Truist Checking Account Advantages: Unlock Exclusive Benefits

Truist One Checking offers numerous benefits for those seeking a reliable banking solution. It stands out with features like automatic upgrades and no overdraft fees.

Are you looking for a checking account that balances convenience and financial flexibility? Truist One Checking might be the perfect fit for you. This account eliminates overdraft fees, ensuring you won’t face unexpected charges. Plus, new customers have the chance to earn a $400 bonus. The account is easy to manage online, with direct deposit options making your banking experience smooth and hassle-free. With a minimum opening deposit of just $50, it’s accessible and straightforward. Discover all the advantages of the Truist One Checking account today and take control of your finances with confidence. Ready to open an account? Learn more and get started here.

Introduction To Truist Checking Account

Truist One Checking is a personal checking account that offers many advantages for its users. This post will provide an overview of Truist and its mission, as well as the purpose of the Truist Checking Account.

Overview Of Truist And Its Mission

Truist is a banking institution dedicated to enhancing the financial well-being of its customers. The mission of Truist is to build a better financial experience through reliability, innovative solutions, and exceptional customer service. Truist aims to offer convenient and flexible banking options, ensuring their clients achieve financial stability and growth.

Purpose Of Truist Checking Account

The Truist One Checking account is designed to provide financial flexibility and convenience. This account features automatic upgrades and no overdraft fees. The account also provides an opportunity to earn a $400 bonus for new customers.

The Truist One Checking account offers:

- Automatic upgrades: Your account improves automatically as you meet certain conditions.

- No overdraft fees: Avoid the stress and financial burden of overdraft charges.

- New customer offer: Earn a $400 bonus by meeting specific criteria.

To open a Truist One Checking account, a minimum deposit of $50 is required. New customers must open an account online using the promo code DC2425TR1400 and complete at least two direct deposits totaling $1,000 within 120 days to qualify for the $400 reward.

For more information, visit the Truist website or contact Truist customer service at 844-4TRUIST (844-487-8478).

Key Features Of Truist Checking Account

The Truist One Checking account offers a range of advantages tailored to meet your financial needs. From no monthly maintenance fees to personalized debit card designs, this account is designed to make banking simple and convenient. Below, we explore the key features of the Truist Checking Account in detail.

No Monthly Maintenance Fees

One of the standout features of the Truist One Checking account is that there are no monthly maintenance fees. This allows you to manage your money without worrying about extra charges eating into your balance. It’s a cost-effective option for anyone looking to keep their expenses low.

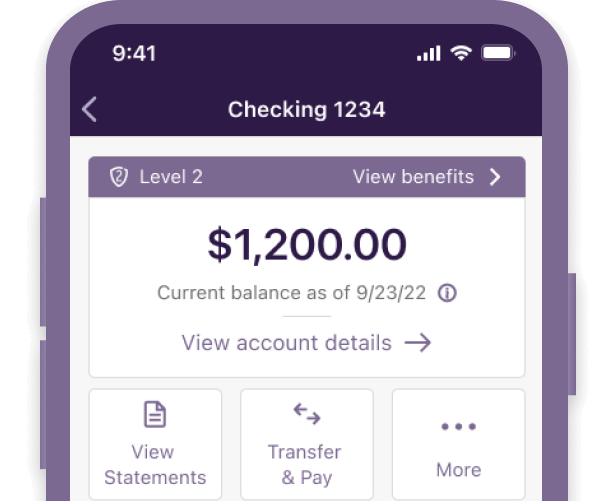

Convenient Online And Mobile Banking

Truist offers convenient online and mobile banking options. You can easily check your balance, transfer funds, and pay bills from the comfort of your home or on the go. The user-friendly app ensures you have access to your account anytime, anywhere.

Access To A Wide Atm Network

With Truist, you gain access to a wide network of ATMs. This means you can withdraw cash without worrying about fees at numerous locations. It’s a convenient feature for those who need cash regularly.

Overdraft Protection Options

Truist One Checking provides various overdraft protection options. You can link your checking account to a savings account or a credit line to avoid overdraft fees. This feature offers peace of mind and financial flexibility.

Personalized Debit Card Designs

Personalize your banking experience with customized debit card designs. Truist allows you to choose from a variety of designs to make your debit card uniquely yours. It’s a small touch that adds a personal flair to your financial tools.

Pricing And Affordability

Truist One Checking offers competitive pricing and affordability. This checking account provides several features, ensuring value for your money. Below, we break down the fee structure, compare it with competitors, and highlight special offers and discounts.

Fee Structure Breakdown

Understanding the fee structure is crucial. Truist One Checking boasts minimal fees, making it an attractive option.

| Feature | Details |

|---|---|

| Minimum Opening Deposit | $50 |

| Overdraft Fees | None |

With no overdraft fees and a low minimum opening deposit, Truist One Checking is designed to be accessible.

Comparative Analysis With Competitors

How does Truist One Checking stack up against other banks? Let’s look at the key points.

- Truist One Checking: No overdraft fees, $50 minimum deposit, $400 bonus for new customers.

- Bank A: $35 overdraft fee, $100 minimum deposit, no sign-up bonus.

- Bank B: $25 overdraft fee, $75 minimum deposit, $100 sign-up bonus.

Truist One Checking stands out for its no overdraft fees and attractive $400 bonus.

Special Offers And Discounts

Truist One Checking provides special offers to new customers:

- New Customer Offer: Earn $400 when opening a new account online.

- Complete two qualifying direct deposits totaling $1,000 within 120 days.

- Receive the $400 reward within four weeks.

This offer is available to new customers who are U.S. residents, 18 or older, and meet the eligibility criteria.

Truist One Checking is a great option. It offers affordability, competitive features, and exclusive rewards.

Pros And Cons Of Truist Checking Account

Truist Checking Account offers various features and benefits that cater to the needs of individuals looking for a reliable banking option. While it has many advantages, it also has some potential drawbacks. This section will highlight both the benefits and cons of the Truist Checking Account.

Benefits Of Using Truist Checking Account

The Truist One Checking Account comes with several attractive benefits:

- No overdraft fees: This feature allows financial flexibility without worrying about incurring extra charges.

- Automatic upgrades: Your account can be automatically upgraded, ensuring you always have access to the best features.

- Earn $400: New customers can earn a $400 bonus by completing qualifying direct deposits.

- Convenient online account management: Manage your account easily through the online platform.

- Direct deposit options: Simplifies receiving payments directly into your account.

Potential Drawbacks To Consider

Despite its many benefits, the Truist Checking Account has some potential drawbacks:

- Minimum opening deposit: A minimum deposit of $50 is required to open the account.

- Reward forfeiture conditions: You may lose the $400 bonus if specific conditions are not met, such as changing the account type or closing the account before the reward is deposited.

- Eligibility restrictions: The offer is available only to new customers who meet certain criteria, including U.S. residency and being at least 18 years old.

Understanding these pros and cons can help you determine if the Truist One Checking Account aligns with your financial needs and goals.

Specific Recommendations For Ideal Users

The Truist One Checking account offers many advantages. It is designed to meet various financial needs. Understanding who will benefit the most can help you decide if this account is right for you.

Who Will Benefit Most From Truist Checking Account?

The Truist One Checking account is ideal for individuals who want financial flexibility. It suits those who often worry about overdraft fees. This account can be a perfect match for people who need convenient online account management.

- Individuals who want to avoid overdraft fees

- New customers seeking a $400 bonus

- People who prefer managing their finances online

- Those who regularly use direct deposit

Scenarios Where Truist Checking Account Shines

This checking account shines in several scenarios:

- New customers opening an account between 10/31/24 and 4/30/25 can earn a $400 bonus.

- Users who set up at least two qualifying direct deposits totaling $1,000 within 120 days benefit from the bonus.

- People who want to start with a low minimum opening deposit of $50.

- Individuals who need an account that automatically upgrades based on usage.

| Feature | Details |

|---|---|

| Overdraft Fees | None |

| Minimum Opening Deposit | $50 |

| New Customer Bonus | $400 with qualifying direct deposits |

| Account Management | Online |

Frequently Asked Questions

What Are Truist Checking Account Benefits?

Truist checking accounts offer numerous benefits. These include no monthly fees, extensive ATM networks, and online banking. Additionally, there are options for overdraft protection and mobile check deposits.

Does Truist Provide Overdraft Protection?

Yes, Truist offers overdraft protection. This service helps you avoid insufficient fund fees. It can link to another account to cover shortfalls.

How To Open A Truist Checking Account?

Opening a Truist checking account is simple. You can apply online or visit a branch. Basic information and identification are required.

Are Truist Checking Accounts Free?

Some Truist checking accounts have no monthly fees. Others may require a minimum balance to waive fees. Check specific account details for exact information.

Conclusion

Choosing a Truist One Checking account offers several benefits. Enjoy no overdraft fees and automatic upgrades. New customers can earn a $400 bonus. Manage your account easily online. Direct deposit options add convenience. Ready to start? Open your account today by visiting Truist One Checking. Enjoy financial flexibility with Truist.