Understand Credit Scores: Unlock Your Financial Potential Today

Understanding credit scores is essential for financial health. These scores impact loans, credit cards, and even job applications.

A credit score is a number representing your creditworthiness. It helps lenders decide if you are a risk. Knowing how this score is calculated can be empowering. It lets you take control of your financial future. Credit Sesame is a free tool that shows your daily credit score and report summary. You get personalized tips to improve your score. No credit card is needed to sign up. Learn how to better manage your credit and reach your financial goals. Click here to start your journey with Credit Sesame today.

Introduction To Credit Scores

Understanding credit scores is crucial for anyone who wants to manage their finances effectively. Credit scores impact many aspects of financial life, from getting loans to securing the best interest rates. Let’s dive into what credit scores are and why they matter.

What Is A Credit Score?

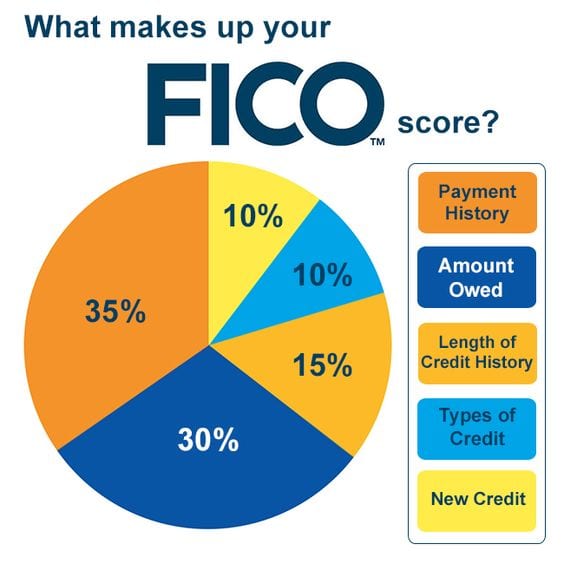

A credit score is a numerical representation of an individual’s creditworthiness. This number is calculated based on various factors, including payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries.

Credit scores range from 300 to 850. Higher scores indicate better credit health. Lenders use these scores to determine the risk of lending money to a borrower.

Why Credit Scores Matter

Credit scores are important for several reasons:

- Loan Approval: Lenders review credit scores to approve or deny loan applications.

- Interest Rates: Higher scores often lead to lower interest rates on loans and credit cards.

- Credit Limits: Better scores can result in higher credit limits.

- Rental Applications: Landlords may check credit scores during the rental application process.

- Employment: Some employers review credit scores as part of the hiring process.

Improving your credit score can open up more financial opportunities and save you money in the long run.

| Credit Score Range | Rating |

|---|---|

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-850 | Excellent |

Using tools like Credit Sesame can help you monitor and improve your credit score. Credit Sesame provides daily access to your credit score and report summary. It offers personalized recommendations to help you reach your financial goals.

Credit Sesame’s unique features include:

- Daily Credit Score Access: Check your score every day.

- Sesame Grade: Understand your score better with a clear letter grade.

- Personalized Actions: Get tailored steps to improve your score.

- Credit Offers: Find credit products with high approval chances.

- Credit Builder: Build credit using everyday purchases without a credit check.

These features make managing and improving your credit score easier and more accessible.

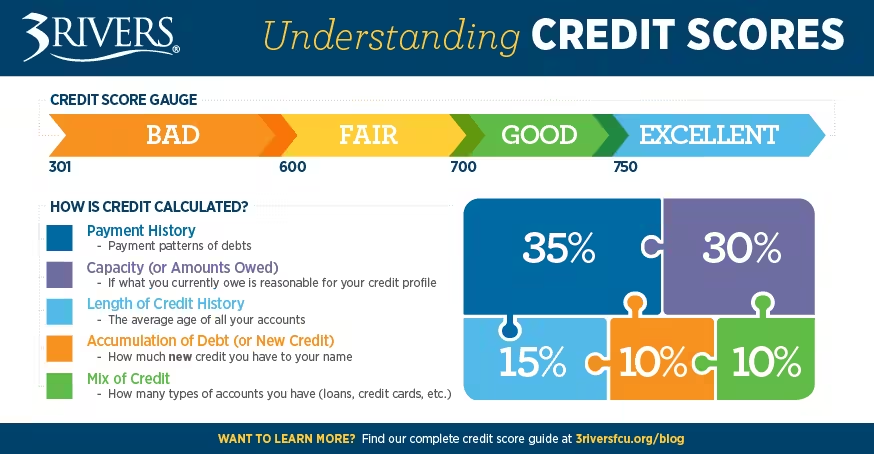

Key Components Of A Credit Score

Understanding the key components of a credit score can help you improve your credit health. Your credit score is influenced by various factors, each playing a significant role. Let’s explore these components in detail.

Payment History

Your payment history is the most crucial component of your credit score. It accounts for about 35% of your score. Lenders want to know if you have paid past credit accounts on time. Late payments, delinquencies, and collections can negatively impact this part of your score.

Amounts Owed

The amounts owed make up around 30% of your credit score. This factor considers the total debt you owe across all accounts. High balances on credit cards can indicate that you are overextended, which may lower your score. Keeping your credit card balances low can help improve this component.

Length Of Credit History

The length of your credit history contributes about 15% to your credit score. This component looks at the age of your oldest credit account, the age of your newest credit account, and the average age of all your accounts. A longer credit history generally boosts your score. Therefore, keeping old accounts open can be beneficial.

New Credit Inquiries

New credit inquiries account for approximately 10% of your credit score. This factor considers the number of recent credit inquiries and new accounts you have opened. Too many inquiries in a short period can signal financial distress and may lower your score. It’s advisable to limit applications for new credit.

Types Of Credit In Use

Types of credit in use also make up about 10% of your credit score. This component looks at the mix of credit accounts you have, such as credit cards, retail accounts, installment loans, and mortgage loans. A diverse credit mix can positively impact your score, showing lenders you can manage different types of credit responsibly.

How To Check Your Credit Score

Understanding your credit score is crucial for managing your finances. Checking your credit score regularly helps you know where you stand and what you need to improve. Here’s how you can check your credit score effortlessly.

Free Credit Reports

Many services offer free credit reports. One of them is Credit Sesame. It allows you to see your credit score and credit report summary daily without requiring a credit card. You can access your credit information at no cost, ensuring you stay informed about your financial health.

Credit Sesame provides:

- Daily Credit Score Access: Check your credit score daily.

- Sesame Grade: Understand your score with a letter grade based on five major factors.

- Personalized Actions: Get tailored actions to improve your score.

Credit Monitoring Services

Credit monitoring services help you keep track of changes in your credit report. They alert you to any suspicious activity, helping you protect your credit. Credit Sesame offers secure credit monitoring, using 256-bit encryption to protect your data.

Benefits of using Credit Sesame:

- Free Access: No cost to see your credit score and report summary.

- No Credit Card Required: Sign-up does not require a credit card.

- High Approval Odds: Find credit products with a high chance of approval based on your profile.

Understanding Your Credit Report

Your credit report includes detailed information about your credit history. Understanding this report helps you identify areas to improve. With Credit Sesame, you receive a summary of your credit report, making it easier to understand your financial standing.

Key features of Credit Sesame:

- Personalized Financial Guidance: Provides actionable steps to improve your credit scores.

- Credit Builder: Build credit using everyday purchases made with a debit card.

Using these tools and services, you can monitor, understand, and improve your credit score effectively.

Improving Your Credit Score

Improving your credit score can open doors to better financial opportunities. With services like Credit Sesame, you can track and improve your score daily. Here are some effective ways to boost your credit score.

Paying Bills On Time

Paying your bills on time is crucial. Late payments can negatively affect your credit score. Set reminders or automatic payments to ensure bills are paid promptly. Credit Sesame can help you monitor your payment history and keep track of due dates.

Reducing Debt

High levels of debt can lower your credit score. Focus on reducing your debt to improve your score. Create a budget to pay off outstanding balances. Credit Sesame provides personalized actions to help you manage and reduce debt effectively.

Avoiding New Credit Applications

Each new credit application can lower your score temporarily. Avoid applying for new credit cards or loans frequently. Credit Sesame shows credit offers with a high chance of approval, reducing the need for multiple applications.

Keeping Old Accounts Open

Closing old credit accounts can decrease your credit history length. Keep old accounts open to maintain a longer credit history. Credit Sesame helps you understand how the age of your accounts affects your credit score.

Disputing Errors On Your Credit Report

Errors on your credit report can harm your score. Regularly check your credit report for inaccuracies. Dispute any errors you find to ensure your report is accurate. Credit Sesame provides free access to your credit report summary, making it easy to spot and dispute errors.

| Action | Benefit |

|---|---|

| Paying Bills on Time | Improves payment history |

| Reducing Debt | Decreases debt-to-income ratio |

| Avoiding New Credit Applications | Prevents temporary score drops |

| Keeping Old Accounts Open | Maintains longer credit history |

| Disputing Errors | Ensures accurate credit report |

These strategies can help you improve your credit score over time. Use Credit Sesame to track your progress and receive personalized recommendations tailored to your financial goals.

The Impact Of Credit Scores On Your Financial Life

Understanding your credit score is crucial. It affects many aspects of your financial life. From getting a loan to finding an apartment, your credit score plays a significant role.

Loan And Mortgage Approvals

Lenders use your credit score to decide if you qualify for a loan or mortgage. A high score increases your chances of approval. It shows you are reliable and manage your debts well. A low score could mean rejection or higher scrutiny.

Interest Rates

Your credit score also affects the interest rates you receive. With a high score, lenders offer lower interest rates. This means you pay less over the life of the loan. A low score results in higher rates, increasing your borrowing costs.

Rental Applications

Landlords check your credit score before approving rental applications. A high score shows you are responsible and can pay rent on time. This makes you a desirable tenant. A low score might cause landlords to reject your application or ask for a higher deposit.

Employment Opportunities

Some employers review credit scores during the hiring process. They believe a good score indicates reliability and financial responsibility. A high score can improve your job prospects. A low score might raise concerns about your trustworthiness.

Insurance Premiums

Insurance companies consider your credit score when setting premiums. A high score can lead to lower premiums. It suggests you are less risky to insure. A low score might result in higher premiums due to perceived higher risk.

Using services like Credit Sesame can help you monitor and improve your credit score. Credit Sesame provides free daily access to your credit score and report summary. It offers personalized actions to improve your score and reach your financial goals.

Common Credit Score Myths Debunked

Many people believe myths about credit scores. Misunderstanding these can harm your financial health. Let’s clear up some common myths.

Checking Your Score Hurts It

Many think checking their credit score will lower it. This is not true. Viewing your score through services like Credit Sesame does not affect it. These are soft inquiries. They do not impact your credit score. Hard inquiries, like applying for a loan, can affect your score. But simply checking it does no harm.

Closing Accounts Improves Your Score

Another myth is that closing accounts will boost your credit score. Closing an account can actually lower your score. It reduces your available credit and changes your credit utilization ratio. Keeping accounts open, even with zero balance, is often better. Use Credit Sesame to monitor your accounts and see how each one impacts your score.

Paying Off Debt Removes It From Your Report

Some believe that paying off debt removes it from their credit report. This is not the case. Paid debts stay on your report for up to seven years. They still affect your credit history. But paying off debt can improve your score over time. Credit Sesame provides personalized actions to help you manage and reduce your debt.

Specific Recommendations For Ideal Scenarios

Understanding credit scores is crucial for financial health. Whether you are building credit from scratch, rebuilding damaged credit, or maintaining excellent credit, there are specific strategies you can follow. Below, we provide detailed recommendations for each scenario using insights from Credit Sesame, a free service to help manage your credit score.

Building Credit From Scratch

For those new to credit, establishing a strong foundation is essential. Here are some recommendations:

- Open a Credit Builder Account: Credit Sesame offers a Credit Builder feature that allows you to build credit with everyday purchases made using a debit card, without a credit check or security deposit.

- Get a Secured Credit Card: These cards require a deposit that acts as your credit limit. They are great for beginners and help establish a credit history.

- Become an Authorized User: Ask a family member with good credit to add you as an authorized user on their credit card. This can boost your credit score.

- Pay Bills on Time: Always pay your bills on time. Payment history is a significant factor in your credit score.

Rebuilding Damaged Credit

If your credit score has taken a hit, don’t worry. Here are steps to rebuild it:

- Check Your Credit Report: Use Credit Sesame to monitor your credit report daily and identify errors or negative items that can be disputed.

- Pay Down Debt: Focus on paying down high-interest debt first. This can improve your credit utilization ratio.

- Settle Outstanding Debts: Contact creditors to settle any outstanding debts. This can sometimes result in the removal of negative marks from your report.

- Use Credit Responsibly: Keep your credit card balances low and avoid applying for too many new credit accounts at once.

Maintaining Excellent Credit

For those with a good credit score, maintaining it is just as important. Follow these tips:

- Continue Monitoring Your Credit: Regularly use Credit Sesame to check your score and report. This helps catch any potential issues early.

- Keep Utilization Low: Aim to keep your credit utilization ratio below 30%. This means using less than 30% of your available credit.

- Avoid Unnecessary Credit Inquiries: Hard inquiries can lower your score. Only apply for credit when necessary.

- Maintain a Mix of Credit Types: A mix of credit accounts, such as credit cards, mortgages, and car loans, can positively impact your score.

Using these tailored strategies can help you manage your credit effectively. Credit Sesame provides the tools and personalized recommendations to guide you through each step of your credit journey.

Pros And Cons Of Focusing On Credit Scores

Understanding credit scores is essential for managing your finances. However, focusing too much on credit scores has its own advantages and disadvantages. Let’s explore both sides to help you make informed decisions.

Advantages Of A High Credit Score

A high credit score offers multiple benefits that can improve your financial health. Here are some key advantages:

- Lower Interest Rates: With a higher credit score, you can qualify for lower interest rates on loans and credit cards.

- Better Loan Approval Odds: Lenders are more likely to approve your loan applications.

- Higher Credit Limits: You may receive higher credit limits, providing more flexibility in financial planning.

- More Credit Options: Access to a wider range of credit products and services.

- Better Rental Opportunities: Landlords often consider credit scores when approving rental applications.

Potential Downsides Of Obsessing Over Credit

While having a good credit score is important, obsessing over it can lead to negative consequences. Consider these potential downsides:

- Increased Stress: Constantly monitoring your credit score can cause unnecessary stress and anxiety.

- Neglecting Other Financial Goals: Focusing solely on credit scores may lead to overlooking other important financial goals.

- Risky Financial Behaviors: You might engage in risky behaviors, like opening multiple credit cards, just to improve your score.

- Potential for Identity Theft: Frequent credit checks can increase the risk of identity theft and fraud.

Understanding the pros and cons of focusing on credit scores can help you balance your financial priorities. Services like Credit Sesame provide tools and insights to help manage your credit effectively. Credit Sesame offers free access to your credit score and personalized recommendations to improve it. Use these resources wisely to maintain a healthy financial life.

Conclusion: Unlocking Your Financial Potential

Understanding your credit score is the key to unlocking your financial potential. By taking control of your credit, you can achieve your financial goals and secure a better future. Let’s summarize the key points and outline the next steps towards financial health.

Summary Of Key Points

Here are the essential points to remember:

- Daily Credit Score Access: Check your credit score daily for free.

- Sesame Grade: A clear letter grade helps you understand your credit score.

- Personalized Actions: Get tailored recommendations to improve your score.

- Credit Offers: See credit offers with high approval odds based on your profile.

- Credit Builder: Build credit using everyday debit card purchases.

Taking The Next Steps Towards Financial Health

To continue improving your financial health, consider the following steps:

- Regular Monitoring: Use Credit Sesame to monitor your credit score daily.

- Understand Sesame Grade: Learn how the five major factors affect your score.

- Follow Personalized Actions: Implement the tailored recommendations provided.

- Explore Credit Offers: Apply for credit products with high chances of approval.

- Utilize Credit Builder: Build your credit with everyday purchases.

Credit Sesame is a reliable tool that provides free access to your credit score and report summary. It offers personalized actions to help you improve your credit score. Sign up today and take control of your financial future.

For more information, visit the Credit Sesame website.

Frequently Asked Questions

What Is A Credit Score?

A credit score is a numerical representation of your creditworthiness. It ranges from 300 to 850. Higher scores indicate better credit history.

How Is A Credit Score Calculated?

A credit score is calculated based on payment history, credit utilization, length of credit history, new credit, and credit mix.

Why Is A Good Credit Score Important?

A good credit score helps you get lower interest rates. It can also improve your chances of loan approval and better financial opportunities.

How Can I Improve My Credit Score?

To improve your credit score, pay bills on time, reduce debt, avoid new credit inquiries, and monitor your credit report regularly.

Conclusion

Understanding your credit score is essential for financial health. Regularly checking it can help you spot errors and improve your credit. Using a service like Credit Sesame offers free access to your score and personalized tips. Stay informed and take control of your financial future today.