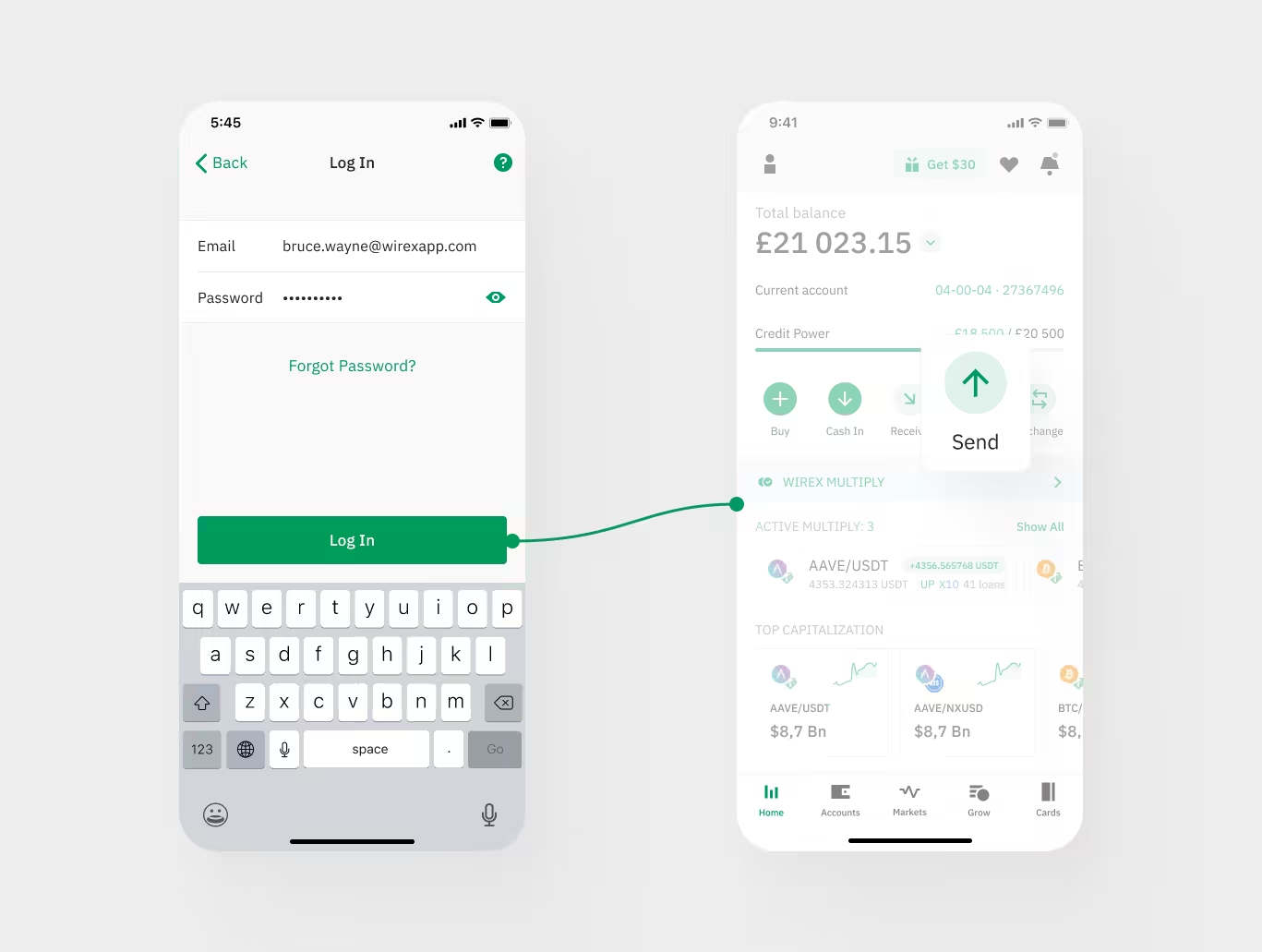

Wirex Cash Withdrawal: Simplifying Your Crypto to Cash Process

Wirex makes cash withdrawals simple and efficient. With the Wirex card, you can easily access your funds wherever you are.

Imagine having a card that combines the benefits of digital currencies with the ease of traditional banking. The Wirex card is designed to make your crypto transactions smooth and hassle-free. It offers features like 0% foreign exchange fees, high withdrawal limits, and exciting rewards. Whether you’re traveling or just need cash on hand, the Wirex card ensures you can withdraw money without stress. Discover more about how Wirex can simplify your financial life by visiting their official website. Read on to learn about the amazing benefits and features of Wirex cash withdrawals.

Introduction To Wirex Cash Withdrawal

Wirex is a popular platform for managing crypto and fiat currencies. The Wirex Card is known for its user-friendly design and secure transactions. It integrates seamlessly with Google Pay™ in Australia and offers high transaction limits with no fees. This makes it a convenient choice for many users. One of the most noteworthy features is the ability to withdraw cash from ATMs. Let’s delve into what Wirex is and the purpose behind Wirex cash withdrawals.

What Is Wirex?

Wirex is a platform that allows users to manage both crypto and fiat currencies. It offers a secure and user-friendly debit card designed for everyday transactions. With Wirex, users can:

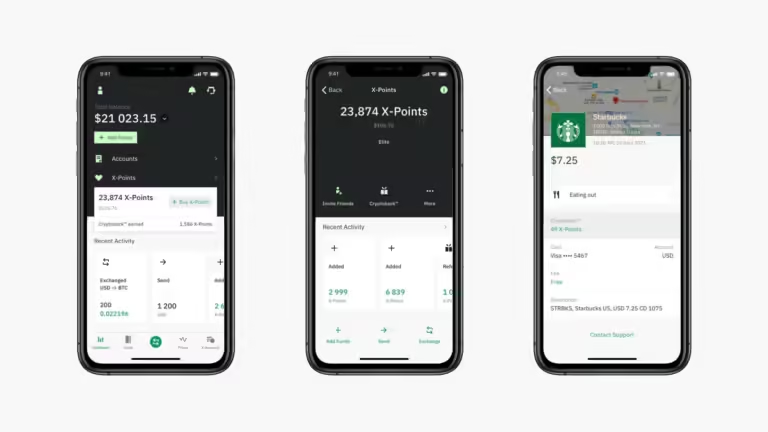

- Earn up to 8% back in crypto with Cryptoback™ rewards.

- Enjoy 0% foreign exchange fees on global transactions.

- Benefit from free ATM withdrawals and unlimited spending.

- Access high-interest earnings with X-Accounts and DUO.

- Transfer assets between blockchains instantly and for free.

Wirex also supports major stablecoins like USDC and USDT, making it versatile for users engaging in digital currency transactions.

Purpose Of Wirex Cash Withdrawal

Wirex cash withdrawals offer flexibility and ease for users needing quick access to their funds. Some key benefits include:

| Benefit | Description |

|---|---|

| High Limits | Withdraw large amounts without restrictions. |

| No Fees | Enjoy free ATM withdrawals worldwide. |

| Global Access | Access your funds anywhere with ease. |

Wirex ensures users can manage their money efficiently, whether they are traveling or need cash for daily expenses. The platform’s high security and $30 million insurance on digital assets further add to its appeal.

Key Features Of Wirex Cash Withdrawal

Wirex offers a range of features that make cash withdrawal seamless and convenient. Below are some of the most important features that set Wirex apart from other services.

Instant Conversion From Crypto To Cash

Wirex allows users to instantly convert their crypto assets to cash. This process is fast, ensuring you have immediate access to your funds. You no longer need to wait for lengthy transaction times.

Global Atm Access

With Wirex, you can withdraw cash from ATMs worldwide. The card supports free ATM withdrawals, making it an ideal choice for travelers. Enjoy the freedom to access your money wherever you go.

Multi-currency Support

Wirex supports multiple currencies, including major stablecoins like USDC and USDT. This allows users to manage and withdraw funds in various currencies, adding to the card’s flexibility.

Real-time Transaction Notifications

Stay informed with real-time transaction notifications on your Wirex app. This feature helps you keep track of your spending and ensures the security of your account. Immediate alerts ensure you are always aware of your transactions.

Pricing And Affordability Breakdown

The Wirex Card offers a range of features tailored for crypto enthusiasts. Understanding its pricing and affordability is crucial. Let’s break down the costs associated with the Wirex Card.

Withdrawal Fees

The Wirex Card boasts high limits and no fees for ATM withdrawals. This benefit applies regardless of the plan you choose, whether it’s the Standard, Premium, or Elite plan.

Currency Conversion Rates

Wirex stands out with its 0% foreign exchange fees. This means you can spend globally without worrying about extra charges for currency conversion. Additionally, Wirex supports major stablecoins like USDC and USDT across multiple blockchains, ensuring flexibility and convenience.

Atm Fees

For ATM withdrawals, Wirex users enjoy free withdrawals. This is a significant advantage, especially for frequent travelers or those who often need cash. The benefit of free ATM withdrawals applies across all Wirex plans.

Overall Cost Analysis

Let’s summarize the overall costs associated with the Wirex Card:

| Plan | Monthly Fee | Cryptoback™ Rewards | ATM Withdrawal Fees |

|---|---|---|---|

| Standard Plan | Free | Up to 1% | Free |

| Premium Plan | $9.99 | Up to 3% | Free |

| Elite Plan | $29.99 | Up to 8% | Free |

The Wirex Card is a cost-effective solution for crypto transactions. With zero foreign exchange fees, free ATM withdrawals, and substantial Cryptoback™ rewards, it offers great value for every user.

Pros And Cons Of Wirex Cash Withdrawal

The Wirex Card offers a seamless way to withdraw cash, blending the convenience of digital currencies with traditional financial systems. This section delves into the pros and cons of using Wirex for cash withdrawals. We’ll explore its advantages, potential drawbacks, and compare it with other similar services.

Advantages Of Using Wirex

Wirex provides several benefits, making it a popular choice for cash withdrawals:

- High Limits, No Fees: Wirex offers free ATM withdrawals and unlimited spending, making it cost-effective.

- 0% Foreign Exchange Fees: No fees on global transactions, allowing users to save money when traveling.

- Cryptoback™ Rewards: Earn up to 8% back in crypto on every transaction, including cash withdrawals.

- Google Pay™ Integration: Available in Australia for added convenience.

- Security: Digital assets are insured up to $30 million, ensuring peace of mind.

Potential Drawbacks

Despite its many advantages, there are some potential drawbacks to using Wirex for cash withdrawals:

- Subscription Fees: Premium plans, such as the $29.99/month Elite Plan, may be expensive for some users.

- Jurisdictional Limitations: Availability of certain features depends on the user’s location.

- Regulatory Restrictions: Some services are subject to regulatory restrictions, which could affect usability.

Comparison With Other Services

Wirex stands out among similar services due to its unique features and benefits. Below is a comparison with other popular services:

| Feature | Wirex | Competitor A | Competitor B |

|---|---|---|---|

| Free ATM Withdrawals | Yes | No | Yes |

| Foreign Exchange Fees | 0% | 2% | 1% |

| Cryptoback™ Rewards | Up to 8% | None | Up to 2% |

| Subscription Cost | $0 – $29.99/month | $5 – $20/month | $10 – $25/month |

In summary, while Wirex offers several advantages, it is essential to consider potential drawbacks and compare it with other services to determine if it meets your needs.

Recommendations For Ideal Users Or Scenarios

Wirex offers a versatile debit card for crypto enthusiasts. It suits various users and scenarios. Here are some ideal recommendations.

Best Use Cases

- Frequent Travelers: Benefit from 0% foreign exchange fees and free ATM withdrawals worldwide.

- Crypto Traders: Utilize institutional asset pricing to buy digital assets at competitive rates.

- Passive Income Seekers: Leverage X-Accounts to earn up to 16% variable AER interest.

- High Spenders: Enjoy high transaction limits and significant rewards with every purchase.

Who Should Use Wirex?

| User Type | Benefits |

|---|---|

| Digital Nomads | Access stablecoins and make instant transfers between blockchains. |

| Investors | Generate up to 360% APR with DUO and other passive earnings options. |

| Everyday Users | Earn up to 8% back in crypto on everyday transactions. |

Scenarios Where Wirex Shines

- Global Shopping: Shop globally with no extra fees and earn rewards.

- High-Yield Savings: Park your money in X-Accounts to earn high interest.

- Secure Transactions: Enjoy the peace of mind with $30 million insurance on digital assets.

- Borrowing Needs: Borrow stablecoins at 0% APR without credit checks.

Frequently Asked Questions

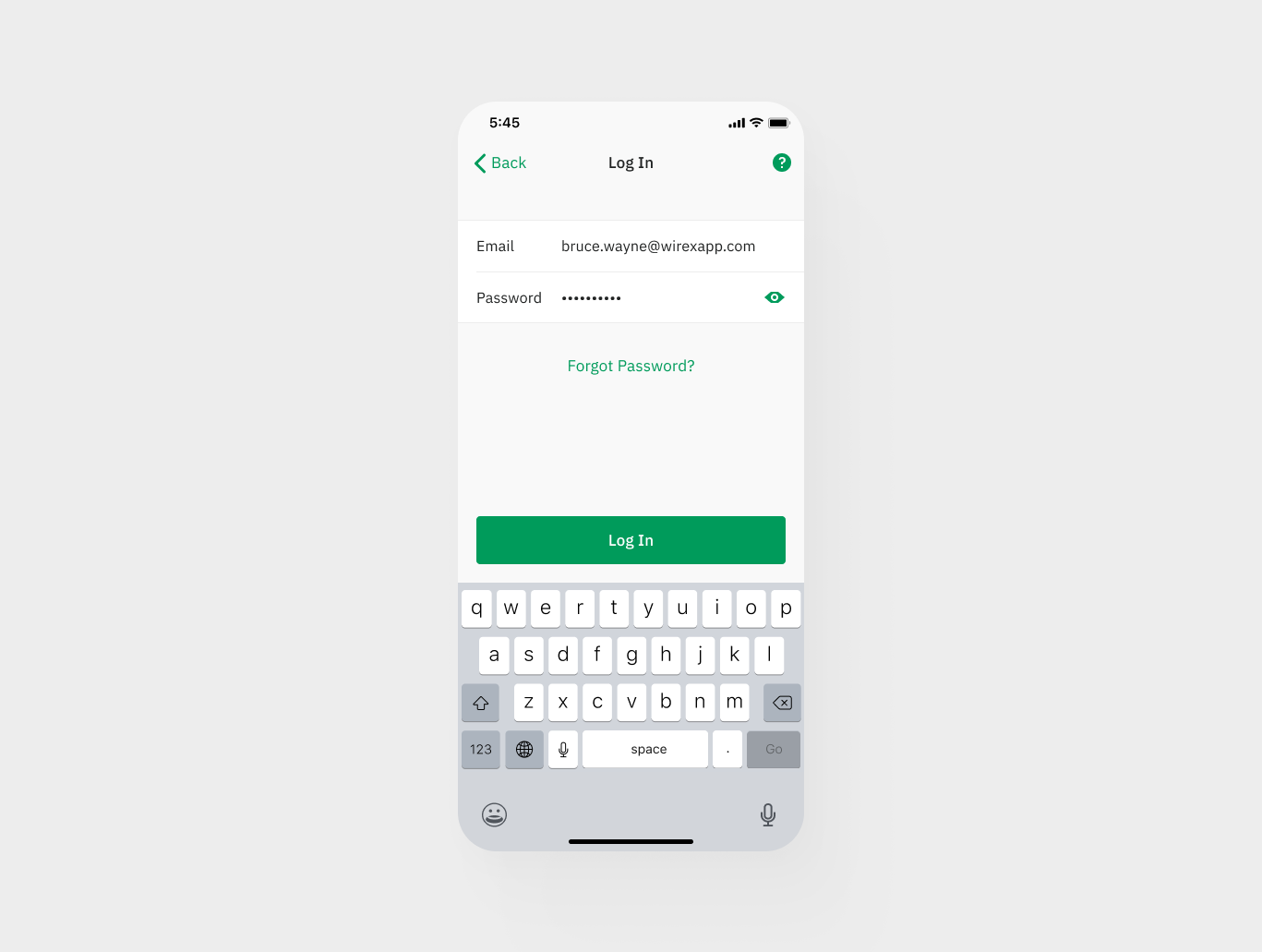

How To Withdraw Cash With Wirex?

To withdraw cash with Wirex, locate a compatible ATM. Insert your Wirex card, enter your PIN, and select the withdrawal amount.

Are Wirex Cash Withdrawals Safe?

Yes, Wirex cash withdrawals are safe. Wirex employs advanced security measures, including encryption and two-factor authentication, to protect your transactions.

What Are The Wirex Atm Fees?

Wirex charges a small fee for ATM withdrawals. The exact fee varies by location and currency. Check the app for details.

Is There A Withdrawal Limit On Wirex?

Yes, Wirex has a daily ATM withdrawal limit. The limit can vary by account type and location. Check the app for specifics.

Conclusion

Using Wirex for cash withdrawals offers convenience and flexibility. The card’s zero foreign exchange fees and high transaction limits make it ideal for global use. Plus, the Cryptoback™ rewards and other benefits make every transaction worthwhile. With security features and user-friendly options, Wirex simplifies managing digital assets. For more details, visit the official Wirex site.