Varo Instant Approval: Get Your Account Up and Running Fast

Are you tired of long wait times for bank approvals? Imagine getting instant approval without the hassle.

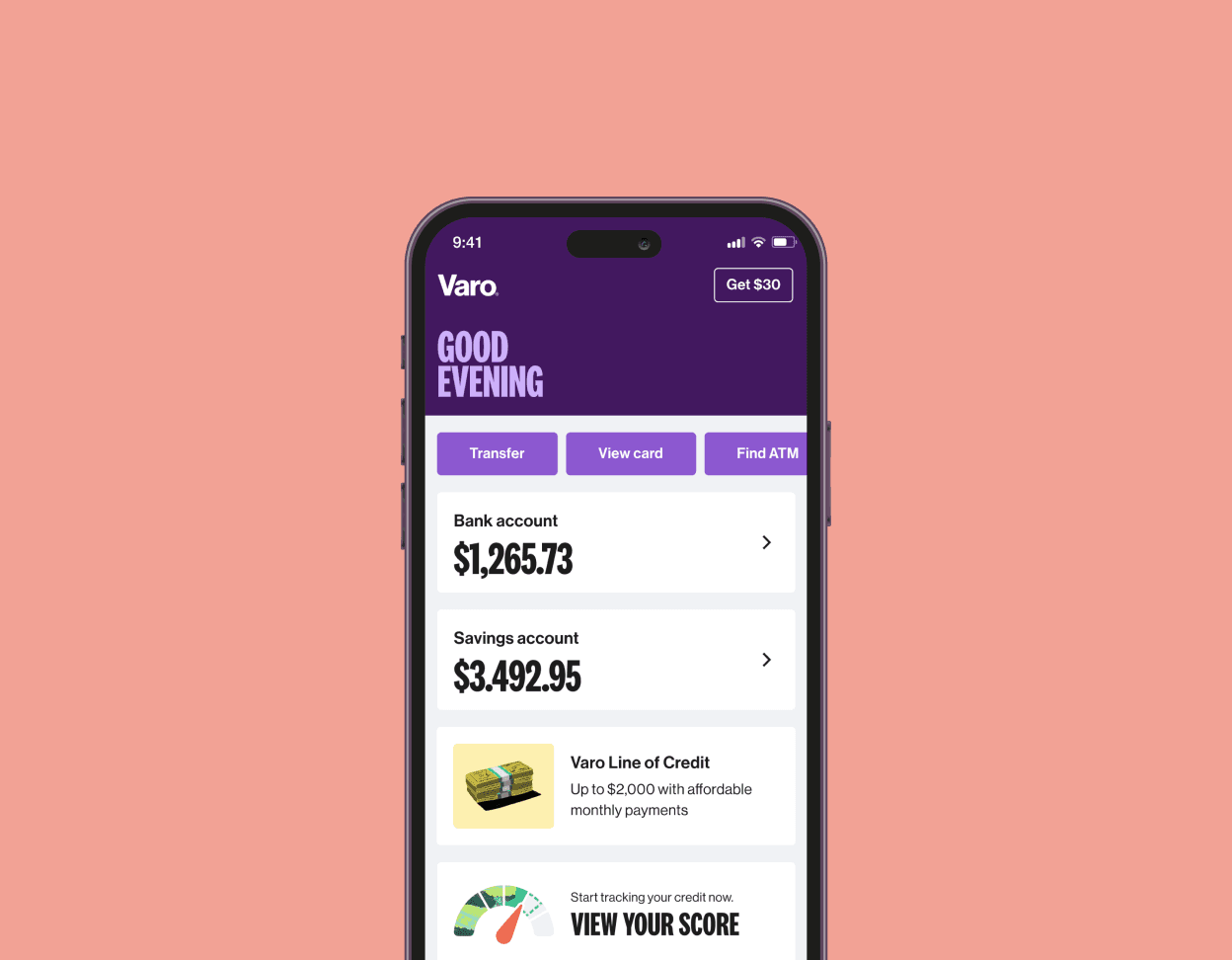

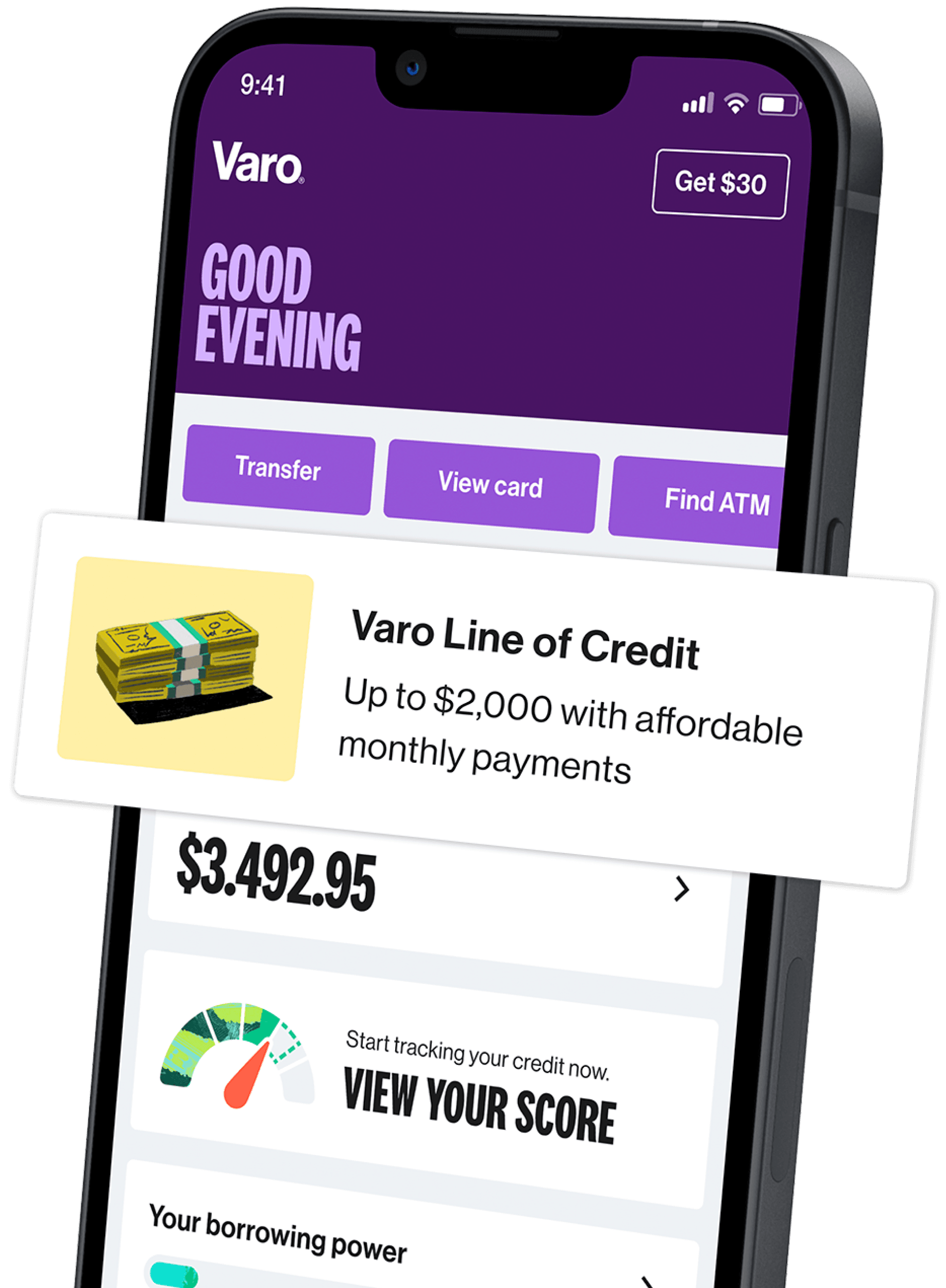

Varo offers a mobile banking experience designed for convenience and security. Varo Bank, accessible through the Varo App, brings banking to your fingertips. With its user-friendly interface, you can manage your accounts, monitor transactions, and enjoy secure logins. The app provides real-time updates, ensuring you stay on top of your finances. Whether you are at home or on the go, Varo makes banking easy and efficient. Ready to experience hassle-free banking? Click here to explore Varo Bank now.

Introduction To Varo Instant Approval

Varo Bank provides a seamless and user-friendly experience for managing financial accounts. One of its key features is the Varo Instant Approval. This feature simplifies the process of obtaining a bank account. Let’s explore what Varo Instant Approval is and its benefits.

What Is Varo Instant Approval?

Varo Instant Approval is a feature of the Varo App. It allows users to get their bank account approved quickly. This means no lengthy waiting periods. Users can start managing their finances immediately.

The Varo App offers a simple and fast way to open an account. The process is entirely mobile. Users complete the application on their smartphones. This makes banking more accessible and convenient.

The Purpose And Benefits Of Instant Approval

The main purpose of Varo Instant Approval is to provide quick access to banking services. Traditional banks often require long approval times. Varo shortens this process significantly.

Here are the key benefits:

- Convenience: Open an account from anywhere using your mobile device.

- Speed: Get approved within minutes, not days.

- Security: Enhanced features protect user data during and after the application process.

- User-friendly: The interface is simple and easy to navigate.

Instant approval means users can immediately enjoy the app’s features. These include transaction monitoring and secure login. Varo offers real-time updates on financial activities. This helps users stay informed and in control of their finances.

In summary, Varo Instant Approval is designed to make banking easier and faster. By leveraging technology, Varo Bank ensures users have access to their accounts almost instantly.

Key Features Of Varo Instant Approval

Varo Instant Approval offers several standout features that make banking quick and easy. This section dives into the key aspects that set it apart.

Quick And Easy Application Process

Applying for an account with Varo is simple. The process is designed to be fast and user-friendly, ensuring a smooth experience. Here’s what you need to know:

- Fill out a short online form

- Submit necessary identification documents

- Receive instant approval within minutes

Immediate Account Access

Once approved, you get immediate access to your account. This means you can start managing your finances without delay. Key benefits include:

- Instant access to account features

- No waiting period

- Start transactions right away

No Minimum Balance Requirements

Varo Instant Approval does not require a minimum balance. This is great for those who are just starting or prefer flexibility. Benefits include:

- No minimum balance needed

- Avoid fees for low balances

- Freedom to maintain any balance

User-friendly Mobile App

The Varo App makes banking on the go easy. It offers a user-friendly interface that simplifies managing your finances. Features of the app include:

- Mobile banking access

- Account management

- Transaction monitoring

- Secure login

With Varo Instant Approval, you get a seamless banking experience that is both convenient and secure.

Pricing And Affordability

Varo Bank offers an attractive pricing structure, making it a great choice for budget-conscious individuals. Here’s a detailed look at its affordability.

No Monthly Fees

One of the most appealing aspects of the Varo App is that it comes with no monthly fees. Users can enjoy all the banking features without worrying about a monthly maintenance fee. This makes managing finances easier and more cost-effective.

Free Atm Withdrawals

Varo Bank provides free ATM withdrawals at over 55,000 Allpoint® ATMs worldwide. This allows users to access their cash without incurring extra charges, adding another layer of affordability to the banking experience.

Competitive Interest Rates

Varo App offers competitive interest rates on savings accounts. Users can earn more on their savings compared to traditional banks. This helps in growing their money faster and achieving financial goals more efficiently.

Additional Cost Considerations

- Overdraft fees: Information not provided

- International fees: Information not provided

- Transfer fees: Information not provided

While Varo Bank doesn’t provide specific details on certain fees, it’s essential to consider these potential costs. Always review the terms and conditions to understand all possible charges.

Pros And Cons Based On Real-world Usage

The Varo App offers instant approval for a variety of banking services. Users appreciate the convenience and security it provides. Yet, real-world usage shows both advantages and drawbacks. Let’s dive into these aspects.

Advantages Of Varo Instant Approval

- Quick Access: Users gain immediate access to their accounts.

- Convenience: Manage finances from anywhere with ease.

- Enhanced Security: Advanced security features protect user data.

- Real-Time Updates: Get instant transaction notifications.

- User-Friendly Interface: Simple and intuitive design for easy navigation.

Potential Drawbacks To Consider

- Limited Features: Some users desire more advanced banking tools.

- Poor Customer Service: Users report slow responses from support.

- Technical Glitches: Occasional app crashes and bugs frustrate users.

- Inconsistent Updates: Some features take time to improve.

- Pricing Transparency: Lack of clear pricing details can be confusing.

| Pros | Cons |

|---|---|

| Quick Access | Limited Features |

| Convenience | Poor Customer Service |

| Enhanced Security | Technical Glitches |

| Real-Time Updates | Inconsistent Updates |

| User-Friendly Interface | Pricing Transparency |

Ideal Users And Scenarios For Varo Instant Approval

The Varo App offers a seamless mobile banking experience. It’s designed to make managing finances simple and secure. But who benefits the most from Varo Instant Approval? Let’s explore the ideal users and scenarios for this feature.

Who Can Benefit Most From Varo Instant Approval?

- Freelancers and Gig Workers: These individuals often face irregular income. Varo’s real-time transaction updates help them stay on top of their finances.

- Students: Young adults need an easy and secure way to manage their money. Varo’s user-friendly interface makes it simple.

- Travelers: Accessing banking services on the go is crucial. Varo’s mobile access allows travelers to manage accounts from anywhere.

- Busy Professionals: Time is money. Quick and secure login features save valuable time for professionals.

Specific Scenarios Where Varo Shines

Unexpected expenses happen. Varo’s instant approval ensures funds are available when needed most.

Real-time transaction updates help users keep track of their spending. This is especially useful for those on a tight budget.

Managing money abroad can be challenging. Varo’s mobile access makes it easier to handle transactions in different time zones.

Freelancers often juggle multiple projects. Varo’s secure login and account management features help them manage payments efficiently.

Frequently Asked Questions

What Is Varo Instant Approval?

Varo Instant Approval is a feature that allows quick and easy access to financial services. It simplifies the approval process, making it fast and convenient.

How Does Varo Instant Approval Work?

Varo Instant Approval works by quickly evaluating your financial information. It uses advanced algorithms to provide instant decisions, ensuring a seamless experience.

Is Varo Instant Approval Safe?

Yes, Varo Instant Approval is safe. Varo uses advanced security measures to protect your personal and financial information, ensuring privacy and security.

Who Can Apply For Varo Instant Approval?

Anyone meeting Varo’s eligibility criteria can apply. Typically, you need to be a U. S. resident with a valid Social Security number.

Conclusion

Varo Instant Approval offers a seamless banking experience. The Varo App provides easy account access and management. Users can monitor transactions and enjoy secure logins. This convenience helps manage finances from anywhere, anytime. Experience real-time updates and a user-friendly interface. Explore more about Varo Bank by visiting their website here. This mobile banking solution can enhance your financial management. Discover the ease and security it brings today.