Varo Vs Traditional Banks: Which Offers Better Benefits?

Choosing between Varo and traditional banks can be challenging. Both have unique features and benefits.

Varo, a mobile-only bank, offers a modern approach to banking. Traditional banks, on the other hand, have been around for decades and offer a range of services. Comparing these options helps you understand which fits your needs better. With Varo, you get the convenience of banking from your phone. Traditional banks might provide a sense of security through physical branches. This blog post will explore the differences and help you decide which is the best fit for you. To learn more about Varo, visit Varo Bank.

Introduction To Varo And Traditional Banks

Understanding the differences between Varo and traditional banks helps you make informed decisions about your finances. Both offer unique features and benefits. Let’s explore them in detail.

Overview Of Varo

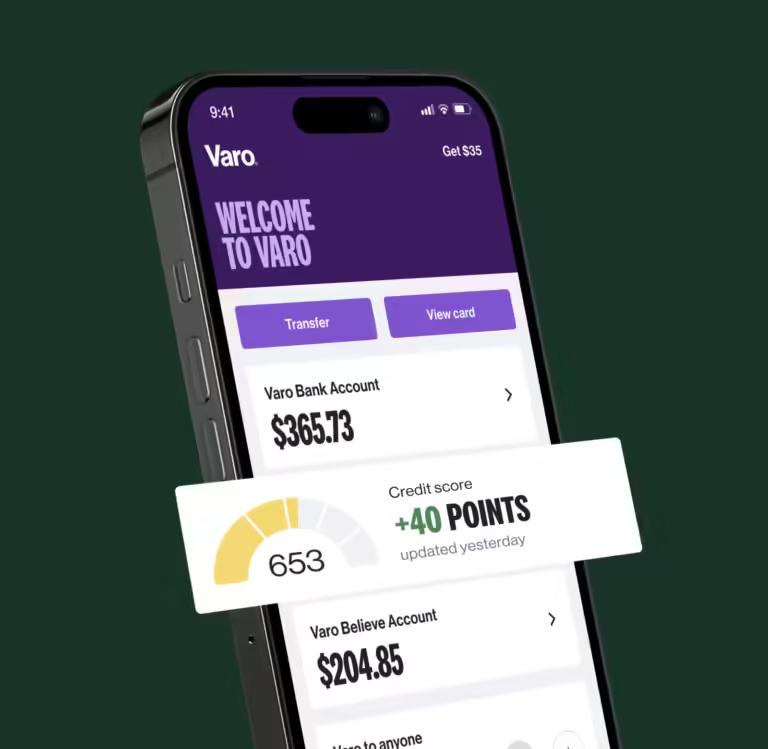

Varo App is a mobile banking application designed to provide users with an easy and convenient way to manage their finances. It allows access to banking services via mobile devices, ensuring secure login and account management. Users can track transactions and utilize budgeting tools. Varo also offers reliable customer support and assistance.

The main benefits of Varo include the convenience of banking from your mobile device, enhanced security features to protect user information, and tools that help with financial management and planning. There are no explicit pricing details or refund policies mentioned for Varo.

Overview Of Traditional Banks

Traditional banks have been the cornerstone of financial services for decades. They offer a wide range of services such as savings and checking accounts, loans, credit cards, and investment options. Customers can visit physical branches for in-person assistance.

Traditional banks provide the security of established financial institutions with a long history of trust. They also offer personalized services and face-to-face customer support. However, they may charge higher fees and require more documentation for account management and other services.

Purpose Of The Comparison

The comparison between Varo and traditional banks aims to highlight the advantages and disadvantages of each. This helps you choose the best banking option based on your needs and preferences.

Varo offers a modern, mobile-centric approach, while traditional banks provide the reliability of long-standing institutions. By understanding their differences, you can determine which banking solution aligns with your lifestyle and financial goals.

Key Features And Benefits Of Varo

Varo Bank offers a modern, convenient, and user-friendly banking experience. Let’s explore the key features and benefits that make Varo a compelling alternative to traditional banks.

No-fee Banking

Varo Bank stands out with its no-fee banking model. Unlike traditional banks, Varo does not charge:

- Monthly maintenance fees

- Minimum balance fees

- Overdraft fees

This means more savings for you. Your money stays in your account where it belongs.

High-yield Savings Accounts

Varo offers high-yield savings accounts that help your money grow faster. The interest rates are often higher than those of traditional banks. Here’s a comparison:

| Bank | Interest Rate |

|---|---|

| Varo | Up to 3.00% APY |

| Traditional Banks | 0.01% – 0.10% APY |

Investing in a Varo high-yield savings account can significantly boost your savings over time.

Digital-first Experience

Varo is built for the digital age. The Varo App provides:

- Secure login and account management

- Transaction tracking and budgeting tools

With Varo, you can manage your finances from your phone. No need to visit a branch. The app is designed to be user-friendly and intuitive.

Customer Service And Support

Varo offers reliable customer service and support. You can get help through:

- In-app chat

- Email support

Varo’s support team is responsive and ready to assist you with your banking needs. This ensures a smooth and hassle-free banking experience.

Key Features And Benefits Of Traditional Banks

Traditional banks offer secure, in-person services and a wide range of financial products. They provide personalized customer support and established trust.

Traditional banks have been around for centuries, offering numerous benefits and features that stand the test of time. Their reliability, wide range of services, and personal touch make them a preferred choice for many. Let’s explore some key features and benefits of traditional banks.Physical Branch Access

One of the most significant advantages of traditional banks is physical branch access. Customers can visit branches for face-to-face interactions, which can be crucial for complex transactions or personalized advice. Physical branches also provide a sense of security and trust, as customers can see and interact with bank staff directly.

Having access to a physical branch allows customers to:

- Deposit or withdraw large sums of money

- Access safe deposit boxes

- Resolve issues in person

Wide Range Of Financial Products

Traditional banks offer a wide range of financial products tailored to meet various needs. These products include:

- Savings and checking accounts

- Credit cards and loans

- Investment options

- Insurance services

This diversity allows customers to manage all their financial needs under one roof, providing convenience and comprehensive financial planning.

Established Trust And Security

Traditional banks have built a reputation for trust and security over many years. They are regulated by government authorities, ensuring that customer deposits are protected and transactions are secure. Banks use advanced security measures to safeguard customer information and funds, including:

- Encryption technologies

- Fraud detection systems

- Regulatory compliance

This established trust gives customers peace of mind knowing their money is safe.

Customer Service And Personal Touch

Another key benefit of traditional banks is their emphasis on customer service and personal touch. Bank staff are trained to provide personalized assistance, helping customers with their specific financial needs and concerns. This can include:

- Financial advice and planning

- Assistance with loan applications

- Resolving account issues

Personal interactions build strong relationships between the bank and its customers, fostering loyalty and satisfaction.

Pricing And Affordability

When deciding between Varo and Traditional Banks, understanding pricing and affordability is crucial. This section explores the fee structures and interest rates of both options, helping you make an informed choice.

Fee Structures Of Varo

Varo Bank offers a fee-free experience. There are no monthly maintenance fees, no overdraft fees, and no minimum balance requirements. This makes Varo an attractive option for those looking to avoid traditional banking fees.

- No monthly maintenance fees

- No overdraft fees

- No minimum balance requirements

Moreover, Varo provides free access to over 55,000 Allpoint ATMs. This means users can withdraw money without incurring additional charges.

Fee Structures Of Traditional Banks

Traditional banks often come with various fees. These may include monthly maintenance fees, overdraft fees, and minimum balance requirements.

| Fee Type | Traditional Banks |

|---|---|

| Monthly Maintenance Fee | $10 – $15 |

| Overdraft Fee | $35 per transaction |

| Minimum Balance Requirement | $500 – $1500 |

These fees can add up and become a significant financial burden for many customers.

Comparison Of Interest Rates

Interest rates are another critical factor. Varo Bank offers competitive interest rates on savings accounts. Users can earn up to 2.80% APY, depending on their account balance and activity.

- Standard Savings Account: 0.50% APY

- High-Yield Savings Account: Up to 2.80% APY (with qualifying activity)

Traditional banks typically offer lower interest rates on savings accounts. The average interest rate for a traditional savings account is around 0.01% to 0.05% APY.

To sum up, Varo Bank provides a more affordable and rewarding banking experience. With no fees and higher interest rates, it stands out as a cost-effective choice for many customers.

Pros And Cons Based On Real-world Usage

Banking has evolved significantly with the advent of mobile banking apps like Varo. Comparing Varo with traditional banks can help you decide which option suits your needs. Below, we explore the real-world pros and cons of both Varo and traditional banks.

Pros Of Using Varo

- Convenience: You can manage your finances from your mobile device.

- Enhanced Security: Secure login and account management features protect user information.

- Financial Tools: Access to transaction tracking and budgeting tools.

- Customer Support: Reliable customer assistance available through the app.

Cons Of Using Varo

- Internet Dependency: Requires a stable internet connection for optimal use.

- Geographic Limitations: Avoid connecting from blocked countries.

- Technical Issues: Sometimes requires app updates for better performance.

Pros Of Using Traditional Banks

- Physical Branches: Access to in-person services and advice.

- Established Trust: Long history and established trust with customers.

- Comprehensive Services: A wide range of financial products and services.

- ATM Networks: Extensive ATM networks for easy access to cash.

Cons Of Using Traditional Banks

- Limited Access: Banking hours and location constraints.

- Higher Fees: Often associated with higher account maintenance and transaction fees.

- Slower Processes: Longer processing times for transactions and services.

Specific Recommendations For Ideal Users

Choosing between Varo and traditional banks can be difficult. Each has its unique benefits. Understanding who benefits most from each option helps make this choice easier.

Who Should Use Varo?

Varo App is designed for those who value convenience. If you prefer managing finances on your mobile device, Varo is ideal. The app offers:

- Secure login and account management

- Transaction tracking and budgeting tools

- Reliable customer support

Varo suits tech-savvy users. It’s great for those who need easy access to banking services. If you travel frequently or have a busy schedule, Varo’s mobile banking can save time.

Who Should Use Traditional Banks?

Traditional banks are best for users who prefer face-to-face interactions. They offer:

- Physical branches for in-person service

- Wide range of financial products

- Established trust and reliability

Traditional banks are suitable for those who need a variety of services. If you need personal consultations or have complex financial needs, traditional banks provide the necessary support.

Best Scenarios For Each Option

| Scenario | Best Option |

|---|---|

| Mobile banking and ease of use | Varo |

| Face-to-face customer service | Traditional Banks |

| Frequent travel | Varo |

| Complex financial needs | Traditional Banks |

| Budgeting tools and transaction tracking | Varo |

| Wide range of financial products | Traditional Banks |

Frequently Asked Questions

What Is Varo?

Varo is a digital-only bank offering online banking services. It provides features like no-fee checking accounts and high-yield savings accounts.

How Does Varo Compare To Traditional Banks?

Varo offers lower fees and higher interest rates than traditional banks. It’s also entirely online, providing convenience and accessibility.

Are Varo Accounts Fdic Insured?

Yes, Varo accounts are FDIC insured up to $250,000. This ensures your money is protected, similar to traditional banks.

Can You Deposit Cash Into Varo?

Yes, you can deposit cash into Varo using Green Dot locations. This adds convenience for users needing to deposit physical cash.

Conclusion

Choosing between Varo and traditional banks depends on your needs. Varo offers the convenience of mobile banking. Traditional banks provide in-person services and a long-standing reputation. Consider what matters most to you. Explore Varo’s features, like secure login and budgeting tools. Reliable customer support is also available. Learn more about the Varo App here. Make an informed decision based on your preferences.