Varo Bank: Revolutionizing Digital Banking for Modern Users

Varo Bank is a modern financial solution for today’s digital world. It offers a seamless banking experience through its innovative mobile app.

In today’s fast-paced environment, managing your finances on-the-go is essential. Varo Bank provides a secure and convenient mobile banking service designed to simplify your financial life. With features like real-time transaction notifications and advanced financial management tools, Varo Bank ensures you are always in control. Additionally, the app’s secure login and authentication enhance the safety of your banking activities. Whether you’re looking to monitor your spending or receive immediate alerts for any financial activity, Varo Bank has got you covered. Discover how Varo Bank can transform your banking experience by visiting their official website today.

Introduction To Varo Bank

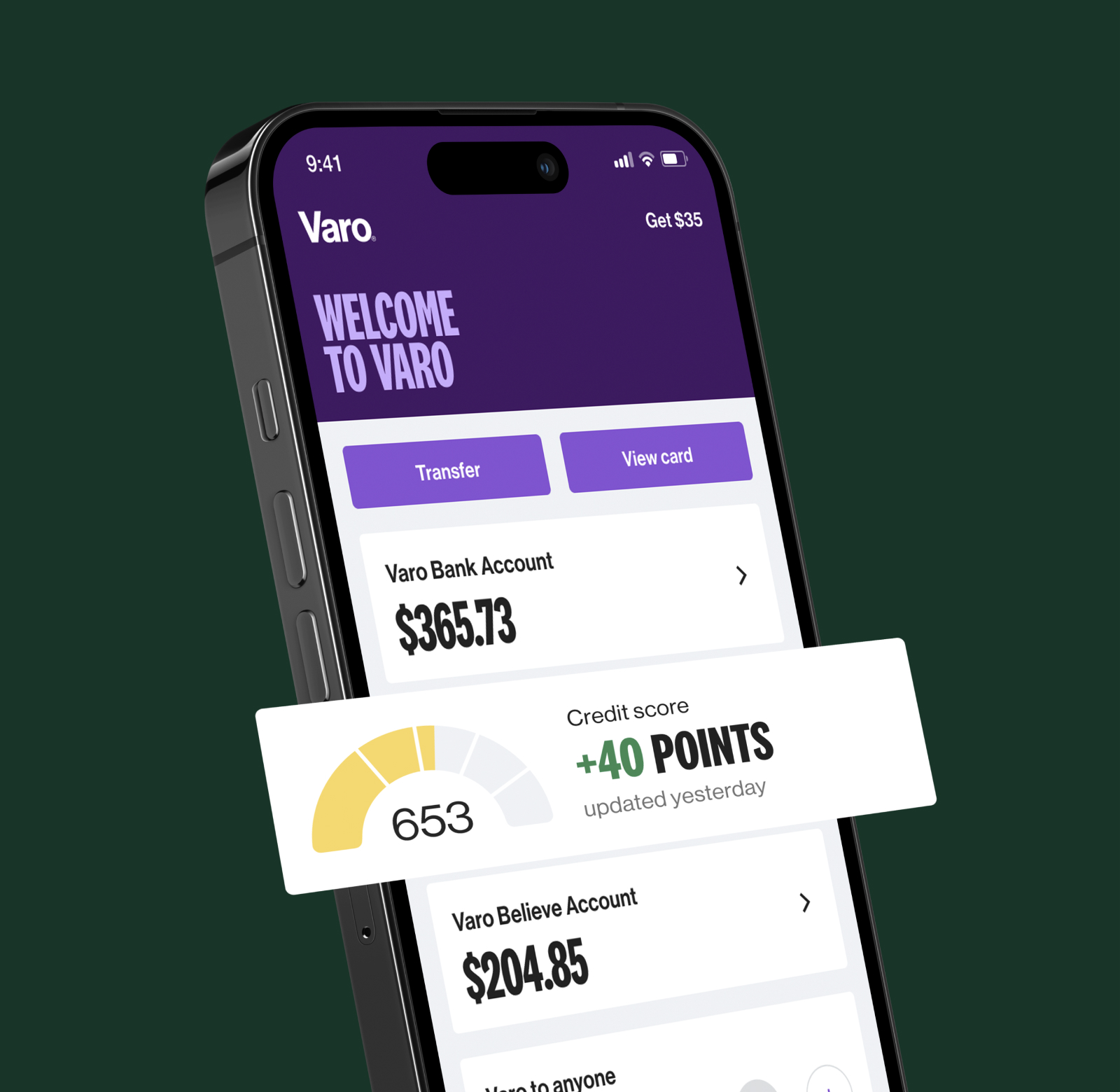

Welcome to Varo Bank, a modern banking solution tailored for today’s digital world. Varo Bank offers a range of services through its mobile banking application. It aims to simplify financial management for users, providing them with the tools they need to manage their finances effortlessly and securely.

What Is Varo Bank?

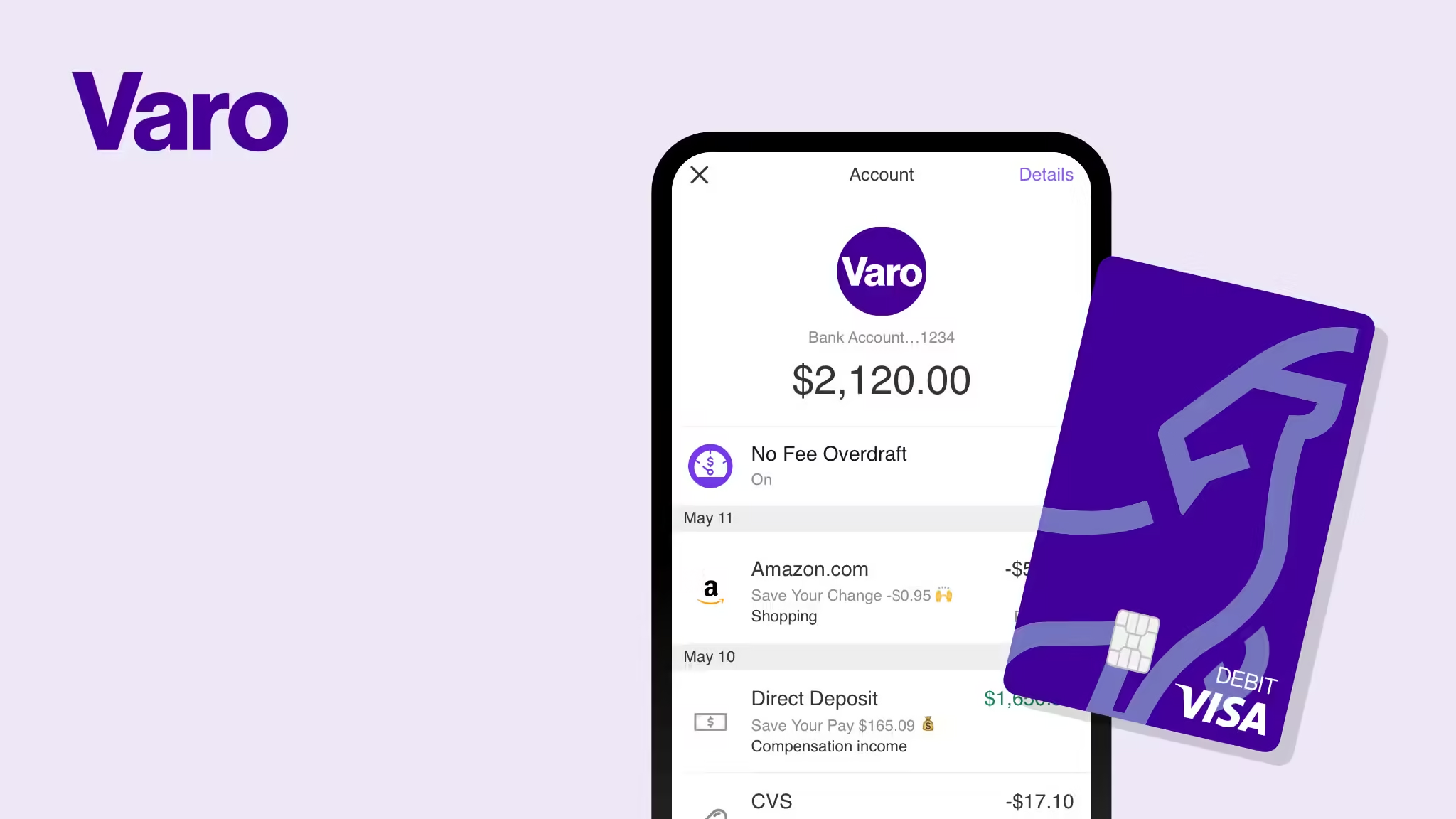

Varo Bank is a mobile banking service designed for the digital age. It allows users to access various financial services directly from their smartphones. The Varo App offers features like real-time transaction notifications, financial management tools, and secure login and authentication. This makes it easy for users to manage their finances on the go.

The Mission And Vision Of Varo Bank

Varo Bank’s mission is to provide convenient and accessible banking services to everyone. It seeks to empower users by offering easy-to-use financial tools and real-time updates. The vision of Varo Bank is to create a banking experience that is simple, secure, and available to all.

Target Audience And Market

Varo Bank targets a diverse audience, including:

- Individuals seeking convenient mobile banking solutions

- Young professionals managing their finances on-the-go

- Tech-savvy users looking for secure and modern banking options

Varo Bank is ideal for those who prefer managing their money through their smartphones. Its user-friendly interface and real-time alerts make it attractive to users who value convenience and security.

Key Features Of Varo Bank

Varo Bank offers a variety of innovative features that cater to modern banking needs. With a focus on convenience, security, and financial well-being, Varo Bank stands out in the digital banking landscape. Explore the key features that make Varo Bank a preferred choice for many users.

No-fee Banking And Its Benefits

Varo Bank provides no-fee banking services, eliminating common charges such as monthly maintenance fees, overdraft fees, and foreign transaction fees. This means you can manage your finances without worrying about hidden costs, making banking more affordable and straightforward.

High-yield Savings Accounts

With Varo Bank, you can take advantage of high-yield savings accounts that offer competitive interest rates. This means your savings grow faster compared to traditional banks, helping you reach your financial goals sooner.

Early Direct Deposit Feature

Varo Bank’s early direct deposit feature allows you to receive your paycheck up to two days early. This can be a lifesaver for managing expenses and ensuring you have access to your funds when you need them most.

Automatic Savings Tools

Varo Bank offers automatic savings tools that help you save money effortlessly. You can set up recurring transfers from your checking to your savings account or round up your purchases to the nearest dollar, with the difference going into your savings.

Personalized Financial Insights

Varo Bank provides personalized financial insights through its app. These insights help you understand your spending habits, identify areas where you can save, and manage your finances more effectively. Real-time transaction notifications and secure login features ensure your account is always safe and up-to-date.

Pricing And Affordability

Varo Bank offers various financial services through its mobile app. Understanding its pricing and affordability is crucial for users. This section explores the costs associated with Varo Bank.

Overview Of Fees And Charges

Varo Bank is known for its transparent fee structure. Users can enjoy many services without hefty charges. Here are some key points:

- No monthly maintenance fees

- No minimum balance requirements

- No foreign transaction fees

- No overdraft fees for qualified accounts

While Varo Bank has minimal fees, some charges may apply. These include:

- Out-of-network ATM fees

- Cash deposit fees at retail locations

Comparison With Traditional Banks

Varo Bank’s fee structure is more affordable compared to traditional banks. Here’s a comparison:

| Service | Varo Bank | Traditional Banks |

|---|---|---|

| Monthly Maintenance Fees | None | $10 – $15 |

| Minimum Balance Requirements | None | $500 – $1500 |

| Overdraft Fees | None (for qualified accounts) | $35 per occurrence |

| Foreign Transaction Fees | None | 3% of the transaction |

Cost-saving Benefits For Users

Choosing Varo Bank can lead to significant savings. Here are some benefits:

- No monthly fees: Save up to $180 annually.

- No overdraft fees: Avoid unexpected charges.

- No foreign transaction fees: Save while traveling.

These features make Varo Bank an affordable choice. Users can manage their finances without worrying about hidden costs.

Pros And Cons Of Varo Bank

Varo Bank offers a range of features and benefits through its mobile banking application. While there are several advantages, there are also some potential drawbacks. This section will explore both aspects in detail.

Advantages Of Using Varo Bank

Varo Bank provides numerous advantages for its users. Here are some key benefits:

- Mobile banking access: Users can access their banking services anytime, anywhere through their smartphones.

- Financial management tools: The app includes tools to help users manage their finances effectively.

- Real-time transaction notifications: Users receive immediate alerts for any financial activities.

- Secure login and authentication: Enhanced security measures to protect user accounts.

- Convenient access: Users can easily manage their finances on-the-go.

Potential Drawbacks And Limitations

While Varo Bank has many benefits, there are some potential drawbacks and limitations:

- Internet dependency: Users need a stable internet connection to access the app.

- VPN and IP proxy restrictions: The app may not function correctly if users connect via VPNs or IP proxies.

- App updates: Users must ensure the Varo app is updated to the latest version for seamless functionality.

- Geographical limitations: The app may be blocked in certain countries.

User Feedback And Reviews

User feedback for Varo Bank is generally positive. Many users appreciate the convenience and security of the mobile banking app. Reviews highlight the easy management of finances and real-time notifications. However, some users have reported issues with internet connectivity and app updates.

Overall, Varo Bank provides a reliable and secure mobile banking experience, although users should be aware of its limitations.

Ideal Users And Scenarios

The Varo Bank app offers a range of features designed to cater to diverse financial needs. Understanding who can benefit the most from Varo Bank and specific scenarios where its features shine will help users make the best of this mobile banking solution.

Who Will Benefit The Most From Varo Bank?

Varo Bank is ideal for:

- Young professionals who need easy access to their finances.

- Students managing their limited budgets and looking for financial tools.

- Freelancers requiring convenient banking services on-the-go.

- Tech-savvy users who prefer mobile banking over traditional methods.

Specific Use Cases And Examples

Varo Bank’s features are especially useful in the following scenarios:

| Scenario | Benefit |

|---|---|

| Traveling | Immediate alerts and secure access to accounts. |

| Budgeting | Real-time transaction notifications and financial management tools. |

| Freelance Work | Quick access to earnings and managing finances remotely. |

| Daily Transactions | Convenient mobile banking access for daily financial activities. |

Recommendations For Potential Users

To make the most of Varo Bank, potential users should:

- Ensure they have a stable internet connection for seamless access.

- Avoid using VPNs or IP proxies to prevent access issues.

- Keep the Varo app updated to the latest version for the best experience.

- Avoid connecting from blocked countries as it may restrict access.

Varo Bank’s mobile banking app is a powerful tool for modern financial management. Ideal for young professionals, students, and freelancers, it provides convenient access and robust financial tools. Ensure a stable internet connection and keep the app updated to enjoy its full benefits.

Frequently Asked Questions

What Is Varo Bank?

Varo Bank is a digital-only bank offering online financial services. It provides checking and savings accounts, loans, and financial tools.

Is Varo Bank Fdic Insured?

Yes, Varo Bank is FDIC insured up to $250,000. This ensures your deposits are safe and secure.

How Do I Open A Varo Bank Account?

You can open a Varo Bank account online through their website or mobile app. The process is straightforward and quick.

Does Varo Bank Charge Fees?

Varo Bank has no monthly maintenance fees. It also does not charge overdraft fees, foreign transaction fees, or minimum balance fees.

Conclusion

Varo Bank offers convenient and secure mobile banking. Manage your finances easily with real-time transaction alerts. Enjoy enhanced account security and financial management tools. Discover more about Varo Bank and its benefits on their official website.