Varo Interest Rates: Maximize Your Savings Potential Today

Varo Bank offers competitive interest rates for its customers. Understanding these rates can help you manage your finances better.

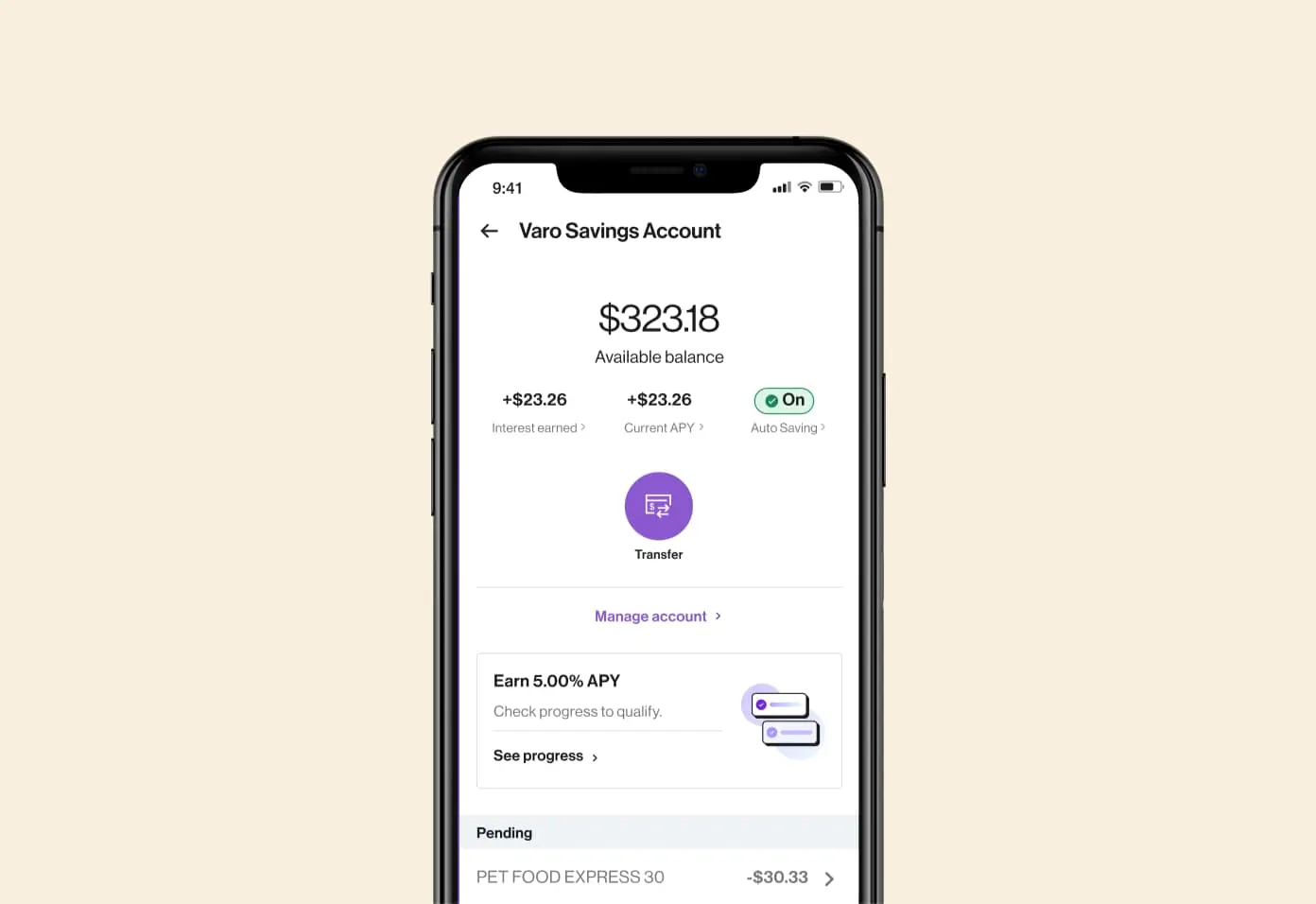

Varo is a mobile banking app that simplifies banking. It provides users with secure, easy access to banking services. Mobile banking is becoming more popular due to its convenience. Varo’s features include account management and secure login. Using Varo can make banking easier and more secure. With Varo, you can manage your money from your phone. Explore Varo’s interest rates to see how it can benefit your financial goals. Learn more about Varo Bank’s offerings by visiting Varo’s website.

Introduction To Varo And Its Savings Potential

Varo Bank offers a unique opportunity for users to maximize their savings. With its user-friendly mobile app and competitive interest rates, it provides a seamless banking experience. Let’s explore what Varo is and how its savings account can benefit you.

What Is Varo?

Varo is a mobile banking application designed to make banking easy and accessible. The app offers various features to help you manage your finances efficiently.

- Mobile banking capabilities

- Account management

- Secure login

Using the Varo app, you can access your banking services from anywhere. It ensures secure and reliable performance, making it a trusted choice for many.

Overview Of Varo’s Savings Account

Varo Bank’s savings account stands out with its competitive interest rates. It provides users with an opportunity to grow their savings effortlessly. Here are some key features:

- High-interest rates to maximize savings potential

- No minimum balance requirements

- No monthly fees

Here’s a quick comparison of Varo’s savings account features:

| Feature | Details |

|---|---|

| Interest Rate | Competitive and high |

| Minimum Balance | None |

| Monthly Fees | None |

With these features, Varo Bank makes saving money simple and effective. The app’s easy-to-use interface and secure login add to its appeal. It’s an ideal choice for anyone looking to manage their savings efficiently.

Key Features Of Varo Interest Rates

Varo Bank offers a range of features that make its interest rates attractive and beneficial for users. Here, we explore the key features that set Varo Interest Rates apart.

High-yield Savings Account

Varo Bank provides a high-yield savings account with competitive interest rates. Users can earn more on their savings compared to traditional banks. This makes it an excellent option for those looking to grow their savings efficiently.

No Minimum Balance Requirement

One of the standout features of Varo Bank is that there is no minimum balance requirement. Users can open and maintain their accounts without worrying about keeping a specific amount in their account. This flexibility is ideal for individuals at different financial stages.

Automatic Savings Tools

Varo Bank offers automatic savings tools to help users save effortlessly. Features like automatic transfers and savings round-ups make saving money easy and consistent. These tools ensure that users steadily build their savings without manual intervention.

Fee-free Banking

Varo Bank prides itself on offering fee-free banking. Users do not have to worry about hidden fees or charges that can eat into their savings. This transparency and cost-effectiveness make Varo a preferred choice for many.

| Feature | Description |

|---|---|

| High-Yield Savings Account | Earn more on your savings with competitive interest rates. |

| No Minimum Balance Requirement | Open and maintain accounts without a specific balance. |

| Automatic Savings Tools | Save effortlessly with automatic transfers and round-ups. |

| Fee-Free Banking | Enjoy banking without hidden fees or charges. |

Varo Bank’s interest rates and features make it a strong contender in the banking sector. With user-friendly options and no hidden costs, it caters to a wide range of financial needs.

How Varo’s Interest Rates Benefit You

Varo offers competitive interest rates that can help you grow your savings. Understanding these benefits can help you manage your finances better. Let’s explore how Varo’s interest rates can benefit you.

Maximize Your Earnings

Varo provides high-yield savings accounts that offer better interest rates than traditional banks. This means you earn more on your savings. For instance, if you have $1,000 in your savings account, a higher interest rate can significantly increase your earnings over time.

Here is an example:

| Account Balance | Traditional Bank Interest Rate | Varo Interest Rate | Yearly Earnings |

|---|---|---|---|

| $1,000 | 0.01% | 2.00% | $20 |

Encourage Regular Savings

Varo’s attractive interest rates motivate you to save regularly. The more you save, the more interest you earn. This can help you build a healthy savings habit. For example, setting up automatic transfers to your savings account ensures you save consistently.

- Set automatic transfers

- Track savings growth

- Reach financial goals faster

Ease Of Access And Management

With the Varo app, managing your savings is simple and convenient. The app offers easy access to your accounts, allowing you to monitor your earnings anytime. You can also make transfers or set up automatic deposits with just a few taps.

Key features include:

- Mobile banking capabilities

- Account management

- Secure login

These features ensure you stay on top of your finances without any hassle.

Pricing And Affordability

Varo offers competitive interest rates and transparent pricing, ensuring accessibility for everyone. Below, we will explore how Varo’s pricing compares to other banks and highlight the absence of hidden fees.

Comparative Analysis With Other Banks

Varo’s interest rates are structured to provide significant savings. Let’s compare Varo with traditional banks:

| Bank | Interest Rate | Monthly Fees |

|---|---|---|

| Varo | 1.20% APY | $0 |

| Bank A | 0.05% APY | $10 |

| Bank B | 0.01% APY | $12 |

As shown, Varo offers higher interest rates with no monthly fees. This makes it a favorable option for many users.

No Hidden Fees Or Charges

Varo prioritizes transparency. It assures users of no hidden fees or unexpected charges. Here are some key points:

- No monthly maintenance fees

- No minimum balance requirements

- No overdraft fees

- No foreign transaction fees

These benefits make Varo an attractive choice for those seeking affordable and straightforward banking services.

Pros And Cons Based On Real-world Usage

The Varo App offers many features that appeal to users looking for mobile banking solutions. Understanding the advantages and limitations can help you decide if it’s the right choice for you.

Advantages Of Using Varo

The Varo App provides several benefits that make it popular among users.

- Mobile Banking Capabilities: Manage your finances from anywhere using your mobile device.

- Secure Login: Varo ensures secure access, protecting your personal data.

- Easy Access: Enjoy convenient access to various banking services without visiting a branch.

Many users appreciate the reliable performance and easy access that the Varo App offers.

Potential Drawbacks And Limitations

While Varo has many strengths, there are some limitations to consider.

- Pricing Details: The app does not provide clear information about pricing, which can be confusing.

- Refund or Return Policies: Lack of information on refund or return policies may concern some users.

These drawbacks might affect users who need transparent pricing and clear policies.

Overall, the Varo App offers many advantages, but it is essential to be aware of its limitations.

Ideal Users And Scenarios

Varo Bank offers a range of features that cater to different users. Understanding who can benefit the most from Varo’s interest rates and savings account can help maximize its potential. Here’s a detailed look at the ideal users and scenarios.

Who Should Use Varo?

Varo is perfect for those who prefer mobile banking. If you want easy access to banking services on your mobile device, Varo is a great option. It’s also suitable for users who value secure and reliable performance. Varo’s secure login ensures your data is safe.

Young adults and tech-savvy individuals will find Varo convenient. If you are a student or a young professional, Varo’s mobile banking capabilities can simplify your financial management.

Best Situations To Utilize Varo’s Savings Account

Varo’s savings account is ideal for users looking to grow their savings. The competitive interest rates make it a smart choice for building an emergency fund. If you have short-term savings goals, Varo’s savings account can help you achieve them faster.

Consider using Varo for automatic savings. Setting up recurring transfers can help you save without even thinking about it. If you want to save for a vacation, a new gadget, or any other goal, Varo can make this process smoother and more efficient.

Conclusion: Is Varo Right For You?

Varo Bank offers a mobile banking experience tailored for those seeking convenience. With its secure login and account management features, Varo ensures reliable performance for its users. But is it the right choice for you? Let’s break it down.

Summarizing The Benefits

Varo Bank provides several key benefits:

- Mobile banking capabilities: Manage your account from your smartphone.

- Secure login: Protect your data with advanced security features.

- Easy access: Bank anytime, anywhere with the Varo app.

Final Recommendations

Consider the following points to decide if Varo Bank is suitable for you:

- If you value convenient mobile banking, Varo is a solid choice.

- For those who need secure account management, Varo provides a reliable platform.

- If pricing or refund policies are crucial, note that information is not provided.

Overall, Varo Bank offers a user-friendly experience with essential banking features. It could be a good match for your banking needs.

Frequently Asked Questions

What Are Varo’s Current Interest Rates?

Varo offers competitive interest rates on savings accounts. Rates can vary based on account type and balance. Check Varo’s website for the latest rates.

How Can I Increase My Varo Interest Rate?

To increase your Varo interest rate, maintain a higher account balance. Also, consider meeting specific criteria set by Varo for higher rates.

Are Varo Interest Rates Better Than Traditional Banks?

Varo often offers higher interest rates compared to traditional banks. This can help maximize your savings and grow your money faster.

Does Varo Have A High-yield Savings Account?

Yes, Varo offers a high-yield savings account. It provides attractive interest rates, helping you earn more on your savings.

Conclusion

Varo offers a simple and secure way to manage your banking. With its mobile app, you can access banking services anytime, anywhere. Check account balances, transfer money, and enjoy secure login features. Varo makes banking easy and reliable. Interested in learning more? Visit the Varo website now here.