Varo Online Banking: Transform Your Financial Management Today

In today’s digital age, banking has evolved. Traditional banks are no longer the only option.

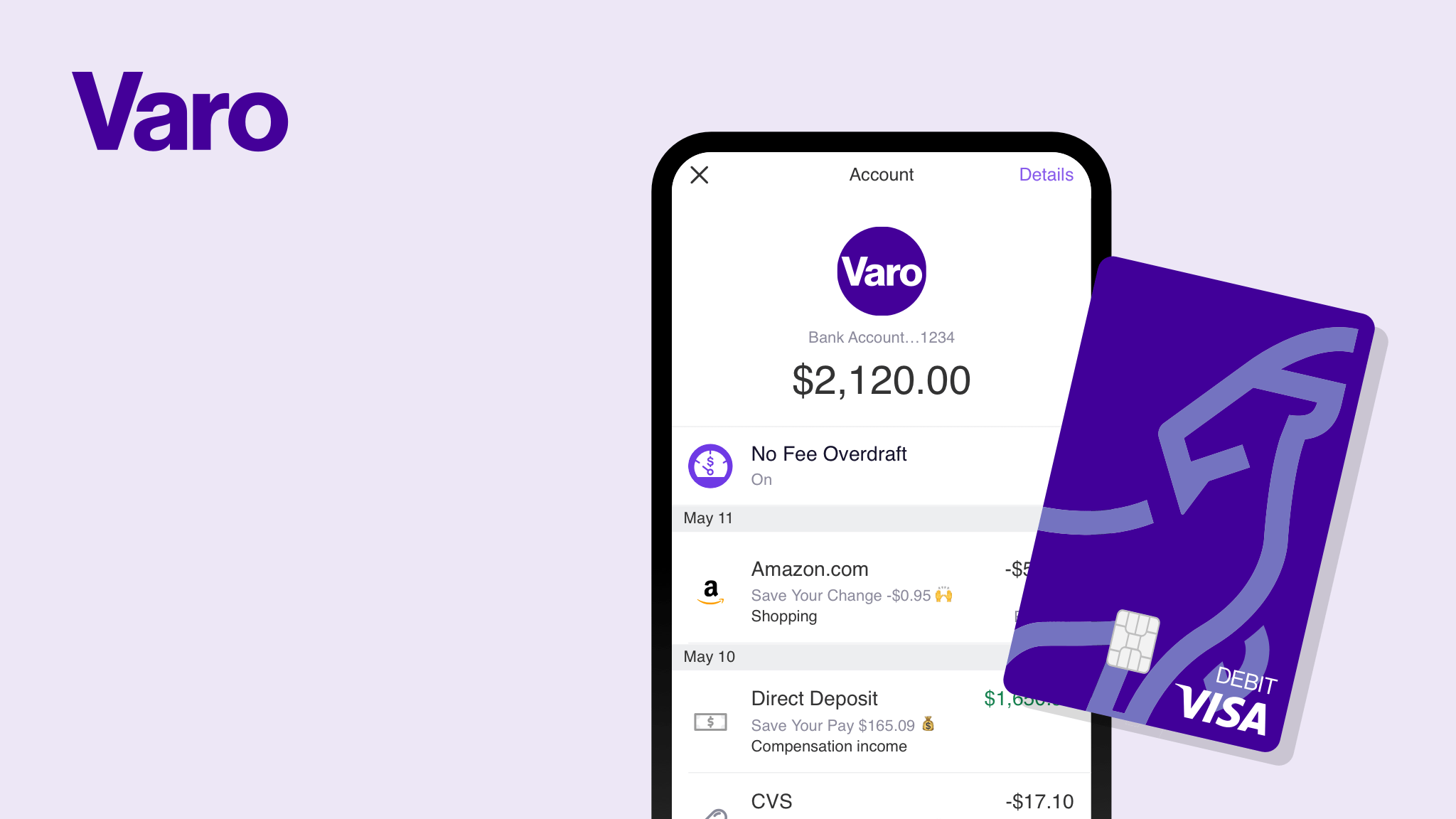

Varo Online Banking offers a modern solution for managing your finances. Varo Bank is a mobile banking app designed to simplify your financial life. With secure transactions and a user-friendly interface, Varo ensures convenient banking on the go. Regular updates keep the app running smoothly, making it easy for anyone to use. Whether you need to check your balance, transfer money, or pay bills, Varo makes it possible from the palm of your hand. Plus, the app is free to download and use, providing a cost-effective banking solution. Ready to experience hassle-free banking? Discover Varo Online Banking here.

Introduction To Varo Online Banking

Varo Online Banking offers a seamless and secure way to manage your finances. With its user-friendly design, anyone can navigate the app and keep track of their money effortlessly. Let’s dive into what Varo Online Banking is and its mission.

What Is Varo Online Banking?

Varo Online Banking is a mobile banking application designed to make financial management simple. It provides users with convenient, secure, and efficient services. You can handle your banking needs on-the-go with the Varo app.

Main features of the Varo app include:

- Mobile banking capabilities

- Secure transactions

- User-friendly interface

- Regular updates for optimal performance

These features ensure that you can manage your finances with ease and confidence.

Purpose And Mission Of Varo

The purpose of Varo is to provide a convenient financial management tool that you can use anytime, anywhere. The app aims to enhance your banking experience with its easy-to-use interface.

Varo’s mission is to offer a secure and efficient banking solution. It ensures that your transactions are safe and your data is protected. Varo uses Cloudflare for optimal performance and security.

With Varo, you can enjoy a hassle-free banking experience without any hidden costs. The app is free to download and use. Just ensure you have a stable internet connection and avoid using VPN or IP proxies.

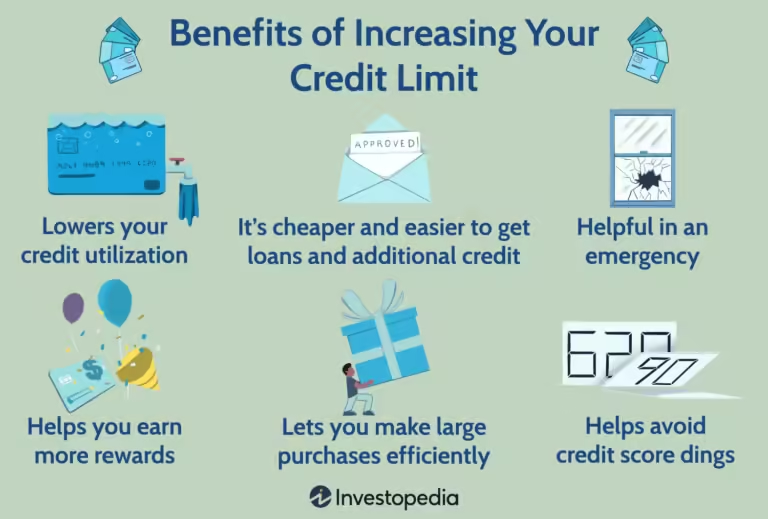

Key Features Of Varo Online Banking

Varo Online Banking offers a range of features that make managing your finances simple and efficient. Here are some key benefits you can enjoy:

No Monthly Fees: Save More With Zero Maintenance Costs

Varo does not charge any monthly maintenance fees. This means you can keep more of your money in your account. No hidden costs or unexpected charges. It’s straightforward and transparent.

Early Direct Deposit: Get Paid Faster

With Varo, you can receive your direct deposits up to two days early. This feature helps you access your funds quicker, so you can pay bills or make purchases without waiting.

High-yield Savings Account: Grow Your Savings Efficiently

Varo offers a high-yield savings account with competitive interest rates. This helps your savings grow faster compared to traditional savings accounts. Earn more on your money over time.

Automatic Savings Tools: Simplify Your Saving Process

Varo provides automatic savings tools to help you save effortlessly. You can set up rules to transfer money to your savings account automatically. This makes saving money simple and consistent.

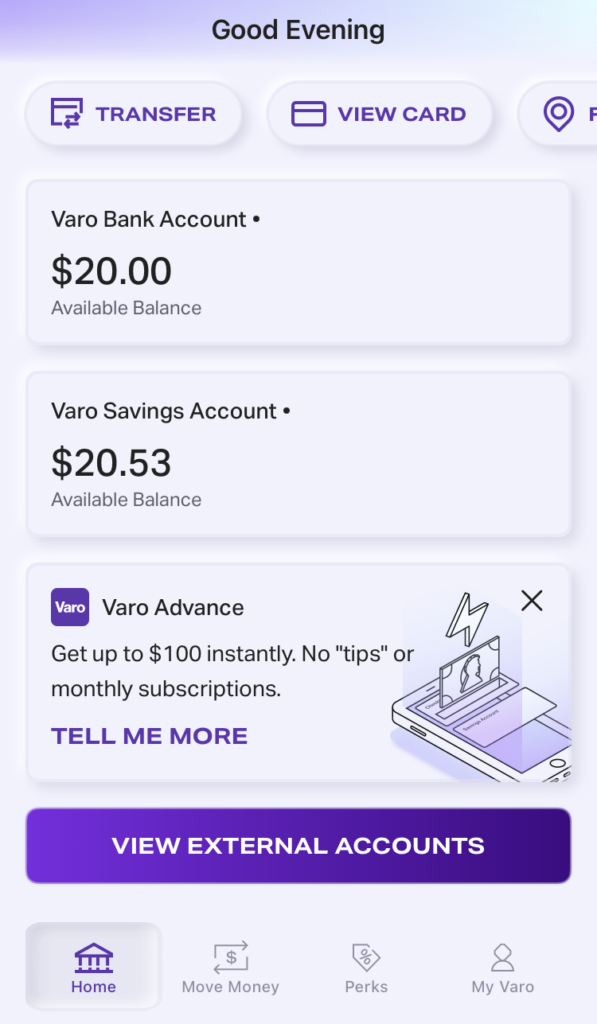

Varo Advance: Access Cash Instantly

Need cash quickly? Varo Advance allows you to access funds instantly. You can borrow up to $100 without any fees. Repayments are flexible and straightforward.

Budgeting Tools: Manage Your Money Better

Varo offers built-in budgeting tools to help you manage your finances. Track your spending, set budgets, and monitor your progress. Stay on top of your financial goals with ease.

Security Features: Keep Your Account Safe

Security is a top priority at Varo. The app uses advanced encryption and fraud detection systems. Your transactions and personal information are always protected. Enjoy peace of mind knowing your account is secure.

For more information, visit the official website: Varo Bank.

Pricing And Affordability Breakdown

Varo Bank offers a user-friendly mobile banking experience. Its pricing structure is designed to be accessible and affordable for everyone. Let’s dive into the specifics of Varo’s cost structure and how it compares to traditional banks.

Fee-free Banking: Understanding The Cost Structure

One of the standout features of Varo Bank is its fee-free banking. This means no monthly maintenance fees, no overdraft fees, and no foreign transaction fees. Here is a breakdown of the costs:

- No monthly maintenance fees: Varo does not charge for maintaining your account.

- No overdraft fees: Avoid costly surprises with Varo’s fee-free overdraft protection.

- No foreign transaction fees: Travel abroad without worrying about additional costs.

- Free ATM withdrawals: Access your money without fees at over 55,000 Allpoint ATMs.

Comparing Varo’s Costs With Traditional Banks

Traditional banks often come with a range of fees that can add up over time. Here’s a comparison of Varo’s costs versus those of traditional banks:

| Service | Varo | Traditional Banks |

|---|---|---|

| Monthly Maintenance Fee | Free | $10 – $15 |

| Overdraft Fee | Free | $35 per occurrence |

| Foreign Transaction Fee | Free | 3% of transaction |

| ATM Withdrawal Fee | Free at Allpoint ATMs | $2.50 – $3 per withdrawal |

Varo Bank’s fee-free structure can save users a significant amount of money annually. Traditional banks often charge for services that Varo provides for free. This makes Varo a more affordable and attractive option for modern banking needs.

Pros And Cons Of Varo Online Banking

Varo Online Banking offers many features and benefits for users seeking convenient and secure financial management. Yet, like any service, it comes with its own set of pros and cons. Below, we explore the advantages and limitations of Varo Online Banking to help you make an informed decision.

Advantages: What Users Love About Varo

- Mobile Banking Capabilities: Varo allows users to handle all their banking needs directly from their smartphones. This means you can manage your finances on-the-go.

- Secure Transactions: Varo ensures that all transactions are secure, providing users with peace of mind.

- User-Friendly Interface: The app is easy to navigate, making financial management simple even for beginners.

- Regular Updates: The app receives regular updates, ensuring it runs smoothly and efficiently.

- No Fees: The Varo app is free to download and use, making it an economical choice for many users.

Limitations: Areas For Improvement

- Internet Connection Required: Users need a stable internet connection to access all features of the app.

- VPN Restrictions: The app does not support connections through VPNs or IP proxies, which may limit access for some users.

- Geographical Limitations: Varo may not be accessible from certain blocked countries, restricting its use for international travelers.

Understanding the pros and cons of Varo Online Banking can help you determine if it fits your financial needs. While it offers numerous benefits like mobile banking and secure transactions, it also has some limitations that might affect your experience. Weigh these factors carefully to make the best choice for your banking needs.

Specific Recommendations For Ideal Users

Varo Online Banking offers a range of features that cater to various user needs. Understanding who benefits most from Varo can help potential users decide if it’s the right choice for them.

Who Should Use Varo Online Banking?

Varo Online Banking is ideal for individuals who prefer managing their finances on-the-go. The app is especially suited for:

- People who want convenient financial management through their smartphones.

- Users looking for secure transactions without the need for physical bank visits.

- Individuals who appreciate a user-friendly interface for easy navigation.

- Those who prefer free banking services with no hidden costs.

Scenarios Where Varo Shines

Varo Online Banking performs exceptionally well in several scenarios, making it a top choice for many users. Here are some specific situations:

| Scenario | Benefit |

|---|---|

| Traveling frequently | Manage finances anywhere with a stable internet connection |

| Busy lifestyle | Quick and easy transactions without visiting a bank |

| Security concerns | Enhanced security features for worry-free transactions |

Users will find Varo beneficial in these scenarios:

- Managing finances while traveling.

- Conducting secure transactions from home.

- Quickly accessing banking services during a busy day.

Varo Online Banking offers the perfect blend of convenience, security, and user-friendly design, meeting the needs of modern users effectively.

Conclusion: Transform Your Financial Management With Varo

Varo Online Banking offers a modern solution for managing your finances. With its secure, user-friendly mobile application, Varo provides a simple yet effective way to handle your banking needs. Below, we summarize the benefits and encourage you to try Varo for a more streamlined financial experience.

Summarizing The Benefits

| Feature | Benefit |

|---|---|

| Mobile Banking Capabilities | Manage finances on-the-go |

| Secure Transactions | Enhanced security for all transactions |

| User-Friendly Interface | Easy to navigate and use |

| Regular Updates | Ensure smooth operation |

| Free to Use | No cost involved |

Final Thoughts And Encouragement To Try Varo

Varo Bank provides a convenient and secure way to manage your money. With its easy-to-use interface and regular updates, Varo ensures a smooth banking experience. The app is free, making it accessible to everyone.

Consider downloading the Varo app today. Experience the benefits of managing your finances with ease and security. Make your financial management a breeze with Varo.

Frequently Asked Questions

What Is Varo Online Banking?

Varo Online Banking is a digital banking platform. It offers banking services through a mobile app. Users can manage their finances, make transactions, and access various banking features online.

Is Varo Online Banking Safe?

Yes, Varo Online Banking is safe. It uses advanced encryption and security measures. Your personal and financial information is protected. Varo is FDIC insured, ensuring your deposits are safe.

How Do I Open A Varo Account?

Opening a Varo account is simple. Download the Varo app from the App Store or Google Play. Follow the on-screen instructions to complete the sign-up process.

Does Varo Charge Any Fees?

Varo aims to be fee-free. There are no monthly maintenance fees, overdraft fees, or minimum balance requirements. However, some third-party fees may apply, like out-of-network ATM fees.

Conclusion

Discover the ease of banking with Varo. Manage your finances effortlessly. Varo App offers secure and user-friendly features. Enjoy seamless mobile banking without hidden fees. Ready to experience convenient financial management? Download Varo for free today. Learn more about Varo Bank here.