Wallester Features: Unlocking Advanced Payment Solutions

Managing corporate expenses can be challenging. Wallester simplifies this task with its robust features.

Wallester Business Expense Cards offer a seamless solution for businesses of all sizes. With 300 free virtual cards and no hidden fees, Wallester provides an efficient way to manage corporate spending. The platform supports real-time tracking, instant issuance, and compliance with financial regulations, ensuring both security and convenience. Whether you need virtual or physical Visa-branded cards, Wallester has you covered. Customizable spending limits, continuous fraud monitoring, and integration with digital wallets like Apple Pay and Google Pay make it an ideal choice for modern businesses. Explore how Wallester can transform your expense management by visiting their website here.

Introduction To Wallester

Wallester is a leading solution in the field of credit cards and personal finance. It offers innovative tools for managing corporate spending with a focus on security and efficiency. Below, we explore the key aspects of Wallester.

Overview Of Wallester

Wallester provides a comprehensive platform for businesses to manage their expenses. The service includes:

- 300 free virtual cards

- No hidden fees

- Real-time tracking

- Open API

- Instant issuance

- Visa-branded cards

- Compliance with KYC and AML regulations

- Card tokenization for digital wallets

- 3D Secure protection

- Continuous fraud monitoring

Wallester allows businesses to have instant access to funds and control expenses in real-time. The platform is user-friendly and integrates seamlessly with existing systems.

Purpose And Mission

Wallester’s mission is to provide an efficient and safe way to manage corporate expenses. The company aims to offer:

- Instant access to funds

- Real-time expense control

- Customizable spending limits for employees

- Secure transactions compliant with financial regulations

With over 25 years of experience and a user base of over 350k, Wallester has processed transactions worth 0.9B+ EUR. The company ensures high security and compliance with financial regulations.

Wallester operates under Estonian financial regulations and is a Visa Principal Member. The service is free due to partnerships with Visa and other entities.

Wallester also provides additional services such as:

- Tokenization

- 3D Secure

- Fraud Monitoring

- KYC/KYB and AML Compliance

- Apple Pay and Google Pay Integration

With a strong focus on safety and compliance, Wallester offers a reliable solution for managing corporate expenses.

| Feature | Description |

|---|---|

| 300 free virtual cards | Allows businesses to issue multiple cards without additional cost |

| No hidden fees | Transparent pricing with no unexpected charges |

| Real-time tracking | Monitor expenses as they happen |

| Open API | Integrate Wallester with your existing systems |

| Instant issuance | Generate physical and virtual cards immediately |

Wallester’s commitment to efficient expense management and secure transactions makes it a valuable tool for businesses of all sizes.

Key Features Of Wallester

Wallester offers innovative solutions for managing corporate expenses through its comprehensive platform. The key features make it an ideal choice for businesses looking for secure and efficient financial management.

Wallester provides both virtual and physical Visa-branded cards. Businesses can issue up to 300 free virtual cards with no hidden fees. The instant issuance feature ensures that employees have immediate access to funds.

With real-time tracking, businesses can monitor expenses as they occur. The platform offers continuous fraud monitoring and 3D Secure protection to ensure every transaction is secure.

Wallester allows businesses to customize the design of their cards. This feature helps in branding and provides a personalized touch to the financial tools used by employees.

The platform includes an open API for easy integration with existing systems. This ensures a seamless experience and minimizes disruptions during the transition phase.

Wallester complies with KYC and AML regulations, ensuring high-level security and compliance. The platform also supports card tokenization for digital wallets like Apple Pay and Google Pay, enhancing the security of transactions.

| Feature | Description |

|---|---|

| Virtual and Physical Cards | Issue up to 300 free Visa-branded cards instantly. |

| Real-Time Tracking | Monitor transactions and expenses as they happen. |

| Customizable Card Designs | Personalize card designs to align with business branding. |

| Open API | Integrate easily with existing systems for a seamless experience. |

| Advanced Security | Complies with KYC, AML, and supports card tokenization. |

Comprehensive Card Issuing

Wallester provides a comprehensive solution for issuing and managing corporate cards. The platform offers a range of features to streamline expense management, ensuring efficiency and security.

Variety Of Card Types

Wallester supports both virtual and physical Visa-branded cards. These cards cater to different business needs and preferences. Virtual cards are ideal for online transactions, while physical cards are suitable for in-person payments.

The platform offers 300 free virtual cards without hidden fees. This makes it cost-effective for businesses to manage corporate expenses. Additionally, the system supports card tokenization for digital wallets like Apple Pay and Google Pay.

Instant Issuance And Management

Wallester enables instant issuance of corporate cards. Businesses can generate both virtual and physical cards in real-time. This feature ensures immediate access to funds, enhancing operational efficiency.

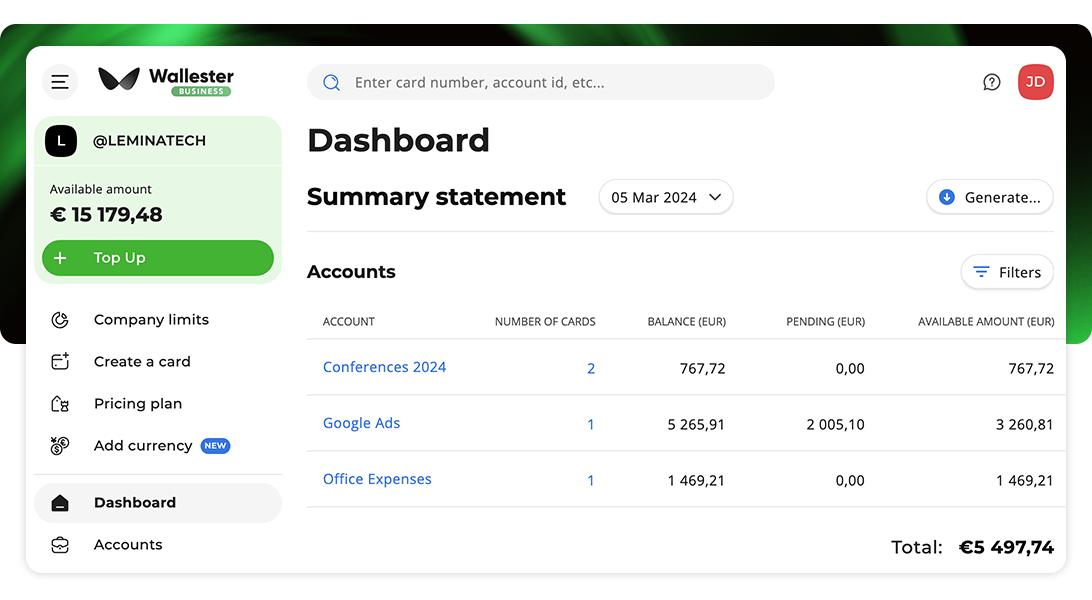

The platform also provides real-time tracking and management of expenses. Users can monitor transactions through a unified system, ensuring transparency and control over corporate spending.

International Acceptance

Wallester cards are internationally accepted, making them suitable for global businesses. These Visa-branded cards ensure seamless transactions across different countries. Companies can operate without geographical limitations, enhancing their global reach.

Moreover, Wallester adheres to financial regulations, including KYC and AML compliance. This ensures secure and compliant transactions, minimizing the risk of fraud.

With features like 3D Secure protection and continuous fraud monitoring, Wallester offers a safe and reliable card issuing solution for businesses worldwide.

Real-time Transaction Monitoring

Wallester’s real-time transaction monitoring feature ensures you stay on top of your finances. This powerful tool keeps you informed and secure with every transaction.

Instant Alerts And Notifications

Wallester provides instant alerts and notifications for every transaction. You receive updates immediately when a transaction occurs. This helps in keeping track of your spending at all times.

The instant alerts notify you via email or mobile app. This ensures you never miss any important transaction activity. You can customize the notifications to suit your needs.

Fraud Detection And Prevention

Continuous fraud monitoring is a key feature of Wallester. The system detects unusual activity and prevents potential fraud. It uses advanced algorithms to identify suspicious transactions.

If any suspicious activity is detected, you are notified immediately. This allows you to take prompt action to secure your account. Wallester is compliant with KYC and AML regulations, ensuring high security.

Detailed Transaction Reports

Wallester offers detailed transaction reports. These reports provide a comprehensive view of your spending. You can access these reports anytime through the platform.

The reports include information such as date, amount, and merchant details. This helps in analyzing your expenses and making informed decisions. The data can be exported for further analysis or accounting purposes.

Here is a summary of the main features of Wallester Business Expense Cards:

| Feature | Description |

|---|---|

| 300 Free Virtual Cards | Manage corporate spending with multiple cards |

| No Hidden Fees | Transparent pricing with no extra costs |

| Real-Time Tracking | Monitor transactions as they happen |

| Compliance | KYC and AML regulations adhered to |

| 3D Secure | Extra layer of security for online transactions |

Wallester ensures efficient and secure management of corporate expenses. The platform integrates seamlessly with existing systems and offers cost-effective solutions.

Customizable Card Designs

Wallester offers an impressive range of customizable card designs. Businesses can create unique cards that reflect their brand identity. This feature enhances brand recognition and customer loyalty.

Brand Personalization

With Wallester, brand personalization is seamless. Companies can incorporate their logos, colors, and design elements. This ensures every card issued aligns with the company’s visual identity. The result? Stronger brand presence and recall.

Design Flexibility

Wallester provides extensive design flexibility for card customization. Whether you need a sleek, professional look or a vibrant, eye-catching design, the possibilities are endless. Here are some customizable features:

- Logos and branding

- Color schemes

- Cardholder details

- Custom graphics

This flexibility allows businesses to create cards that truly stand out.

Enhanced Customer Experience

A well-designed card can significantly improve the customer experience. By offering visually appealing and personalized cards, Wallester helps businesses make a lasting impression. Customers appreciate the attention to detail and feel valued, fostering loyalty and trust.

In summary, Wallester’s customizable card designs empower businesses to enhance their brand, provide unique experiences, and ensure card designs that reflect their identity.

Seamless Api Integration

Wallester ensures seamless API integration, enabling businesses to quickly and efficiently manage their corporate expenses. This feature is designed to integrate smoothly with your existing systems, providing a hassle-free experience.

Developer-friendly Documentation

Wallester provides comprehensive and user-friendly documentation for developers. The documentation includes clear instructions, code examples, and detailed explanations. This makes it easy for developers to understand and implement the API. The structured documentation ensures that developers spend less time troubleshooting and more time building.

Quick And Easy Implementation

The API integration process is designed to be quick and straightforward. With Wallester’s open API, you can start issuing both virtual and physical Visa-branded cards in no time. The step-by-step implementation guide and support from Wallester’s team ensure a smooth setup. This reduces the time to market and allows your business to start benefiting from the platform immediately.

Scalability And Flexibility

Wallester’s API is scalable and flexible, making it suitable for businesses of all sizes. Whether you need a few cards or thousands, the system can handle the load without compromising performance. The API supports real-time tracking and instant issuance, ensuring your operations run smoothly. Additionally, the customizable spending limits feature provides the flexibility needed to manage different employee needs effectively.

| Feature | Description |

|---|---|

| Developer-Friendly Documentation | Clear instructions, code examples, detailed explanations. |

| Quick and Easy Implementation | Step-by-step guide, support from Wallester’s team. |

| Scalability and Flexibility | Suitable for all sizes, customizable spending limits. |

With Wallester, managing corporate expenses becomes efficient and straightforward, thanks to their robust API integration capabilities.

Advanced Security Measures

Wallester takes security very seriously, ensuring that all transactions and personal information are protected at the highest level. Here, we discuss some of the advanced security measures Wallester employs to keep your data safe and secure.

Encryption And Tokenization

Wallester uses state-of-the-art encryption methods to protect data during transmission and storage. This ensures that sensitive information is unreadable to unauthorized users.

Tokenization replaces sensitive card details with a unique identifier, or token. This token can be used for transactions without exposing the actual card information. Wallester supports digital wallets like Apple Pay and Google Pay through card tokenization.

| Feature | Description |

|---|---|

| Encryption | Protects data during transmission and storage |

| Tokenization | Replaces card details with unique tokens for secure transactions |

Compliance With Industry Standards

Wallester complies with various industry standards to ensure the highest level of security and trust.

- KYC and AML regulations: Ensures customer identity verification and anti-money laundering compliance.

- PCI DSS compliant: Meets the Payment Card Industry Data Security Standard to protect card data.

- 3D Secure: Adds an additional layer of authentication for online transactions.

Multi-factor Authentication

Wallester employs multi-factor authentication (MFA) to enhance security. MFA requires users to provide two or more verification methods before accessing their accounts.

- Something you know: Password or PIN.

- Something you have: A physical device like a smartphone.

- Something you are: Biometric verification like fingerprint or facial recognition.

This reduces the risk of unauthorized access, ensuring that only legitimate users can perform transactions.

Pricing And Affordability

Wallester Business Expense Cards offer a comprehensive solution for managing corporate spending. The focus on pricing and affordability makes it an attractive option for businesses of all sizes. Let’s delve into the various pricing tiers, cost-benefit analysis, and value for money.

Pricing Tiers And Options

Wallester provides its business solution for free. The service generates revenue through partnerships with Visa and other entities. This allows Wallester to offer 300 free virtual cards, with no hidden fees. The platform is designed for ease of use and real-time tracking.

| Feature | Details |

|---|---|

| Virtual Cards | 300 free |

| Hidden Fees | None |

| Real-Time Tracking | Included |

| API Access | Included |

| Visa-Branded Cards | Available |

Cost-benefit Analysis

The cost-benefit analysis of Wallester Business Expense Cards shows significant advantages. The platform offers features like real-time expense control, customizable spending limits, and continuous fraud monitoring. These features help businesses manage expenses efficiently and securely.

- Real-time expense control: Monitor transactions instantly.

- Customizable spending limits: Set limits per employee.

- Fraud monitoring: Continuous protection from fraud.

- Compliance: Adheres to KYC and AML regulations.

By providing these essential features at no cost, Wallester ensures businesses can focus on growth without worrying about hidden expenses.

Value For Money

Wallester Business Expense Cards deliver exceptional value for money. The service is free due to partnerships, making it a cost-effective solution. Businesses receive instant access to funds, seamless integration with existing systems, and secure, compliant financial operations.

- Cost-effective: Free service with no hidden fees.

- Instant access to funds: Cards issued instantly.

- Seamless integration: Works with existing systems.

- Secure and compliant: Meets all financial regulations.

With these benefits, Wallester positions itself as a valuable tool for businesses aiming to streamline expense management while maintaining financial control.

Pros And Cons Of Wallester

Wallester offers comprehensive solutions for managing corporate spending. It features virtual and physical Visa-branded cards, real-time tracking, and no hidden fees. Let’s explore the advantages and drawbacks of using Wallester.

Advantages Of Using Wallester

| Feature | Benefit |

|---|---|

| 300 Free Virtual Cards | Manage multiple employees without additional cost |

| No Hidden Fees | Transparent pricing structure |

| Real-Time Tracking | Monitor expenses instantly |

| Instant Issuance | Immediate access to funds |

| Compliance with KYC/AML | Ensures safety and regulatory adherence |

| Card Tokenization | Compatible with Apple Pay and Google Pay |

| 3D Secure Protection | Enhanced security during transactions |

| Continuous Fraud Monitoring | Reduces risk of unauthorized transactions |

Potential Drawbacks

- Availability limited to specific regions (EEA, UK, Switzerland, Ireland)

- No specific refund or return policies mentioned

- Dependent on bank transfer for initial top-up

User Feedback And Reviews

Wallester has gained significant traction with over 350k+ users and 25+ years of experience in the industry. Users appreciate the platform’s ease of use and real-time tracking capabilities.

One common praise is the absence of hidden fees, making financial management straightforward. The ability to issue 300 free virtual cards is also a highlighted feature, particularly for larger companies.

However, some users note the limitation in geographical availability. The dependency on bank transfers for initial top-ups is another point of feedback.

Ideal Users And Scenarios

Wallester Business Expense Cards are designed to streamline corporate spending. They cater to a wide range of users and scenarios. Below, we explore who can benefit most, the best use cases, and the industry applications.

Who Can Benefit Most

Wallester’s features cater to businesses of various sizes and industries. Here are the primary users:

- Small and Medium Enterprises (SMEs): Simplify expense management with up to 300 free virtual cards.

- Large Corporations: Benefit from real-time tracking and instant issuance of cards.

- Startups: Access a cost-effective solution with no hidden fees.

- Freelancers and Consultants: Manage business expenses efficiently and securely.

Best Use Cases

Wallester Business Expense Cards can be applied in various scenarios:

- Employee Expenses: Set customizable spending limits and monitor transactions in real-time.

- Travel Management: Issue virtual and physical Visa-branded cards for travel expenses.

- Departmental Budgets: Allocate funds to different departments and track spending efficiently.

- Subscription Payments: Use virtual cards for recurring payments and subscriptions.

Industry Applications

Wallester’s solutions are versatile and can be applied across various industries:

- Financial Services: Banks and loan providers can integrate Wallester’s features for seamless expense management.

- E-commerce: Online retailers can manage vendor payments and customer refunds efficiently.

- Fintech: Startups and established companies can leverage the open API for custom integrations.

- Insurance: Insurers can streamline claim payments with instant card issuance.

- Corporate Employers: Manage employee expenses and departmental budgets with real-time tracking.

In summary, Wallester Business Expense Cards offer a comprehensive solution for various users and scenarios. Their features make them ideal for SMEs, large corporations, and freelancers, providing flexible and secure expense management.

Frequently Asked Questions

What Are Wallester’s Key Features?

Wallester offers advanced card issuance, transaction management, and real-time data analytics. It provides customizable solutions for businesses, ensuring seamless financial operations.

How Secure Is Wallester?

Wallester ensures top-notch security with PCI DSS compliance and advanced fraud protection. It uses encryption and multi-factor authentication for enhanced safety.

Can Wallester Integrate With Other Platforms?

Yes, Wallester supports integration with various platforms via APIs. This allows seamless connectivity with existing systems, enhancing operational efficiency.

What Types Of Cards Does Wallester Issue?

Wallester issues virtual and physical cards, including prepaid, debit, and credit cards. These cards are tailored to meet diverse business needs.

Conclusion

Wallester Business Expense Cards streamline corporate spending effortlessly. Enjoy 300 free virtual cards and no hidden fees. Monitor expenses in real-time and stay compliant. Ready to simplify your financial management? Discover more about Wallester here.