Truist Checking Account Benefits: Maximize Your Banking Experience

Are you looking for a checking account that offers more than just basic features? The Truist One Checking Account could be the perfect solution for you.

Designed with automatic upgrades and no overdraft fees, it provides a seamless banking experience. The Truist One Checking Account stands out with its unique benefits and user-friendly features. New customers can earn a $400 bonus by meeting specific qualifying activities, adding extra value to your banking experience. This account ensures peace of mind with no overdraft fees and offers convenient mobile app access for easy account management. Whether you’re looking to simplify your finances or enjoy the perks of a modern checking account, the Truist One Checking Account offers an array of features designed to meet your needs. Discover more about the Truist One Checking Account and how it can benefit you by visiting Truist One Checking Account.

Introduction To Truist Checking Account

When considering a new checking account, the Truist One Checking Account stands out with its unique features and benefits. Designed to meet diverse financial needs, it offers a seamless banking experience. Let’s delve deeper into what makes this checking account a great option.

Overview Of Truist And Its Mission

Truist Bank emerged from the merger of BB&T and SunTrust Banks, forming a financial powerhouse. It aims to build better banking experiences for its customers. With a mission to inspire and build better lives and communities, Truist focuses on trust and innovation.

Purpose Of Truist Checking Account

The Truist One Checking Account serves as an all-encompassing solution for personal banking needs. It is designed to provide flexibility and peace of mind.

- Automatic account upgrades ensure your account evolves with your financial needs.

- No overdraft fees help avoid unexpected charges.

- The mobile app offers easy account management and spending insights.

New customers can benefit from a $400 bonus by meeting specific qualifying activities. The account can be opened with a minimum deposit of $50.

| Feature | Details |

|---|---|

| Automatic Upgrades | Yes |

| Overdraft Fees | None |

| Mobile App | Available |

| Bonus for New Customers | $400 |

| Minimum Opening Deposit | $50 |

To qualify for the bonus, open a new account online between 10/31/2024 and 4/30/2025. Complete at least two direct deposits totaling $1,000 or more within 120 days of account opening. Use promo code DC2425TR1400 during the account opening process.

For more detailed information, visit the Truist official website or contact their customer support at 800.709.8700.

Key Features Of Truist Checking Account

The Truist One Checking account offers many benefits to make banking easy and convenient. This account is perfect for those who want a hassle-free banking experience with valuable features.

One of the standout features of the Truist One Checking account is the absence of monthly maintenance fees. This means more savings for you. Whether you are a student, professional, or retiree, you can keep more of your money without worrying about extra charges each month.

Truist’s mobile app offers a seamless banking experience. You can manage your account from anywhere at any time. The app provides access to your account balance, transaction history, and spending insights. You can also deposit checks and pay bills directly through the app, making banking extremely convenient.

The Truist One Checking account provides peace of mind with no overdraft fees. This means you won’t be penalized for accidental overspending. Additionally, there are options to link your checking account to a savings account or credit card to cover any overdrafts automatically.

Truist offers various financial wellness tools to help you manage your finances better. These tools include budgeting tips, spending insights, and financial advice. They are designed to help you make informed decisions and improve your financial health.

Explore the Truist One Checking account for more details and start enjoying these benefits today.

No Monthly Maintenance Fees

The Truist One Checking Account stands out with its no monthly maintenance fees. This feature provides significant savings for account holders, enhancing the value of the account.

How It Saves You Money

Monthly maintenance fees can add up quickly. With the Truist One Checking Account, you save on these recurring charges. Here are some ways you benefit:

- No monthly maintenance fees mean more money stays in your account.

- Automatic upgrades without additional costs.

- No overdraft fees provide peace of mind and financial security.

These savings can be substantial over time, making this account a cost-effective choice.

Eligibility Requirements

To enjoy the benefits of the Truist One Checking Account, you must meet specific eligibility criteria:

- Open a new account online between 10/31/2024 and 4/30/2025.

- Complete at least two qualifying direct deposits totaling $1,000 or more within 120 days of account opening.

- Use promo code DC2425TR1400 when opening the account.

Meeting these requirements ensures you qualify for the $400 bonus and other benefits.

| Requirement | Details |

|---|---|

| Account Opening | Open online between 10/31/2024 and 4/30/2025 |

| Direct Deposits | Two deposits totaling $1,000 within 120 days |

| Promo Code | DC2425TR1400 |

Remember, these steps must be completed to avoid forfeiting the reward. Keep your account in good standing to receive all the benefits.

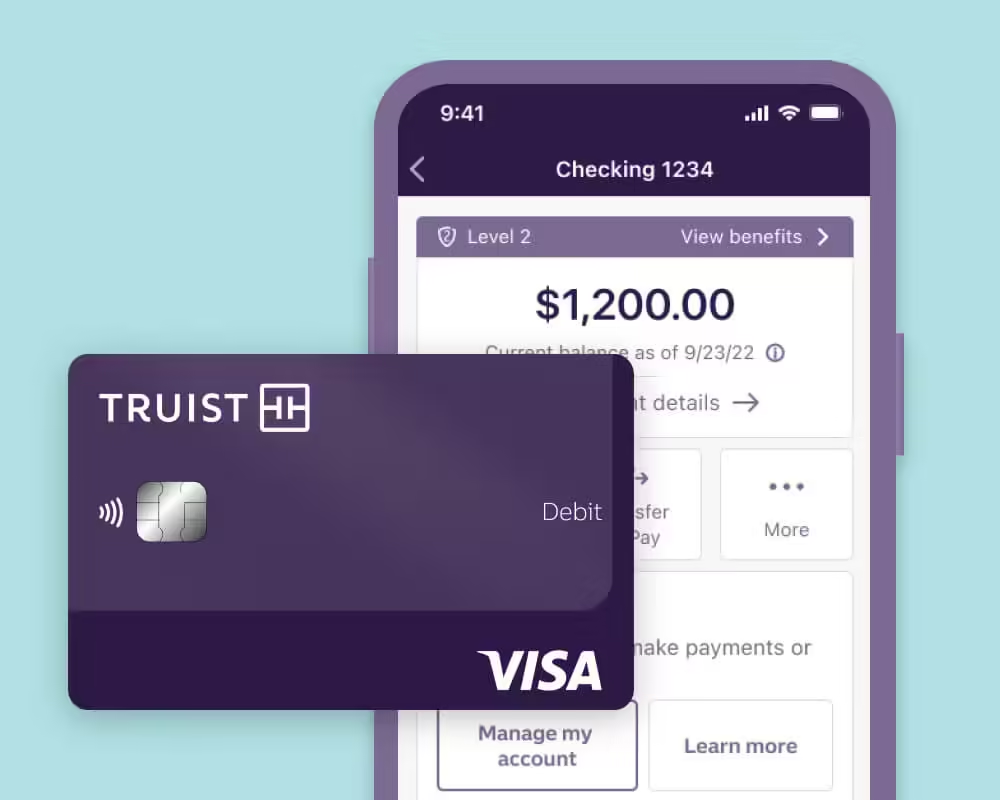

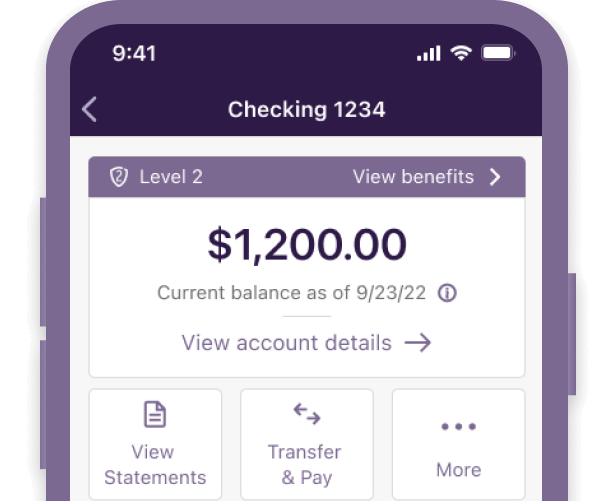

Mobile Banking Capabilities

The Truist One Checking Account offers a range of mobile banking capabilities. These features ensure that you can manage your finances conveniently and securely on the go. Whether you need to check your balance, deposit a check, or receive real-time alerts, the mobile app has you covered.

Convenient Mobile App

The Truist mobile app provides a user-friendly interface. You can easily access your account information, transfer funds, and pay bills. The app is designed to make your banking experience smooth and efficient.

- Account Management: View your account balances and transaction history.

- Fund Transfers: Transfer money between your accounts with ease.

- Bill Payments: Pay your bills directly through the app.

Mobile Check Deposit

With the mobile check deposit feature, depositing checks is quick and simple. You no longer need to visit a branch or ATM. Just take a picture of your check with your phone and deposit it through the app.

- Step 1: Open the Truist mobile app and select “Deposit Checks”.

- Step 2: Take a clear photo of the front and back of your check.

- Step 3: Confirm the deposit details and submit.

Real-time Alerts And Notifications

Stay informed with real-time alerts and notifications. The Truist mobile app sends you updates on your account activities. These alerts help you monitor your spending and keep track of important transactions.

- Balance Alerts: Get notified when your balance falls below a specified amount.

- Transaction Alerts: Receive alerts for large or unusual transactions.

- Payment Reminders: Set up reminders for upcoming bill payments.

The mobile banking capabilities of the Truist One Checking Account make managing your finances easier and more convenient. Whether you are at home or on the go, you have full control over your account at your fingertips.

Overdraft Protection Options

Managing your finances can be challenging. Sometimes, unexpected expenses arise. With the Truist One Checking Account, you get peace of mind. This is especially true with their overdraft protection options.

How Overdraft Protection Works

Overdraft protection helps you avoid declined transactions. It covers expenses when your account balance is low. With Truist One Checking, there are no overdraft fees. This means you can make purchases without worry.

Overdraft protection works by linking your checking account to another account. This could be a savings account or a line of credit. When your checking account balance is insufficient, funds are transferred from the linked account. This ensures your transactions are covered.

Benefits Of Avoiding Overdraft Fees

Overdraft fees can add up quickly. With Truist One Checking, you won’t face these charges. This can save you money and reduce stress. Here are some key benefits:

- Cost Savings: No fees mean more money in your pocket.

- Peace of Mind: Avoid the worry of declined transactions.

- Financial Flexibility: Cover unexpected expenses with ease.

The Truist One Checking Account offers more than just overdraft protection. It provides a $400 bonus for new customers and automatic account upgrades. This makes it a smart choice for managing your finances.

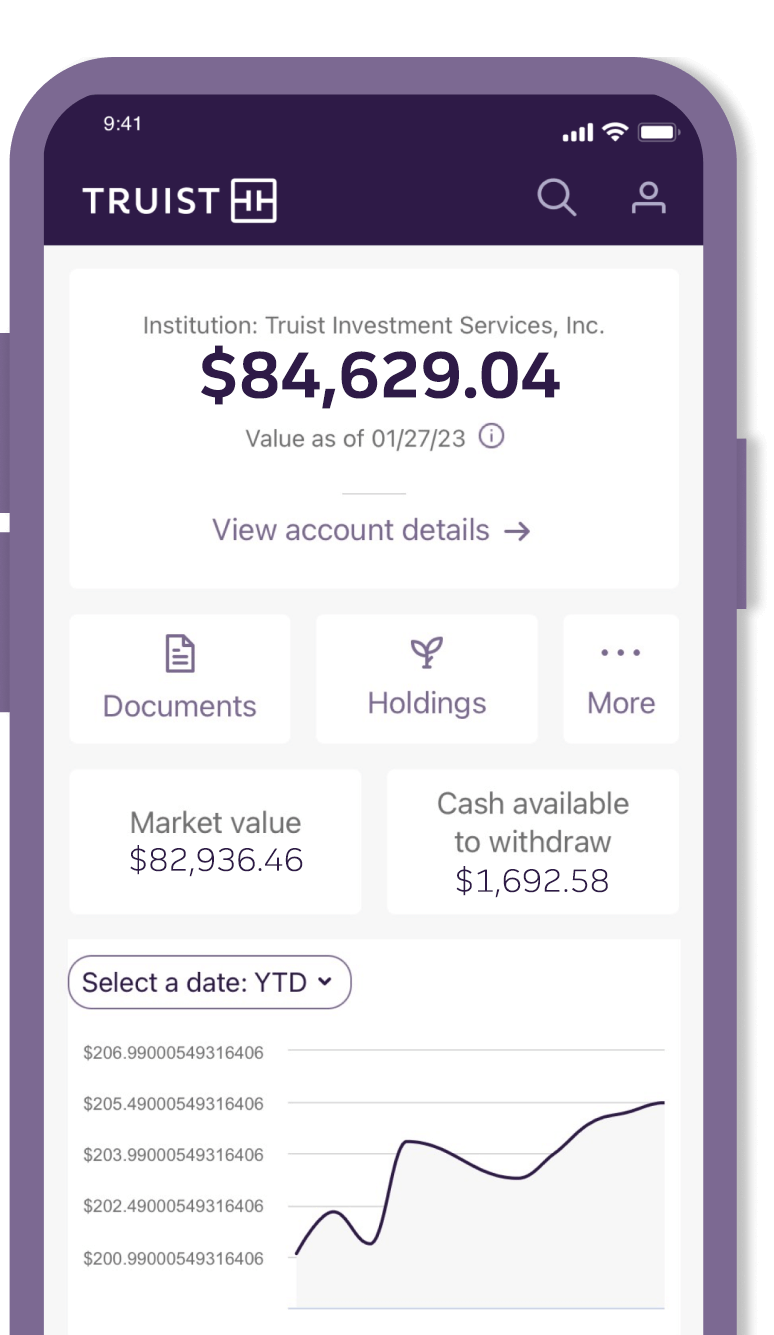

Access To Truist Financial Wellness Tools

The Truist One Checking Account offers more than just basic banking. With access to Truist Financial Wellness Tools, account holders can manage their finances better. Below are some of the key features available.

Budgeting And Spending Insights

The Truist mobile app provides detailed budgeting and spending insights. Users can track their expenses and categorize their transactions. This helps in understanding where your money goes. You can see spending trends over weeks and months.

Key features include:

- Automatic transaction categorization

- Visual charts and graphs

- Customizable budget categories

Savings Goal Tracker

Setting and achieving savings goals is easier with the Savings Goal Tracker. You can set specific targets and monitor your progress. Whether you’re saving for a vacation, a new car, or an emergency fund, the tool keeps you motivated.

Features include:

- Customizable savings goals

- Progress tracking

- Automated reminders and tips

Credit Score Monitoring

Maintaining a healthy credit score is crucial. The Truist mobile app offers credit score monitoring for its users. You can check your credit score regularly and get tips on how to improve it.

Benefits include:

- Free credit score updates

- Insights on factors affecting your score

- Personalized tips for credit improvement

With these tools, Truist helps you take control of your financial health effortlessly.

Pricing And Affordability

The Truist One Checking Account offers a transparent and affordable banking experience. With a minimal opening deposit and no hidden fees, this account provides great value. Below, we explore the detailed breakdown of fees and how Truist compares with its competitors.

Detailed Breakdown Of Fees

The Truist One Checking Account is designed to be budget-friendly. Here is a detailed breakdown of the key fees:

| Fee Type | Amount |

|---|---|

| Minimum Opening Deposit | $50 |

| Overdraft Fees | None |

| Monthly Maintenance Fee | Varies (waivable) |

New customers can also earn a $400 bonus by meeting specific qualifying activities, which adds significant value to the account.

Comparison With Competitors

Let’s see how Truist One Checking Account stands against its competitors:

- Bank of America:

- Minimum Opening Deposit: $100

- Overdraft Fees: $35 per item

- Monthly Maintenance Fee: $12 (waivable)

- Chase Bank:

- Minimum Opening Deposit: $25

- Overdraft Fees: $34 per item

- Monthly Maintenance Fee: $12 (waivable)

- Wells Fargo:

- Minimum Opening Deposit: $25

- Overdraft Fees: $35 per item

- Monthly Maintenance Fee: $10 (waivable)

Clearly, the Truist One Checking Account offers competitive pricing and significant savings with its no overdraft fee policy. The low minimum opening deposit and the potential to earn a $400 bonus make it an attractive option for those seeking an affordable checking account.

Pros And Cons Of Truist Checking Account

The Truist One Checking Account offers several benefits and some limitations. Understanding these can help you decide if this account fits your needs.

Advantages Based On User Experience

- Automatic Account Upgrades: Users appreciate the seamless upgrade process.

- No Overdraft Fees: This feature gives peace of mind and saves money.

- Mobile App Access: The app provides easy account management and spending insights.

- $400 Bonus: New customers can earn a substantial bonus by meeting specific requirements.

| Benefit | Description |

|---|---|

| Automatic Upgrades | Account features enhance automatically without user intervention. |

| No Overdraft Fees | Users avoid additional charges for overdrafts. |

| Mobile App | Convenient access for managing accounts on the go. |

| $400 Bonus | Available for new customers who meet qualifying criteria. |

Common Drawbacks And Limitations

- Opening Deposit: A minimum deposit of $50 is required to open the account.

- Qualifying Activities for Bonus: Customers must complete specific direct deposits totaling $1,000 within 120 days.

- Geographic Restrictions: Offer available only to U.S. residents in specific states.

- Account Maintenance: The account must remain open and in good standing to receive the bonus.

| Drawback | Description |

|---|---|

| Minimum Opening Deposit | Requires a $50 deposit to start the account. |

| Bonus Eligibility | Must complete direct deposits totaling $1,000 within 120 days. |

| Geographic Restrictions | Offer limited to residents in specific states. |

| Account Maintenance | Must keep the account open and in good standing to receive the bonus. |

Ideal Users For Truist Checking Account

Ideal users for Truist Checking Account enjoy benefits like no overdraft fees and easy online account management. Great for those who appreciate convenience and value.

The Truist One Checking Account offers unique benefits, making it suitable for various individuals. This account stands out with features like automatic upgrades, no overdraft fees, and a $400 bonus for new customers. Let’s explore who can benefit the most from this account and specific scenarios where it excels.Who Can Benefit The Most

Many people can benefit from a Truist One Checking Account. Here’s a look at who might find it most useful:

- Young Professionals: They can take advantage of the $400 bonus and no overdraft fees.

- Students: The account’s low minimum deposit of $50 makes it accessible.

- Frequent Travelers: The mobile app access allows easy account management from anywhere.

- Individuals with Irregular Income: Automatic upgrades and no overdraft fees provide peace of mind.

Specific Scenarios Where It Excels

The Truist One Checking Account shines in several specific scenarios. Here are a few:

| Scenario | Benefit |

|---|---|

| Starting a New Job | Qualify for the $400 bonus with direct deposits. |

| Managing Finances | Use the mobile app for easy tracking of spending. |

| Budgeting | No overdraft fees help avoid extra charges. |

| Building Savings | Automatic upgrades enhance account features over time. |

With its diverse range of benefits, the Truist One Checking Account is ideal for many users. Whether you are a young professional, a student, or someone with irregular income, this account can meet your needs.

Frequently Asked Questions

What Are The Benefits Of A Truist Checking Account?

A Truist checking account offers multiple benefits including no monthly fees, free online banking, and access to a large ATM network.

Does Truist Checking Account Have Monthly Fees?

No, Truist checking accounts do not have any monthly maintenance fees, making it cost-effective for users.

How To Open A Truist Checking Account Online?

You can easily open a Truist checking account online by visiting their website and following the step-by-step instructions.

Can I Access Truist Checking Account Via Mobile App?

Yes, Truist offers a mobile app that allows you to manage your checking account on-the-go with ease.

Conclusion

Choosing Truist One Checking means enjoying a hassle-free banking experience. Automatic upgrades and no overdraft fees add convenience. The $400 bonus is a great perk for new customers. Managing your account is simple with their mobile app. Interested? Visit the Truist website to learn more.