Varo Credit Card Benefits: Unlocking Financial Freedom

In today’s digital age, managing finances can be a hassle. Luckily, Varo offers a credit card with many benefits.

Varo Bank, accessible via the Varo App, provides a seamless banking experience. This mobile banking app allows users to handle their financial tasks directly from their smartphones. It includes features like secure login, real-time transaction notifications, and integrated budgeting tools. What’s more, there are no hidden fees or minimum balance requirements. With Varo, users can enjoy convenient banking from anywhere, ensuring their financial information stays protected. The app also helps users save money and manage their finances efficiently. Whether you’re new to mobile banking or looking to switch, Varo offers a transparent and user-friendly solution.

Introduction To Varo Credit Card

The Varo Credit Card is an innovative solution for managing your finances. This card offers a range of benefits designed to simplify and enhance your banking experience.

A Brief Overview

Varo Bank, renowned for its mobile banking app, has introduced the Varo Credit Card. It integrates seamlessly with the Varo app, providing users with an intuitive and secure way to manage their credit. This card is perfect for those who prefer handling their finances on the go.

| Main Features |

|---|

| Seamless integration with Varo app |

| Secure login and account management |

| Real-time transaction notifications |

| Integrated budgeting and savings tools |

| No hidden fees or minimum balance requirements |

Purpose And Target Audience

The Varo Credit Card is designed to meet the needs of tech-savvy individuals. It is ideal for those who seek convenience and transparency in their banking activities. With its user-friendly interface and robust security features, the Varo Credit Card appeals to a wide range of users.

- Convenient management of banking activities from anywhere

- Enhanced security features to protect user information

- Tools to help users save money and manage finances effectively

- Transparent fee structure with no unexpected charges

The Varo Credit Card also caters to those who prefer a cashless lifestyle. With no minimum balance requirements and real-time transaction notifications, it ensures a smooth and hassle-free banking experience.

Key Features Of The Varo Credit Card

The Varo Credit Card offers numerous benefits for users. It’s designed to provide convenience, rewards, and financial tools. Below are the key features of the Varo Credit Card.

No Annual Fees

One of the most attractive features of the Varo Credit Card is that it comes with no annual fees. You can enjoy the benefits of the card without worrying about extra costs. This makes it an ideal choice for budget-conscious consumers.

Cash Back Rewards

The Varo Credit Card offers cash back rewards on purchases. Earn rewards on everyday spending, helping you save money. The rewards program is straightforward and easy to understand.

Low Interest Rates

The Varo Credit Card offers low interest rates compared to many other credit cards. This can help you save money on interest charges, especially if you carry a balance from month to month.

Credit Building Tools

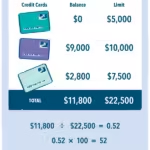

The card provides valuable credit building tools to help you improve your credit score. Use the Varo app to monitor your credit score and get tips on how to build better credit. These tools are designed to support your financial health.

Seamless Integration With Varo Bank

The Varo Credit Card integrates seamlessly with the Varo Bank app. This integration allows for easy management of your credit card account alongside your banking activities. Enjoy real-time transaction notifications and a comprehensive overview of your finances in one place.

Overall, the Varo Credit Card offers a combination of affordability, rewards, and useful financial tools, making it a smart choice for many consumers.

Pricing And Affordability Breakdown

The Varo Credit Card stands out in the market for its affordability. It offers several benefits that make it a wise choice for many users. Here’s a detailed look at its pricing and affordability.

Interest Rates And Fees

The Varo Credit Card provides competitive interest rates. This is crucial for users who carry a balance. The card’s fees are transparent. Users are not surprised by hidden charges. Below is a breakdown of the Varo Credit Card’s interest rates and fees:

| Feature | Details |

|---|---|

| Interest Rate | 14.49% – 25.49% Variable APR |

| Annual Fee | $0 |

| Late Payment Fee | $0 |

| Foreign Transaction Fee | $0 |

Comparison With Competitors

When comparing the Varo Credit Card to other cards, its affordability is evident. Below is a comparison table highlighting key differences:

| Feature | Varo Credit Card | Competitor A | Competitor B |

|---|---|---|---|

| Annual Fee | $0 | $95 | $99 |

| Interest Rate | 14.49% – 25.49% | 16.99% – 24.99% | 15.99% – 23.99% |

| Foreign Transaction Fee | $0 | 3% | 2% |

Value For Money

The Varo Credit Card offers excellent value. Users enjoy a no annual fee and low-interest rates. There are no hidden fees, enhancing its affordability. This makes it a smart choice for budget-conscious consumers.

Additionally, users benefit from real-time transaction notifications. This feature helps in managing finances effectively. Enhanced security ensures user information is safe. With these features, the Varo Credit Card proves to be a valuable tool for modern banking needs.

Pros And Cons Of The Varo Credit Card

Understanding the benefits and limitations of the Varo Credit Card can help you make an informed decision. This section explores the advantages and potential drawbacks of using Varo’s credit card.

Advantages Of Using Varo

- No hidden fees: Varo offers a transparent fee structure with no unexpected charges, ensuring you know exactly what to expect.

- Real-time transaction notifications: Stay updated with your spending and account activity through instant alerts on your mobile device.

- Budgeting and savings tools: The Varo app integrates tools to help you manage your finances effectively, making it easier to save money.

- Secure login and account management: Enhanced security features protect your personal and financial information, giving you peace of mind.

- Convenient access: Manage your banking activities from anywhere through the Varo mobile app, offering flexibility and ease of use.

Potential Drawbacks

- Internet dependency: A stable internet connection is required to access Varo services, which may be inconvenient if you have connectivity issues.

- Limited geographic access: Ensure you are not in a blocked country, as Varo services are restricted in certain regions.

- VPN and IP proxy restrictions: Avoid using VPN or IP proxy services to access Varo, as this may lead to connectivity problems.

By considering both the advantages and potential drawbacks, you can decide if the Varo Credit Card suits your financial needs.

Ideal Users And Scenarios For Varo Credit Card

The Varo Credit Card is designed for various types of users. It offers unique benefits tailored to specific needs. Here are the ideal users and scenarios for the Varo Credit Card.

Best For Young Adults And Students

Young adults and students can benefit greatly from the Varo Credit Card. It offers an easy way to manage finances. Here are some key features:

- No hidden fees: Helps students avoid unnecessary charges.

- Real-time transaction notifications: Keeps track of spending easily.

- Integrated budgeting tools: Assists in managing limited budgets.

This makes it an excellent choice for those new to financial management. It helps build good financial habits early on.

Suitable For Individuals Building Or Rebuilding Credit

For those building or rebuilding credit, the Varo Credit Card is a great option. It offers:

- No minimum balance requirements: Makes it accessible to everyone.

- Secure login and account management: Provides peace of mind.

- Transparent fee structure: Ensures no unexpected charges.

This card is ideal for improving credit scores over time. It helps users stay on top of their finances.

Effective For Budget-conscious Consumers

Budget-conscious consumers will find the Varo Credit Card effective. It provides tools to manage and save money:

- Integrated budgeting and savings tools: Helps in effective financial planning.

- No hidden fees: Saves money by avoiding unexpected charges.

- Convenient management via mobile app: Allows easy monitoring of expenses.

This card is perfect for those who want to keep a close eye on their spending. It helps in making informed financial decisions.

Frequently Asked Questions

What Are The Main Benefits Of Varo Credit Card?

The Varo Credit Card offers no annual fees, no foreign transaction fees, and cashback rewards. It also helps build credit with responsible use.

How Does Varo Credit Card Cashback Work?

Varo Credit Card provides cashback on eligible purchases. The cashback percentage varies based on promotions and spending categories.

Does Varo Credit Card Help Build Credit?

Yes, Varo Credit Card helps build credit by reporting to major credit bureaus. Responsible use can improve your credit score.

Are There Any Fees For Varo Credit Card?

No, the Varo Credit Card has no annual fees, no foreign transaction fees, and no hidden charges.

Conclusion

Choosing the Varo credit card is a smart move. It offers convenient access to banking services. Manage your finances easily with the Varo app. Stay informed with real-time notifications. Enjoy no hidden fees and no minimum balance requirements. Secure your financial future with Varo’s enhanced security features. Ready to simplify your banking? Discover more about Varo Bank by visiting their website here.