Varo Personal Loans: Achieve Financial Freedom Today

Looking for a reliable way to manage your finances? Varo Personal Loans might be the solution.

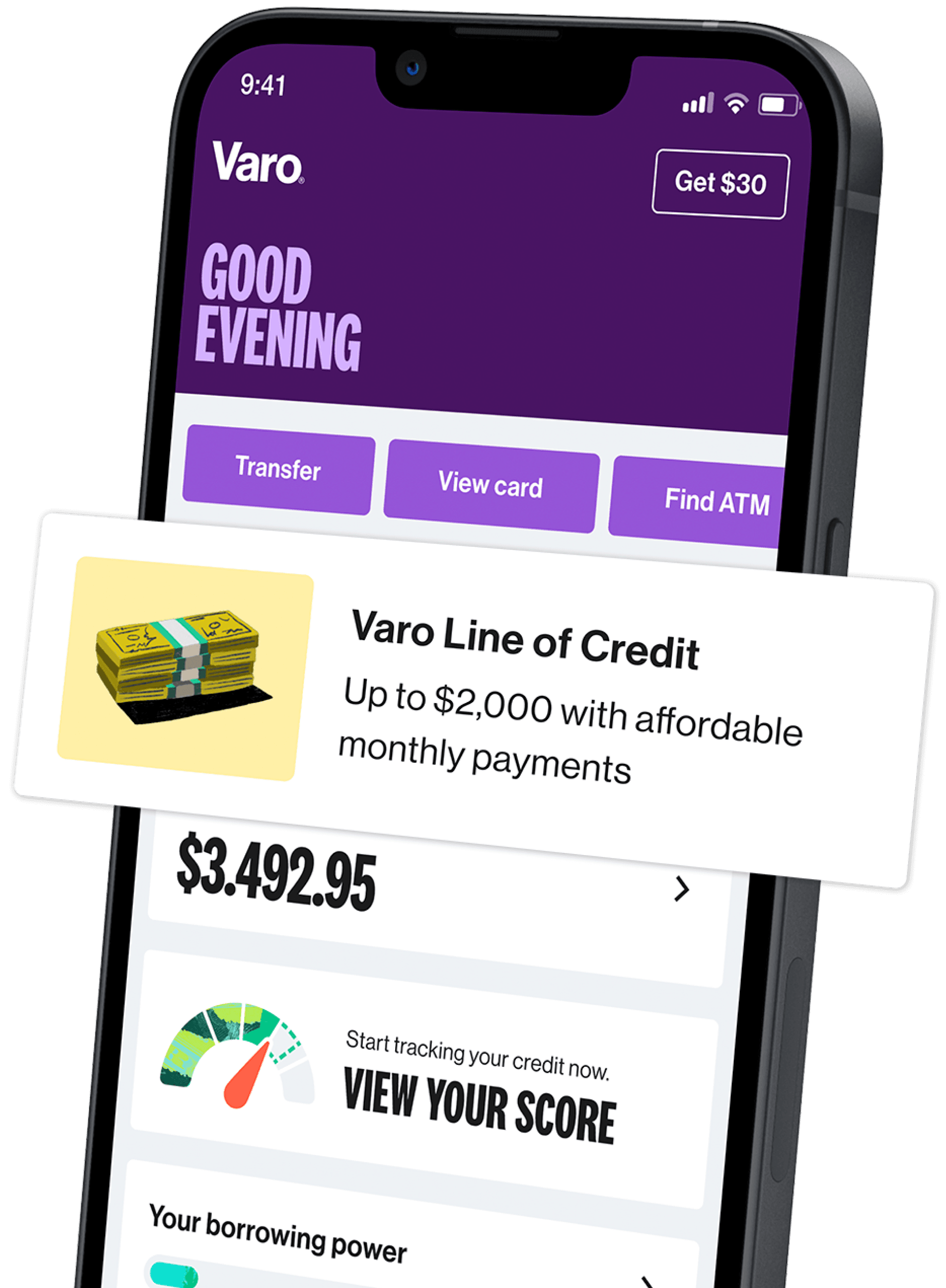

This blog will explore how Varo can help you achieve your financial goals efficiently. Varo Bank offers a range of financial services through its mobile app, Varo App. With features like real-time account monitoring, money transfers, and budgeting tools, Varo makes managing your finances easy and secure. The app is free to download, though some services may have additional fees. Varo’s user-friendly interface ensures you can handle your banking needs from anywhere, anytime. This introduction provides an overview of Varo’s offerings and benefits, setting the stage for a deeper dive into how Varo Personal Loans can support your financial journey.

Introduction To Varo Personal Loans

Varo Personal Loans offer a convenient solution for those in need of financial assistance. Through the Varo app, users can access personal loans with ease, ensuring that they manage their financial needs effectively. The following sections will provide a detailed look at what Varo Personal Loans are, their purposes, and the benefits they offer.

What Are Varo Personal Loans?

Varo Personal Loans are financial products provided through the Varo app, designed to help users meet their various personal financial needs. These loans can be used for a range of purposes, including debt consolidation, home improvements, medical expenses, or other personal projects. The application process is straightforward, and users can manage their loans directly from their mobile devices.

Purpose And Benefits Of Varo Personal Loans

The primary purpose of Varo Personal Loans is to provide users with flexible financial assistance. Whether you’re looking to consolidate debt or fund an emergency expense, Varo Personal Loans can cater to your needs.

| Purpose | Benefits |

|---|---|

| Debt Consolidation |

|

| Home Improvements |

|

| Medical Expenses |

|

| Personal Projects |

|

With Varo Personal Loans, users benefit from competitive interest rates and flexible repayment terms. The loans can be managed through the Varo app, providing a seamless experience from application to repayment. Additionally, the security features of the app ensure that all transactions are safe.

Key Features Of Varo Personal Loans

Varo Personal Loans offer a range of features designed to provide users with flexibility and ease of use. Here are some of the key features that set Varo Personal Loans apart from other options available in the market.

Varo Personal Loans provide flexible loan amounts to suit various financial needs. Whether you need a small amount for an emergency or a larger sum for a significant expense, Varo has options for you. Choose the loan amount that best fits your requirements.

One of the standout features of Varo Personal Loans is their competitive interest rates. These rates are designed to be affordable and accessible, helping you manage your finances more effectively. You can save money in the long run with lower interest rates compared to other lenders.

Varo Personal Loans come with no hidden fees. Transparency is a core value, and you won’t encounter unexpected charges. You will know exactly what you are paying for, ensuring peace of mind and straightforward financial planning.

Varo offers a fast approval process for personal loans. The application process is streamlined to save you time. You can get your loan approved quickly, allowing you to address your financial needs without delay.

The Varo mobile app is user-friendly and enhances your loan management experience. With the Varo app, you can monitor your loan status, make payments, and access other banking services. The intuitive interface makes it easy for anyone to navigate and use.

Here is a quick overview of the features in a tabular format for better understanding:

| Feature | Description |

|---|---|

| Flexible Loan Amounts | Choose the loan amount that suits your needs. |

| Competitive Interest Rates | Affordable rates that help you save money. |

| No Hidden Fees | Transparent charges without unexpected costs. |

| Fast Approval Process | Quick and efficient loan approval. |

| User-Friendly Mobile App | Manage loans easily through the Varo app. |

Varo Personal Loans are designed with user convenience in mind. With these key features, you can manage your finances with confidence and ease.

Flexible Loan Amounts

Varo Personal Loans offer a range of loan amounts designed to meet diverse financial needs. Whether you need a small loan for an emergency expense or a larger amount for a significant purchase, Varo has you covered.

Range Of Loan Amounts Available

Varo provides loans with amounts starting from as low as $1,000 to as high as $50,000. This broad range ensures that borrowers can find a loan that fits their specific requirements without taking on unnecessary debt.

| Loan Amount | Purpose |

|---|---|

| $1,000 – $5,000 | Emergency expenses, small purchases |

| $5,000 – $20,000 | Home improvements, medical bills |

| $20,000 – $50,000 | Major purchases, debt consolidation |

Tailoring Loans To Individual Needs

With Varo Personal Loans, borrowers can tailor their loan amounts to suit their unique financial situations. Varo’s flexible loan options allow you to choose an amount that fits your budget and repayment capacity.

- Choose a loan amount based on your financial needs

- Flexible repayment terms to match your income

- Competitive interest rates to keep costs manageable

By providing a range of loan amounts, Varo ensures that each borrower can find the right financial solution. Whether you need a small loan for immediate expenses or a larger amount for significant investments, Varo’s flexible loan options are designed to meet your needs.

Competitive Interest Rates

Varo Bank offers personal loans with competitive interest rates. These rates make borrowing more affordable. Understanding how these rates compare to competitors and their impact on repayment can help you make informed decisions.

How Varo’s Rates Compare To Competitors

Varo Bank’s interest rates are among the most competitive in the market. This means lower costs for borrowers.

| Bank | Interest Rate (APR) |

|---|---|

| Varo Bank | 6.99% – 23.99% |

| Bank A | 7.99% – 25.99% |

| Bank B | 8.49% – 26.99% |

As shown, Varo offers lower starting rates compared to many competitors. This can lead to significant savings over the loan term.

Impact Of Interest Rates On Repayment

Interest rates directly affect your monthly payments and total loan cost. A lower interest rate means lower monthly payments and less interest paid over time.

For example, with a $10,000 loan over 5 years:

- At 6.99% APR: Monthly payment is $198.01, total interest is $1,880.60.

- At 8.99% APR: Monthly payment is $207.58, total interest is $2,454.80.

Choosing a lower interest rate can save you hundreds of dollars. This makes Varo’s personal loans a smart choice for cost-conscious borrowers.

No Hidden Fees

Varo Personal Loans stand out in the financial market due to their transparency. One of the most significant advantages is the absence of hidden fees. This feature ensures that borrowers know exactly what they are getting into, making the loan process straightforward and stress-free.

Transparency In Loan Terms

Varo Bank takes pride in its clear and understandable loan terms. Borrowers receive a detailed breakdown of all costs associated with their loan. This includes the interest rate, repayment schedule, and any other charges. There are no surprises, just clear and upfront information.

For example, the loan agreement will specify the exact monthly payment amount. It will also detail the total interest paid over the life of the loan. This level of transparency helps borrowers make informed decisions.

How No Hidden Fees Benefit Borrowers

The absence of hidden fees offers several benefits to borrowers:

- Peace of Mind: Knowing all costs upfront reduces financial stress.

- Budgeting: Borrowers can plan their finances more effectively without unexpected charges.

- Trust: Transparent terms build trust between Varo Bank and its customers.

Borrowers appreciate the honesty and simplicity of Varo Personal Loans. This commitment to transparency sets Varo Bank apart from other lenders.

Fast Approval Process

Varo Personal Loans stand out for their fast approval process. This makes them an excellent choice for individuals in need of quick funds. Below, we explore the various aspects that contribute to this rapid approval.

Streamlined Application Process

The application process for a Varo Personal Loan is simple and straightforward. Users can complete the application directly through the Varo App. No need to visit a bank branch or fill out extensive paperwork. Instead, you can apply from the comfort of your home.

To apply, follow these easy steps:

- Open the Varo App on your mobile device.

- Navigate to the Personal Loans section.

- Fill in your personal and financial details.

- Submit the application for review.

Quick Turnaround Time For Loan Approval

Varo is known for its quick turnaround time on loan approvals. Once you submit your application, it undergoes an expedited review process. This ensures that you receive a decision fast. Most users get their approval status within minutes.

If approved, the funds are deposited directly into your Varo account. This means you can access your money almost immediately. This quick process makes Varo Personal Loans ideal for emergency expenses.

Whether you need funds for an unexpected bill or a planned purchase, Varo Personal Loans offer a fast and efficient solution.

User-friendly Mobile App

Varo Bank offers a user-friendly mobile app to manage personal loans and other financial services. The app is designed for ease of use, making it simple to handle your finances on the go. Let’s explore the features that make the Varo app stand out.

Features Of The Varo Mobile App

The Varo app comes with a variety of features tailored to enhance your financial management experience. Here are some key features:

- Mobile banking services: Access your bank account anytime, anywhere.

- Real-time account monitoring: Keep track of your account balance and transactions.

- Money transfers: Send and receive money securely.

- Bill payments: Pay your bills directly through the app.

- Savings tools: Use tools to help you save money efficiently.

- Budgeting features: Manage your budget with easy-to-use tools.

The app is available for free download, but some services may incur additional fees. Always use the latest version for the best experience.

Managing Loans On The Go

Managing loans through the Varo app is straightforward and convenient. Here are some ways the app simplifies loan management:

- Loan tracking: Monitor your loan balance and payment history.

- Payment reminders: Receive alerts to avoid missing payments.

- Easy payments: Make loan payments directly from your mobile device.

- Secure transactions: Benefit from high-level security for all transactions.

With these features, the Varo app makes loan management hassle-free and accessible. Download the app today to experience seamless banking and loan management.

Pricing And Affordability Breakdown

Understanding the pricing and affordability of Varo Personal Loans is essential for making informed financial decisions. This section provides a comprehensive breakdown of interest rates, repayment terms, and affordability for different income levels.

Interest Rate Structures

Varo Personal Loans offer competitive interest rates. The rates vary based on creditworthiness and loan amount. Here’s a simple table to illustrate:

| Credit Score Range | Interest Rate |

|---|---|

| Excellent (720+) | 5.99% – 12.99% |

| Good (680-719) | 13.00% – 19.99% |

| Fair (640-679) | 20.00% – 25.99% |

| Poor (Below 639) | 26.00% – 35.99% |

Repayment Terms

Varo Personal Loans offer flexible repayment terms. Borrowers can select from different loan durations based on their financial needs. The repayment terms range from 12 to 60 months. This flexibility helps to manage monthly payments and overall loan cost.

- 12 months: Suitable for smaller loan amounts

- 24 months: Balanced option for moderate loan amounts

- 36 months: Common choice for larger loan amounts

- 48 months: Extended term for significant loan amounts

- 60 months: Longest term, lowest monthly payments

Affordability For Different Income Levels

Varo Personal Loans are designed to be accessible for various income levels. The affordability of these loans can be broken down as follows:

- Low Income (Below $30,000/year): Smaller loan amounts with longer repayment terms help manage monthly payments.

- Moderate Income ($30,000 – $70,000/year): Mid-sized loans with flexible terms provide a balanced approach to borrowing and repayment.

- High Income (Above $70,000/year): Larger loans with shorter repayment terms can be managed efficiently due to higher disposable income.

Varo Personal Loans cater to a wide range of financial needs, ensuring that borrowers can find a suitable option regardless of their income level.

Pros And Cons Of Varo Personal Loans

Varo offers personal loans through its mobile banking app. Understanding the pros and cons is essential. Here is a detailed look at the advantages and potential drawbacks of Varo personal loans.

Advantages Of Choosing Varo

There are several benefits to opting for Varo personal loans:

- Convenient Access: You can manage loans directly from your mobile device.

- Real-Time Monitoring: Keep track of your loan status and payments in real-time.

- Secure Transactions: Varo ensures the safety of your transactions and personal information.

- Integrated Financial Tools: Use budgeting and savings tools to manage your finances better.

- No Hidden Fees: Varo provides clear information on any fees that may apply.

Potential Drawbacks To Consider

Before taking a Varo personal loan, consider these potential drawbacks:

- Internet Dependency: You need a stable internet connection to access the app and services.

- Limited Access: The app may not be accessible from certain countries.

- Service Fees: Some services or features may incur additional fees.

- Technical Issues: Ensure you use the most updated version of the app to avoid any technical issues.

Varo personal loans offer many conveniences but also have some limitations. Weighing the pros and cons can help you make an informed decision.

Ideal Users For Varo Personal Loans

Varo Personal Loans offer flexible, accessible financial solutions for a wide range of users. Understanding who can benefit the most can help potential borrowers make informed decisions. Below, we explore the ideal users and scenarios where Varo Personal Loans shine.

Who Can Benefit The Most

Varo Personal Loans are perfect for individuals seeking quick, convenient financial support. Here are some groups that can benefit:

- Young professionals needing funds for career advancement or relocation.

- Students requiring additional money for tuition or living expenses.

- Small business owners looking to cover short-term expenses.

- Individuals with limited credit history who need to build or improve their credit score.

Scenarios Where Varo Personal Loans Shine

Varo Personal Loans are versatile and can be useful in various situations:

| Scenario | How Varo Personal Loans Help |

|---|---|

| Emergency Expenses | Cover unexpected costs like medical bills or car repairs quickly. |

| Debt Consolidation | Combine multiple debts into one manageable payment with a lower interest rate. |

| Home Improvements | Finance renovations or repairs to increase your property’s value. |

| Major Purchases | Buy essential items like appliances or furniture without straining your budget. |

These loans are tailored for those seeking fast, reliable financial solutions. By leveraging Varo’s user-friendly mobile app, borrowers can manage their finances seamlessly and securely. The app’s features, including real-time account monitoring and budgeting tools, further enhance the borrowing experience.

Frequently Asked Questions

What Is Varo Personal Loans?

Varo Personal Loans are financial products offered by Varo Bank. They provide quick access to funds for various needs.

How Do Varo Personal Loans Work?

Varo Personal Loans work by offering fixed-rate loans. Borrowers repay the loan in monthly installments over a set period.

Who Can Apply For Varo Personal Loans?

Anyone meeting Varo Bank’s eligibility criteria can apply. This usually includes being a U. S. resident and having a valid bank account.

What Are The Interest Rates For Varo Personal Loans?

The interest rates for Varo Personal Loans vary. They are based on the borrower’s creditworthiness and loan terms.

Conclusion

Varo Personal Loans offer a convenient solution for your financial needs. With Varo, managing your finances becomes simpler and more efficient. The app provides real-time account monitoring, money transfers, and budgeting tools. These features help you stay on top of your finances. Secure transactions ensure your money is safe. Want to learn more? Explore Varo’s services here. Make your banking experience better with Varo.