Upstart Personal Loans: Unlock Your Financial Freedom Today

In today’s fast-paced world, securing a personal loan can be daunting. Upstart Personal Loans offer a unique solution.

Designed for those needing quick and reliable financial support, Upstart connects you with the right lenders efficiently. Upstart Personal Loans focus on providing a secure and user-friendly platform. This helps borrowers find the best match for their needs. Unlike traditional loans, Upstart evaluates more than just your credit score. It considers factors like education and employment, offering a fairer chance for approval. The platform also emphasizes security, ensuring your data stays safe. With easy access and comprehensive support, Upstart makes personal loans more accessible. Explore more about Upstart Personal Loans at their official website.

Introduction To Upstart Personal Loans

Upstart Personal Loans offer a fresh approach to borrowing. They use advanced technology to provide personal loans tailored to your financial needs. This platform aims to make borrowing accessible and straightforward for everyone.

What Are Upstart Personal Loans?

Upstart Personal Loans are designed to help you meet your financial goals. These loans cater to various needs such as debt consolidation, home improvement, medical expenses, and more. Upstart uses a unique model to evaluate borrowers, considering factors beyond traditional credit scores.

Purpose Of Upstart Personal Loans

The primary purpose of Upstart Personal Loans is to provide financial support. Whether you need to pay off high-interest credit card debt or finance a large purchase, Upstart can help. Their goal is to offer accessible loans with fair terms to a wide range of individuals.

| Purpose | Examples |

|---|---|

| Debt Consolidation | Combine multiple debts into one payment |

| Home Improvement | Renovate or repair your home |

| Medical Expenses | Cover unexpected medical bills |

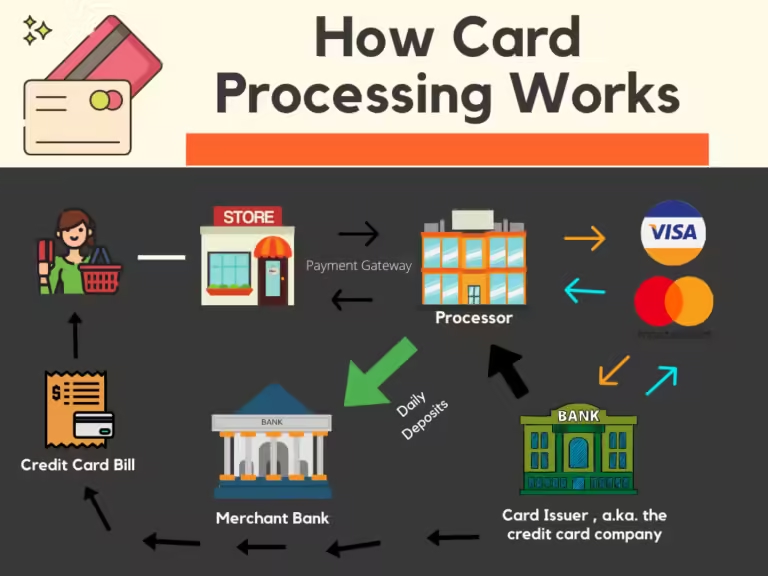

Overview Of Upstart’s Unique Approach

Upstart stands out with its innovative approach to lending. They use artificial intelligence and machine learning to assess your creditworthiness. This means they look at your education, job history, and other factors, not just your credit score.

Here are some key features:

- Entrepreneur and Backer Matching: Connects you with potential backers.

- User Login: Secure login system for easy access.

- Security Check: Ensures a secure process for all users.

- Support Resources: Offers comprehensive support and information.

By considering a broader range of data, Upstart can offer loans to individuals who might not qualify with traditional lenders. This approach helps more people achieve their financial goals and improves accessibility to personal loans.

Key Features Of Upstart Personal Loans

Upstart Personal Loans offer several unique features that set them apart. Designed with user convenience in mind, these loans provide a seamless borrowing experience. Below, we explore the key features that make Upstart Personal Loans an attractive option for many.

One of the standout features of Upstart Personal Loans is their AI-driven approval process. Unlike traditional lenders, Upstart uses advanced algorithms to assess an applicant’s creditworthiness. This method considers more than just credit scores, including educational background and work history. This comprehensive approach can increase approval chances for many borrowers.

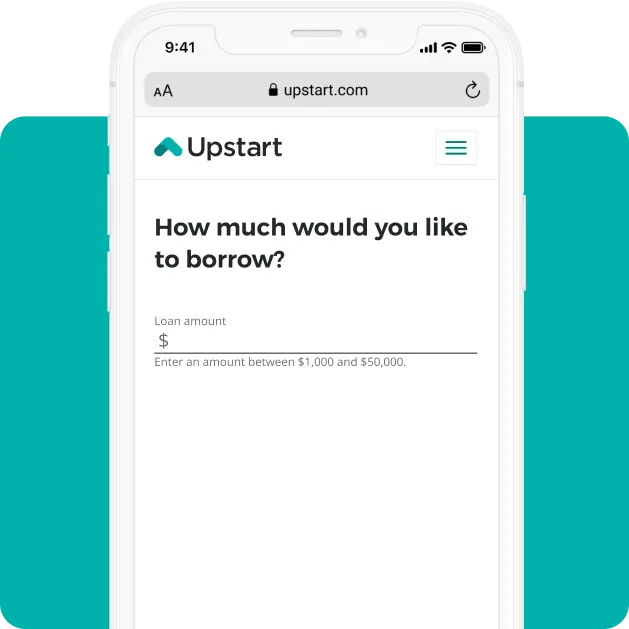

Upstart offers flexible loan amounts and terms to suit different financial needs. Borrowers can choose loan amounts ranging from $1,000 to $50,000. Additionally, loan terms are flexible, typically between three and five years. This flexibility allows borrowers to select a repayment plan that fits their budget and financial goals.

Another significant feature is the quick funding process. Once approved, borrowers can receive their funds as soon as the next business day. This fast turnaround can be crucial for those needing immediate financial assistance, making Upstart an ideal choice for urgent borrowing needs.

Upstart Personal Loans come with no prepayment penalty. Borrowers can repay their loans early without any additional fees. This feature offers flexibility and potential savings on interest payments for those who can pay off their loans ahead of schedule.

With these features, Upstart Personal Loans provide a user-friendly, flexible, and efficient borrowing solution. For more details, visit the Upstart website.

Ai-driven Approval Process

Upstart Personal Loans leverages an AI-driven approval process to assess loan applications. This innovative approach uses advanced algorithms to evaluate various factors beyond traditional credit scores. Let’s explore how AI enhances loan approval, the benefits for borrowers with limited credit history, and the improved approval rates and speed.

How Ai Enhances Loan Approval

AI technology analyzes a broad range of data points to assess creditworthiness. These include employment history, education, and even work habits. This comprehensive evaluation gives a more accurate picture of a borrower’s ability to repay the loan. Traditional methods rely heavily on credit scores, but AI considers more variables.

| Traditional Methods | AI-Driven Methods |

|---|---|

| Credit Score | Credit Score + Employment History + Education |

| Limited Data Points | Multiple Data Points |

Benefits For Borrowers With Limited Credit History

Many borrowers have thin credit files. This means they have limited credit history and struggle to get approved for loans. The AI-driven process evaluates more than just credit scores. It considers additional data such as:

- Job stability

- Educational background

- Income potential

This broader evaluation helps those with limited credit history get better loan offers. It opens opportunities for borrowers who might have been overlooked by traditional lenders.

Improved Approval Rates And Speed

AI streamlines the loan approval process. Applications are processed faster, reducing wait times for borrowers. The automated system analyzes data quickly and accurately, leading to higher approval rates.

Here are some key advantages:

- Faster application processing

- Higher approval rates

- Reduced human error

These improvements enhance the overall customer experience, making Upstart Personal Loans a preferred choice for many.

Flexible Loan Amounts And Terms

Upstart Personal Loans offer flexibility to meet diverse financial needs. Borrowers can choose loan amounts and repayment terms that suit their specific situations. This flexibility ensures a more personalized borrowing experience.

Range Of Loan Amounts Available

Upstart Personal Loans provide a wide range of loan amounts. Borrowers can choose from as little as $1,000 to as much as $50,000. This range allows individuals to borrow only what they need, avoiding excessive debt. Here’s a breakdown:

| Minimum Loan Amount | Maximum Loan Amount |

|---|---|

| $1,000 | $50,000 |

Customizable Repayment Terms

With Upstart, repayment terms are customizable. Borrowers can choose terms ranging from 3 years to 5 years. This flexibility helps manage monthly payments more effectively. It allows borrowers to pick a term that aligns with their budget.

- 3-year repayment term

- 5-year repayment term

Catering To Diverse Financial Needs

Upstart Personal Loans cater to various financial needs. Whether it’s consolidating debt, funding a major purchase, or covering emergency expenses, Upstart has options. The combination of flexible amounts and terms makes it easier to address unique financial situations.

Upstart’s approach ensures that each borrower finds a plan that works best for them. This flexibility and customization make Upstart a valuable option in personal financing.

Quick Funding

Upstart Personal Loans offer a remarkable solution for those in need of quick funding. The platform is tailored to provide swift loan disbursement, which is a huge relief for many borrowers. Let’s delve into the specifics of how Upstart ensures rapid access to funds.

Speed Of Loan Disbursement

One of the most compelling features of Upstart Personal Loans is the speed of loan disbursement. Once approved, borrowers can typically receive their funds within one business day. This rapid turnaround time is ideal for individuals who need money urgently.

Traditional lenders often take several days to process and disburse funds. Upstart, on the other hand, leverages modern technology to streamline the approval and funding process. This efficiency is crucial for addressing immediate financial needs.

Convenience For Urgent Financial Needs

Upstart Personal Loans are designed with convenience in mind, especially for those facing urgent financial needs. The application process is straightforward and can be completed online within minutes. Borrowers do not need to visit a physical branch or deal with lengthy paperwork.

This ease of access is particularly beneficial for those who have unexpected expenses, such as medical bills or emergency repairs. Quick funding ensures that borrowers can address these issues without unnecessary delays.

Comparison To Traditional Lenders

Comparing Upstart Personal Loans to traditional lenders highlights several advantages:

| Feature | Upstart Personal Loans | Traditional Lenders |

|---|---|---|

| Loan Disbursement Time | Within 1 Business Day | Several Days to a Week |

| Application Process | Online and Quick | In-Person and Lengthy |

| Convenience | High | Moderate |

| Urgent Financial Needs | Highly Suitable | Less Suitable |

Upstart’s focus on quick funding, combined with the ease of the application process, makes it a preferred option for many borrowers. The convenience and efficiency offered by Upstart Personal Loans are unmatched by traditional lending institutions.

No Prepayment Penalty

Upstart Personal Loans offer a significant advantage with their No Prepayment Penalty feature. Borrowers can repay their loans early without facing any additional fees. This flexibility can lead to substantial savings and financial freedom.

Advantages Of No Prepayment Penalties

- Financial Flexibility: Borrowers have the freedom to pay off their loans early.

- Cost Savings: Avoid paying extra interest over the loan term.

- Debt-Free Sooner: Achieve financial goals faster.

Encouraging Early Repayments

With no prepayment penalties, borrowers are encouraged to make early repayments. This motivation to pay off loans faster can lead to a reduced financial burden. Early repayments also positively impact credit scores.

Impact On Overall Loan Cost

Repaying a loan early decreases the total interest paid over time. This feature of Upstart Personal Loans can result in significant savings. Here’s a simple example:

| Loan Amount | Term | Interest Rate | Total Interest Paid (Standard) | Total Interest Paid (Early Repayment) |

|---|---|---|---|---|

| $10,000 | 5 years | 10% | $2,748 | $1,500 |

This table shows how early repayment can reduce the total cost of the loan. By taking advantage of the no prepayment penalty feature, borrowers can save money and reduce their debt faster.

Pricing And Affordability

Understanding the pricing and affordability of Upstart Personal Loans can help you make informed decisions. This section will cover interest rates, fee structures, and a cost comparison with other lenders.

Interest Rates Overview

Upstart Personal Loans offer competitive interest rates. These rates depend on several factors, such as your credit score and loan amount. The annual percentage rate (APR) ranges from 6.18% to 35.99%. This range ensures that borrowers with different credit profiles find suitable options.

Upstart uses a unique underwriting model. It takes into account education, employment, and credit history. This model helps many borrowers secure better rates than traditional lenders.

Fee Structure Breakdown

Upstart Personal Loans have a transparent fee structure. Here is a breakdown of the common fees:

- Origination fee: 0% to 8% of the loan amount

- Late payment fee: $15 or 5% of the past due amount, whichever is greater

- Check processing fee: $15 if you pay by check

- Prepayment fee: No prepayment penalties

These fees are standard in the personal loan industry. However, Upstart stands out by not charging prepayment penalties.

Cost Comparison With Other Lenders

Comparing costs can show how Upstart Personal Loans measure up. Here’s a quick comparison with other popular lenders:

| Lender | APR Range | Origination Fee | Prepayment Penalty |

|---|---|---|---|

| Upstart | 6.18% – 35.99% | 0% – 8% | No |

| SoFi | 5.99% – 18.85% | 0% | No |

| Prosper | 7.95% – 35.99% | 2.4% – 5% | No |

| LendingClub | 6.95% – 35.89% | 1% – 6% | No |

This table highlights that Upstart’s rates and fees are competitive. While some lenders have lower APRs, Upstart’s unique model may offer better rates for certain borrowers.

Pros And Cons Of Upstart Personal Loans

Upstart Personal Loans offer a unique approach to lending by leveraging AI technology. While this innovative system provides several advantages, it also comes with potential drawbacks. Here, we break down the pros and cons to help you make an informed decision.

Pros: Ai-driven Approvals, Quick Funding, Flexible Terms

| Pros | Details |

|---|---|

| AI-driven approvals | Upstart uses AI algorithms to approve loans. This allows for a more inclusive assessment of your creditworthiness. It means more people can qualify for loans even if their credit score is not perfect. |

| Quick funding | Upstart offers fast funding. In most cases, you can receive your funds the next business day after approval. This quick turnaround is ideal for emergencies or urgent needs. |

| Flexible terms | Upstart provides flexible loan terms. You can choose from various repayment periods. This allows you to find a plan that fits your financial situation. |

Cons: Potentially Higher Interest Rates For Some Borrowers

Despite the advantages, there are some cons to consider:

- Potentially higher interest rates: Some borrowers may face higher interest rates. This can happen if the AI assessment deems you a higher risk. It’s essential to compare rates before committing.

User Feedback And Real-world Usage

Understanding user experiences can provide valuable insights:

- Positive Experiences: Many users praise the quick approval and funding process. They appreciate the flexibility in loan terms and the ease of the online application.

- Negative Experiences: Some users report dissatisfaction with high-interest rates. They also mention occasional confusion with the AI-driven approval process.

Overall, Upstart Personal Loans offer a modern approach to lending. Weighing the pros and cons can help you decide if it’s the right choice for your financial needs.

Ideal Users And Scenarios

Upstart Personal Loans offer flexible borrowing options for a wide range of users. This section explores who can benefit the most, ideal scenarios for usage, and real-life experiences.

Who Can Benefit Most From Upstart Personal Loans?

Upstart Personal Loans are suitable for various individuals. Here are some key groups:

- Young Professionals: Those starting their careers with limited credit history.

- Entrepreneurs: Small business owners needing quick capital for their ventures.

- Students: Individuals looking to consolidate educational expenses.

- People with Limited Credit History: Users who might not have extensive credit records.

Scenarios Where Upstart Personal Loans Are Ideal

Various scenarios make Upstart Personal Loans an excellent choice:

| Scenario | Why Ideal? |

|---|---|

| Debt Consolidation | Combine multiple debts into one manageable payment. |

| Home Renovation | Get quick funds for home improvement projects. |

| Medical Expenses | Cover unexpected medical costs with ease. |

| Wedding Expenses | Finance your special day without stress. |

Case Studies And User Experiences

Real-life experiences shed light on the benefits of Upstart Personal Loans:

- John’s Debt Consolidation: John combined his credit card debts into one loan, saving on interest and reducing monthly payments.

- Sophia’s Home Renovation: Sophia used an Upstart loan to renovate her kitchen, adding value to her home.

- Mark’s Medical Expenses: Mark faced unexpected medical bills and secured an Upstart loan for immediate relief.

- Emma’s Wedding: Emma financed her wedding through Upstart, ensuring a memorable event without financial strain.

Each of these cases highlights the versatility and convenience of Upstart Personal Loans for various financial needs.

:fill(white):max_bytes(150000):strip_icc()/upstart-f229ab62838d4a88a95cde6a6f74bc49.png)

Frequently Asked Questions

What Are Upstart Personal Loans?

Upstart personal loans are unsecured loans for various purposes, like debt consolidation, home improvements, or medical expenses.

How Do Upstart Personal Loans Work?

Upstart personal loans are granted based on a combination of credit score, education, and employment history.

What Is The Minimum Credit Score For Upstart Loans?

Upstart requires a minimum credit score of 600, but other factors are also considered.

How Quickly Can You Get Funds From Upstart?

You can receive funds as soon as the next business day after approval.

Conclusion

Choosing Upstart Personal Loans can be a smart financial move. The platform offers secure, easy access and valuable support. Connect with backers effortlessly and enjoy peace of mind with their safety measures. For more details, visit the official site by clicking here. Make informed decisions and secure your financial future today.