User-Friendly Credit Reporting: Simplifying Your Financial Insights

In today’s digital age, managing your business finances efficiently is crucial. User-friendly credit reporting can make a big difference.

It helps you stay on top of your financial health and make informed decisions. VIALET Business Account offers a seamless experience for businesses. With features like instant money transfers, open banking solutions, and multiple IBAN setups, it simplifies your financial tasks. Imagine having the ability to handle multi-currency payments, issue virtual corporate cards, and automate bulk payouts—all from one platform. VIALET ensures robust security and transparent fees, making it a reliable choice for businesses. Ready to streamline your financial management? Explore more about VIALET’s offerings here.

Introduction To User-friendly Credit Reporting

Understanding your credit report can be daunting. With VIALET, things get simpler. Their user-friendly approach makes financial insights easy to grasp.

Understanding The Importance Of Credit Reporting

A credit report reflects your financial health. It influences loan approvals, interest rates, and even job opportunities. A clear, accurate report is crucial for businesses and individuals. VIALET ensures that users get precise, up-to-date information.

Purpose Of Simplifying Financial Insights

Complex financial data can be overwhelming. VIALET’s user-friendly credit reporting aims to simplify this. With features like:

- Flexible Business Account: Open multiple IBANs from one account.

- Multi-Currency Payments: Handle various currencies with transparent fees.

- Virtual Corporate Cards: Issue virtual cards for business expenses.

- Mass Payouts via API: Automate bulk payments efficiently.

VIALET helps businesses and individuals understand their credit standing without hassle. Their support team is always ready to help, ensuring a smooth experience.

For more details, visit VIALET’s website.

Key Features Of User-friendly Credit Reporting Tools

User-friendly credit reporting tools are essential for managing your credit effectively. These tools offer various features to help you understand and monitor your credit score. Let’s explore the key features that make these tools indispensable.

Intuitive Dashboard For Easy Navigation

An intuitive dashboard is crucial for a seamless user experience. It allows users to navigate easily through different sections. The dashboard provides a clear overview of your credit status. This includes your credit score, recent changes, and any alerts.

The layout is often clean and organized. Key information is displayed prominently. This ensures that users can quickly find what they need.

Real-time Credit Score Updates

Real-time updates are essential in a credit reporting tool. They ensure you are always aware of your current credit score. This feature helps you track any changes immediately. It also allows you to take prompt action if necessary.

Real-time updates provide peace of mind. Knowing your score is up-to-date helps you make informed financial decisions.

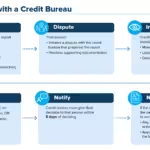

Detailed Reports With Visual Summaries

Detailed reports are another vital feature. They offer an in-depth analysis of your credit history. These reports often include visual summaries. Charts and graphs make it easier to understand complex data.

Visual summaries highlight key information. They help users quickly grasp their credit status. This makes it easier to identify areas that need improvement.

Custom Alerts For Credit Changes

Custom alerts are invaluable for staying informed. They notify you of any significant changes in your credit report. This includes new accounts, hard inquiries, or changes in your credit score.

Setting up custom alerts is simple. You can choose the types of changes you want to be notified about. This feature ensures you are always in the loop. It helps you maintain control over your credit health.

Benefits Of Using User-friendly Credit Reporting Tools

Understanding credit reports is essential for financial health. User-friendly credit reporting tools like VIALET Business Account offer numerous benefits. They help in understanding and managing credit effectively. Below are key benefits:

Enhanced Financial Awareness

User-friendly tools provide clear and concise information. They help users understand their credit status quickly. VIALET Business Account offers detailed insights into transactions. This helps businesses keep track of their spending and manage finances better.

Proactive Management Of Credit Health

With tools like VIALET, businesses can monitor their credit health easily. They can detect potential issues early and take corrective actions. The platform supports multiple IBAN setups, making it easier to manage various accounts and maintain a good credit score.

Time Efficiency And Reduced Complexity

VIALET simplifies complex financial processes. It supports instant money transfers and automates bulk payments. This saves time and reduces the complexity of managing finances. The platform also integrates with preferred apps, streamlining payment processes further.

Better Decision Making

Access to detailed and clear credit reports aids in better decision making. Businesses can make informed choices regarding expenses and investments. VIALET offers transparent charges and rates, helping businesses plan their finances effectively.

| Main Features | Benefits |

|---|---|

| Flexible Business Account | Manage multiple IBANs and assign access levels |

| Multi-Functional Payment Platform | Supports various payment methods and currencies |

| Virtual Corporate Cards | Issue cards for business expenses |

| Mass Payouts via API | Automate bulk payments efficiently |

| E-commerce Acquiring | Enhance checkout experience |

Using user-friendly credit reporting tools like VIALET Business Account can significantly enhance financial management and decision-making processes. They provide essential insights and streamline financial operations, making them an invaluable asset for businesses.

Pricing And Affordability

Choosing a user-friendly credit reporting solution often hinges on its pricing and affordability. VIALET Business Account offers a competitive and transparent pricing structure, designed to cater to businesses of all sizes. Let’s dive into the details of their pricing plans, the differences between free and paid features, and a cost-benefit analysis to help you make an informed decision.

Breakdown Of Pricing Plans

VIALET Business Account provides a range of services with transparent pricing. Here is a detailed breakdown of their pricing plans:

| Service | Details | Cost |

|---|---|---|

| Multi-Currency Payments | Handle multiple currencies with transparent charges | Competitive Rates |

| Virtual Corporate Cards | Issue Visa or Mastercard for business expenses | Included |

| Mass Payouts via API | Automate bulk payments to multiple recipients | Included |

| SEPA, SEPA Instant, SWIFT Payments | Supports various payment options | Included |

Free Vs. Paid Features

VIALET Business Account offers a mix of free and paid features. Here’s a comparison to help you understand what’s included:

- Free Features:

- Quick account setup

- Basic multi-currency handling

- Issuance of virtual corporate cards

- Paid Features:

- Advanced multi-currency payments

- Mass payouts via API

- Customized B2B API connections

Cost-benefit Analysis

Understanding the cost-benefit of VIALET Business Account is crucial. Here’s a simplified analysis:

- Cost: Competitive rates for multi-currency payments, no hidden fees

- Benefit: Quick transactions, enhanced checkout experiences, robust security

- Cost: Potential fees for advanced features

- Benefit: Personalized support, efficient bulk payments, seamless integration

Investing in VIALET Business Account ensures speed, ease of use, and security, making it a smart choice for businesses aiming to streamline their financial processes.

Pros And Cons Of User-friendly Credit Reporting Tools

Understanding the advantages and limitations of user-friendly credit reporting tools is crucial. These tools simplify credit management but come with their own set of pros and cons. Below, we explore these aspects in detail.

Advantages Based On User Feedback

Users have highlighted several benefits of user-friendly credit reporting tools:

- Ease of Use: Simplified interfaces make navigation easy, even for beginners.

- Quick Access: Instant access to credit reports and scores helps in timely decision-making.

- Comprehensive Insights: Detailed analytics provide a clear picture of credit health.

- Real-Time Updates: Users receive notifications on credit score changes and new credit activities.

Common Drawbacks And Limitations

Despite the benefits, there are some common limitations:

- Limited Features: Basic tools may lack advanced functionalities needed for comprehensive analysis.

- Subscription Costs: Premium features often come with a subscription fee, which can add up over time.

- Data Privacy: Concerns about data security and privacy can deter users from sharing sensitive information.

Comparing Different Tools

| Tool | Key Features | Pros | Cons |

|---|---|---|---|

| Tool A | Real-time updates, detailed reports | Instant notifications, user-friendly | High subscription cost |

| Tool B | Basic insights, free version | No cost, simple interface | Limited features |

| Tool C | Advanced analytics, secure | Comprehensive data, strong security | Complex for beginners |

Recommendations For Ideal Users

Choosing the right credit reporting tool is crucial for business growth. VIALET Business Account provides a comprehensive solution for many users. Understanding who can benefit the most from this service and the best scenarios for its use is essential.

Who Can Benefit The Most

Various businesses can leverage the VIALET Business Account. Here’s a look at the ideal users:

- Small to Medium Enterprises (SMEs): Companies that need flexible and scalable solutions for their financial transactions.

- Freelancers and Consultants: Professionals who require multiple IBANs and virtual corporate cards for managing their expenses.

- Startups: New businesses needing quick setup and efficient payment processes.

- E-commerce Businesses: Online stores that want to enhance their checkout experience and manage mass payouts.

Best Scenarios For Usage

VIALET Business Account excels in various scenarios. Some of the best scenarios for its usage include:

- International Transactions: Businesses handling multi-currency payments (EUR, USD, GBP, etc.) will find the transparent charges and rates advantageous.

- Team Management: Companies needing to add team members and assign different access levels can benefit from the flexible account features.

- Automated Payments: Firms looking to automate bulk payments using the mass payouts via API feature.

- Open Banking Solutions: Businesses that want to streamline their payment processes through open banking and local payment options.

Tips For Getting Started

To get started with VIALET Business Account, follow these steps:

- Sign Up: Visit the VIALET website and sign up for a business account.

- Set Up Multiple IBANs: Configure your account with multiple IBANs for different transactions and team members.

- Issue Virtual Cards: Create virtual Visa or Mastercard for various business expenses and salary payments.

- Integrate with Apps: Use the B2B API connections to integrate with your preferred apps and automate payments.

- Consult Support: Reach out to your account manager for personalized assistance and support.

With these tips, businesses can efficiently use the VIALET Business Account to manage their financial operations.

Frequently Asked Questions

What Is User-friendly Credit Reporting?

User-friendly credit reporting simplifies credit information for consumers. It ensures clarity, accessibility, and easy-to-understand data. This helps users make informed financial decisions.

How Does It Benefit Consumers?

It benefits consumers by providing clear, understandable credit information. This helps in managing finances better, identifying errors, and improving credit scores.

What Features Make Credit Reports User-friendly?

User-friendly credit reports feature simple language, organized data, and clear explanations. Visual aids like charts and graphs enhance understanding.

Are User-friendly Credit Reports Accurate?

Yes, user-friendly credit reports maintain accuracy. They simplify presentation without compromising the integrity and correctness of the information.

Conclusion

Choosing a user-friendly credit reporting service can simplify financial management. VIALET Business Account offers flexible solutions for businesses. It streamlines transactions with features like instant transfers and multi-currency support. The platform ensures secure, fast, and transparent payments. For more details, visit VIALET. Simplify your business finances today with VIALET.