Wirex Comparison: Discover the Best Features and Benefits

In the world of digital finance, Wirex stands out. Known for its unique crypto-friendly banking services, Wirex offers a versatile debit card and a free account, designed to meet modern financial needs.

Comparing financial products can be daunting. With so many options, it’s hard to know which one suits you best. This is where a detailed comparison becomes invaluable. By examining key features, benefits, and pricing, you can make an informed decision. In this blog post, we will compare Wirex with other popular options, highlighting what makes it unique. Ready to dive into the world of Wirex and see how it stacks up? Let’s get started. For more details, visit the Wirex website.

Introduction To Wirex

Wirex offers a unique blend of traditional banking and modern cryptocurrency solutions. It provides a secure platform for managing everyday crypto needs. Let’s dive into the specifics of what Wirex is and its core mission.

What Is Wirex?

Wirex is a banking alternative built for Web3. It provides a free account and a secure Wirex debit card. This card is designed to cater to everyday crypto needs. Wirex supports seamless asset management, offering features like Cryptoback™ rewards, 0% foreign exchange fees, and high-interest earnings.

The Wirex Card allows users to earn up to 8% crypto rewards on every card transaction. It supports multiple stablecoins and includes features like Google Pay integration and free ATM withdrawals. Wirex aims to make crypto transactions easy and accessible worldwide.

Purpose And Mission Of Wirex

The primary mission of Wirex is to bridge the gap between traditional banking and the cryptocurrency world. Wirex seeks to provide a secure, user-friendly platform for managing both fiat and digital currencies. By offering up to 16% AER on selected currencies and up to 360% APR through passive earnings, Wirex ensures that users maximize their financial potential.

Wirex’s purpose also involves offering institutional asset pricing, high limits, and no fees. This includes free and instant cross-chain bridges for stablecoins and crypto, making it a versatile tool for global users. With over $20 billion in crypto transactions processed and $30 million in digital asset insurance, Wirex prioritizes security and reliability.

Wirex is committed to innovation and community engagement. It has a strong customer base, trusted by 6 million people since 2014. Wirex continuously updates its features and services to meet the evolving needs of its users, ensuring a robust and efficient platform for all crypto enthusiasts.

| Feature | Description |

|---|---|

| Cryptoback™ Rewards | Earn up to 8% crypto rewards on every card transaction. |

| Foreign Exchange Fees | 0% foreign exchange fees globally. |

| X-Accounts | Earn interest up to 16% AER on selected currencies. |

| DUO | Generate up to 360% APR with passive earnings and Cryptoback™ rewards. |

| Institutional Asset Pricing | Buy digital assets at institutional prices. |

| High Limits & No Fees | Free ATM withdrawals, unlimited spending, and no monthly fee. |

| Cross-Chain Bridge | Free and instant bridge for stablecoins and crypto. |

| Stablecoins Support | Seamless deposit options for USDC and USDT on multiple blockchains. |

| Credit | Borrow stablecoins starting at 0% APR with no credit checks and instant funding. |

For more details or to sign up, visit the Wirex website.

Key Features Of Wirex

Wirex offers a variety of features that make it a popular choice for managing both fiat and cryptocurrency. These features provide convenience, security, and rewards for its users. Let’s explore the key features of Wirex below.

Wirex allows you to manage multiple fiat and cryptocurrency accounts in one place. This feature is perfect for users who need to handle different currencies. You can easily switch between currencies, making transactions seamless and hassle-free.

Wirex integrates cryptocurrencies into everyday financial activities. You can buy, hold, and exchange digital assets at institutional prices. The platform supports multiple stablecoins, making it a versatile tool for crypto enthusiasts.

The Wirex Card is a secure debit card designed for everyday crypto needs. It offers numerous benefits:

- Cryptoback™ Rewards: Earn up to 8% crypto rewards on every card transaction.

- Foreign Exchange Fees: 0% foreign exchange fees globally.

- Google Pay Integration: Available with Google Pay in Australia.

- High Limits & No Fees: Free ATM withdrawals, unlimited spending, and no monthly fee.

The Wirex Card is an excellent choice for those looking to integrate cryptocurrency into their daily spending.

Wirex offers a rewarding experience through its various plans:

| Plan | Monthly Fee | Cryptoback™ Rewards | Annual Savings Bonus |

|---|---|---|---|

| Standard Plan | Free | Up to 1% | Merchant offers |

| Premium Plan | $9.99/month | Up to 3% | Up to 6% |

| Elite Plan | $29.99/month | Up to 8% | Up to 16% |

The rewards program offers significant benefits, including high Cryptoback™ rewards and savings bonuses.

Wirex prioritizes security to protect users’ assets. Key security features include:

- Secure Transactions: Extra secure Wirex debit card.

- Insurance: $30 million insurance on digital assets.

- Customer Support: Help Hub available for customer support.

These measures ensure that your transactions and assets are safe with Wirex.

Multi-currency Accounts

Wirex offers multi-currency accounts that cater to both traditional and digital currencies. These accounts are designed for users who frequently deal with various currencies, providing a seamless experience without the hassle of managing multiple accounts.

Benefits Of Multi-currency Accounts

There are numerous benefits to using Wirex’s multi-currency accounts:

- Convenience: Manage multiple currencies within a single account.

- 0% Foreign Exchange Fees: Enjoy zero foreign exchange fees worldwide.

- High Rewards: Earn up to 8% Cryptoback™ rewards on every transaction.

- Seamless Integration: Use Google Pay integration for easy payments in Australia.

Wirex ensures users enjoy a streamlined and rewarding experience when handling different currencies.

How It Solves Currency Exchange Issues

Wirex’s multi-currency accounts address common currency exchange problems:

- No Exchange Fees: Avoid hefty foreign exchange fees with 0% charges globally.

- Instant Conversion: Convert between currencies instantly with no delays.

- Stablecoins Support: Seamlessly deposit and manage stablecoins like USDC and USDT.

- Free Cross-Chain Bridge: Enjoy free and instant transfers between stablecoins and crypto.

These features make currency exchange effortless and cost-effective for Wirex users.

Why Multi-currency Accounts Are Important

Multi-currency accounts are crucial for several reasons:

- Global Usage: Use your Wirex card anywhere with 0% foreign exchange fees.

- High Limits & No Fees: Benefit from free ATM withdrawals and unlimited spending.

- Secure Transactions: The extra secure Wirex debit card ensures safe and reliable transactions.

- Interest Earnings: Earn up to 16% AER on account balances and up to 360% APR through DUO.

These advantages highlight the importance of having a multi-currency account, especially for those who travel frequently or deal with multiple currencies.

Cryptocurrency Integration

Wirex stands out with its cryptocurrency integration, making it easy for users to manage and use digital assets. This section explores how Wirex supports cryptocurrencies, simplifies buying and selling, and why cryptocurrency integration is crucial.

Supported Cryptocurrencies

Wirex supports a wide range of cryptocurrencies, allowing users to diversify their portfolios. Key supported cryptocurrencies include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Stellar (XLM)

- Stablecoins like USDC and USDT

Wirex also supports stablecoins, offering seamless deposit options for USDC and USDT on multiple blockchains. This broad support ensures users can manage various digital assets efficiently.

Ease Of Buying And Selling

Wirex makes buying and selling cryptocurrencies straightforward. Users can buy digital assets at institutional prices, ensuring cost-effective transactions. The platform offers:

- High Limits & No Fees: Free ATM withdrawals and no monthly fee.

- Instant Transactions: Quick and easy crypto purchases and sales.

- Cross-Chain Bridge: Free and instant bridge for stablecoins and crypto.

Wirex ensures that users experience minimal hassle when trading cryptocurrencies. The cross-chain bridge feature allows for instant and free transfers between different blockchains, enhancing liquidity and flexibility.

Importance Of Cryptocurrency Integration

Integrating cryptocurrencies into daily financial activities is becoming increasingly important. Here’s why:

- Global Usage: Cryptocurrencies allow for seamless international transactions without hefty fees.

- Financial Inclusion: They provide access to financial services for the unbanked population.

- Diversification: Adding crypto to portfolios helps in diversifying investments.

- Rewards and Earnings: Wirex offers up to 8% Cryptoback™ rewards on purchases and up to 16% AER interest on account balances.

With features like Cryptoback™ Rewards and DUO, Wirex enhances the utility of cryptocurrencies. This integration not only promotes the adoption of digital currencies but also provides users with financial benefits.

Wirex’s commitment to high rewards, no fees, and secure transactions makes it an ideal choice for those looking to integrate cryptocurrencies into their everyday lives.

For more details or to sign up, visit the Wirex website.

Wirex Card

The Wirex Card offers a modern banking experience tailored for Web3. It provides users with a free account and a secure debit card for everyday crypto needs. Let’s explore its features, benefits, and how it enhances spending and saving.

Features Of The Wirex Card

The Wirex Card comes packed with impressive features:

- Cryptoback™ Rewards: Earn up to 8% crypto rewards on every card transaction.

- Foreign Exchange Fees: 0% foreign exchange fees worldwide.

- Google Pay Integration: Available with Google Pay in Australia.

- X-Accounts: Earn interest up to 16% AER on selected currencies.

- DUO: Generate up to 360% APR with passive earnings and Cryptoback™ rewards.

- Institutional Asset Pricing: Buy digital assets at institutional prices.

- High Limits & No Fees: Free ATM withdrawals, unlimited spending, and no monthly fee.

- Cross-Chain Bridge: Free and instant bridge for stablecoins and crypto.

- Stablecoins Support: Seamless deposit options for USDC and USDT on multiple blockchains.

- Credit: Borrow stablecoins starting at 0% APR with no credit checks and instant funding.

Benefits Of Using The Wirex Card

The Wirex Card provides numerous benefits:

- High Rewards: Earn up to 8% Cryptoback™ rewards on purchases.

- Interest Earnings: Up to 16% variable AER on account balances.

- Passive Income: Up to 360% APR through DUO.

- No Fees: Free ATM withdrawals and no monthly fees.

- Global Usage: 0% foreign exchange fees worldwide.

- Secure Transactions: Extra secure Wirex debit card.

- Seamless Asset Management: Free cross-chain bridge and support for multiple stablecoins.

How It Enhances Spending And Saving

The Wirex Card enhances spending and saving in several ways:

- High Rewards on Spending: Earn up to 8% Cryptoback™ rewards on every purchase, making your spending more rewarding.

- Interest on Balances: Earn up to 16% AER on selected currencies through X-Accounts, boosting your savings effortlessly.

- Zero Fees: Enjoy 0% foreign exchange fees and free ATM withdrawals, reducing extra costs.

- Passive Income Opportunities: With DUO, generate up to 360% APR, maximizing your earnings passively.

- Instant Crypto Management: Free and instant cross-chain bridge for stablecoins, ensuring smooth asset management.

All these features make the Wirex Card a versatile tool for managing both spending and saving efficiently.

Wirex Rewards Program

The Wirex Rewards Program offers unique incentives for users of the Wirex Card. This program allows customers to earn rewards and cashback for daily transactions. Let’s dive into the details of this program to understand its benefits better.

Overview Of The Rewards Program

The Wirex Rewards Program includes the Cryptoback™ Rewards feature. Users can earn up to 8% crypto rewards on every transaction made with the Wirex Card. There are different plans available:

- Standard Plan: Free, up to 1% Cryptoback™ rewards

- Premium Plan: $9.99/month, up to 3% Cryptoback™ rewards

- Elite Plan: $29.99/month, up to 8% Cryptoback™ rewards

Earning Rewards And Cashback

To earn rewards, simply use your Wirex Card for purchases. Based on your plan, you can get 1% to 8% Cryptoback™ rewards. These rewards are added to your account balance in crypto. Moreover, the Premium and Elite plans offer additional savings bonuses:

- Premium Plan: Up to 6% annual Savings Bonus

- Elite Plan: Up to 16% annual Savings Bonus

These bonuses help maximize your earnings, making everyday spending more rewarding.

Advantages Of The Rewards Program

The Wirex Rewards Program offers several advantages:

| Feature | Benefit |

|---|---|

| High Rewards | Earn up to 8% Cryptoback™ rewards on purchases. |

| No Fees | Enjoy free ATM withdrawals and no monthly fees. |

| Global Usage | 0% foreign exchange fees worldwide. |

| Passive Income | Up to 360% APR through DUO. |

These features make the Wirex Rewards Program an attractive choice for those looking to earn more from their daily spending.

Security Measures

Security is paramount when dealing with digital assets and transactions. Wirex employs robust security measures to protect user data and funds. In this section, we will delve into the security features of Wirex, how it ensures the safety of funds, and the importance of security for users.

Security Features Of Wirex

- Two-Factor Authentication (2FA): Adds an extra layer of security by requiring two forms of verification.

- Cold Storage: Majority of digital assets are stored offline, reducing the risk of hacking.

- Encryption: Uses advanced encryption techniques to protect sensitive information.

- Fraud Detection: Monitors transactions for suspicious activity.

- Insurance: $30 million insurance on digital assets.

How Wirex Ensures Safety Of Funds

Wirex employs multiple strategies to ensure the safety of user funds. The majority of digital assets are stored in cold storage, which is an offline environment, minimizing exposure to online threats. The platform also uses two-factor authentication (2FA) to add an extra layer of security for account access.

Additionally, advanced encryption techniques are applied to protect sensitive data. Wirex also has a dedicated fraud detection system that monitors transactions continuously to identify and prevent any suspicious activity.

Importance Of Security For Users

Security is a top priority for users dealing with digital assets. Ensuring the safety of funds and personal information builds trust and confidence. With the increasing number of cyber threats, robust security measures are essential for any financial service provider.

Wirex’s comprehensive security features provide peace of mind to its users. The combination of cold storage, 2FA, encryption, and fraud detection ensures that user assets and information remain protected.

Wirex is trusted by over 6 million people and has processed over $20 billion in crypto transactions. This trust is built on the strong security measures that Wirex has in place.

Pricing And Affordability

Wirex offers a range of pricing plans designed to cater to different user needs. Whether you are a casual user or a heavy spender, Wirex provides options that ensure you get the best value for your money. In this section, we will break down the costs of using Wirex services, compare them with competitors, and evaluate the overall value for money.

Cost Of Using Wirex Services

Wirex offers three main pricing plans:

- Standard Plan: Free, up to 1% Cryptoback™ rewards, merchant offers.

- Premium Plan: $9.99/month, up to 3% Cryptoback™ rewards, up to 6% annual Savings Bonus, merchant offers.

- Elite Plan: $29.99/month, up to 8% Cryptoback™ rewards, up to 16% annual Savings Bonus, up to 20% APR on X-Accounts, merchant offers.

All plans include benefits such as free ATM withdrawals, no monthly fees, and 0% foreign exchange fees globally.

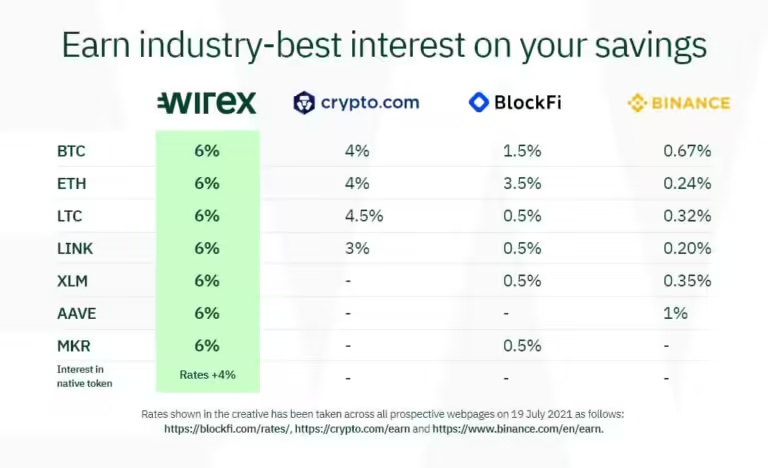

Comparison With Competitors

When comparing Wirex to its competitors, the following points stand out:

- Cryptoback™ Rewards: Wirex offers up to 8% crypto rewards, which is higher compared to many other crypto cards.

- Foreign Exchange Fees: With 0% foreign exchange fees, Wirex is highly competitive in the global market.

- ATM Withdrawals: Wirex provides free ATM withdrawals, unlike many competitors that charge fees.

- Interest Earnings: Earn up to 16% AER on selected currencies, a feature that many competitors lack.

Value For Money

Wirex stands out in terms of value for money due to several factors:

- High Rewards: Users can earn up to 8% Cryptoback™ rewards on purchases.

- No Fees: The absence of monthly fees and foreign exchange fees makes Wirex an affordable option.

- Passive Income Opportunities: With DUO, users can generate up to 360% APR.

- Secure Transactions: The Wirex debit card offers extra secure transactions, ensuring user safety.

The combination of high rewards, no fees, and passive income opportunities make Wirex a highly valuable option for both casual and serious users.

Pros And Cons Of Wirex

Choosing the right financial tool is crucial. Wirex offers unique features and benefits, but it also has some drawbacks. This section explores the pros and cons of the Wirex Card to help you make an informed decision.

Pros

- High Rewards: Earn up to 8% Cryptoback™ rewards on purchases.

- No Foreign Exchange Fees: Enjoy 0% foreign exchange fees worldwide.

- Interest Earnings: Earn up to 16% AER on selected currencies in X-Accounts.

- Free ATM Withdrawals: Withdraw cash without any fees.

- Google Pay Integration: Available in Australia for easy payments.

- Passive Income: Generate up to 360% APR with DUO.

- Institutional Pricing: Buy digital assets at institutional prices.

- Stablecoins Support: Deposit USDC and USDT on multiple blockchains seamlessly.

- No Monthly Fees: Standard plan users enjoy no monthly fees.

- Secure Transactions: Extra secure debit card for peace of mind.

Cons

- Premium Plans Cost: $9.99/month for Premium and $29.99/month for Elite.

- Jurisdictional Limitations: Some features may not be available in all regions.

- Customer Support: Help Hub is the primary support option, which may not suit everyone.

Understanding both the strengths and weaknesses of the Wirex Card helps you decide if it fits your financial needs.

Ideal Users And Scenarios

The Wirex Card is designed for individuals who seek a seamless integration of traditional and crypto banking. Understanding who benefits the most and the best scenarios to use Wirex can help you decide if this innovative product suits your financial needs.

Who Benefits Most From Wirex?

Crypto Enthusiasts: Wirex is ideal for users actively involved in the cryptocurrency market. With features like up to 8% Cryptoback™ rewards and 0% foreign exchange fees, it offers significant advantages.

Frequent Travelers: The card’s global usage with 0% foreign exchange fees makes it perfect for frequent travelers. They can enjoy hassle-free transactions worldwide without worrying about additional charges.

Investors: Users looking to grow their investments can benefit from up to 16% AER on selected currencies and 360% APR with passive earnings through the DUO feature.

Best Use Cases For Wirex

Daily Purchases: Use Wirex for everyday transactions and earn rewards. The Cryptoback™ feature allows you to earn crypto rewards on every purchase.

Crypto Trading: With institutional asset pricing, Wirex users can buy and trade digital assets at competitive rates.

ATM Withdrawals: Enjoy free ATM withdrawals with no monthly fees, making it convenient to access your funds anytime.

Scenarios Where Wirex Excels

| Scenario | Benefits |

|---|---|

| Traveling Abroad | 0% foreign exchange fees and global acceptance |

| High Spending | Unlimited spending and no fees |

| Stablecoin Management | Free and instant cross-chain bridge |

| Passive Income | Up to 360% APR through DUO |

With its diverse features, Wirex excels in scenarios that require flexibility and ease of use. It is a versatile tool for anyone looking to integrate crypto with daily financial activities.

Frequently Asked Questions

What Is Wirex?

Wirex is a digital payment platform. It combines traditional and cryptocurrency services. It offers a card for seamless spending.

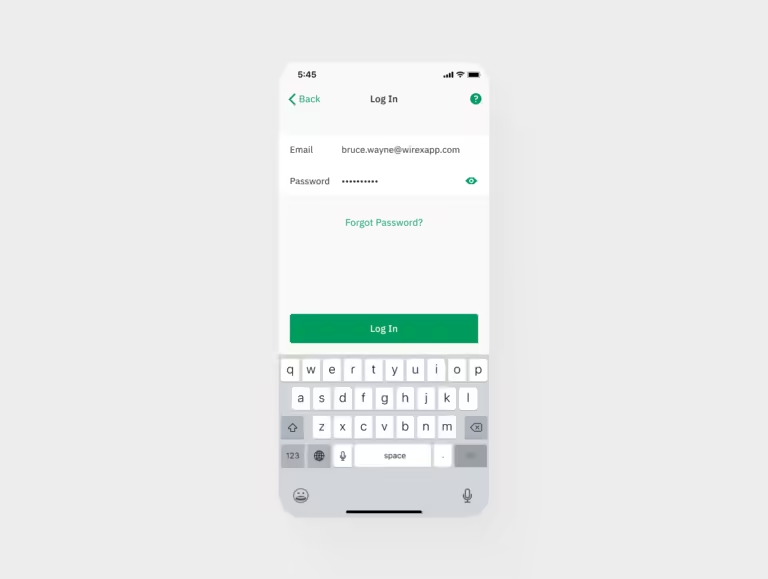

How Does Wirex Work?

Wirex integrates fiat and cryptocurrency accounts. You can use their app to manage funds. It also offers a debit card for transactions.

Is Wirex Safe To Use?

Yes, Wirex is secure. It uses advanced security protocols. It includes multi-signature authorization and two-factor authentication.

What Currencies Does Wirex Support?

Wirex supports multiple fiat and cryptocurrencies. These include USD, EUR, BTC, and ETH. It continues to add more currencies regularly.

Conclusion

Wirex offers a comprehensive solution for crypto and traditional banking needs. The Wirex Card provides unique benefits like Cryptoback™ rewards and zero foreign exchange fees. Users can earn interest up to 16% AER and enjoy free ATM withdrawals. Wirex also supports seamless cross-chain asset management. Ready to experience these features? Discover more on the official Wirex website here. Consider Wirex for secure and rewarding financial management.