Upstart Loan Offers: Unlocking Your Financial Potential

If you’re seeking a personal loan with a straightforward process, consider Upstart. Upstart offers a unique approach to personal loans.

Their platform uses AI to assess your creditworthiness, making the process easier and more inclusive. Upstart stands out in the crowded loan market. They don’t just look at your credit score. Instead, they consider education and job history too. This holistic approach can help more people get approved. Upstart’s secure and user-friendly platform ensures a smooth experience. Whether you’re consolidating debt or funding a new project, Upstart might be the solution you need. Explore their offerings to see how they can meet your financial needs. Learn more about Upstart Personal Loans on their website.

Introduction To Upstart Loan Offers

Upstart Loan Offers provide a unique approach to personal loans. They are designed to cater to individual needs with a focus on personal finance and credit cards. These loans are known for their straightforward application process and competitive rates.

What Is Upstart?

Upstart is an innovative lending platform. It uses artificial intelligence to assess creditworthiness. Unlike traditional lenders, Upstart considers various factors beyond credit scores. This includes education, employment, and more.

Founded in 2012, Upstart aims to improve access to affordable credit. It helps people with limited credit history get loans at fair rates. The platform has gained popularity for its customer-friendly policies and transparency.

The Purpose Of Upstart Loans

Upstart Loans serve several key purposes. Here are the main ones:

- Debt Consolidation: Combine multiple debts into a single loan with a lower interest rate.

- Credit Card Refinancing: Pay off high-interest credit card debt with a more manageable loan.

- Home Improvement: Fund renovations or repairs without tapping into home equity.

- Personal Expenses: Cover major purchases, medical expenses, or other personal needs.

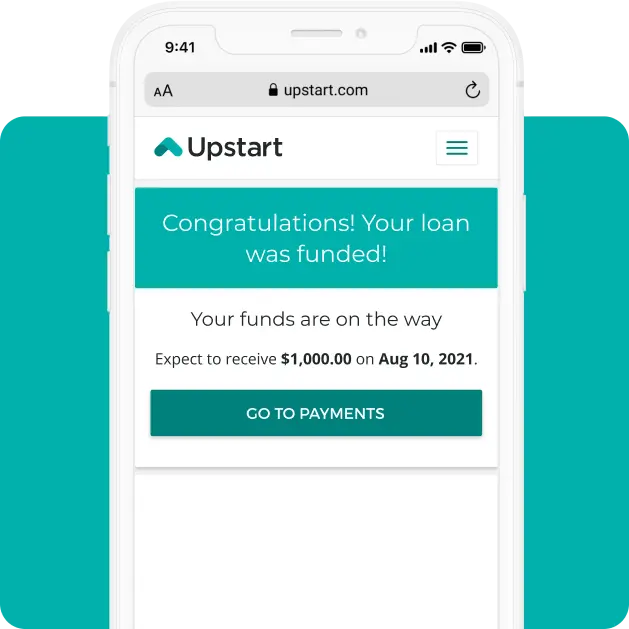

These loans offer flexible terms and quick approval. Borrowers can receive funds within a few business days. The process is designed to be simple, with minimal paperwork and clear terms.

Upstart’s approach benefits both borrowers and lenders. Borrowers enjoy lower rates and better terms. Lenders gain access to a broader pool of potential clients. This innovative model sets Upstart apart in the personal finance niche.

Explore Upstart Personal Loans to learn more about their offerings and start your application today.

:fill(white):max_bytes(150000):strip_icc()/upstart-f229ab62838d4a88a95cde6a6f74bc49.png)

Key Features Of Upstart Loans

Upstart Personal Loans offer a range of features designed to meet the diverse needs of borrowers. Here are some key features that make Upstart Loans stand out:

Personalized Loan Offers

Upstart Loans provide personalized loan offers tailored to your unique financial situation. By evaluating more than just your credit score, Upstart considers your education, employment history, and other factors. This comprehensive approach helps in offering loan terms that are more favorable and suited to your needs.

Ai-powered Approval Process

Upstart utilizes an AI-powered approval process to streamline loan approvals. This technology quickly analyzes your financial background, ensuring a faster and more efficient application process. The AI system reduces human error and speeds up the approval time, allowing you to get the funds you need promptly.

Flexible Loan Terms

With Upstart, you can choose from flexible loan terms to match your financial situation. Whether you need a short-term or long-term loan, Upstart offers various term lengths. This flexibility ensures that you can manage your repayments comfortably and avoid financial strain.

No Prepayment Penalties

One of the significant advantages of Upstart Loans is the absence of prepayment penalties. This means you can pay off your loan early without incurring any additional fees. Paying off your loan ahead of schedule can save you money on interest and help you become debt-free sooner.

How Upstart Loans Benefit You

Upstart Personal Loans offer various advantages that can help you meet your financial needs efficiently. Here, we will explore the key benefits, making it easier for you to understand why Upstart Loans might be the right choice for you.

Quick And Easy Application Process

Applying for an Upstart Loan is straightforward and user-friendly. The application process can be completed online within minutes. You only need basic personal and financial information to get started. This convenience saves time and reduces stress.

Competitive Interest Rates

Upstart Loans offer competitive interest rates based on your credit score and financial profile. This can result in lower monthly payments compared to other loan providers. The competitive rates make it easier to manage your repayments and save money over the loan term.

Improving Your Credit Score

Timely repayments of an Upstart Loan can help improve your credit score. A higher credit score can open doors to better financial opportunities in the future. Consistent payments demonstrate your reliability to other lenders.

Funding For Various Needs

Upstart Loans can be used for a variety of purposes, such as:

- Debt consolidation

- Home improvements

- Medical expenses

- Educational expenses

With flexible loan options, you can tailor the funds to meet your specific needs. This versatility makes Upstart Loans a practical choice for many financial situations.

Pricing And Affordability

When considering a personal loan, understanding the pricing and affordability of the options available is crucial. Upstart Personal Loans offer a range of features designed to make borrowing more accessible and transparent. Let’s break down the key components of Upstart’s pricing and affordability.

Interest Rates Breakdown

Upstart Personal Loans offer competitive interest rates tailored to individual borrowers. The interest rates are determined based on:

- Credit score

- Income level

- Employment history

- Education background

Typical interest rates range from 6.76% to 35.99% APR. This range ensures that borrowers with different financial backgrounds can find a rate that suits their needs.

Fees And Charges

Understanding the fees associated with a loan is essential. Upstart Personal Loans come with the following fees:

- Origination Fee: 0% to 8% of the loan amount

- Late Payment Fee: $15 or 5% of the past due amount

- Prepayment Penalty: None

These fees are clearly outlined to ensure transparency and avoid unexpected costs for borrowers.

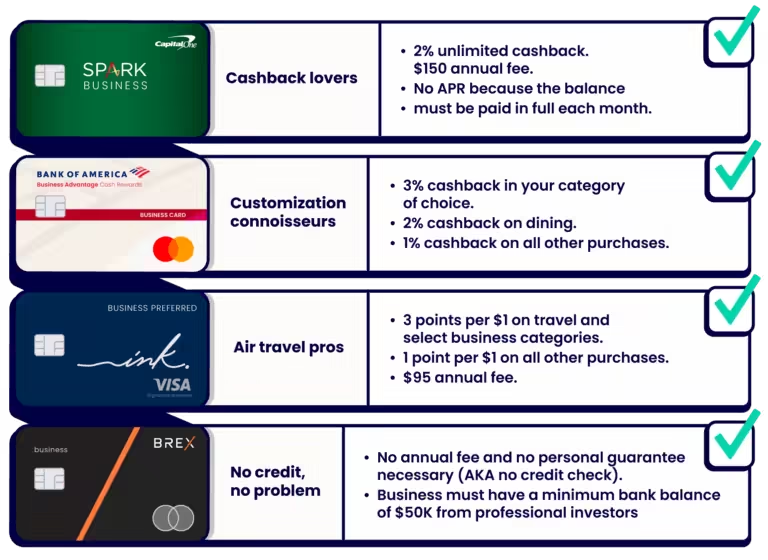

Comparison With Traditional Loans

Comparing Upstart Personal Loans to traditional loans highlights several advantages:

| Feature | Upstart Personal Loans | Traditional Loans |

|---|---|---|

| Interest Rates | 6.76% – 35.99% APR | Varies widely, often higher |

| Approval Process | Quick, AI-driven | Slower, manual review |

| Fees | Transparent, no prepayment penalty | Varies, may include hidden fees |

| Accessibility | Available to a broader range of borrowers | More restrictive |

With Upstart Personal Loans, borrowers can benefit from competitive rates, clear fee structures, and a more inclusive approval process.

Pros And Cons Of Upstart Loans

Upstart Personal Loans have become a popular choice for many seeking financial assistance. Understanding the advantages and disadvantages of these loans can help you make an informed decision. Let’s dive into the pros and cons of Upstart Loans.

Advantages Of Upstart Loans

- Quick Approval Process: Upstart offers a fast and easy application process. Many users receive approval within minutes.

- No Minimum Credit Score: Upstart looks beyond your credit score. They consider your education and job history for approval.

- Flexible Loan Amounts: Borrow between $1,000 and $50,000, depending on your needs.

- Fixed Interest Rates: Upstart provides fixed rates, so your payments remain the same throughout the loan term.

- No Prepayment Penalty: Pay off your loan early without any extra fees.

Disadvantages And Considerations

- Higher Interest Rates for Some: Interest rates can be high, especially if you have a lower credit profile.

- Origination Fees: Upstart charges an origination fee of 0% to 8% of the loan amount.

- Limited Availability: Upstart loans are not available in all states. Check availability in your state before applying.

- Strict Repayment Terms: Upstart offers loan terms of three or five years, which might not be flexible for all borrowers.

Ideal Users And Scenarios For Upstart Loans

Upstart Personal Loans are designed to cater to a broad range of users. They offer flexible terms and quick approvals. This makes them a versatile choice for many financial situations. Below, we explore who should consider Upstart loans and the best scenarios for using them.

Who Should Consider Upstart Loans?

- Young Professionals: Ideal for recent graduates and young professionals. They often have a limited credit history but stable income.

- Individuals with Fair Credit: Those with fair credit scores might find Upstart more forgiving. They look beyond credit scores.

- People Needing Fast Funds: Suitable for those who need quick access to funds. Upstart offers fast approvals and funding.

Best Situations For Using Upstart Loans

There are several scenarios where Upstart loans can be particularly beneficial:

| Scenario | Details |

|---|---|

| Debt Consolidation | Consolidate high-interest debts into a single, lower-interest payment. |

| Home Improvement | Finance home renovations or repairs without tapping into home equity. |

| Medical Expenses | Cover unexpected medical bills or elective procedures. |

| Educational Expenses | Pay for courses, certifications, or continuing education. |

Upstart loans offer flexibility and quick access to funds. This makes them a valuable tool for various financial needs.

Frequently Asked Questions

What Is An Upstart Loan?

An Upstart loan is a personal loan offered by Upstart. It is designed for various financial needs like debt consolidation, home improvements, or medical expenses.

How Does Upstart Determine Loan Eligibility?

Upstart determines loan eligibility based on factors like credit score, income, and education. They also consider your employment history and other financial information.

What Are The Interest Rates For Upstart Loans?

Interest rates for Upstart loans vary. They typically range from 5. 4% to 35. 99%. Your rate depends on your creditworthiness and other factors.

Can I Use An Upstart Loan For Debt Consolidation?

Yes, you can use an Upstart loan for debt consolidation. It helps combine multiple debts into one manageable monthly payment.

Conclusion

Exploring Upstart Personal Loans can help you manage finances more effectively. The platform offers secure transactions and user-friendly navigation. Interested in learning more? Check out their features and benefits on their official site. For more details, visit Upstart Personal Loans.