Varo Account Management: Simplify Your Financial Life

Managing a Varo account has never been simpler. This mobile banking app offers convenience and security at your fingertips.

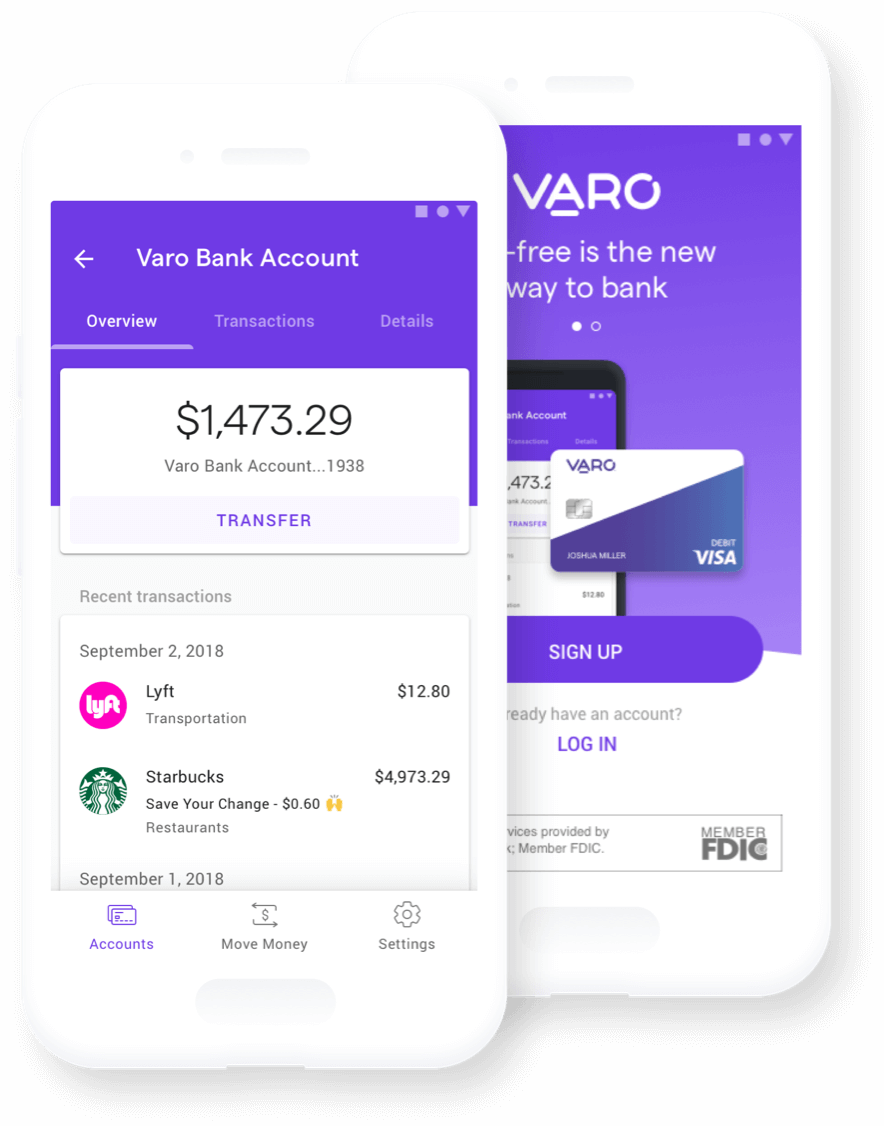

Varo Bank provides an all-in-one solution for managing your finances. The Varo Mobile Banking App allows you to handle your banking needs anytime, anywhere, directly from your smartphone. With features designed for ease of use, the app ensures you stay on top of your financial health without stepping into a bank. Whether you need to check your balance, transfer money, or pay bills, Varo makes it easy. Security is a top priority, with enhanced measures to keep your data safe. The app is free to download and use, making it an accessible tool for everyone. Discover the simplicity of modern banking with Varo. For more details, visit Varo Bank.

Introduction To Varo Account Management

Managing your bank account should be simple and convenient. With the Varo Mobile Banking App, you can handle your banking needs from your smartphone. This introduction will help you understand the essentials of Varo Account Management.

What Is Varo?

Varo is a mobile banking app designed to offer easy and convenient banking services directly from your smartphone. It allows users to manage their finances with just a few taps.

Purpose Of Varo Account Management

The purpose of Varo Account Management is to make banking accessible and efficient. Here are some key benefits:

- Convenience: Manage your banking needs anytime, anywhere with your mobile device.

- Security: Enhanced security features to protect user accounts and data.

- User-Friendly: Regular updates ensure the app remains easy to use and feature-rich.

Varo ensures a smooth experience by requiring a stable internet connection and the latest app version. Here are some technical requirements:

| Requirement | Details |

|---|---|

| Stable Internet Connection | Ensures uninterrupted access to banking services. |

| No VPN or IP Proxy Usage | Access is restricted through VPNs or IP proxies for security reasons. |

| Updated App Version | Users must have the latest version of the Varo app. |

| Access Restrictions | The app cannot be accessed from certain blocked countries. |

The Varo Mobile Banking App is free to download and use. Some specific banking services may have associated fees, detailed within the app. Issues with transactions can be resolved through Varo’s customer support.

For optimal performance and security, Varo is managed by Cloudflare. Users receive a unique Cloudflare Ray ID for troubleshooting and support purposes. Always ensure a stable internet connection and avoid using VPNs or IP proxies to prevent access issues.

Key Features Of Varo Account Management

The Varo Mobile Banking App offers a range of features that make managing your finances easy and convenient. Below are some key features that enhance the user experience.

Varo provides a user-friendly interface that is simple and intuitive. With regular updates, the app ensures ease of use and feature-rich functionality.

- Easy navigation

- Clear and simple design

- Accessible for all ages

Automate your savings with Varo’s automated savings tools. These tools help you save without thinking about it.

- Round-up savings on purchases

- Scheduled savings transfers

- Customizable savings goals

Varo prides itself on having no hidden fees. What you see is what you get.

- No monthly maintenance fees

- No overdraft fees

- No foreign transaction fees

The mobile check deposit feature allows you to deposit checks directly from your smartphone. This is convenient and saves you time.

- Open the Varo app

- Select “Deposit Checks”

- Follow the prompts to take a photo of your check

With early direct deposit, get your paycheck up to two days early. This feature is beneficial for those who need quick access to their money.

- Faster access to funds

- More financial flexibility

- Simple setup through the app

For more information, visit the Varo Bank website.

User-friendly Interface

The Varo Mobile Banking App offers a user-friendly interface that makes managing your finances simple and enjoyable. It is designed to provide a seamless experience on your smartphone, ensuring that you can handle all your banking needs easily and conveniently.

Simplified Navigation

The Varo Mobile Banking App is known for its simplified navigation. Users can effortlessly move between different sections of the app. The intuitive layout allows you to access various features, such as checking your balance, transferring money, and viewing transaction history, with just a few taps.

| Feature | Benefit |

|---|---|

| Easy Access | Quickly find what you need |

| Simple Menu | No confusion, straightforward options |

Customizable Dashboard

With the Varo app, you can enjoy a customizable dashboard. Tailor the interface to your preferences. Add shortcuts to frequently used features, making your banking experience even more efficient. The flexibility to personalize your dashboard ensures that everything you need is right at your fingertips.

- Shortcuts to favorite features

- Personalized layout

- Quick access to essential services

Intuitive Design

The intuitive design of the Varo Mobile Banking App ensures that users can navigate the app with ease. The design is clean and modern, with clear icons and labels that guide users through the app seamlessly. Even those who are not tech-savvy will find it easy to use.

- Clean and modern interface

- Clear icons and labels

- User-friendly experience

Overall, the Varo Mobile Banking App’s user-friendly interface, simplified navigation, customizable dashboard, and intuitive design make it an excellent choice for managing your finances on the go.

Automated Savings Tools

Varo Bank offers a range of automated savings tools. These tools help manage your finances effortlessly. Let’s explore some of the key features.

Automatic Transfer To Savings

Varo makes saving easy with automatic transfers. Set a schedule for moving money from checking to savings. You can choose daily, weekly, or monthly transfers. This ensures you save regularly without even thinking about it.

Round-up Transactions

The Round-Up Transactions feature rounds up your purchases to the nearest dollar. The difference is transferred to your savings account. For example, if you spend $5.75, Varo rounds it up to $6.00. The extra $0.25 goes straight into your savings.

High-yield Savings Account

Varo offers a High-Yield Savings Account. Enjoy a higher interest rate compared to traditional savings accounts. This means your money grows faster. Combine this with automated saving tools for even better results.

Below is a summary of the key features:

| Feature | Description |

|---|---|

| Automatic Transfer to Savings | Schedule regular transfers from checking to savings |

| Round-Up Transactions | Round up purchases and transfer the difference to savings |

| High-Yield Savings Account | Earn higher interest rates on your savings |

With Varo’s automated savings tools, saving money becomes simple and effective. These features help you build your savings effortlessly.

No Hidden Fees

Discover the freedom of banking with Varo Mobile Banking App, where transparency is the cornerstone. With Varo, you can enjoy seamless banking without the worry of hidden fees.

Transparent Fee Structure

Varo believes in clarity. Our fee structure is straightforward and easy to understand. We ensure all charges are clearly detailed within the app, so you know exactly what you are paying for.

Here’s a quick overview of the fees:

| Service | Fee |

|---|---|

| Monthly Maintenance | None |

| ATM Withdrawal | Free at 55,000+ Allpoint® ATMs |

| Overdraft | Free up to $50 |

No Minimum Balance Requirement

With Varo, there’s no need to maintain a minimum balance. You can manage your funds as you see fit without the worry of incurring extra charges. This feature makes Varo an excellent choice for individuals who prefer flexibility in their banking.

Fee-free Overdraft Protection

Unexpected expenses can happen. Varo offers fee-free overdraft protection up to $50. This means you can avoid costly fees if your balance dips below zero. Simply repay the overdraft within 30 days to continue enjoying this benefit.

Enjoy banking with confidence and peace of mind. Choose Varo for a transparent, user-friendly, and fee-free experience.

Mobile Check Deposit

The Varo Mobile Banking App simplifies the process of depositing checks. With the mobile check deposit feature, you can deposit checks anytime, from anywhere. This eliminates the need to visit a bank branch, making banking more convenient than ever.

Convenient Check Deposits

Depositing checks with the Varo app is straightforward. Open the app and select the mobile check deposit option. Follow the simple instructions to take a photo of the front and back of your check. Submit the deposit and you’re done. It’s that easy.

Fast Processing Times

Varo ensures that your deposits are processed quickly. Once you submit your check, the app provides you with an estimated time for the funds to become available. This is usually within a few business days, depending on the check amount and other factors. Stay updated on the status of your deposit through the app’s notifications.

Secure Transactions

Security is a top priority for Varo. The mobile check deposit feature uses advanced encryption to protect your data. No need to worry about your information being compromised. Each deposit is securely transmitted and processed, providing you with peace of mind.

Early Direct Deposit

Early Direct Deposit is a standout feature of the Varo Mobile Banking App. This service allows users to receive their paychecks up to two days earlier than their scheduled payday. It’s a convenient way to get your money faster and manage your finances more effectively.

Get Paid Faster

With Varo’s Early Direct Deposit, you can get paid faster. No more waiting for your paycheck to clear. Once your employer processes your payroll, you can access your funds almost immediately.

No Waiting Periods

One of the best aspects of Early Direct Deposit is that there are no waiting periods. Traditional banks often make you wait for your paycheck to clear. Varo eliminates this delay, giving you instant access to your money.

Improved Cash Flow Management

Early Direct Deposit also helps with improved cash flow management. By getting your money sooner, you can manage your bills and expenses more efficiently. This can reduce financial stress and help you stay on top of your finances.

Here’s a quick comparison of Varo Early Direct Deposit vs Traditional Bank Deposit:

| Feature | Varo Early Direct Deposit | Traditional Bank Deposit |

|---|---|---|

| Speed | Up to 2 days earlier | On payday |

| Waiting Period | None | 1-2 days |

| Cash Flow Management | Improved | Standard |

Using Varo’s Early Direct Deposit can make a significant difference in your financial management. It provides faster access to your money, eliminates waiting periods, and improves your overall cash flow management.

For more information, visit the Varo Bank website.

Pricing And Affordability

Varo Mobile Banking App offers a range of banking services at competitive prices. Understanding the costs involved and the benefits offered can help you make informed decisions. Here, we will discuss the account fees, savings account interest rates, and how Varo compares to traditional banks.

Account Fees

The Varo Mobile Banking App is free to download and use. There are no monthly maintenance fees, and you can manage your account without any hidden charges. However, some specific banking services may have associated fees, which are detailed within the app. This transparent pricing ensures you know exactly what to expect.

Savings Account Interest Rates

Varo offers competitive interest rates on savings accounts. These rates are designed to help you grow your savings more effectively than traditional banks. By utilizing the Varo app, you can benefit from higher returns on your deposits, making it a smart choice for those looking to maximize their savings.

Comparison With Traditional Banks

When comparing Varo to traditional banks, several key differences stand out:

| Feature | Varo | Traditional Banks |

|---|---|---|

| Account Fees | No monthly fees | Monthly maintenance fees |

| Savings Interest Rates | Higher rates | Lower rates |

| Accessibility | Mobile-first approach | Branch visits required |

| Convenience | Manage anytime, anywhere | Limited to branch hours |

Varo’s mobile-first approach means you can manage your account anytime, anywhere, without visiting a branch. This convenience, combined with no monthly fees and higher interest rates, makes Varo an attractive option for modern banking needs.

Pros And Cons Of Varo Account Management

Varo is a popular mobile banking app designed to offer convenient banking services directly from your smartphone. While it has many advantages, it also has some drawbacks that users should consider. Below, we explore the pros and cons of using Varo account management.

Advantages Of Using Varo

- Convenience: Manage your banking needs anytime, anywhere with your mobile device.

- Security: Enhanced security features protect user accounts and data.

- User-Friendly: Regular updates ensure the app remains easy to use and feature-rich.

- No Fees: The app is free to download and use. Some specific banking services may have fees, which are detailed within the app.

The convenience of managing your banking needs from your phone is a significant advantage. The enhanced security features provide peace of mind, knowing your data is protected. Regular updates keep the app user-friendly and feature-rich.

Potential Drawbacks

- Stable Internet Required: A stable internet connection is necessary to access banking services smoothly.

- Access Restrictions: The app cannot be accessed from certain blocked countries for compliance and security reasons.

- No VPN or IP Proxy Usage: For security, the app does not support access through VPNs or IP proxies.

While Varo offers many advantages, there are some potential drawbacks. Users must have a stable internet connection to use the app effectively. Access may be restricted in certain countries, and the app does not support VPN or IP proxy usage for security reasons.

User Reviews And Feedback

User feedback for Varo is generally positive. Many users appreciate the convenience and security features. Some users have expressed frustration with the need for a stable internet connection and the access restrictions.

| Aspect | User Feedback |

|---|---|

| Convenience | Users love managing their banking on the go. |

| Security | Enhanced security features are highly appreciated. |

| Stable Internet | Some users find the need for stable internet a drawback. |

| Access Restrictions | Users in restricted countries cannot use the app. |

Recommendations For Ideal Users

Varo Mobile Banking App offers a range of features that cater to various user needs. Understanding who benefits most from this app can help you decide if it fits your financial management style.

Best Scenarios For Using Varo

Varo Mobile Banking is perfect in several scenarios. If you often travel domestically and need a banking app that is reliable and easy to access, Varo is a good option. The app is designed for those who rely on their smartphones for daily tasks, including banking. Its user-friendly interface and enhanced security make it suitable for users who prioritize convenience and safety.

Who Will Benefit Most?

Varo Mobile Banking is ideal for:

- Frequent travelers: Manage your finances on the go, as long as you have a stable internet connection.

- Tech-savvy users: Those who prefer handling their banking needs through a smartphone app will find Varo intuitive and easy to navigate.

- Security-conscious individuals: Enhanced security features provide peace of mind, ensuring your data and transactions are safe.

Specific Use Cases

Here are specific scenarios where Varo Mobile Banking excels:

| Use Case | Description |

|---|---|

| Daily Banking Needs | Check balances, transfer money, and pay bills anytime from your mobile device. |

| Travel | Access your account securely without needing a physical bank branch. |

| Security | Benefit from regular app updates and enhanced security features. |

Varo Mobile Banking ensures you can manage your finances easily, securely, and conveniently, making it a great choice for a broad range of users.

Frequently Asked Questions

How Do I Open A Varo Account?

To open a Varo account, download the Varo app. Follow the on-screen instructions to sign up. You will need to provide personal information and verify your identity.

Can I Deposit Cash Into Varo?

Yes, you can deposit cash into your Varo account. Visit a participating Green Dot location and use your Varo debit card to deposit funds.

Does Varo Charge Monthly Fees?

Varo does not charge any monthly maintenance fees. There are also no minimum balance requirements or hidden fees.

How Do I Transfer Money From Varo?

You can transfer money from Varo using the app. Go to the “Move Money” section and follow the prompts to complete the transfer.

Conclusion

Managing your Varo account is simple and secure. With Varo, you enjoy seamless banking anytime, anywhere. The app’s user-friendly design makes handling finances easy. Remember to keep your app updated. This ensures you benefit from the latest features and security measures. Avoid using VPNs or proxies for smooth access. Varo’s customer support is always ready to help with any issues. Enjoy convenient and secure banking with Varo. For more information, visit Varo Bank.