Varo Savings Account: Maximize Your Savings with High Interest Rates

Saving money is crucial for financial health. The Varo Savings Account offers a smart way to grow your savings.

Varo Bank, through its mobile app, provides a seamless banking experience. This app offers a user-friendly interface, making it easy to manage your savings. You can access your account anytime, anywhere, using your iOS or Android device. The app is secure, ensuring your data remains protected. Regular updates keep the app running smoothly, providing you with the best banking experience. Plus, it’s free to download and use. Ready to start saving with ease? Learn more about the Varo Savings Account here.

Introduction To Varo Savings Account

The Varo Savings Account offers a modern way to save money. With advanced features and a user-friendly interface, it provides an efficient banking experience. Explore more about Varo Savings Account below.

Overview Of Varo As A Financial Institution

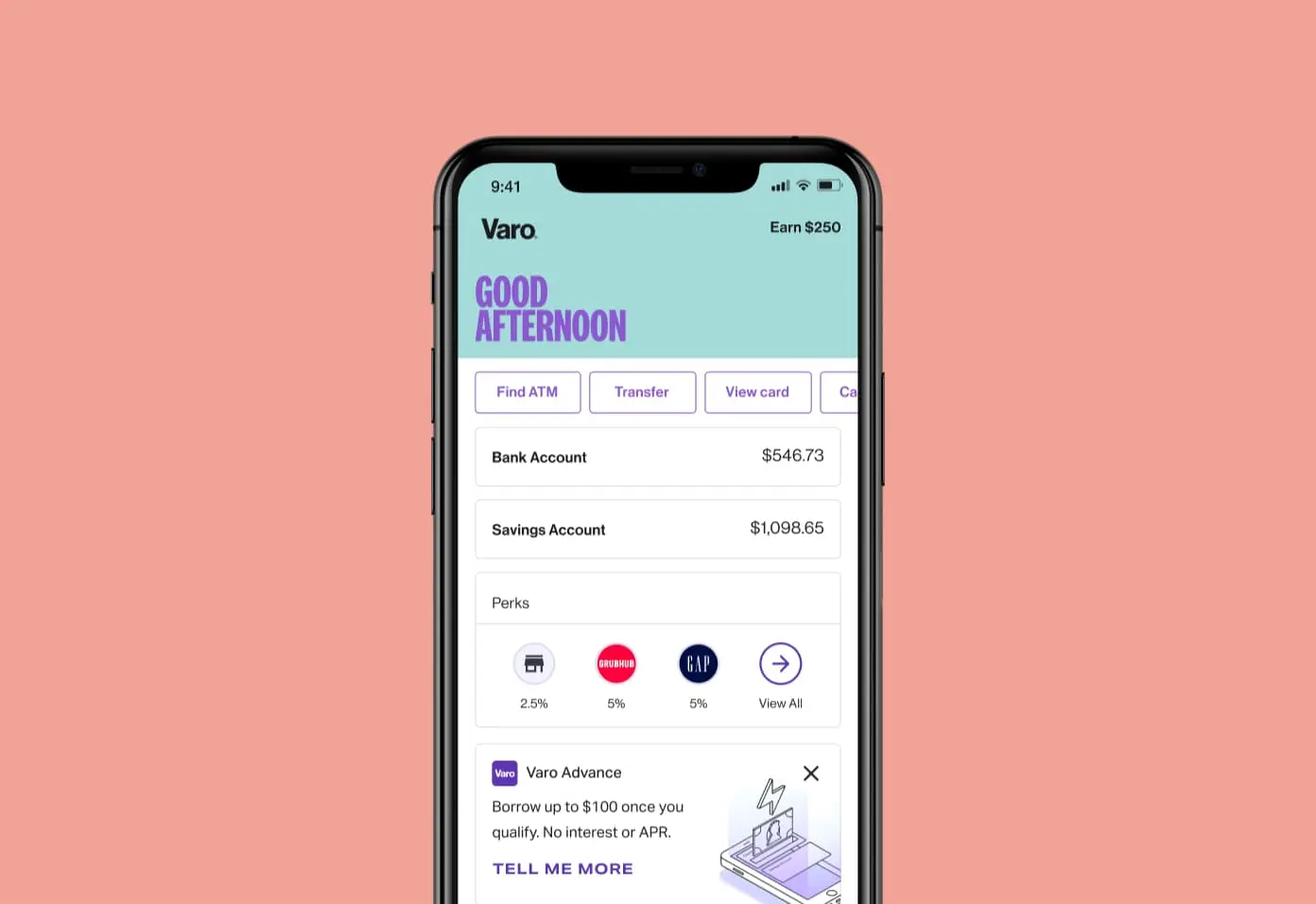

Varo Bank is a digital bank that operates through the Varo App. It aims to make banking more accessible and convenient. Here are some key points about Varo:

- Mobile banking capabilities: Access your accounts anytime, anywhere.

- User-friendly interface: Easy to navigate and use.

- Secure login and transaction processes: Protects your data and transactions.

- Compatibility with both iOS and Android devices: Available on most smartphones.

Varo provides a seamless banking experience without the need for physical branches.

Purpose Of Varo Savings Account

The Varo Savings Account is designed to help users save money efficiently. Some of the key benefits include:

- Easy access to banking services: Manage your savings on the go.

- Enhanced security measures: Keep your savings secure with advanced protection.

- Regular updates: Ensure optimal performance and new features.

The Varo Savings Account is free to use, making it an excellent choice for individuals looking to save without incurring extra costs.

Key Features Of Varo Savings Account

The Varo Savings Account offers many benefits that help you save money easily. Let’s explore the key features that make this account a great choice.

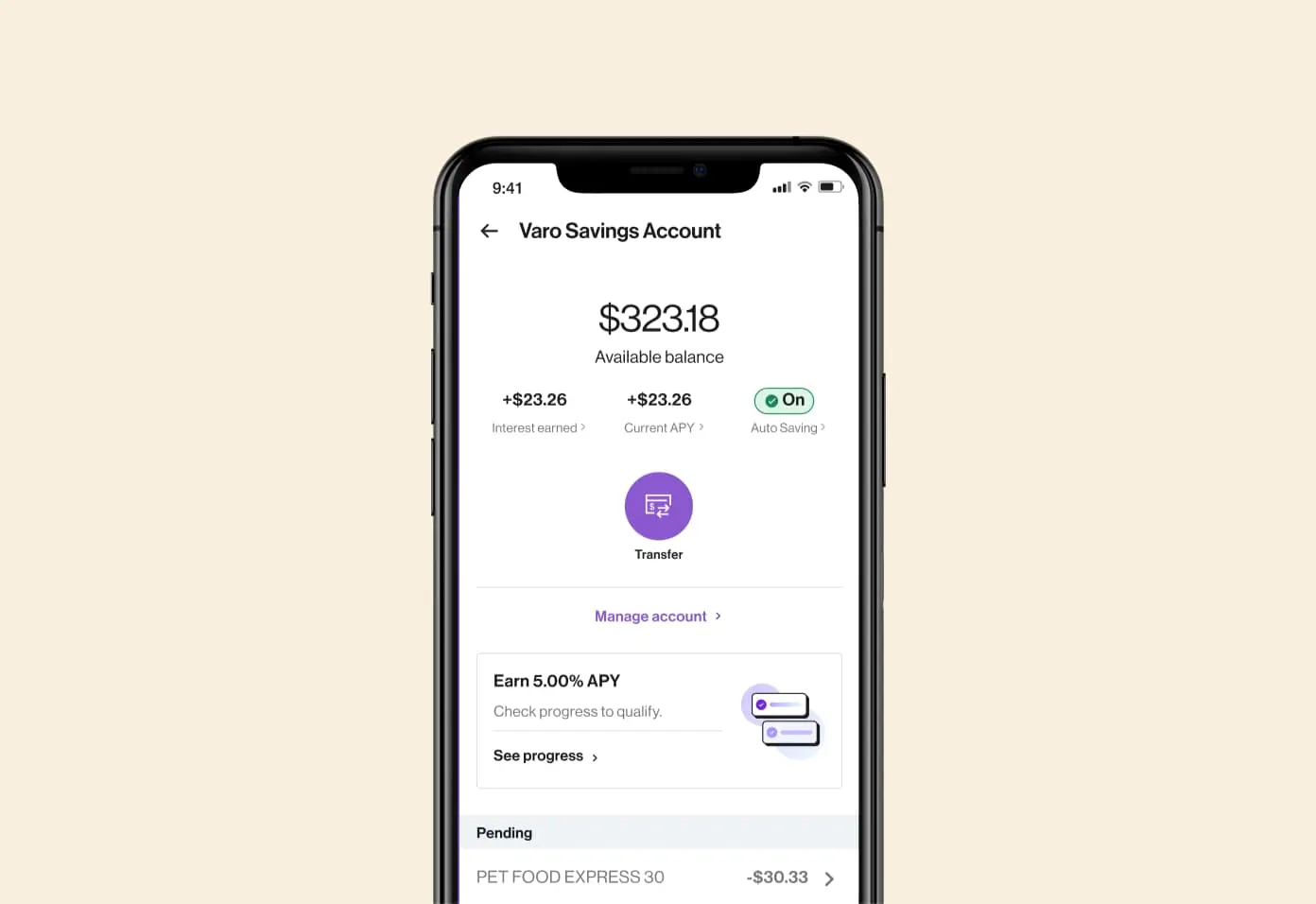

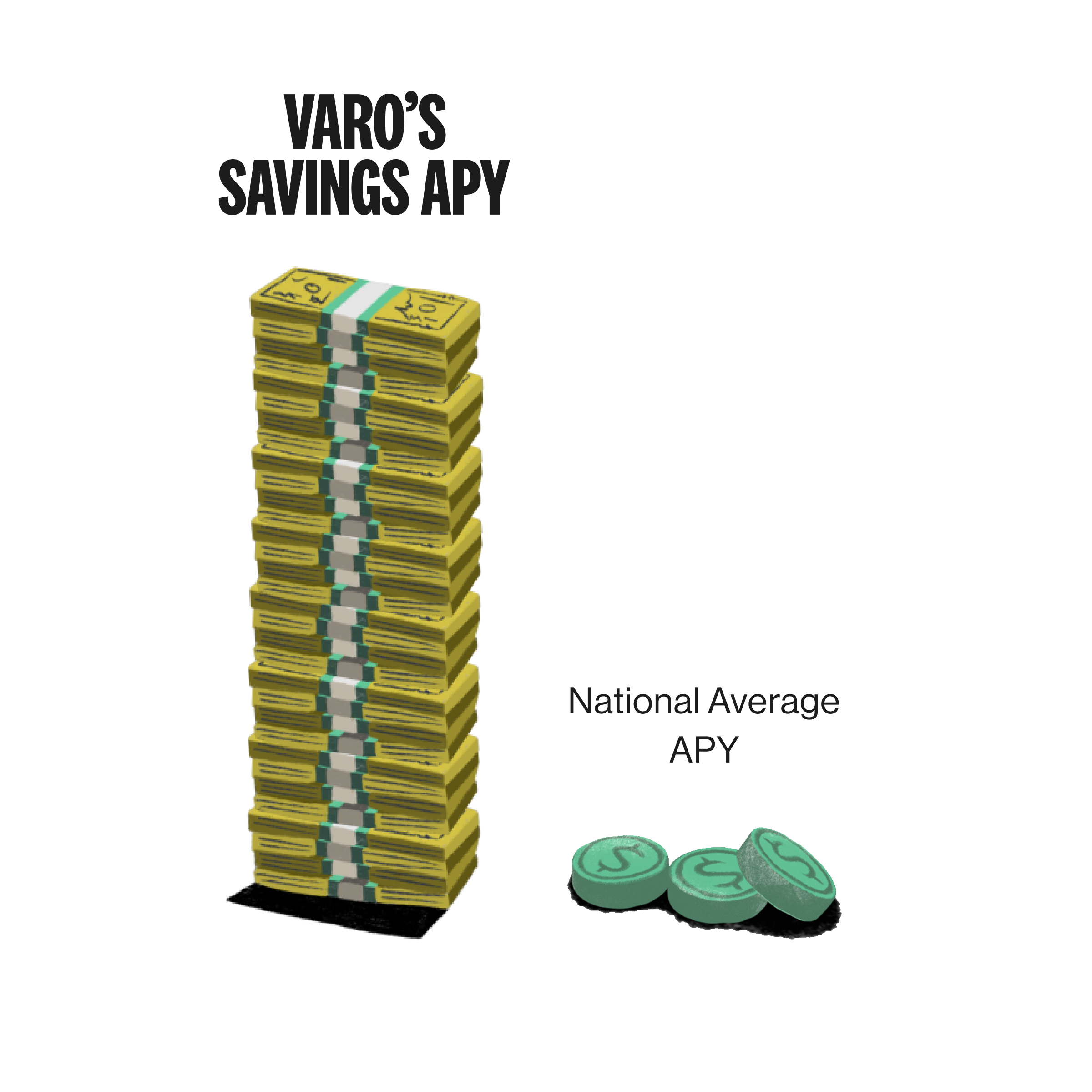

High Interest Rates: Maximizing Your Savings

Varo offers competitive interest rates. This helps you grow your savings faster. The interest rates are higher than many traditional banks. It means you earn more money on your balance.

Automatic Savings Tools: Convenience And Consistency

Varo provides automatic savings tools. These tools help you save money without thinking about it. You can set up automatic transfers from your checking account to your savings account. There are also options to round up your purchases to the nearest dollar and save the difference.

No Monthly Fees: Keeping More Of Your Money

With Varo, there are no monthly maintenance fees. You don’t have to worry about hidden charges eating into your savings. This means more of your money stays in your account.

User-friendly Mobile App: Banking On The Go

The Varo App is easy to use. It works on both iOS and Android devices. You can access your account anytime, anywhere. The app offers secure login and transaction processes. It also receives regular updates to ensure it runs smoothly.

Pricing And Affordability

The Varo Savings Account offers a variety of features that make it a competitive option for users seeking affordability and transparency. Let’s delve into the specifics of its pricing and affordability by examining the fee structure and comparing it with traditional banks.

Fee Structure: What You Need To Know

One of the standout aspects of the Varo Savings Account is its fee-free structure. Unlike many traditional banks, Varo does not charge monthly maintenance fees, overdraft fees, or minimum balance fees. This makes it an attractive option for those looking to avoid hidden charges.

| Fee Type | Varo Savings Account | Traditional Banks |

|---|---|---|

| Monthly Maintenance Fee | $0 | Up to $15 |

| Overdraft Fee | $0 | $35 per occurrence |

| Minimum Balance Fee | $0 | $0-$25 |

In addition to the absence of these fees, the Varo Savings Account offers competitive interest rates, allowing users to grow their savings without the worry of losing money to fees.

Comparing Varo To Traditional Banks

Comparing Varo to traditional banks highlights the significant savings potential. Traditional banks often impose various fees that can add up quickly. With Varo, users can save more and avoid common pitfalls associated with traditional banking.

- Monthly Maintenance Fees: Many traditional banks charge monthly maintenance fees. Varo users enjoy a fee-free experience.

- Overdraft Fees: Traditional banks may charge hefty overdraft fees. Varo offers a $0 overdraft fee policy.

- Minimum Balance Requirements: Traditional banks often require a minimum balance to avoid fees. Varo does not have any minimum balance requirements.

Choosing Varo over traditional banks can lead to significant savings. It’s an ideal choice for those who want to maximize their savings without worrying about extra charges.

Pros And Cons Of Varo Savings Account

The Varo Savings Account offers several advantages but also comes with some limitations. Here is a detailed look at the pros and cons of the Varo Savings Account.

Pros: High Yield, No Fees, And More

High Yield:

The Varo Savings Account provides a high-yield interest rate compared to traditional banks. This means more earnings on your savings. For those looking to maximize their savings, the high yield can be a significant benefit.

No Fees:

Varo does not charge monthly maintenance fees. This is a major advantage as it helps you save more. There are also no minimum balance requirements, so you can start saving with any amount.

More Benefits:

- Easy access to your savings through the Varo App.

- The Varo App offers secure login and transaction processes.

- Compatibility with both iOS and Android devices ensures broad accessibility.

- Regular updates to the app ensure optimal performance and security.

Cons: Limitations And Potential Drawbacks

Limitations:

Varo Savings Account has limitations on the number of transfers you can make. This might not be suitable for those who need frequent access to their funds.

Potential Drawbacks:

- There are no physical branches, which can be a drawback for some.

- Customer service is available only online or by phone.

- Some users may find the mobile app interface less intuitive compared to other banking apps.

Ideal Users And Scenarios

The Varo Savings Account is designed to cater to a wide range of users. It offers flexibility and security, making it suitable for various financial goals. Whether you are saving for a short-term goal or planning for the future, Varo has you covered.

Who Benefits Most From Varo Savings Account?

Varo Savings Account is perfect for individuals who prefer mobile banking. It suits those who need easy access to their funds and appreciate a user-friendly interface.

- Young professionals who are tech-savvy

- Students managing their finances

- Freelancers and gig workers

- Anyone looking for a secure and convenient banking option

Best Use Cases: Short-term And Long-term Savings Goals

The Varo Savings Account is versatile. It can help you achieve both short-term and long-term savings goals.

Short-Term Goals:

- Saving for a vacation

- Building an emergency fund

- Setting aside money for a special purchase

Long-Term Goals:

- Saving for a down payment on a house

- Planning for retirement

- Investing in education

Varo’s mobile banking capabilities make it easy to track and manage your savings. Regular updates and enhanced security measures ensure your data is protected. Download the app for free and start saving today.

Frequently Asked Questions

What Is A Varo Savings Account?

A Varo Savings Account is an online savings account offering competitive interest rates. It provides easy access through a mobile app.

How To Open A Varo Savings Account?

You can open a Varo Savings Account online. Simply download the Varo app, sign up, and follow the instructions.

Does Varo Savings Account Have Fees?

No, Varo Savings Account does not charge monthly maintenance fees. There are also no minimum balance requirements.

Is My Money Safe In Varo Savings Account?

Yes, your money is safe. Varo Savings Account is FDIC insured up to $250,000 through Varo Bank, N. A.

Conclusion

Choosing Varo Savings Account can streamline your banking needs. The Varo App provides secure, mobile access to your finances. Enjoy easy navigation and enhanced security on both iOS and Android devices. Best part? It’s free to download and use. With Varo, managing your money becomes simpler and safer. Curious to learn more? Check out Varo Bank here. Start enjoying the convenience of mobile banking today.