Varo Bank Benefits: Unlocking Financial Freedom

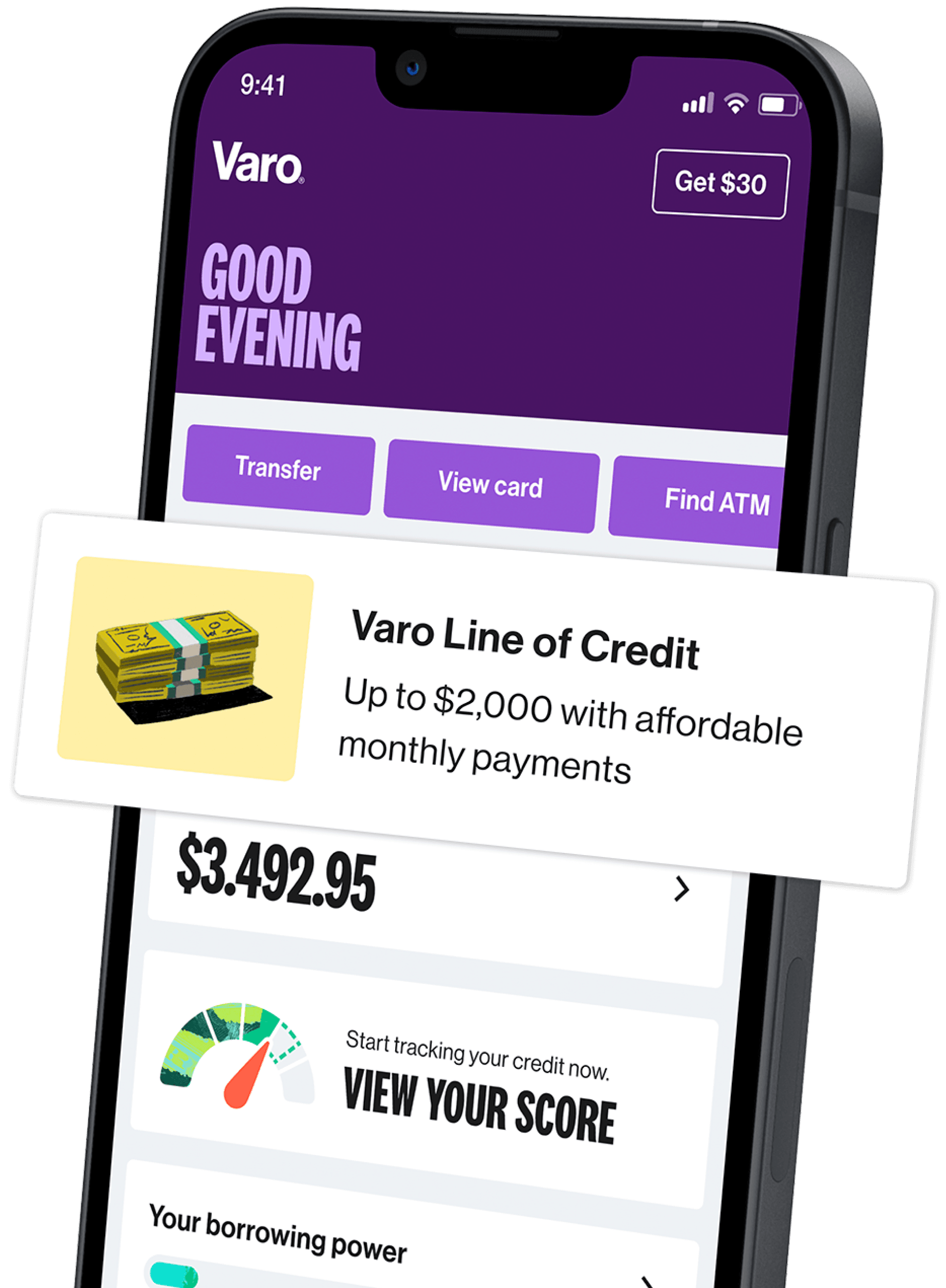

Banking has never been easier with Varo Bank. This mobile banking app offers a range of financial services tailored to your needs.

With Varo Bank, you can access checking and savings accounts right from your phone. Its user-friendly interface and secure transactions make managing your finances simple. Plus, there are no monthly maintenance fees. This means more savings for you. Whether you need to check your balance, transfer money, or pay bills, Varo Bank has you covered. Ready to experience convenient banking? Visit the official Varo Bank website and start today: https://www.varomoney.com/. Discover how Varo Bank can benefit your financial life.

Introduction To Varo Bank

Varo Bank offers a modern solution to traditional banking. It provides a range of financial services through its user-friendly mobile app. With secure transactions and easy account management, Varo Bank aims to simplify your financial life.

What Is Varo Bank?

Varo Bank is a mobile banking application. It offers both checking and savings accounts. The app is designed to be user-friendly and secure. It is compatible with modern mobile devices, ensuring you can manage your finances on the go.

Purpose And Mission Of Varo Bank

The main goal of Varo Bank is to provide convenient access to banking services anytime, anywhere. Their mission is to offer enhanced security for financial transactions. They aim to simplify the management of personal finances through their app.

- No monthly maintenance fees for checking or savings accounts

- Secure and user-friendly interface

- Free to download and use

Varo Bank ensures that your financial transactions are safe and your banking experience is seamless. Review their terms and conditions for detailed information on refund and return policies.

Key Features Of Varo Bank

Varo Bank offers a range of unique features that make managing your finances simpler and more efficient. From no-fee banking to innovative savings solutions, Varo Bank has something for everyone.

Varo Bank stands out with its no-fee banking services. Users enjoy zero monthly maintenance fees for both checking and savings accounts. Say goodbye to surprise charges and hello to more savings.

With a high-yield savings account, Varo Bank helps you grow your money faster. The competitive interest rates ensure your savings work harder for you. This feature is perfect for those looking to maximize their savings potential.

Varo Bank offers an early direct deposit feature, allowing users to access their paychecks up to two days early. This can be especially helpful for managing cash flow and staying ahead of bills.

Need quick access to cash? The Varo Advance feature provides small cash advances to help you cover unexpected expenses. This service ensures you have funds available when you need them most.

The Varo Believe Program is designed to help users build or improve their credit. This program offers a secured credit card with no annual fees, making it easier for users to establish a positive credit history.

| Feature | Benefits |

|---|---|

| No-Fee Banking | No monthly maintenance fees, more savings |

| High-Yield Savings Account | Competitive interest rates, faster growth of savings |

| Early Direct Deposit | Access paychecks up to two days early |

| Varo Advance | Quick cash advances for unexpected expenses |

| Varo Believe Program | Build or improve credit with no annual fees |

No-fee Banking

Varo Bank offers a unique banking experience with its No-Fee Banking feature. This allows users to manage their finances without worrying about hidden costs. Let’s explore the specific benefits of this feature:

Elimination Of Monthly Fees

One of the biggest advantages is the elimination of monthly fees. Traditional banks often charge monthly maintenance fees for checking or savings accounts. With Varo Bank, you won’t face these charges. This helps you save money each month.

| Traditional Bank | Varo Bank |

|---|---|

| $10 – $15 per month | No monthly fees |

No Overdraft Fees

Varo Bank also offers no overdraft fees. Overdrawing your account can lead to costly penalties at traditional banks. Varo Bank eliminates this worry. You can manage your finances with peace of mind, knowing you won’t be charged for accidental overdrafts.

Free Atm Withdrawals

Another significant benefit is free ATM withdrawals. Varo Bank provides access to a network of over 55,000 ATMs worldwide. You can withdraw cash without paying extra fees. This makes accessing your money convenient and cost-effective.

- No fees at 55,000+ ATMs

- Convenient cash access

Varo Bank’s No-Fee Banking ensures you can manage your money without unnecessary costs. This makes it a great choice for anyone looking for a hassle-free banking experience.

High-yield Savings Account

Varo Bank offers a High-Yield Savings Account that provides numerous benefits. This account is designed to help you save more effectively with competitive interest rates, no minimum balance requirements, and automatic savings tools. It’s an excellent choice for anyone looking to maximize their savings with ease.

Competitive Interest Rates

One of the standout features of Varo’s High-Yield Savings Account is its competitive interest rates. Unlike traditional banks, Varo offers rates that are significantly higher. This means your money grows faster, helping you reach your financial goals sooner.

These higher rates can make a substantial difference over time. Even small amounts can compound significantly with Varo’s attractive rates, making it a smart choice for savers.

No Minimum Balance Requirements

Another advantage of Varo’s savings account is the absence of minimum balance requirements. You can start saving with any amount you have. There is no pressure to maintain a high balance to avoid fees.

This feature makes Varo accessible to everyone. Whether you are just starting your savings journey or already have a substantial amount saved, Varo’s High-Yield Savings Account fits your needs.

Automatic Savings Tools

Varo Bank also offers automatic savings tools to help you save effortlessly. These tools can round up your purchases to the nearest dollar and transfer the difference to your savings account. They can also transfer a fixed amount from your checking to your savings account regularly.

These tools simplify the saving process. You can build your savings without even thinking about it. It’s a hassle-free way to ensure you are consistently putting money aside.

Early Direct Deposit

Varo Bank offers a unique feature called Early Direct Deposit. This feature allows you to access your funds up to two days earlier than traditional banks. It’s a simple yet powerful tool for managing your finances more effectively.

Get Paid Up To Two Days Early

With Varo Bank, you can get paid up to two days early when your paycheck is directly deposited into your Varo account. This early access to your money can help you manage your cash flow better, pay bills on time, and avoid late fees.

How It Works

Setting up early direct deposit with Varo is straightforward. Here’s how it works:

- Provide your employer with your Varo account and routing numbers.

- Request that your paycheck is directly deposited into your Varo account.

- Once your employer processes your paycheck, Varo credits the amount to your account up to two days earlier than your normal payday.

Benefits For Financial Planning

Early direct deposit offers several benefits for financial planning:

- Timely Bill Payments: Avoid late fees by paying bills on time.

- Improved Cash Flow: Access funds when you need them, reducing financial stress.

- Better Budgeting: Plan your expenses more effectively with predictable income.

By receiving your paycheck early, you can make smarter financial decisions and stay ahead of your financial obligations. This feature is just one of the many ways Varo Bank makes banking more convenient and user-friendly.

Varo Advance

Varo Bank offers a unique feature called Varo Advance. This service provides small cash advances to help you handle unexpected expenses. It is a part of the Varo app, which is designed to make banking simple and convenient.

Access To Small Cash Advances

With Varo Advance, you can access small cash advances directly from your phone. This feature is especially useful for those sudden, unavoidable expenses. The process is quick and easy, ensuring you have funds when you need them most.

- Quick access to small amounts of cash

- Convenient application process

- Funds available directly in your Varo account

Eligibility And Repayment Terms

To qualify for Varo Advance, you need to meet certain eligibility criteria. This includes having a Varo Bank account in good standing. The terms of repayment are straightforward, with clear guidelines on when and how to repay the advance.

| Eligibility Criteria | Repayment Terms |

|---|---|

| Active Varo Bank account | Clear repayment schedule |

| Good account standing | Flexible repayment options |

Ideal Scenarios For Use

Varo Advance is ideal for various scenarios. It can be a lifesaver for unforeseen expenses, such as a sudden car repair or an urgent medical bill. Below are some scenarios where Varo Advance can be most helpful:

- Emergency car repairs

- Unexpected medical expenses

- Covering essential bills before payday

By providing quick and easy access to funds, Varo Advance offers a practical solution for managing financial surprises. This feature ensures you have the financial flexibility you need, right at your fingertips.

Varo Believe Program

The Varo Believe Program is designed to help users build and improve their credit scores. This program offers a unique approach with the Varo Believe Credit Builder Card, making it easier for users to manage their credit responsibly.

Credit Builder Card

The Varo Believe Credit Builder Card is a secured credit card that helps users build credit. It works by allowing users to set a spending limit based on the amount they deposit into their secured account. This ensures that users can only spend what they have, making it easier to manage finances and avoid debt.

How It Helps Improve Credit Scores

The Varo Believe Credit Builder Card helps users improve their credit scores by reporting their activities to major credit bureaus. By making regular, on-time payments, users can demonstrate responsible credit behavior, which can positively impact their credit scores over time. Additionally, the card offers tools and resources to help users understand their credit and make informed financial decisions.

Secured Credit With No Fees

One of the standout features of the Varo Believe Credit Builder Card is that it offers secured credit with no fees. This means users do not have to worry about annual fees, monthly fees, or hidden charges. The card provides a transparent and straightforward way to build credit without the added financial burden of fees.

Overall, the Varo Believe Program offers a practical solution for those looking to build or improve their credit. With its secured credit card, reporting to credit bureaus, and no fees, it provides a user-friendly and effective way to achieve better financial health.

Pricing And Affordability

One of the major benefits of Varo Bank is its pricing and affordability. This section will explore the costs and fees associated with using Varo, how it compares to traditional banks, and the overall value for money it provides.

Overview Of Costs And Fees

Varo Bank offers a range of financial services through its mobile app, which is free to download and use. There are no monthly maintenance fees for checking or savings accounts, making it a cost-effective choice for many users.

| Service | Cost |

|---|---|

| Downloading the Varo App | Free |

| Monthly Maintenance (Checking and Savings) | Free |

| Specific Services/Transactions | Varies |

Other fees may apply for specific services or transactions, which users can review in detail within the app or on the official Varo website.

Comparison With Traditional Banks

Traditional banks often charge various fees, which can add up over time. These may include:

- Monthly maintenance fees

- Overdraft fees

- Minimum balance fees

- ATM fees

In contrast, Varo Bank eliminates many of these common fees, offering a more affordable option for many users.

Value For Money

Varo Bank provides excellent value for money by combining affordability with a range of features. Users benefit from:

- Convenient access to banking services anytime, anywhere

- Enhanced security for financial transactions

- Simplified management of personal finances

With no monthly maintenance fees and a user-friendly interface, Varo Bank is an economical choice that doesn’t compromise on quality or security.

Pros And Cons Of Varo Bank

Varo Bank provides a range of financial services through its mobile banking app. It offers checking and savings accounts, along with many modern banking features. Understanding its benefits and limitations can help users make informed decisions.

Advantages Of Using Varo Bank

- Convenient Access: The Varo app allows users to access banking services anytime, anywhere.

- No Monthly Fees: There are no monthly maintenance fees for checking or savings accounts.

- User-Friendly Interface: The app is designed to be easy to use, making financial management simpler.

- Enhanced Security: Varo ensures secure transactions, providing peace of mind for users.

- Compatibility: The app works well with modern mobile devices, ensuring a smooth user experience.

Potential Drawbacks And Limitations

- Limited Physical Presence: Varo is an online-only bank, which might not appeal to those who prefer in-person banking.

- Specific Service Fees: While there are no monthly fees, certain services or transactions might incur additional charges.

- Refund and Return Policies: Users must review Varo’s terms and conditions for details on refunds and returns, which may vary.

Recommendations For Ideal Users

Varo Bank offers numerous benefits for users who prefer mobile banking. Understanding who benefits most from Varo Bank’s features can help you determine if it is the right choice for you.

Who Should Use Varo Bank?

Varo Bank is perfect for individuals who value convenience. If you need access to banking services anytime, anywhere, Varo Bank is ideal. It is also a great choice for people who want to manage their finances effortlessly.

- Busy professionals

- Frequent travelers

- Tech-savvy users

- Individuals seeking a fee-free banking experience

Best Use Cases And Scenarios

There are several scenarios where Varo Bank excels. The following use cases highlight the practical applications of Varo Bank for different users.

| Scenario | Varo Bank Benefits |

|---|---|

| Daily Transactions | Varo Bank offers checking accounts with no monthly fees, ensuring cost-effective daily banking. |

| Saving for Future | Varo Bank’s savings accounts allow users to save money securely, without any maintenance fees. |

| On-the-Go Banking | The Varo app provides secure access to banking services from anywhere using modern mobile devices. |

| Personal Finance Management | Varo Bank simplifies financial management with a user-friendly interface and easy-to-use features. |

Frequently Asked Questions

What Are The Benefits Of Varo Bank?

Varo Bank offers no-fee banking, high-interest savings, and early direct deposit. It provides an easy-to-use mobile app and strong customer support.

Does Varo Bank Have Hidden Fees?

Varo Bank has no hidden fees. It offers free checking, savings accounts, and no minimum balance requirements.

How Does Varo Bank’s Mobile App Work?

Varo Bank’s mobile app lets you manage accounts, deposit checks, and transfer money. It is user-friendly and secure.

Can I Get Early Direct Deposit With Varo Bank?

Yes, Varo Bank offers early direct deposit. You can receive your paycheck up to two days early.

Conclusion

Experience the convenience and security Varo Bank offers. Manage your finances easily with the user-friendly Varo app. Enjoy free checking and savings accounts without monthly fees. Access banking services anytime, anywhere. Simplify your financial life with Varo Bank. Ready to get started? Learn more about Varo Bank on the official website.