Varo Credit Reporting: Boost Your Credit Score Effortlessly

Managing your credit can be challenging. Understanding credit reporting is crucial for financial health.

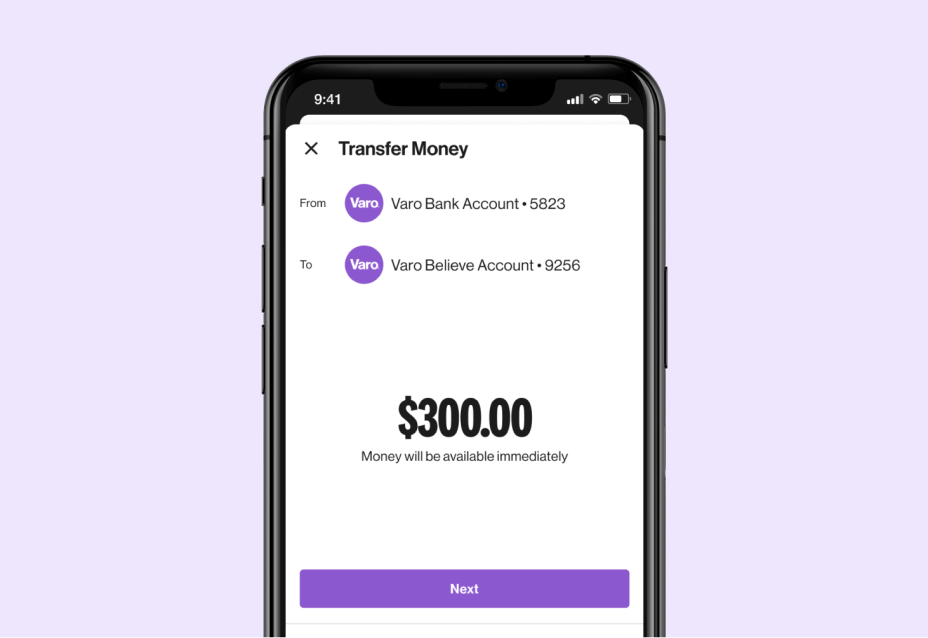

Varo Bank is a mobile banking app that offers secure and convenient financial management. With Varo, users can access their account details instantly, transfer money easily, and pay bills on the go. The app also features budgeting tools and savings account options, making it easier to manage finances efficiently. Varo prioritizes user security, ensuring your personal information is protected. The best part? The app is free to download and use, with some additional banking services that may incur fees. With Varo, you can enjoy the convenience of banking from anywhere, along with enhanced security and user-friendly features. Explore Varo today and take control of your financial journey!

Introduction To Varo Credit Reporting

Varo Credit Reporting is an essential feature for users looking to build or improve their credit score. This service helps users understand their credit status and provides tools to enhance it. Let’s delve deeper into what Varo Credit Reporting is, its purpose, and the benefits it offers.

What Is Varo Credit Reporting?

Varo Credit Reporting is a feature within the Varo app, which is a mobile banking application. This feature allows users to monitor their credit reports and scores directly from their mobile devices. It integrates seamlessly with Varo’s other financial tools, offering a comprehensive view of one’s financial health.

The credit reporting service provides details from major credit bureaus, ensuring users receive up-to-date and accurate information. Users can track their credit history, see changes in their credit score, and get insights into factors affecting their credit.

Purpose And Benefits

The primary purpose of Varo Credit Reporting is to empower users with knowledge about their credit. Here are some of the key benefits:

- Convenience: Access credit reports and scores anytime, anywhere through the Varo app.

- Enhanced Security: Your financial data is protected with robust security features.

- Financial Insights: Get detailed insights into what impacts your credit score, such as payment history and credit utilization.

- Credit Monitoring: Stay informed about changes to your credit report and address potential issues promptly.

- Improve Credit: Use the insights and tools to take steps towards improving your credit score.

Varo Credit Reporting stands out by combining ease of use with powerful financial tools. It simplifies financial management and helps users stay on top of their credit health.

With Varo, managing your finances and understanding your credit has never been easier. The app’s user-friendly interface and comprehensive features make it an invaluable tool for anyone looking to improve their credit.

Key Features Of Varo Credit Reporting

Varo Credit Reporting offers several essential features to help users manage and improve their credit scores. Below, we explore these key features, which include automated credit score updates, credit utilization insights, credit building tools, and real-time notifications.

Automated Credit Score Updates

Automated credit score updates provide users with regular updates on their credit scores. This feature ensures users are always aware of their current credit standing. Regular updates help users make informed financial decisions.

Credit Utilization Insights

Credit utilization insights help users understand how their credit usage impacts their credit scores. This feature offers detailed information about credit limits and balances. Users can see how much credit they are using compared to their limits, helping them manage their credit better.

Credit Building Tools

Credit building tools are designed to help users improve their credit scores. These tools offer personalized tips and strategies. Users can follow these tips to build a stronger credit history and achieve better financial health.

Real-time Notifications

Real-time notifications alert users about significant changes to their credit reports. This feature ensures users stay informed about any new accounts, credit inquiries, or other important updates. Staying informed helps users respond promptly to any potential issues or opportunities.

How Varo Credit Reporting Benefits Users

Varo Credit Reporting offers many advantages to its users. It provides effortless credit score monitoring, personalized credit improvement tips, and enhanced financial awareness. Here’s a closer look at how these features benefit you.

Effortless Credit Score Monitoring

With Varo, monitoring your credit score is simple. The app provides instant access to your credit information. This allows you to keep track of your credit health regularly. No more waiting for monthly statements or logging into multiple platforms. You can view your credit score anytime, anywhere, right from your mobile device.

Personalized Credit Improvement Tips

Varo goes beyond just showing your credit score. It offers personalized tips to help you improve it. The app analyzes your credit behavior and provides specific advice tailored to your situation. This might include suggestions like reducing your credit card balance or setting up automatic payments. These personalized tips make it easier to understand and act on ways to boost your credit score.

Enhanced Financial Awareness

Using Varo helps enhance your overall financial awareness. By regularly checking your credit score and following improvement tips, you become more aware of your financial standing. The app also offers various financial management tools. These tools help you track your spending, set budgets, and save money efficiently. This comprehensive approach to financial management helps you make informed decisions and achieve your financial goals.

The combination of these features makes Varo an invaluable tool for anyone looking to manage their credit and finances effectively.

Pricing And Affordability

Varo Credit Reporting offers a cost-effective solution for managing your credit score. Many users find it valuable for its transparency and budget-friendly options. Below, we explore the pricing details, compare it with competitors, and assess its overall value for money.

Cost Of Varo Credit Reporting

The Varo app is free to download and use. It provides various features such as secure mobile banking, instant access to account details, easy money transfers, bill payments, budgeting tools, and savings account options. While the basic services are free, additional banking services may incur fees, which are clearly detailed within the app.

| Service | Cost |

|---|---|

| App Download | Free |

| Basic Banking Services | Free |

| Additional Banking Services | Varies |

Comparison With Competitors

Varo stands out in the market due to its no-cost basic services. Many competitors charge for similar features. For example:

- Competitor A: Charges $5 per month for similar services.

- Competitor B: Offers a free version but with limited features; the premium version costs $10 per month.

- Competitor C: Charges a one-time fee of $20 for setup and $2 per transaction.

Varo’s pricing structure is more attractive, especially for users looking for a comprehensive service without high fees.

Value For Money

With Varo, users benefit from a range of features at no cost. The app’s user-friendly interface makes managing finances simple and efficient. Enhanced security features ensure peace of mind. For those who need additional services, the associated fees are transparent and reasonable.

The combination of free basic services and affordable additional options makes Varo a valuable choice for many users. It offers convenience and efficiency without breaking the bank.

Pros And Cons Of Varo Credit Reporting

Varo Bank offers a variety of financial services, including credit reporting. Understanding the pros and cons of Varo Credit Reporting can help users make informed decisions about using this service. Here, we break down the benefits and drawbacks under the respective headings.

Pros

- Convenient Mobile Banking: Varo’s app allows users to access their credit information from anywhere.

- Secure Access: Enhanced security features ensure that your credit data is safe.

- User-Friendly Interface: The app is designed to be easy to navigate, even for non-tech-savvy users.

- Instant Credit Updates: Users receive real-time updates on their credit status.

- Efficient Financial Management: Tools for budgeting and savings help improve overall financial health.

Cons

- Potential Fees: While the app is free, some banking services might have associated fees.

- Limited Refund Options: As a banking service, traditional refund policies do not apply.

- Customer Support: Issues with accounts must be resolved through customer support, which may be time-consuming.

- Dependence on Mobile Access: Users without smartphones may find it difficult to access their credit information.

| Features | Pros | Cons |

|---|---|---|

| Mobile Access | Convenient and accessible | Dependence on mobile device |

| Security | Enhanced security features | Potential customer support delays |

| User Interface | User-friendly | Learning curve for new users |

| Instant Updates | Real-time credit updates | Potential associated fees |

| Financial Tools | Efficient financial management | Limited refund options |

Recommendations For Ideal Users

Varo Credit Reporting is ideal for those looking to improve their credit score. It offers a convenient and efficient way to manage finances through a secure mobile app. This section will guide you on the best users for Varo Credit Reporting and the scenarios where it works best.

Who Should Use Varo Credit Reporting?

Varo Credit Reporting is a great tool for individuals who want to keep a close eye on their credit status. This service is designed for:

- Young adults who are new to credit and want to build a strong credit history.

- Individuals with existing credit who wish to improve their scores.

- People who prefer managing their finances through a mobile app.

- Anyone needing easy access to account details and budgeting tools.

These users will benefit from the app’s secure banking features, user-friendly interface, and efficient financial management tools.

Best Scenarios For Use

Varo Credit Reporting is most effective in the following scenarios:

- Building Credit: Users starting their credit journey can use Varo to track their credit score and financial activities.

- Improving Credit: Those with low credit scores can use the app to monitor their credit and identify areas for improvement.

- Managing Finances: Users can benefit from the budgeting tools and savings account options to keep their finances in check.

- Secure Banking: Individuals who prioritize security can rely on Varo’s enhanced security features.

In these scenarios, Varo provides a comprehensive solution for managing and improving credit scores through convenient mobile banking.

Frequently Asked Questions

What Is Varo Credit Reporting?

Varo credit reporting refers to how Varo Bank reports your credit activity to credit bureaus. It helps build your credit score.

How Often Does Varo Report To Credit Bureaus?

Varo typically reports to credit bureaus once a month. This helps ensure your credit activity is accurately reflected.

Which Credit Bureaus Does Varo Report To?

Varo reports to the three major credit bureaus: Experian, Equifax, and TransUnion. This helps build a comprehensive credit profile.

Can Varo Improve My Credit Score?

Yes, responsible use of Varo products can improve your credit score. Timely payments and low credit utilization are key.

Conclusion

Varo Credit Reporting offers numerous benefits for managing your finances. It provides secure mobile banking and instant access to account details. Users can also enjoy easy money transfers and bill payments. Plus, the app helps with budgeting and saving. Varo’s user-friendly interface makes banking simple and efficient. Download the Varo app today to experience convenient banking. For more details, visit the Varo Bank website.