Varo No Annual Fee: Save More with Zero Charges

In today’s fast-paced world, managing finances on the go is essential. Varo Bank offers a seamless banking experience without hidden fees.

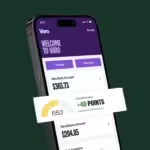

Varo is a mobile banking app designed for simplicity and efficiency. It provides real-time account management, budgeting tools, and savings automation, all with no annual fees. Imagine having all your banking needs met without worrying about extra costs. With Varo, you can track your expenses, manage your accounts, and save money, all from your mobile device. This makes it easier to stay on top of your finances, wherever you are. Ready to explore the benefits of no-fee banking? Discover more about Varo’s features and advantages here.

Introduction To Varo No Annual Fee

Varo Bank offers a unique mobile banking experience with its no annual fee feature. This feature is part of Varo’s commitment to providing user-friendly and cost-effective financial solutions. Let’s explore more about Varo and the purpose behind this beneficial feature.

Overview Of Varo And Its Mission

Varo Bank is a modern mobile banking application aimed at simplifying financial management. It provides users with a comprehensive suite of financial services through a user-friendly platform. Varo’s mission is to make banking more accessible and transparent for everyone.

Key features of Varo include:

- Mobile banking services

- Real-time account management

- Budgeting tools

- Savings automation

- No-fee banking

With these features, Varo ensures users can manage their finances conveniently and efficiently from their mobile devices.

Purpose Of The No Annual Fee Feature

The no annual fee feature is designed to eliminate additional costs for users. This aligns with Varo’s goal of offering transparent and affordable banking services. By not charging an annual fee, Varo ensures that users can benefit from their services without worrying about hidden charges.

Benefits of the no annual fee feature include:

- Cost savings

- Greater financial freedom

- Encourages users to use more banking services

In summary, Varo’s no annual fee feature is a key part of their mission to provide user-friendly and cost-effective banking solutions. It helps users save money and manage their finances more effectively.

Key Features Of Varo No Annual Fee

Varo is a mobile banking application that eliminates the need for annual fees. It provides a suite of financial services designed for ease and efficiency. Here are some of its key features:

Zero Annual Fees: How It Works

Varo offers zero annual fees on all its banking services. This means users can access their accounts without worrying about hidden charges or recurring costs. The app ensures that users can manage their finances without any additional financial burdens.

No Minimum Balance Requirement

One of the standout features of Varo is the no minimum balance requirement. Users are not obligated to maintain a certain balance in their accounts. This feature provides flexibility and convenience, making Varo accessible to individuals from various financial backgrounds.

High-yield Savings Account

Varo offers a high-yield savings account that allows users to earn more on their savings. The interest rates are competitive, providing a better return compared to traditional savings accounts. This feature encourages saving and helps users grow their wealth over time.

Comprehensive Mobile Banking Experience

Varo provides a comprehensive mobile banking experience. The app includes real-time account management, budgeting tools, and savings automation. Users can track their expenses, set savings goals, and manage their finances all in one place. The user-friendly platform makes banking easier and more efficient.

Overall, Varo stands out with its commitment to providing fee-free, flexible, and efficient banking solutions.

Benefits Of Zero Annual Fees

Varo Bank offers a mobile banking app with no annual fees. This feature provides several advantages for users, making it an attractive option for managing their finances. Here are some key benefits of having zero annual fees with Varo Bank.

Maximizing Savings For Users

With no annual fees, users can save more of their money. This means more funds available for other financial goals. Each dollar saved from fees can be redirected towards savings or investments.

- No annual fees means more money for savings.

- Users can allocate funds to emergency savings or other financial priorities.

- Over time, these savings can accumulate, providing a significant financial cushion.

Reducing Financial Burden

Zero annual fees help reduce the financial burden on users. This is especially important for those with tight budgets. It ensures that banking services are accessible without additional costs.

- Eliminating fees reduces financial stress.

- More funds can be used for daily expenses and necessary purchases.

Encouraging Financial Inclusion

Varo Bank’s no-fee structure promotes financial inclusion. It allows more people to access banking services without worrying about costs. This is crucial for those who are unbanked or underbanked.

- Zero fees make banking accessible to everyone.

- It encourages people to use banking services and manage their finances effectively.

By offering no annual fees, Varo Bank makes it easier for users to manage their finances. This approach helps users save money, reduces their financial burden, and promotes financial inclusion.

Pricing And Affordability

Varo App stands out in the banking sector with its no-fee structure, making it an attractive option for those seeking affordable financial services. Understanding its pricing and affordability is key to recognizing its value.

Comparing Varo’s Cost Structure To Traditional Banks

Traditional banks often burden customers with various fees. These include monthly maintenance fees, overdraft charges, and minimum balance requirements. In contrast, Varo App eliminates these fees.

| Fee Type | Traditional Banks | Varo App |

|---|---|---|

| Monthly Maintenance Fee | $5 – $15 | None |

| Overdraft Charges | $25 – $35 per incident | None |

| Minimum Balance Requirements | $500 – $1500 | None |

This comparison highlights the significant savings potential with Varo. Users can avoid unnecessary charges, improving their financial health.

Additional Fee Structures To Be Aware Of

While Varo promotes a no-fee banking experience, some additional services may incur fees. These include:

- ATM fees at non-participating locations

- International transaction fees

Using in-network ATMs is free, avoiding these extra costs. When traveling abroad, users should check for any international charges. These fees are minimal compared to traditional banks.

Overall, Varo’s transparent fee structure ensures users understand the costs associated with their banking services, promoting trust and financial confidence.

Pros And Cons Of Varo No Annual Fee

Varo Bank’s no annual fee policy offers many benefits to users. It’s crucial to understand both the advantages and potential drawbacks of this mobile banking service. In this section, we’ll explore the pros and cons of Varo’s no annual fee feature.

Advantages Of Using Varo

Varo Bank provides several benefits that make it an attractive choice for many users.

- No Annual Fees: There are no annual fees, which can save users a significant amount of money.

- Mobile Banking Services: Access banking services conveniently from your mobile device.

- Real-Time Account Management: Track your expenses and account balances in real-time.

- Budgeting Tools: Use Varo’s tools to help manage your finances effectively.

- Savings Automation: Automatically save money with Varo’s savings features.

- No Hidden Fees: Enjoy banking without worrying about unexpected charges.

Potential Drawbacks And Limitations

While Varo Bank offers many advantages, there are some potential drawbacks to consider.

- Mobile-Only Platform: Varo is primarily a mobile banking app, which may not suit users who prefer desktop banking.

- Limited Physical Presence: Varo does not have physical branches, which might be a disadvantage for those who prefer in-person banking.

- No Credit Products: Varo focuses on banking services and does not offer credit cards or loans.

Understanding both the advantages and limitations of Varo can help users make an informed decision about whether this no annual fee banking option is right for them.

Ideal Users And Scenarios

The Varo No Annual Fee banking service offers a unique solution for a variety of users. Understanding who benefits the most from this service and in what scenarios it shines can help you decide if it’s the right choice for you.

Who Benefits The Most From Varo No Annual Fee

- Budget-conscious individuals: Those who want to save on banking fees.

- Students: Perfect for those who need a simple, fee-free banking solution.

- Freelancers and gig workers: Ideal for managing income without worrying about fees.

- Travelers: Great for managing money on the go with real-time tracking.

Real-world Scenarios Where Varo Shines

Imagine you are a student trying to manage your expenses. The Varo App helps you track your spending in real-time. It provides useful budgeting tools that make it easier to stay on top of your finances.

If you are a freelancer, managing different income streams can be challenging. The Varo No Annual Fee service allows you to keep track of all your earnings without worrying about hidden fees.

For travelers, the Varo App offers a seamless way to manage your money while on the go. With no-fee banking, you can access your funds easily from anywhere in the world without extra charges.

If you aim to save money on banking services, Varo’s no annual fee structure is perfect. It ensures that you do not incur unnecessary charges, making every penny count.

Frequently Asked Questions

What Is Varo’s Annual Fee?

Varo has no annual fee. You won’t be charged yearly for maintaining your account.

Does Varo Charge Any Monthly Fees?

No, Varo does not charge monthly fees. It’s a fee-free banking option.

How Does Varo Make Money?

Varo makes money through interest on loans and interchange fees from debit card transactions.

Is Varo A Good Choice For Students?

Yes, Varo is great for students. It offers fee-free banking with no hidden charges.

Conclusion

Enjoy hassle-free banking with Varo’s no-fee app. Manage your finances easily. Real-time tracking and budgeting tools simplify your life. Access your account anytime, anywhere. No hidden fees, ever. Ready to experience Varo? Click here to get started.