Truist Retail Checking: Unlock the Benefits Today

Managing your finances can be a challenge, but the right checking account can make it easier. Truist Retail Checking, specifically the Truist One Checking account, offers a blend of convenience and rewards, making it a noteworthy choice.

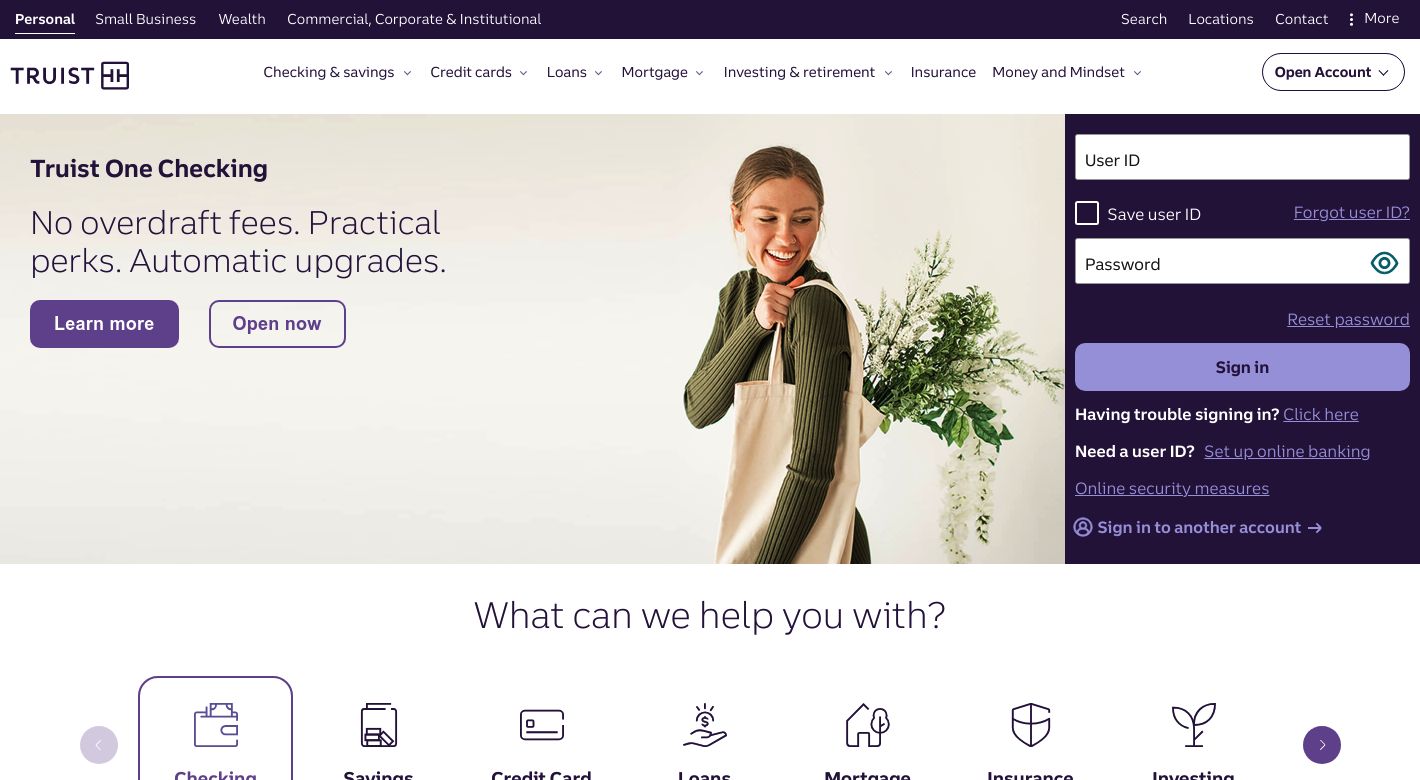

Truist One Checking is designed for those who want more from their banking experience. With this account, new customers can earn a $400 bonus by completing specific qualifying activities. The account eliminates overdraft fees, ensuring you won’t face unexpected charges. Plus, it features automatic upgrades, enhancing your banking experience over time. Whether you need secure online banking or easy account access through a mobile app, Truist One Checking has you covered. Ready to explore further? Discover more about Truist One Checking and how it can benefit you by visiting Truist here.

Introduction To Truist Retail Checking

Truist Retail Checking, a personal checking account, offers a blend of benefits and features. It’s designed to meet the financial needs of individuals seeking a reliable and rewarding banking experience.

Overview Of Truist Bank

Truist Bank, a prominent financial institution, provides diverse banking solutions. It caters to both personal and business needs. Truist stands out for its commitment to customer satisfaction and innovative banking products.

Purpose Of Truist Retail Checking Account

The Truist Retail Checking Account aims to offer a seamless banking experience. It includes attractive benefits such as:

- Financial Incentive: A $400 bonus for new customers who meet specific criteria.

- No Overdraft Fees: Avoid unexpected charges with no overdraft fees.

- Automatic Upgrades: Enjoy automatic upgrades within the account.

This account is perfect for individuals looking for a straightforward and rewarding banking option.

Product Features And Benefits

| Feature | Details |

|---|---|

| Bonus Offer | Earn $400 by opening a new account online and meeting qualifying activities. |

| No Overdraft Fees | Enjoy a checking account without overdraft fees. |

| Automatic Upgrades | Benefit from automatic upgrades within the account. |

These features make Truist Retail Checking a desirable option for many.

Account Opening And Requirements

To open a Truist Retail Checking account, follow these steps:

- Visit the Truist website.

- Use promo code DC2425TR1400 during the application process.

- Make a minimum opening deposit of $50.

- Complete at least two qualifying direct deposits totaling $1,000 or more within 120 days.

Ensure your account remains active and has a positive balance to receive the bonus.

Security And Convenience

Truist emphasizes security and convenience for its customers. The Truist mobile app provides easy access to your account, along with insights into your spending. Enhanced online security measures ensure safe banking.

Contact Information

If you have any questions or need assistance, contact Truist customer service at 800.709.8700.

Key Features Of Truist Retail Checking

Discover the key features of Truist Retail Checking that make it a great choice for managing your finances. This account provides various benefits designed to enhance your banking experience.

No Monthly Maintenance Fees

With Truist Retail Checking, there are no monthly maintenance fees. This means you can save more of your money every month. There is also no need to worry about maintaining a minimum balance to avoid fees.

Overdraft Protection Options

Truist Retail Checking offers multiple overdraft protection options. These options help you manage your finances more effectively. You can link your checking account to a savings account, credit card, or line of credit to cover any overdrafts. This feature ensures you avoid costly overdraft fees.

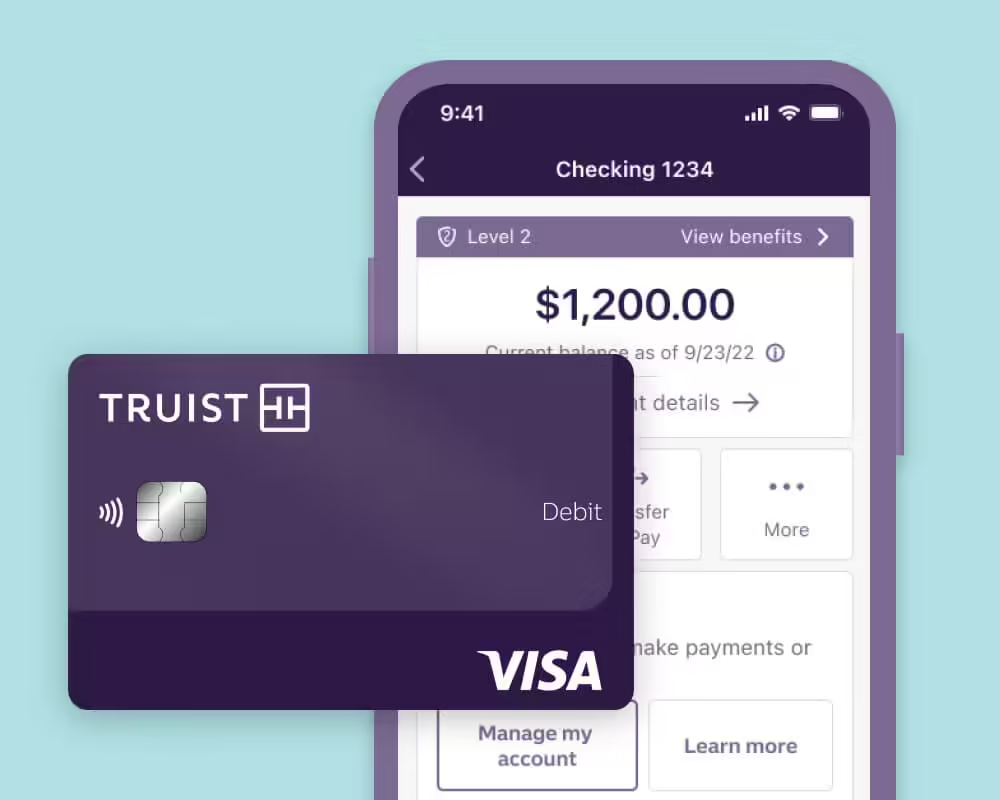

Mobile And Online Banking

Access your Truist Retail Checking account anytime with mobile and online banking. The Truist mobile app provides easy access to your account. You can view your balance, transfer funds, and pay bills. Enhanced online security measures ensure your information is safe.

Access To Nationwide Atms

Enjoy convenient access to nationwide ATMs with Truist Retail Checking. You can withdraw cash from thousands of ATMs across the country without any fees. This feature makes it easy to access your money whenever you need it.

Personalized Debit Card

Get a personalized debit card with your Truist Retail Checking account. You can choose from various designs to match your style. This card allows you to make purchases and withdraw cash easily.

For more information about Truist Retail Checking, visit the official website: Truist.

Pricing And Affordability

Truist One Checking offers a straightforward and affordable solution for everyday banking needs. The account provides valuable features that ensure you get the most out of your money. Let’s explore the pricing and affordability aspects of this checking account.

Minimum Balance Requirements

To open a Truist One Checking account, a minimum opening deposit of $50 is required. There is no ongoing minimum balance requirement, making it accessible for a wide range of customers.

Fee Structure And Charges

One of the key benefits of the Truist One Checking account is the absence of overdraft fees. This means you won’t incur extra charges if you accidentally overdraw your account. The account also offers a $400 bonus for new customers who complete qualifying activities, adding to its affordability and attractiveness.

Comparison With Competitors

Truist One Checking stands out in the market due to its no overdraft fees policy and automatic upgrades. Here’s a brief comparison with other popular checking accounts:

| Feature | Truist One Checking | Competitor A | Competitor B |

|---|---|---|---|

| Minimum Opening Deposit | $50 | $100 | $25 |

| Overdraft Fees | None | $35 per occurrence | $34 per occurrence |

| Bonus Offer | $400 | $200 | $300 |

| Automatic Upgrades | Yes | No | Yes |

As seen in the table, Truist One Checking offers a lower minimum opening deposit and significant bonus offer compared to its competitors. The lack of overdraft fees further enhances its appeal.

Pros And Cons Of Truist Retail Checking

Truist Retail Checking, also known as Truist One Checking, is a personal checking account that comes with a host of features and benefits. Understanding the pros and cons of this account can help you make an informed decision. Below, we delve into the advantages and potential drawbacks of Truist Retail Checking.

Advantages Of Truist Retail Checking

- Bonus Offer: New customers can earn a $400 bonus by opening a Truist One Checking account online and completing specific qualifying activities.

- No Overdraft Fees: Enjoy peace of mind with no overdraft fees, ensuring you avoid additional charges.

- Automatic Upgrades: The account features automatic upgrades, enhancing your banking experience over time.

- Convenient Management: Use the Truist mobile app for easy access to your account and insights into your spending.

- Enhanced Security: Benefit from enhanced online security measures for safe banking.

Potential Drawbacks And Limitations

- Minimum Opening Deposit: A minimum opening deposit of $50 is required to open a Truist One Checking account.

- Eligibility Restrictions: The bonus offer is only valid for new Truist One Checking accounts opened online by U.S. residents. Existing customers or those who closed a Truist checking account on or after October 31, 2023, are not eligible.

- Geographical Limitations: The offer is available only to residents in specific states (AL, AR, FL, GA, IN, KY, MD, MS, NC, NJ, OH, PA, SC, TN, TX, VA, WV, or DC).

- Reward Forfeiture: The $400 bonus will be forfeited if the account type is changed, the account is closed before the bonus is deposited, or the account has a $0.00 or negative balance at the time of verification.

Ideal Users And Scenarios

The Truist Retail Checking account offers numerous benefits. It caters to a wide range of users. It is well-suited for individuals seeking a reliable and feature-rich checking account. Below, we discuss who should consider this account and the best use cases for Truist Retail Checking.

Who Should Consider Truist Retail Checking?

Truist Retail Checking is ideal for individuals who value financial incentives and convenient management.

- New Customers: Those opening a new checking account can earn a $400 bonus.

- Budget-Conscious Users: The no overdraft fees feature helps avoid unexpected charges.

- Tech-Savvy Users: The Truist mobile app offers easy account management and spending insights.

- Security-Minded Individuals: Enhanced online security measures ensure safe banking.

Best Use Cases For Truist Retail Checking Account

The Truist Retail Checking account shines in various scenarios. Here are some of the best use cases:

- Receiving Direct Deposits: To qualify for the $400 bonus, new customers must receive two qualifying direct deposits totaling $1,000 or more.

- Managing Finances: Users can leverage the mobile app for easy tracking and management of spending.

- Enhancing Financial Security: With enhanced online security, users can bank confidently.

- Avoiding Fees: The no overdraft fees feature ensures users avoid extra charges.

Overall, Truist Retail Checking is a versatile and beneficial option for various banking needs.

Conclusion: Is Truist Retail Checking Right For You?

Truist Retail Checking offers various benefits and features. It is essential to understand if it aligns with your financial needs. Below is a summary of key benefits and our final recommendations.

Summary Of Key Benefits

| Feature | Description |

|---|---|

| Bonus Offer | Earn $400 by opening a new Truist One Checking account online and completing qualifying activities. |

| No Overdraft Fees | Enjoy a checking account with no overdraft fees. |

| Automatic Upgrades | The account features automatic upgrades. |

| Convenient Management | Use the Truist mobile app for easy access to your account and insights into your spending. |

| Security | Enhanced online security measures for safe banking. |

Final Recommendations

If you are a new customer looking for a checking account, Truist One Checking could be a good option. The $400 bonus is a significant incentive. To qualify, open an account online and complete the required activities. Ensure you meet the minimum opening deposit of $50.

Truist Retail Checking is suitable for those who prefer no overdraft fees. The automatic upgrades feature adds extra value. Be mindful of the terms and conditions, such as the promo code (DC2425TR1400) and the eligibility criteria.

Consider this account if you reside in one of the eligible states and need a secure and convenient checking account. The Truist mobile app makes managing your finances easier. For more details, visit the official Truist website or contact customer service at 800.709.8700.

Frequently Asked Questions

What Is Truist Retail Checking?

Truist Retail Checking is a basic checking account offered by Truist Bank. It includes essential banking services.

How To Open A Truist Retail Checking?

You can open a Truist Retail Checking account online or at any Truist branch. Required documents include ID and proof of address.

Are There Fees For Truist Retail Checking?

Yes, there are monthly maintenance fees. However, they can be waived by meeting certain criteria like minimum balance.

Does Truist Retail Checking Offer Online Banking?

Yes, Truist Retail Checking includes access to online banking. You can manage your account, pay bills, and transfer funds online.

Conclusion

Truist One Checking offers great benefits and a $400 bonus. No overdraft fees and automatic upgrades make it a smart choice. Open an account with a $50 deposit and complete the requirements. Enjoy secure, convenient banking with Truist. Visit Truist to get started today.