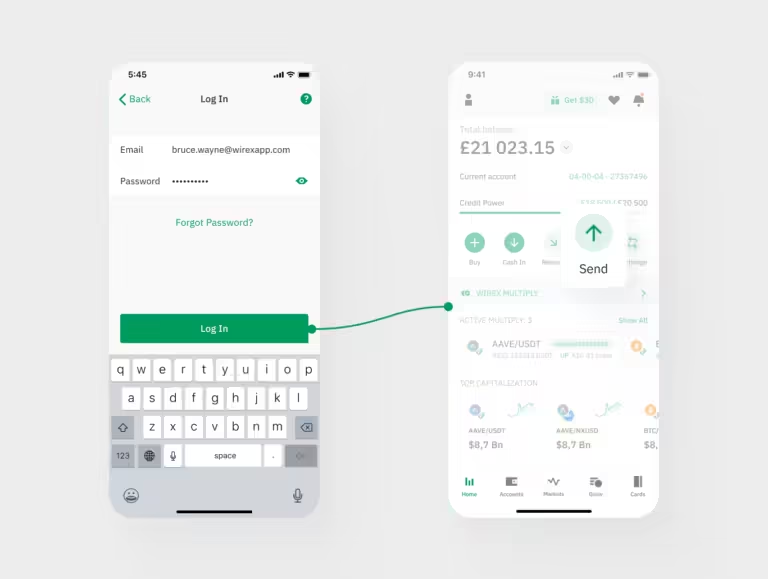

Instant Crypto To Fiat Conversion

One of the standout features is the instant crypto to fiat conversion. This allows users to convert their cryptocurrencies into fiat money quickly and use the funds for everyday transactions. The process is seamless, ensuring that users can access their money whenever needed.

Enhanced Security Measures

Security is a top priority for Wirex. The card comes with $30 million insurance on digital assets, providing users with peace of mind. Additionally, no credit checks are required to borrow stablecoins, making it a secure and user-friendly option.

Rewards And Cashback Programs

Wirex offers attractive rewards and cashback programs. Users can earn up to 8% in Cryptoback™ rewards on every card transaction. The rewards vary based on the plan chosen:

| Plan | Monthly Fee | Cryptoback™ Rewards | Other Benefits |

|---|---|---|---|

| Standard | Free | Up to 1% | Merchant Offers |

| Premium | $9.99 | Up to 3% | Up to 6% annual Savings Bonus, Merchant Offers |

| Elite | $29.99 | Up to 8% | Up to 16% annual Savings Bonus, Up to 20% APR on X-Accounts, Merchant Offers |

Global Accessibility

The Wirex Credit Card is accessible globally, with no foreign exchange fees. Users can enjoy free ATM withdrawals and unlimited spending without worrying about additional charges. The card is also integrated with Google Pay™, making it convenient for users in Australia.

These features make the Wirex Credit Card a versatile and valuable tool for managing your crypto transactions efficiently.

Pricing And Affordability

The Wirex Credit Card offers a range of affordable plans that cater to different user needs. Whether you’re a casual spender or a crypto enthusiast, Wirex provides a cost-effective solution for managing your finances.

Card Issuance Fees

The Wirex Credit Card comes with zero issuance fees. Users can get started without worrying about upfront costs. This makes it accessible for everyone looking to explore crypto transactions without initial financial commitments.

Transaction Fees

Wirex is known for its no transaction fees on purchases. This is a significant advantage, as many traditional credit cards charge fees for each transaction. With Wirex, users can save money on every purchase, making it an economical choice.

Foreign Exchange Rates

One of the standout features of the Wirex Credit Card is its 0% foreign exchange fees. Users can make purchases globally without incurring additional costs. This is particularly beneficial for frequent travelers or those making international transactions.

Comparison With Traditional Credit Cards

| Feature | Wirex Credit Card | Traditional Credit Card |

|---|---|---|

| Issuance Fee | Free | Varies, usually $10-$20 |

| Transaction Fees | None | 1%-3% per transaction |

| Foreign Exchange Fees | 0% | 2%-5% |

Comparing these features, the Wirex Credit Card emerges as a more affordable and practical option. The absence of issuance and transaction fees, along with zero foreign exchange fees, makes it a superior choice. Traditional credit cards often come with higher costs, making Wirex a smart alternative for budget-conscious users.

Pros And Cons Of Wirex Credit Card

The Wirex Credit Card offers a unique combination of benefits and drawbacks. Understanding these can help you decide if it fits your financial needs.

Advantages Of Using Wirex Credit Card

Wirex offers several compelling advantages:

- Cryptoback™ Rewards: Earn up to 8% in crypto rewards on every card transaction.

- 0% Foreign Exchange Fees: Enjoy no fees for global foreign exchanges.

- X-Accounts: Earn up to 16% Variable AER on selected currencies.

- DUO: Generate up to 360% APR through passive earnings.

- High Limits and No Fees: Free ATM withdrawals, unlimited spending, and no monthly fees.

- Cross-Chain Bridge: Free and instant transfers between stablecoins and crypto across different blockchains.

- Stablecoin Support: Supports top stablecoins like USDC and USDT on multiple blockchains.

- Crypto Rewards: Exclusive rewards through Wirex Tokens.

- Secure and Simple: Easy on and off-ramp for crypto needs.

- Institutional Pricing: Buy digital assets at the same price as institutions.

- Global Trust: Trusted by 6 million people since 2014 with $20 billion+ in crypto transactions.

- Insurance: $30 million insurance on digital assets.

- No Credit Checks: Borrow stablecoins starting at 0% APR without credit checks.

- Seamless Integration: Available with Google Pay™ in Australia.

Drawbacks And Limitations

Despite its benefits, the Wirex Credit Card has some drawbacks:

- Subscription Costs: The Premium and Elite plans come with monthly fees of $9.99 and $29.99, respectively.

- Jurisdictional Limitations: Availability of products and services can be restricted by regional laws and regulations.

- Complexity for Beginners: The features related to crypto and stablecoins might be complex for new users.

User Experiences And Reviews

Understanding the experiences of other users can offer valuable insights:

- Many users appreciate the high rewards and low fees.

- Some users find the interface user-friendly and easy to navigate.

- However, a few users report issues with customer support and account restrictions.

- Overall, the card receives praise for its innovative features and flexibility.

For more details, you can visit the official Wirex website.

Ideal Users And Scenarios

The Wirex Credit Card offers unique features for modern financial needs. It combines traditional banking with crypto benefits. Let’s explore who benefits the most and how to use this card effectively.

Who Should Use The Wirex Credit Card?

- Crypto Enthusiasts: Those who transact in cryptocurrencies will find the card beneficial. Enjoy up to 8% Cryptoback™ rewards on every transaction.

- Frequent Travelers: The card offers 0% foreign exchange fees globally. This makes it ideal for international travel.

- High Spenders: The card has high spending limits and no monthly fees, making it suitable for those with higher financial activities.

- Investors: Users who want to earn passive income can benefit from features like X-Accounts and DUO.

Best Use Cases And Scenarios

Here are some scenarios where the Wirex Credit Card shines:

- Daily Expenses: Use the card for everyday purchases and earn crypto rewards.

- Traveling Abroad: Save on foreign exchange fees and enjoy free ATM withdrawals.

- Online Shopping: Benefit from exclusive merchant offers and cryptoback rewards.

- Crypto Investments: Utilize features like X-Accounts and DUO for passive earnings.

Tips For Maximizing Benefits

Here are some tips to get the most out of your Wirex Credit Card:

- Choose the Right Plan: Select a plan that suits your spending habits. The Elite Plan offers the highest rewards and benefits.

- Utilize Cryptoback™ Rewards: Maximize your rewards by using the card for all transactions.

- Leverage X-Accounts: Earn up to 16% variable AER on selected currencies by using X-Accounts.

- Take Advantage of Free ATM Withdrawals: Withdraw cash without fees when traveling.

By following these tips, you can fully benefit from the features of the Wirex Credit Card.

Frequently Asked Questions

What Is A Wirex Credit Card?

A Wirex Credit Card is a versatile card that allows users to spend cryptocurrencies and traditional currencies seamlessly.

How Does Wirex Credit Card Work?

The Wirex Credit Card works by converting your cryptocurrency into fiat currency at the point of sale.

Can I Use Wirex Credit Card Globally?

Yes, the Wirex Credit Card can be used globally wherever Visa is accepted.

What Are The Fees For Wirex Credit Card?

Wirex Credit Card fees include a small monthly maintenance fee and transaction fees for some services.

Conclusion

Wirex Card stands out for its diverse crypto features and user benefits. Enjoy cryptoback rewards, zero foreign exchange fees, and high earning potential with X-Accounts. It’s a secure, simple, and global solution trusted by millions. Explore more about Wirex and its offerings here. Whether you are a crypto enthusiast or a beginner, Wirex Card offers a seamless way to manage and grow your digital assets. Make smart financial moves today with Wirex.