Truist Rewards Program: Maximize Your Benefits Today

Are you curious about the Truist Rewards Program? This program offers exciting benefits for Truist One Checking account holders.

Understanding these benefits could help you make the most of your banking experience. Truist Financial Corporation offers the Truist One Checking Account, which includes automatic upgrades and no overdraft fees. New customers can earn a $400 bonus by opening the account online and completing qualifying activities. This account is designed to provide financial security and convenience with features like easy online access and no unexpected charges. Whether you are new to banking or looking for better options, the Truist Rewards Program might be just what you need. Keep reading to discover how you can benefit from this program and why it might be a perfect fit for you. For more details, visit the official Truist website: Truist One Checking Account.

Introduction To The Truist Rewards Program

The Truist Rewards Program offers exciting opportunities for Truist One Checking account holders. This program is designed to reward loyal customers with various benefits and perks. Understanding how this program works can help you maximize your rewards and enjoy more value from your Truist One Checking account.

What Is The Truist Rewards Program?

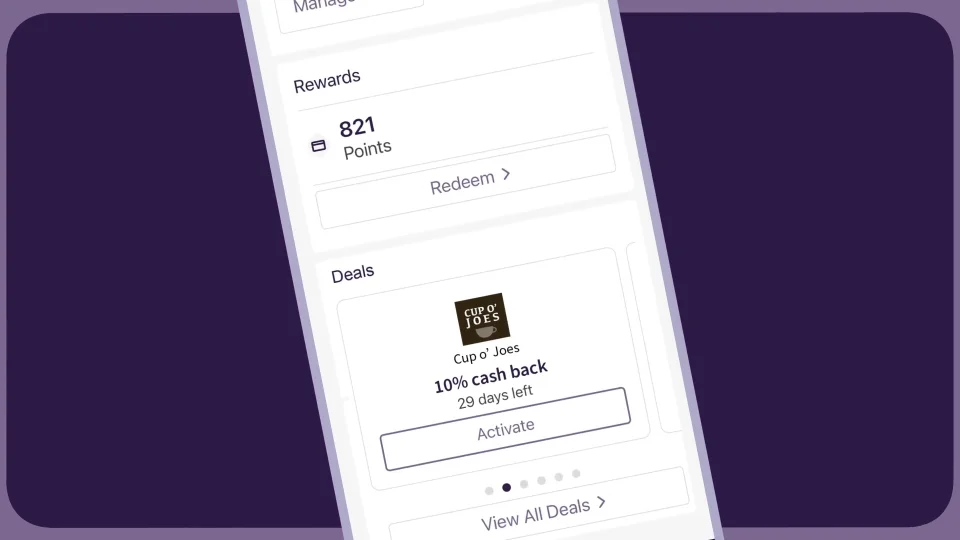

The Truist Rewards Program is a loyalty program for Truist One Checking account holders. It allows customers to earn points through everyday banking activities. These points can be redeemed for a variety of rewards, including travel, gift cards, and merchandise.

With the Truist Rewards Program, every purchase or transaction adds up. The more you use your account, the more points you earn. It’s a simple way to gain extra value from your regular banking activities.

Purpose And Benefits Of Joining

The primary purpose of the Truist Rewards Program is to reward customers for their loyalty. By participating in the program, you can enjoy several benefits:

- Earn Points: Accumulate points with each qualifying transaction.

- Redeem Rewards: Use points for travel, gift cards, and more.

- Exclusive Offers: Access special promotions and offers.

Joining the Truist Rewards Program is easy and free for all Truist One Checking account holders. By making everyday purchases and transactions, you can effortlessly build up points and enjoy the benefits.

Sign up for the Truist Rewards Program today and start earning points on your regular banking activities. Visit the Truist website to learn more and enroll.

Key Features Of The Truist Rewards Program

The Truist Rewards Program offers a range of benefits to its members. These features are designed to enhance the banking experience by providing various ways to earn and redeem points, access exclusive offers, and benefit from bonus opportunities.

Earning Points Through Various Transactions

With the Truist Rewards Program, members can earn points through various transactions. Here are some key methods:

- Everyday Purchases: Earn points on daily purchases using your Truist credit card.

- Online Shopping: Gain additional points when shopping through Truist’s partnered retailers.

- Bill Payments: Earn points by paying bills through your Truist account.

Redeeming Points For Rewards

Truist Rewards points can be redeemed for a variety of rewards. Here are some popular options:

- Travel: Use points for flights, hotel stays, and car rentals.

- Gift Cards: Redeem points for gift cards from major retailers.

- Cash Back: Convert points into cash back credited to your account.

Exclusive Member-only Offers

Members of the Truist Rewards Program gain access to exclusive offers. These offers include:

- Special Discounts: Enjoy discounts on selected products and services.

- Limited-Time Promotions: Take advantage of promotions available only to members.

- Events: Receive invitations to exclusive events and experiences.

Bonus Point Opportunities

The Truist Rewards Program also provides opportunities to earn bonus points. Members can earn extra points through:

- Sign-Up Bonuses: Receive bonus points when you sign up for the program and meet initial spending requirements.

- Referral Bonuses: Earn points by referring friends and family to Truist.

- Seasonal Promotions: Participate in promotions during holidays and special events to earn extra points.

Pricing And Affordability

Understanding the pricing and affordability of the Truist Rewards Program is crucial for potential customers. This section will delve into the costs associated with enrollment, any maintenance fees, and an analysis of the value for money.

Cost Of Enrollment

The Truist One Checking Account requires a minimum opening deposit of $50. This initial deposit ensures that customers can start enjoying the benefits of the account without a significant upfront investment. Additionally, new customers can earn a $400 bonus by opening the account online and completing qualifying activities.

Maintenance Fees

One of the standout features of the Truist One Checking Account is the absence of overdraft fees. Customers are not charged for overdrafting, which provides financial security and peace of mind. This can be especially beneficial for those who are managing their finances closely and want to avoid unexpected charges.

Value For Money Analysis

The Truist One Checking Account offers substantial value for money. Below is a breakdown of the key benefits:

- $400 Bonus: New customers can earn a $400 bonus by setting up qualifying direct deposits totaling $1,000 or more within 120 days.

- No Overdraft Fees: Avoiding overdraft fees can save customers a significant amount of money over time.

- Automatic Upgrades: The account features automatic upgrades to enhance customer benefits over time.

In summary, the Truist Rewards Program provides excellent value for its customers. With a low initial deposit, significant bonuses, and no maintenance fees, it stands out as a cost-effective option for personal checking accounts.

Pros And Cons Of The Truist Rewards Program

The Truist Rewards Program offers a variety of benefits and some limitations. By understanding these, you can decide if this program suits your needs. Below, we discuss the advantages and potential drawbacks of the Truist Rewards Program.

Advantages Of The Program

1. Earn $400 Bonus: New customers can earn a $400 bonus. Open the account online and set up qualifying direct deposits totaling $1,000 or more within 120 days.

2. No Overdraft Fees: Truist One Checking Account does not charge overdraft fees. This provides peace of mind and financial security.

3. Automatic Upgrades: The account features automatic upgrades. This enhances customer benefits over time, ensuring better services as you continue using the account.

4. Convenient Online Access: You can open and manage your account entirely online. This ensures ease and convenience, saving you time and effort.

5. Financial Security: No overdraft fees help avoid unexpected charges. This keeps your finances secure and manageable.

Potential Drawbacks And Limitations

1. Minimum Opening Deposit: A minimum of $50 is required to open the account. This might be a barrier for some potential customers.

2. Reward Eligibility: To receive the $400 reward, the account must meet specific conditions. If the account type changes or the account closes before the reward is deposited, you forfeit the reward.

3. Geographic Limitation: The offer is available only to US residents in specific states. This limits the availability of the promotional offer.

4. Non-Transferable Offer: The promotional offer is non-transferable and cannot be combined with other checking offers. This restricts flexibility for customers seeking multiple benefits.

5. Reward Forfeiture: The reward will be forfeited if the account has a $0.00 or negative balance at the time of verification. Ensure your account remains in good standing to qualify for the reward.

The Truist Rewards Program provides many benefits but also has some limitations. Weighing these pros and cons can help determine if it aligns with your financial goals.

Specific Recommendations For Ideal Users

The Truist Rewards Program offers many benefits. It’s important to know who will gain the most from joining. Below, we explore the ideal users and best scenarios for maximizing benefits.

Who Should Join The Truist Rewards Program?

Frequent Bank Users: Those who often use banking services will benefit the most. They can earn rewards on daily transactions and financial activities.

New Customers: New customers opening a Truist One Checking account can earn a $400 bonus. This is achieved by setting up qualifying direct deposits totaling $1,000 or more within 120 days.

Online Banking Enthusiasts: The account can be opened and managed online. This is perfect for users who prefer digital banking for convenience and ease.

Budget-Conscious Individuals: With no overdraft fees, the account is great for those who wish to avoid unexpected charges. It provides peace of mind and financial security.

Best Scenarios For Maximizing Benefits

Setting Up Direct Deposits: To earn the $400 bonus, set up direct deposits totaling $1,000 or more within 120 days. This is an easy way to maximize initial benefits.

Maintaining Account Balance: Ensure your account balance is positive. The reward will be forfeited if the account has a $0.00 or negative balance at the time of verification.

Utilizing Automatic Upgrades: Take advantage of automatic upgrades offered by the Truist One Checking account. These upgrades enhance customer benefits over time.

Avoiding Account Changes: Keep the same account type and avoid closing the account before the reward is deposited. The promotional offer is non-transferable and cannot be combined with other offers.

Geographic Eligibility: Ensure you reside in eligible states (AL, AR, FL, GA, IN, KY, MD, MS, NC, NJ, OH, PA, SC, TN, TX, VA, WV, or DC) to qualify for the offer.

For more details, review the full terms and conditions on the Truist website.

Tips And Strategies For Maximizing Your Truist Rewards

The Truist Rewards Program offers many opportunities for customers to earn and redeem points. Understanding how to optimize your rewards can help you get the most out of your Truist One Checking account. Below, we provide tips and strategies for maximizing your Truist Rewards.

Optimizing Points Earned

To maximize your points earned, consider the following strategies:

- Use Your Truist Card Regularly: Make everyday purchases with your Truist card to accumulate points.

- Take Advantage of Promotions: Look for special promotions that offer bonus points for specific transactions.

- Set Up Automatic Payments: Use your Truist card for recurring bills and subscriptions to earn points consistently.

- Refer Friends: Some promotions may offer points for referring friends to open a Truist account.

Best Practices For Redeeming Rewards

Redeeming your rewards wisely can enhance the benefits you receive. Here are some best practices:

- Plan Ahead: Save points for larger rewards rather than redeeming them for smaller items.

- Check for Special Offers: Look for limited-time offers that provide more value for your points.

- Use Points for Travel: Redeeming points for travel can often provide better value.

- Combine Points: Some programs allow combining points with other users for bigger rewards.

Staying Updated With Program Changes

The Truist Rewards Program may update its terms and offers. Staying informed is essential:

- Check the Website Regularly: Visit the Truist website for the latest updates on rewards and terms.

- Subscribe to Newsletters: Sign up for Truist newsletters to receive notifications about changes and special offers.

- Contact Customer Service: Reach out to Truist customer service for any questions about the program.

- Read the Fine Print: Always review the terms and conditions to understand any changes that may affect your rewards.

Frequently Asked Questions

What Is The Truist Rewards Program?

The Truist Rewards Program is a loyalty program for Truist Bank customers. It allows you to earn points on eligible transactions.

How Do I Earn Truist Rewards Points?

You earn Truist Rewards points by using your Truist credit or debit card. Points accumulate with every eligible purchase.

Can I Redeem Truist Rewards Points For Cash?

Yes, you can redeem Truist Rewards points for cash back. Other redemption options include travel, gift cards, and merchandise.

How Do I Check My Truist Rewards Balance?

You can check your Truist Rewards balance online through the Truist Rewards portal. Alternatively, you can use the mobile app.

Conclusion

The Truist Rewards Program offers valuable benefits for customers. Enjoy no overdraft fees and automatic upgrades. New customers can earn a $400 bonus. Open your account online with ease. This account provides financial security and convenience. Interested? Learn more or get started today on the Truist website.