Truist Online Banking Features: Unlock Seamless Financial Control

Online banking has become essential in today’s fast-paced world. Truist offers a suite of features to make managing finances simpler and more convenient.

Truist’s online banking includes a range of tools designed for easy and efficient financial management. Whether you need to check your balance, transfer funds, or pay bills, Truist has you covered. With the Truist One Checking Account, you can enjoy benefits such as no overdraft fees and automatic upgrades. This account is perfect for those looking for straightforward, hassle-free banking. Plus, you can earn $400 by opening a new account online. Ready to explore more? Discover the features of Truist Online Banking and see how it can simplify your financial life. For more information, visit Truist today.

Introduction To Truist Online Banking

Discover the convenience and efficiency of Truist Online Banking. Manage your accounts, pay bills, and transfer money with ease. Explore the various features and benefits designed for a seamless banking experience.

What Is Truist Online Banking?

Truist Online Banking is a digital platform offering comprehensive banking services. Manage your finances from the comfort of your home or on the go. It provides access to your accounts, transactions, and services through a secure online portal.

Purpose And Benefits Of Using Truist Online Banking

Truist Online Banking aims to simplify your financial management. Here are some key benefits:

- Convenience: Access your accounts anytime, anywhere.

- Security: Protects your data with advanced security measures.

- Efficiency: Pay bills, transfer funds, and manage your account settings.

Online banking with Truist enhances your financial control. Avoid overdraft fees and enjoy automatic upgrades with the Truist One Checking Account. Earn $400 with a new account and set up direct deposits easily. Open an account online with a minimum deposit of $50.

| Feature | Details |

|---|---|

| Automatic Upgrades | Enjoy better account options over time. |

| No Overdraft Fees | Manage your finances without worrying about overdraft penalties. |

| Online Account Opening | Set up your account quickly and easily online. |

| Direct Deposit Options | Receive your funds directly into your account without delays. |

With Truist Online Banking, your financial management becomes easier and more efficient. Open a Truist One Checking Account today and experience these benefits.

Key Features Of Truist Online Banking

Truist Online Banking offers a range of features designed to simplify banking tasks. From a user-friendly interface to advanced security measures, Truist ensures a seamless online banking experience. Let’s explore some key features.

The user-friendly interface of Truist Online Banking makes navigation easy. Users can quickly access account information, transfer funds, and monitor transactions.

Here are some benefits of the user-friendly interface:

- Simple navigation

- Quick access to account details

- Easy fund transfers

With real-time account monitoring, users can keep track of their account balances and transactions instantly. This feature helps in avoiding overdraft fees and managing finances better.

Key benefits include:

- Instant updates on transactions

- Better financial control

- Avoiding overdraft fees

The seamless bill payments feature allows users to pay bills directly from their Truist Online Banking account. Set up recurring payments and never miss a due date.

Advantages of seamless bill payments:

- Easy setup of recurring payments

- Timely bill payments

- Reduced risk of late fees

Truist Online Banking employs advanced security measures to protect user data. Features include multi-factor authentication, encryption, and fraud monitoring.

Security features at a glance:

- Multi-factor authentication

- Data encryption

- Fraud monitoring

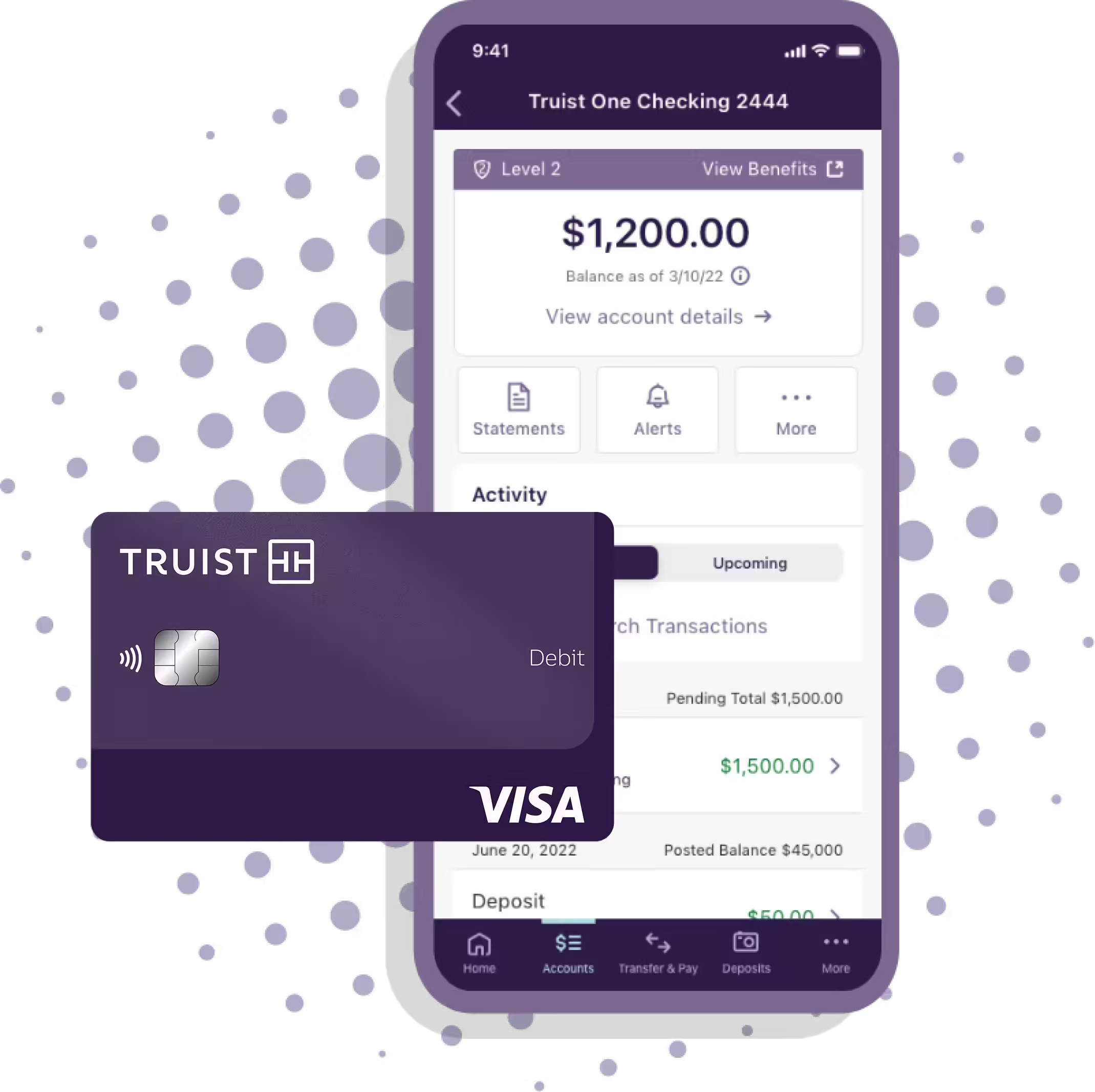

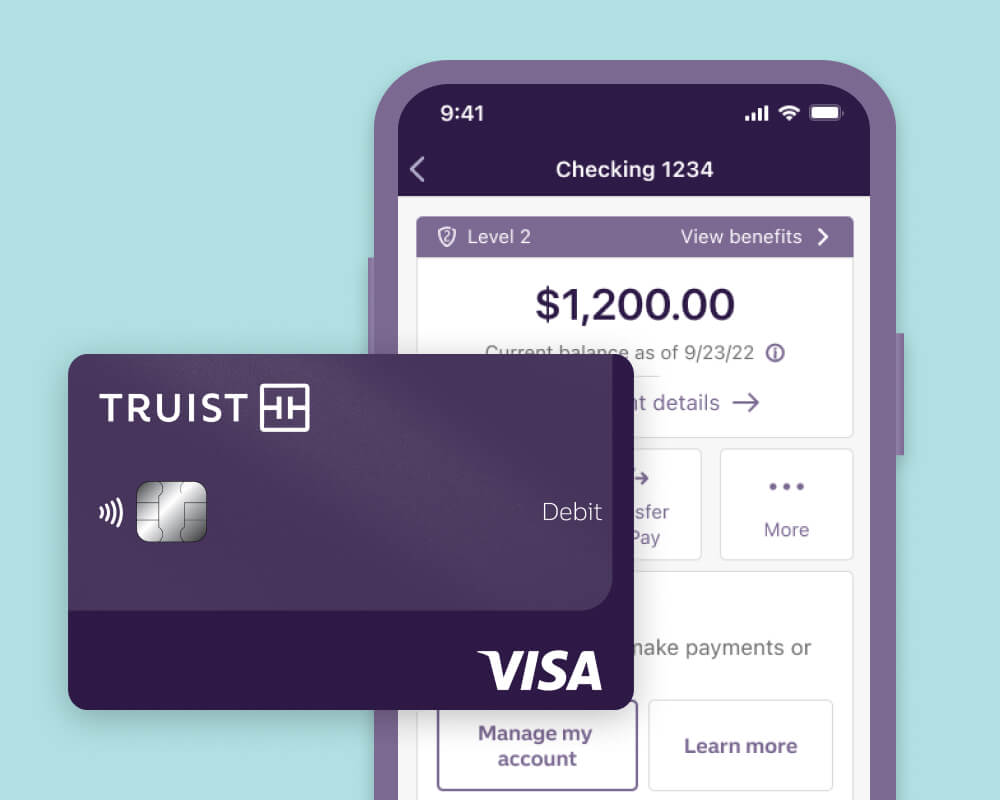

The mobile banking app from Truist offers banking on the go. Users can check balances, transfer funds, and deposit checks using their smartphones.

Features of the mobile banking app:

- Check account balances

- Transfer funds

- Deposit checks

For more details or to open an account, visit the Truist website.

User-friendly Interface

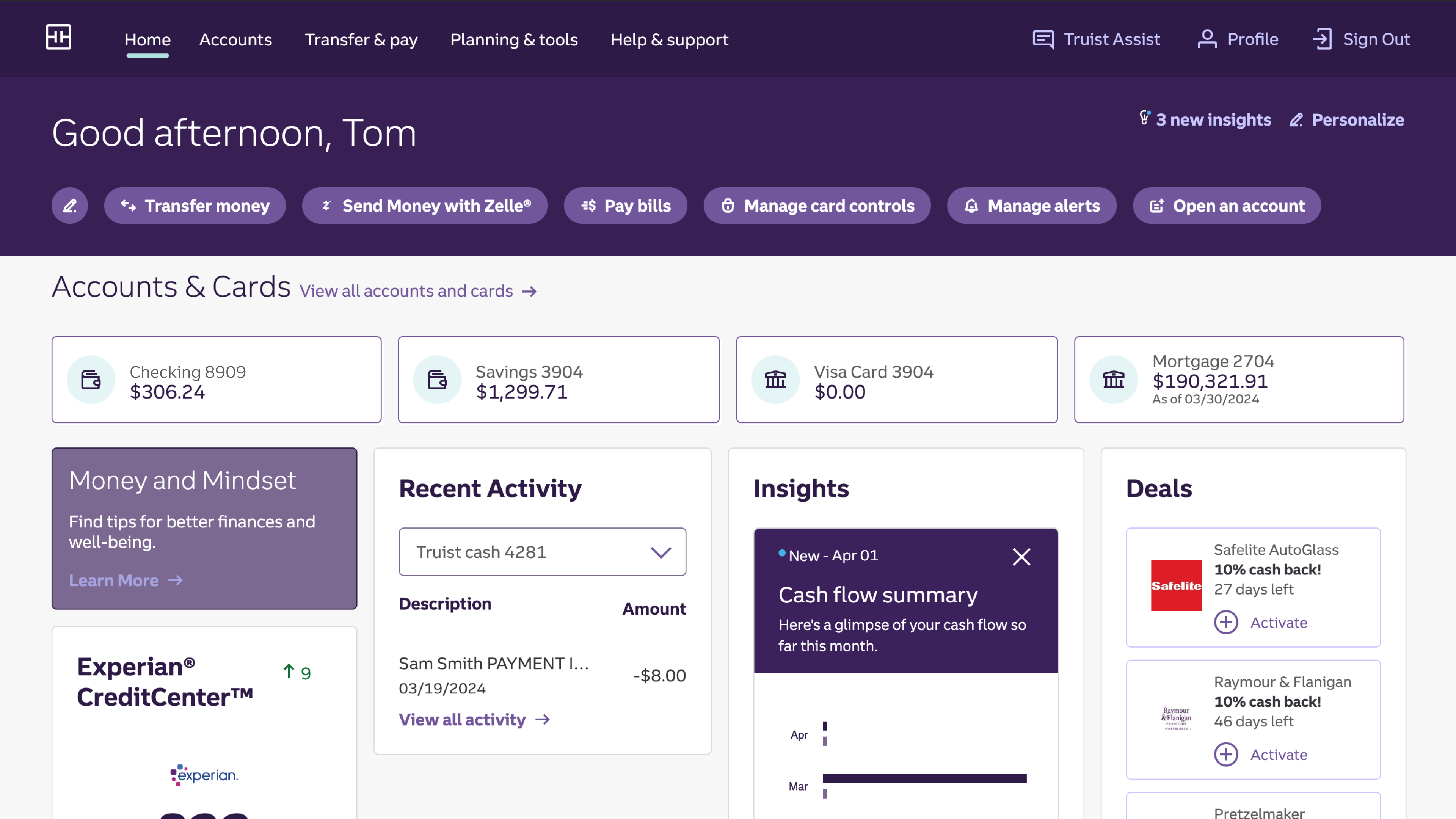

The Truist Online Banking platform offers a user-friendly interface designed to enhance your banking experience. Whether you are managing your Truist One Checking Account or exploring other services, the interface ensures ease of use and accessibility.

Intuitive Navigation

Truist’s online banking interface prioritizes intuitive navigation. Users can easily find what they need with clear and straightforward menus. The navigation bar is thoughtfully designed, making it simple to access key features such as account balances, transaction history, and payment options.

- Easy-to-find menus

- Quick access to account balances

- Effortless transaction history review

The platform provides an efficient search function, allowing users to locate specific transactions or services quickly. No more endless scrolling or complex pathways. Everything is just a few clicks away.

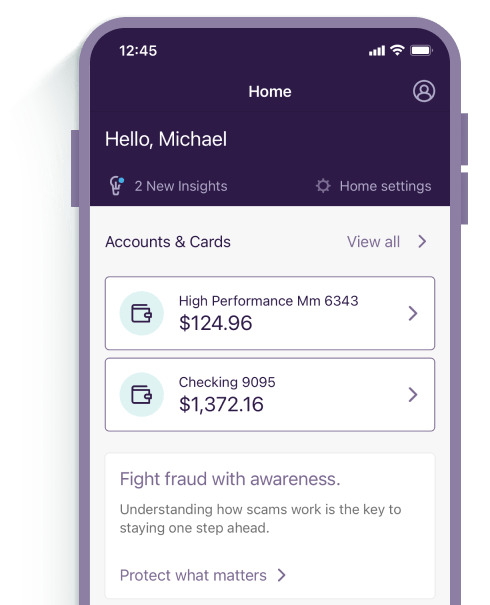

Personalized Dashboard

The personalized dashboard is a standout feature of Truist Online Banking. It allows users to customize their home screen according to their preferences. By prioritizing what matters most, users can have a more tailored and efficient banking experience.

- Customizable home screen

- Quick links to frequently used features

- Personalized alerts and notifications

The dashboard displays essential information at a glance. You can view your account balances, recent transactions, and any pending payments right on the home screen. This ensures you stay on top of your finances effortlessly.

| Feature | Benefit |

|---|---|

| Customizable Home Screen | Access important features quickly |

| Personalized Alerts | Stay informed about account activity |

| Efficient Search Function | Find transactions easily |

Experience the ease and efficiency of Truist’s user-friendly interface. Manage your Truist One Checking Account and other services with confidence and ease.

Real-time Account Monitoring

Truist Online Banking offers Real-Time Account Monitoring for all users. This feature provides instant access to your account information, ensuring you always know your financial status. Below, we explore the benefits of Instant Balance Updates and Transaction Alerts.

Instant Balance Updates

With Truist Online Banking, you receive instant balance updates. This means you can check your account balance at any time and see the most current information. It helps you manage your finances more effectively. No more waiting for statements or guessing your available funds.

Here’s what you can expect:

- Real-time display of available balance

- Easy access through the mobile app or website

- Quick updates after each transaction

Transaction Alerts

Stay informed with transaction alerts. These alerts notify you of any activity in your account, providing peace of mind and enhanced security. You can customize alerts based on your preferences.

Benefits include:

- Immediate notifications of deposits and withdrawals

- Alerts for large transactions or unusual activity

- Customizable alert settings

Setting up transaction alerts is easy. Log into your online banking portal, navigate to the alerts section, and choose your preferences. You can select to receive alerts via email, SMS, or push notifications.

Seamless Bill Payments

Managing your bills has never been easier with Truist Online Banking. The platform offers a range of features to make bill payments smooth and stress-free. Enjoy the convenience of paying all your bills in one place, on time, every time.

Automated Payment Scheduling

One of the standout features is automated payment scheduling. You can set up recurring payments for your regular bills. Never worry about missing a due date again. Simply choose the frequency and amount, and Truist will handle the rest.

For instance, you can schedule:

- Monthly rent payments

- Utility bills

- Subscription services

Automated payments save you time and help maintain your financial health.

Multiple Bill Payment Options

Truist offers multiple bill payment options to suit your needs. You can pay through:

- Bank transfers

- Credit and debit cards

- Direct debits

This flexibility ensures you can manage your finances in a way that works best for you.

Below is a quick overview of the payment options:

| Payment Method | Details |

|---|---|

| Bank Transfers | Secure and direct from your Truist account |

| Credit/Debit Cards | Use your cards for quick payments |

| Direct Debits | Authorize automatic withdrawals for specific bills |

With these options, managing your bills becomes a hassle-free task.

Advanced Security Measures

Truist Online Banking prioritizes the security of your financial data. Advanced security measures ensure your information stays protected. Here are some of the key features:

Multi-factor Authentication

Multi-Factor Authentication (MFA) adds an extra layer of security. With MFA, users must verify their identity through two or more methods. This includes:

- Something you know, like a password

- Something you have, such as a mobile device

- Something you are, like a fingerprint

These steps make it harder for unauthorized users to access your account. Even if they know your password, they still need additional verification.

Fraud Detection Systems

Fraud Detection Systems are essential in protecting your account. Truist uses advanced algorithms to monitor transactions and detect suspicious activities. Here are some features:

- Real-time transaction monitoring

- Alerts for unusual activity

- Automatic blocking of suspicious transactions

If the system detects unusual activity, it alerts you immediately. You can then take action to secure your account. This proactive approach helps prevent fraud before it happens.

Truist Online Banking combines MFA and Fraud Detection Systems to keep your information safe. These advanced security measures ensure that your financial data remains protected.

Mobile Banking App

The Truist Mobile Banking App offers a seamless and convenient way to manage your Truist One Checking Account from your smartphone. The app provides a range of features designed to make banking easier and more accessible, no matter where you are.

On-the-go Account Access

With the Truist Mobile Banking App, you can access your checking account on the go. This feature ensures that you can manage your finances anytime and anywhere. Here are some of the benefits:

- Check your account balance in real-time.

- View transaction history instantly.

- Transfer funds between accounts quickly and easily.

- Set up and manage direct deposits directly from your phone.

Having your bank account information at your fingertips helps you stay on top of your finances and make informed decisions.

Mobile Check Deposit

The Mobile Check Deposit feature on the Truist Mobile Banking App makes depositing checks a breeze. You no longer need to visit a branch or ATM to deposit a check. Follow these simple steps:

- Log into the Truist Mobile Banking App.

- Select the ‘Deposit Checks’ option from the menu.

- Take a photo of the front and back of your check.

- Confirm the deposit details and submit.

This feature saves you time and adds convenience to your banking experience. Depositing checks has never been easier.

Explore more about these features and how the Truist Mobile Banking App can enhance your banking experience by visiting the Truist website.

Pricing And Affordability

The Truist One Checking Account offers a range of features that make it a competitive choice for personal banking. In this section, we will break down the pricing details and analyze the value for money.

Cost Of Using Truist Online Banking

The Truist One Checking Account has a minimum opening deposit of just $50, making it accessible for most people. There are no overdraft fees, which is a significant advantage compared to other banks.

While the account itself does not have a monthly maintenance fee, there may be potential fees for other services. These are detailed in the account terms, so it is important to review them carefully.

| Feature | Cost |

|---|---|

| Minimum Opening Deposit | $50 |

| Overdraft Fees | None |

| Potential Service Fees | Varies |

Value For Money Analysis

One of the standout benefits of the Truist One Checking Account is the promotional offer. You can earn $400 by opening a new account online and completing qualifying direct deposits. This can be a great incentive for new customers.

The account also provides automatic upgrades to better account options, enhancing your banking experience over time. The ease of online account management and direct deposit options adds to the overall convenience.

Here are some key benefits:

- Earn $400 with a new account

- No overdraft fees

- Automatic upgrades to better account options

- Fast setup and easy online management

Overall, the Truist One Checking Account offers excellent value for money, especially with the promotional offer and no overdraft fees. It is a solid choice for anyone looking for a reliable and cost-effective checking account.

Pros And Cons Of Truist Online Banking

The Truist One Checking Account offers a range of features designed to simplify your banking experience. Understanding the pros and cons of Truist Online Banking can help you make an informed decision.

Pros Based On User Experience

- No Overdraft Fees: Users appreciate the absence of overdraft fees, providing peace of mind.

- Automatic Upgrades: The account automatically upgrades, offering better options over time.

- Easy Online Management: The online platform is user-friendly, allowing for quick and easy account management.

- Direct Deposit Options: Setting up direct deposits is straightforward, ensuring timely access to funds.

- Promotional Offer: New users can earn $400 with qualifying direct deposits, adding extra value to their accounts.

Cons And Potential Drawbacks

- Minimum Opening Deposit: A minimum deposit of $50 is required to open the account, which could be a barrier for some.

- Potential Service Fees: While there are no overdraft fees, other service fees may apply as outlined in the account terms.

- Eligibility Restrictions: The promotional offer is not available to current or recent Truist checking account holders, limiting eligibility.

- Reward Forfeiture: Reward forfeiture occurs if the account type changes, the account closes, or maintains a $0.00 or negative balance at verification time.

For more details or to open an account, visit the Truist website and follow the promotional instructions.

Ideal Users And Scenarios For Truist Online Banking

Truist Online Banking offers a range of features that make it a great choice for many users. Whether you need convenient access to your finances or prefer managing your money online, this service could be perfect for you. Let’s explore who can benefit the most and the best use cases for Truist Online Banking.

Who Can Benefit The Most?

Truist Online Banking is ideal for:

- Busy professionals who need to manage their finances on the go.

- College students looking for a hassle-free banking experience.

- Families seeking to keep track of their household expenses easily.

- Small business owners who want to streamline their financial operations.

Each of these user groups will find Truist’s features, like no overdraft fees and automatic upgrades, particularly beneficial.

Best Use Cases

Here are some scenarios where Truist Online Banking shines:

- Frequent travelers: Access your account from anywhere in the world.

- Direct deposit users: Set up direct deposits quickly and easily.

- Bill payers: Pay bills online without the need for checks or cash.

- Money managers: Use Zelle® for fast and secure money transfers.

In each of these cases, Truist Online Banking provides the tools you need for efficient and secure financial management.

| Feature | Benefit |

|---|---|

| No overdraft fees | Enhanced financial control |

| Automatic upgrades | Access to better account options |

| Online account opening | Fast and easy setup |

| Direct deposit options | Convenient management of your income |

Frequently Asked Questions

What Are The Key Features Of Truist Online Banking?

Truist online banking offers features like account management, funds transfer, bill pay, and mobile deposits. It includes budgeting tools and alerts. Users can also access eStatements.

How Secure Is Truist Online Banking?

Truist online banking uses advanced encryption and multi-factor authentication for security. It monitors suspicious activity and offers fraud protection. Your data is safe.

Can I Pay Bills With Truist Online Banking?

Yes, Truist online banking allows you to pay bills online. You can set up recurring payments, view payment history, and manage payees easily.

How Do I Transfer Funds With Truist Online Banking?

You can transfer funds between your Truist accounts or to external accounts. The process is quick and secure. Transfers can be scheduled or done instantly.

Conclusion

Explore Truist One Checking for easy online banking. Enjoy no overdraft fees and automatic upgrades. Open your account now and earn $400 with qualifying deposits. Ready to start? Click here to learn more about Truist One Checking Account. The journey to better banking begins with a single click.