User-Friendly Credit Resources: Simplify Your Financial Journey

Navigating the world of credit can be overwhelming. Finding user-friendly credit resources makes it easier.

In this blog, we’ll explore the best user-friendly credit resources available. These tools simplify the complex process of managing credit, making it accessible for everyone. Whether you are new to credit or looking to improve your score, user-friendly resources can be a game-changer. They offer clear, actionable insights and tools to help you stay on track. From educational articles to interactive tools, these resources are designed with the user in mind. Understanding and managing your credit doesn’t have to be a daunting task. With the right resources, you can take control of your financial future with confidence. Ready to discover the best tools? Let’s dive in! For more details, check out Super.com – Super.

Introduction To User-friendly Credit Resources

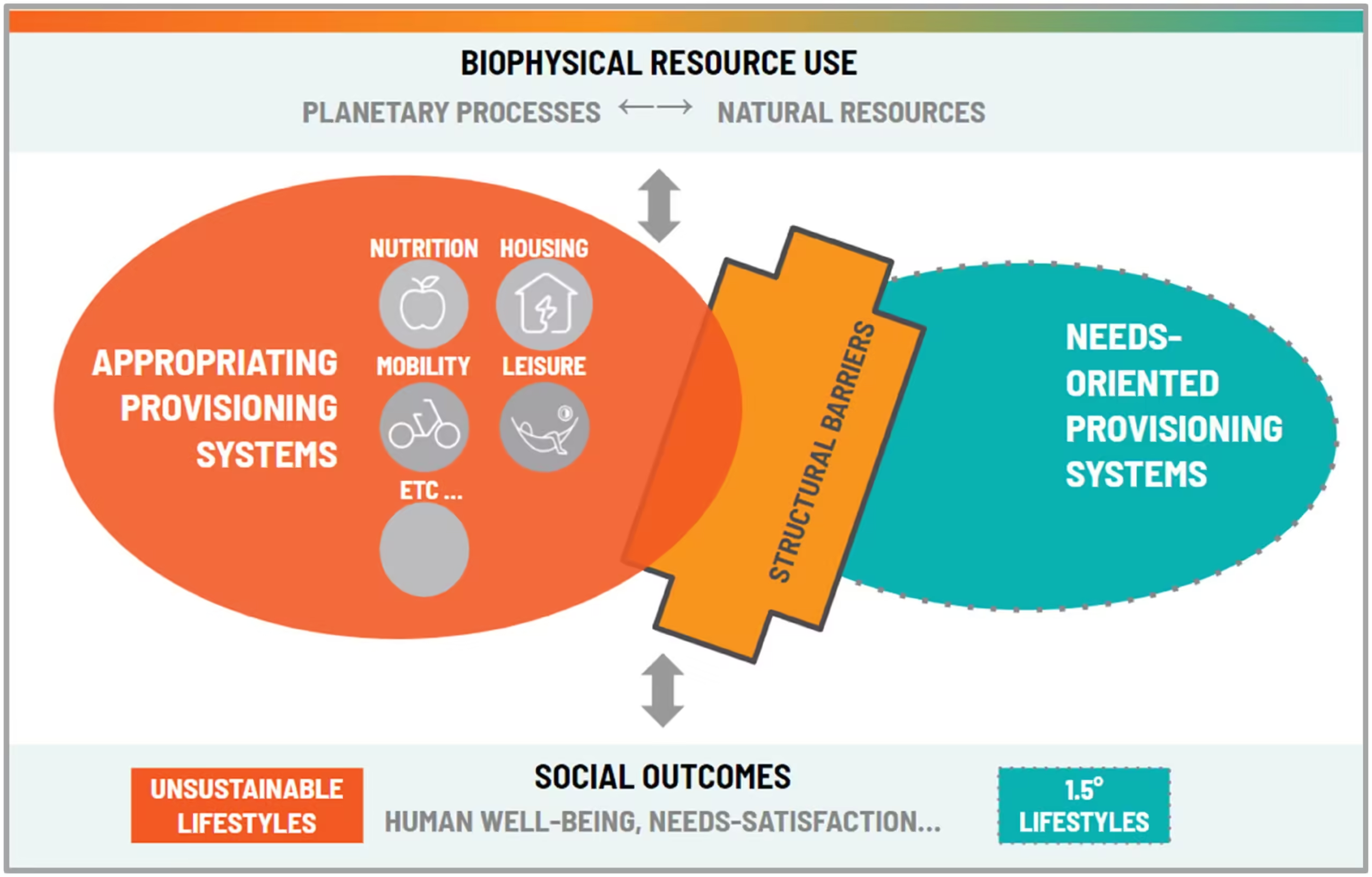

Managing credit effectively is crucial for financial well-being. Yet, many find it daunting due to complex tools and jargon. User-friendly credit resources can simplify this journey, making it accessible for everyone. Let’s explore why these tools are needed and how they can transform your financial path.

Understanding The Need For Simplified Credit Tools

Credit management often feels overwhelming. Many tools are complex, leading to confusion. User-friendly credit resources break down this complexity. They provide clear, straightforward information and tools. This simplification helps users make informed decisions.

Consider the following reasons for needing simplified tools:

- Clarity: Easy-to-understand information reduces confusion.

- Accessibility: Simplified tools are more accessible to non-experts.

- Confidence: Users feel more confident managing their credit.

How User-friendly Credit Resources Can Transform Your Financial Journey

Using user-friendly credit resources can significantly impact your financial journey. These tools offer several benefits:

- Education: They educate users about credit terms and practices.

- Decision-Making: Simplified tools help in better decision-making.

- Monitoring: Easy monitoring of credit scores and reports.

For example, consider a resource like Super.com. This platform offers user-friendly credit tools designed for simplicity and effectiveness.

Overall, user-friendly credit resources can make a significant difference. They simplify credit management and improve financial literacy. This leads to better financial health and confidence.

Key Features Of User-friendly Credit Resources

User-friendly credit resources are designed to help users manage their credit efficiently. They provide tools and features that simplify credit monitoring and financial planning. Here are some key features of these user-friendly credit resources:

Intuitive User Interface And Navigation

A user-friendly credit resource should have an intuitive user interface and easy navigation. Users should find it simple to access all the features. The design should be clean, with clear buttons and labels. Menus should be easy to understand and use.

Comprehensive Credit Score Monitoring

These resources provide comprehensive credit score monitoring. They allow users to track their credit score regularly. Users receive alerts for any significant changes in their score. This feature helps users stay informed about their credit status.

Personalized Financial Advice And Recommendations

User-friendly credit resources offer personalized financial advice. They analyze the user’s credit and financial data. Based on the analysis, they provide tailored recommendations. These can include tips to improve credit scores or suggestions for better credit card offers.

Secure And Private Data Handling

Security is a top priority for user-friendly credit resources. They ensure secure and private data handling. Users’ personal and financial information is protected with advanced encryption. Privacy policies are transparent and user-friendly.

In summary, user-friendly credit resources make managing credit easier and more efficient. They offer an intuitive interface, comprehensive monitoring, personalized advice, and secure data handling. These features provide users with the tools they need to take control of their financial health.

Pricing And Affordability Breakdown

Finding the right credit resource can be challenging. Understanding the cost is crucial to make an informed decision. This section will help you navigate the pricing and affordability of various credit resources.

Free Vs Paid Credit Resources

There are many credit resources available, both free and paid. Here’s a comparison:

| Free Credit Resources | Paid Credit Resources |

|---|---|

|

|

Cost-benefit Analysis Of Premium Features

Investing in premium features can be beneficial. Here’s a cost-benefit analysis to help you decide:

- Detailed Credit Analysis: Understand your credit score deeply. Worth the extra cost for those seeking loans.

- Identity Theft Protection: Protect your identity. A must-have for those with sensitive information.

- Personalized Advice: Get tailored advice. Ideal for users aiming to improve their credit scores.

Finding The Right Credit Resource Within Your Budget

To find the right credit resource within your budget, consider the following steps:

- Identify your credit needs.

- Compare free and paid options.

- Evaluate the cost-benefit of premium features.

- Select a resource that fits your budget.

Balancing cost and benefits ensures you get the best value for your money.

Pros And Cons Based On Real-world Usage

Understanding the pros and cons of user-friendly credit resources is important. Let’s dive into the real-world usage of these tools. This helps in making informed decisions.

Advantages Of Using User-friendly Credit Resources

Using these resources brings multiple benefits. Here are some key advantages:

- Ease of Use: These tools are simple to navigate.

- Time-Saving: Quickly access important credit information.

- Accessibility: Available on various devices and platforms.

- Enhanced Understanding: Clear explanations and guidance.

Common Drawbacks And Limitations

Despite the benefits, there are some drawbacks:

- Cost: Some resources require a subscription.

- Information Overload: Too much data can be confusing.

- Limited Personalization: Generic advice may not fit all needs.

- Technical Issues: Occasional bugs and glitches.

User Testimonials And Feedback

Feedback from real users highlights both strengths and weaknesses:

| User | Feedback |

|---|---|

| Jane Doe | “The interface is very user-friendly and easy to understand.” |

| John Smith | “I wish there were more personalized options for my specific needs.” |

| Emily Brown | “Great tool, but the subscription cost is a bit high.” |

Specific Recommendations For Ideal Users

Finding the right credit resources can be challenging. Different users have different needs. Some are just starting out, while others have more experience. Below are specific recommendations for each type of user.

Best Credit Resources For Beginners

Beginners need simple and easy-to-understand tools. Here are some top choices:

- Super.com – Super: Super.com offers a user-friendly interface.

- Credit Karma: Great for free credit scores and reports.

- Mint: Ideal for tracking spending and managing budgets.

These tools help beginners understand their credit and manage it effectively.

Top Choices For Advanced Users

Advanced users need more detailed and sophisticated tools. Here are the best options:

- Experian: Offers in-depth credit reports and scores.

- MyFICO: Provides detailed FICO scores and analysis.

- Credit Sesame: Includes advanced credit monitoring and identity theft protection.

These resources offer deep insights and advanced features for experienced users.

Ideal Scenarios For Using User-friendly Credit Resources

Different scenarios call for different credit resources. Here are some ideal scenarios:

| Scenario | Recommended Tool |

|---|---|

| Tracking Credit Score | Credit Karma, Experian |

| Managing Spending | Mint |

| Preventing Identity Theft | Credit Sesame |

Use these tools to address specific credit-related needs effectively.

Frequently Asked Questions

What Are User-friendly Credit Resources?

User-friendly credit resources provide easy-to-understand information and tools. They help users manage and improve their credit.

How Do Credit Resources Benefit Users?

Credit resources educate users about credit scores and reports. They offer tips for improving and maintaining good credit.

Where Can I Find Reliable Credit Resources?

Reliable credit resources can be found online. Websites like Credit Karma and Experian offer trustworthy tools and information.

What Features Should User-friendly Credit Resources Have?

User-friendly credit resources should be easy to navigate. They should offer clear, concise information and practical tools.

Conclusion

Finding the right credit resources can simplify your financial journey. User-friendly options save time and reduce stress. Explore Super.com for reliable credit card choices. Make informed decisions and manage your finances better. Happy credit hunting!