Vialet Advantages: Discover the Benefits of Modern Banking

Looking for a flexible and reliable business account? VIALET Business Account might be just what you need.

This all-in-one solution offers instant money transfers and open banking features that are crucial for modern businesses. VIALET provides a seamless platform designed to simplify financial management. With the ability to set up multiple IBANs, manage team access, and handle multi-currency payments, it caters to diverse business needs. The platform supports SEPA, SWIFT, and local payment options, ensuring smooth international transactions. Virtual corporate cards and mass payouts via API make it easy to manage salaries and expenses. Plus, the robust security features and transparent fees make VIALET a trustworthy choice for businesses. Ready to streamline your financial operations? Discover more by visiting VIALET Business Account.

Introduction To Vialet And Its Purpose

VIALET Business Account is designed to cater to modern business needs. It offers a comprehensive solution for flexible business accounts, instant money transfers, and open banking. The platform ensures seamless financial management for businesses, regardless of their size.

What Is Vialet?

VIALET is an all-in-one growth engine for businesses. It provides tools to manage finances efficiently. With VIALET, you can set up multiple IBANs, add team members, and assign different access levels. It supports SEPA, SEPA Instant, SWIFT payments, and local payment options.

- Flexible Business Account: Manage multiple IBANs and team access from a single account.

- Multi-Currency Payments: Handle payments in various currencies like EUR, USD, GBP, and more.

- Virtual Corporate Cards: Use virtual Visa or Mastercard for salaries, expenses, and vendor payments.

- Mass Payouts via API: Automate regular payments to numerous recipients quickly.

The Evolution Of Modern Banking

Modern banking has evolved to meet the fast-paced demands of businesses. Traditional banking methods often fall short in terms of speed and flexibility. VIALET addresses these gaps by offering a multi-functional payment platform. It integrates open banking solutions and local payment options.

Businesses can benefit from:

- Speed & Ease of Use: Quick account setup and swift transactions.

- Personalized Support: Direct communication with an account manager.

- Robust Security: Advanced security features to protect financial data.

- Transparent Fees: Competitive and transparent fee structure.

As part of the VIA SMS Group, VIALET is registered in Lithuania and licensed as an electronic money institution by the Lithuanian Central Bank. This adds an extra layer of trust and compliance for users.

For further information, visit the official VIALET website.

Key Features Of Vialet

VIALET Business Account offers a range of robust features designed to meet the needs of modern businesses. Below, we explore the key features that make VIALET a standout choice for business accounts.

User-friendly Mobile App

The VIALET mobile app is intuitive and easy to navigate. Users can manage their finances on the go. The app allows for quick access to account balances, transaction histories, and other essential features. This user-friendly design ensures that even those with limited tech skills can use it effectively.

Instant Payments And Transfers

With VIALET, businesses can enjoy the benefits of instant money transfers. The platform supports SEPA, SEPA Instant, SWIFT payments, and local payment options. This means faster transactions, which is crucial for maintaining cash flow and ensuring smooth operations.

Global Accessibility

VIALET supports multi-currency payments, allowing businesses to handle transactions in EUR, USD, GBP, PLN, SEK, DKK, CZK, and CHF. This global accessibility makes it easier to conduct international business and manage finances across different currencies.

Advanced Security Measures

Security is a top priority for VIALET. The platform incorporates advanced security features to protect financial data. These measures ensure that all transactions are secure and that sensitive information is safeguarded.

Personalized Financial Insights

VIALET provides personalized financial insights to help businesses make informed decisions. Users can access detailed reports and analytics that offer a clear view of financial health. These insights are crucial for strategic planning and growth.

| Feature | Description |

|---|---|

| User-Friendly Mobile App | Intuitive app for managing finances on the go. |

| Instant Payments and Transfers | Supports SEPA, SEPA Instant, and SWIFT payments. |

| Global Accessibility | Handle transactions in multiple currencies. |

| Advanced Security Measures | Incorporates robust security features. |

| Personalized Financial Insights | Access detailed reports and analytics. |

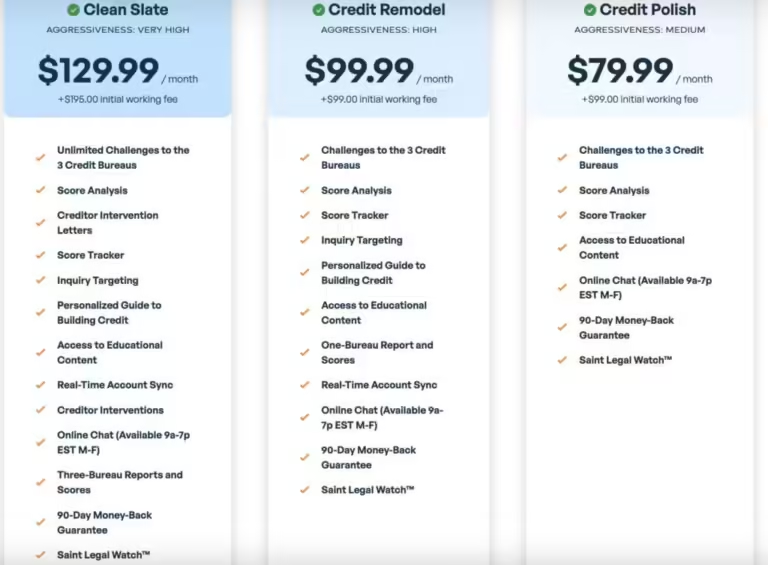

Pricing And Affordability

Choosing a business account often comes down to pricing and affordability. VIALET Business Account stands out with its competitive and transparent fees, making it a cost-effective solution for businesses of all sizes.

Transparent Fee Structure

VIALET offers a transparent fee structure to ensure businesses are aware of all costs upfront. Unlike some traditional banks, VIALET does not burden you with hidden charges.

- Transparent Fees: VIALET emphasizes competitive and honest rates.

- Multi-Currency Payments: Handle payments in various currencies with clear account charges.

- No Hidden Fees: All costs are communicated clearly, providing peace of mind.

With VIALET, businesses can manage their financial activities without worrying about unexpected fees disrupting their budget.

Comparison With Traditional Banking Costs

Traditional banks often charge for a range of services that can add up quickly. Here’s how VIALET compares:

| Service | VIALET Business Account | Traditional Bank |

|---|---|---|

| Account Setup | Quick and easy | Can be lengthy and complex |

| IBAN Management | Multiple IBANs from a single account | Usually one IBAN per account |

| Transaction Fees | Competitive and transparent | Often higher and variable |

| Currency Exchange | Clear rates | May include hidden fees |

| Support | Personalized and direct | Can be less personalized |

By comparing VIALET with traditional banks, it’s clear that VIALET offers a more affordable and transparent solution. This transparency is crucial for businesses aiming to manage costs effectively.

Pros And Cons Of Using Vialet

VIALET offers a comprehensive business account solution, tailored for flexible financial management. This section will explore the key advantages and potential drawbacks of using VIALET for your business needs.

Advantages Of Vialet

- Flexible Business Account: Manage multiple IBANs from a single account, adding team members with different access levels.

- Multi-Functional Payment Platform: Supports SEPA, SEPA Instant, SWIFT, open banking, and local payments.

- Multi-Currency Payments: Handle payments in EUR, USD, GBP, PLN, SEK, DKK, CZK, and CHF with transparent charges and rates.

- Virtual Corporate Cards: Use virtual Visa or Mastercard for salaries, expenses, and vendor payments.

- Mass Payouts via API: Automate regular payments to numerous recipients quickly.

- B2B API Connections: Integrate preferred apps and automate payments seamlessly.

- E-commerce Acquiring: Optimize checkout with preferred payment methods and benefit from instant funds through open banking API.

- Speed & Ease of Use: Quick account setup and swift transactions.

- Personalized Support: Direct communication with an account manager.

- Robust Security: Advanced security features to protect financial data.

- Transparent Fees: Competitive and transparent fee structure.

Potential Drawbacks

- Pricing Details: Detailed pricing information is not provided, which may be a concern for some businesses.

- Refund/Return Policies: Specific refund or return policies are not mentioned, leaving users unsure about these aspects.

- Limited Physical Presence: VIALET operates primarily online, which may not suit businesses preferring in-person banking services.

Ideal Users And Scenarios

VIALET Business Account is tailored to meet the dynamic needs of various businesses. This flexibility and functionality make it suitable for a range of users and scenarios. Let’s explore who benefits the most from VIALET and its best use cases.

Who Benefits Most From Vialet?

- Small and Medium Enterprises (SMEs): VIALET offers flexible business accounts, ideal for SMEs that need multiple IBANs and team member management.

- Startups: Quick account setup and personalized support help startups manage finances efficiently.

- E-commerce Businesses: The e-commerce acquiring feature optimizes checkout processes and supports various payment methods.

- Freelancers and Consultants: Virtual corporate cards and multi-currency payments make it easier to handle international transactions.

- Tech-Savvy Enterprises: B2B API connections allow for seamless integration of preferred apps and automation of payments.

Best Use Cases For Vialet

| Scenario | Features |

|---|---|

| Multiple IBAN Management | Set up multiple IBANs, manage team access from a single account. |

| International Payments | Supports SEPA, SEPA Instant, SWIFT, and local payment options. |

| Mass Payouts | Automate regular payments to numerous recipients via API. |

| Expense Management | Use virtual corporate cards for salaries, expenses, and vendor payments. |

| E-commerce Transactions | Optimize checkout and benefit from instant funds through open banking API. |

VIALET Business Account is an all-in-one solution for businesses seeking efficient and secure financial management. With its diverse features and user-friendly design, it caters to the needs of various business scenarios.

Frequently Asked Questions

What Are The Benefits Of Using Vialet?

Vialet offers a user-friendly interface, low fees, and quick transactions. It ensures secure and efficient financial management. Users can also enjoy seamless international money transfers.

How Secure Is Vialet For Transactions?

Vialet uses advanced encryption and security protocols. It ensures that all transactions and personal data are safe. Users can rely on its robust security measures.

Can I Use Vialet For International Transfers?

Yes, Vialet supports international money transfers. It offers low fees and competitive exchange rates. You can send money abroad quickly and easily.

Does Vialet Have A Mobile App?

Yes, Vialet has a user-friendly mobile app. It is available for both Android and iOS devices. The app allows easy management of your finances on the go.

Conclusion

VIALET Business Account is a smart choice for any business. It offers flexible accounts, multi-currency payments, and virtual corporate cards. The platform ensures speed, ease of use, and robust security. Personalized support and transparent fees further enhance the experience. Consider VIALET for seamless financial management. Start optimizing your business payments today.