Truist Banking Promotions: Unlock Exclusive Offers Today!

Looking for a great banking deal? Truist Banking Promotions have exciting offers.

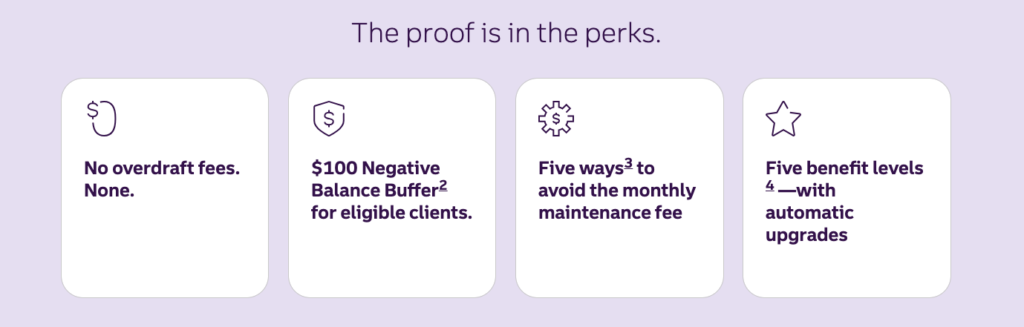

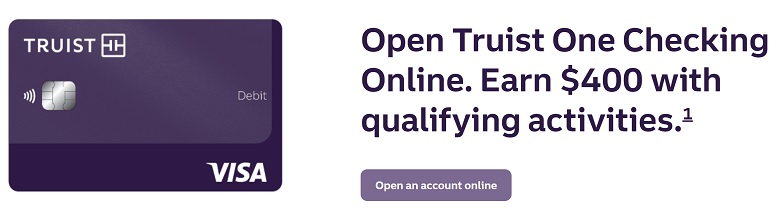

Truist offers new customers a chance to earn a $400 bonus by opening a Truist One Checking Account. This account features no overdraft fees and automatic upgrades. You can easily manage your finances online using the Truist mobile app. To qualify for the bonus, open an account online and complete two direct deposits totaling $1,000 within 120 days. It’s that simple. Truist makes banking convenient and rewarding. For more details, visit Truist and explore all the benefits waiting for you. Secure your financial future with Truist today.

Introduction To Truist Banking Promotions

Truist Banking Promotions offer exciting opportunities for new customers to earn rewards and enjoy top-notch banking services. These promotions are designed to attract new clients by providing attractive incentives like bonuses and fee waivers.

Overview Of Truist Bank

Truist Bank is a well-established financial institution known for its comprehensive range of services including credit cards and banking. It aims to provide personalized banking experiences with a focus on customer satisfaction. Truist Bank merges the strengths of two legacy banks, BB&T and SunTrust, creating a robust financial entity.

Purpose Of Truist Banking Promotions

The primary purpose of Truist Banking Promotions is to attract new customers by offering lucrative incentives. One prominent promotion is the Truist One Checking Account, which provides various benefits to new account holders.

| Main Features | Benefits |

|---|---|

|

|

To qualify for the $400 bonus, new customers must open a Truist One Checking Account online and complete the qualifying activities. The account requires a minimum opening deposit of $50 and has no overdraft fees.

It’s essential to use the promo code DC2425TR1400 during the online account opening process. This promo code ensures eligibility for the bonus. The promotion is valid for accounts opened between 10/31/2024 and 4/30/2025.

The $400 bonus will be deposited within four weeks after meeting the qualifying requirements. Note that the bonus will be forfeited if the account is closed, changed to a non-eligible account type, or has a zero or negative balance before the bonus is deposited.

For more information or assistance, you can contact Truist at 844-4TRUIST (844-487-8478).

Key Features Of Truist Banking Promotions

Truist Banking Promotions offer a range of benefits designed to attract new customers and reward loyal ones. These promotions include exclusive cash bonuses, special interest rates, fee waivers, and rewarding programs. Understanding these features can help you make the most of your Truist One Checking Account.

Exclusive Cash Bonuses

New customers can earn a $400 bonus by opening a Truist One Checking Account online. To qualify, complete two direct deposits totaling $1,000 within 120 days. This bonus will be deposited within four weeks after meeting the requirements.

| Requirement | Details |

|---|---|

| Open Account Online | Use promo code DC2425TR1400 |

| Direct Deposits | Two deposits totaling $1,000 within 120 days |

| Bonus Deposit | Within 4 weeks after qualifying |

Special Interest Rates

Truist Banking Promotions may include special interest rates on savings accounts or certificates of deposit. These rates are often higher than standard rates, providing a better return on your savings. Check the latest offers on Truist’s website for the most current rates.

Fee Waivers And Discounts

Truist One Checking Account offers no overdraft fees, which can save customers money. Additional fee waivers and discounts may be available for maintaining certain balance levels or setting up direct deposits.

- No Overdraft Fees

- Potential fee waivers for maintaining specific balances

- Discounts for setting up direct deposits

Rewards Programs

Truist rewards loyal customers through various rewards programs. These programs can include cashback on purchases, points for account activities, and other benefits that enhance the banking experience. Enroll in Truist’s rewards programs to maximize your benefits.

Example: Earn points for every $1 spent using your Truist credit card.

Taking advantage of these Truist Banking Promotions can significantly enhance your banking experience. Visit the Truist website for more details and to open your account today.

How Truist Banking Promotions Benefit You

Truist Banking Promotions offer numerous benefits that enhance your financial well-being. These promotions are designed to maximize your savings, improve your banking experience, provide access to premium services, and simplify financial management. Let’s explore how these advantages can work for you.

Maximize Your Savings

Truist One Checking Account offers a $400 bonus for new customers. To qualify, open an account online and complete two direct deposits totaling $1,000 within 120 days. This bonus can significantly boost your savings.

There are no overdraft fees, so you avoid unnecessary charges. This feature alone can save you a substantial amount over time, especially if you occasionally overspend.

With a minimum opening deposit of just $50, it’s accessible to many. Plus, the account automatically upgrades as you maintain it, potentially offering more benefits as your financial situation improves.

Enhance Your Banking Experience

The Truist mobile app allows for online account management. This means you can manage your account anytime, anywhere. The app provides quick access and insights into your spending, helping you stay on top of your finances.

Automatic upgrades based on account status ensure you always have the best possible account features. This means you don’t need to worry about manually upgrading or switching accounts as your needs change.

Access To Premium Services

Truist Banking Promotions often include access to premium services that can enhance your overall banking experience. These services might include personalized financial advice, higher interest rates on savings accounts, and exclusive offers on other financial products like credit cards or loans.

Such premium services can provide significant value, especially if you are looking to make the most out of your banking relationship with Truist.

Simplified Financial Management

Managing your finances can be stressful, but Truist makes it easier. The mobile app offers features that simplify financial management, such as budget tracking, spending analysis, and easy transfers between accounts.

By having all your financial information in one place, you can make more informed decisions and avoid potential pitfalls. This holistic approach to financial management ensures you stay on top of your finances effortlessly.

| Feature | Benefit |

|---|---|

| $400 Bonus | Boosts initial savings |

| No Overdraft Fees | Avoid unnecessary charges |

| Online Account Management | Convenience and control |

| Automatic Upgrades | Always have the best features |

For more details, visit the Truist website or contact them at 844-4TRUIST (844-487-8478).

Pricing And Affordability Of Truist Banking Promotions

Truist Banking Promotions offer compelling incentives for new customers. The pricing and affordability aspects make it an attractive option for those looking to open a new checking account. Below, we delve into the costs associated with eligibility, compare Truist with competitors, and uncover any hidden fees or charges.

Cost Of Eligibility

To qualify for the Truist One Checking Account promotion, new customers must complete the following steps:

- Minimum Opening Deposit: $50

- Direct Deposits: Complete two direct deposits totaling $1,000 within 120 days

These requirements are straightforward and affordable, making it easy for customers to qualify for the $400 bonus.

Comparative Analysis With Competitors

When comparing Truist’s promotions with those of other banks, the following factors stand out:

| Bank | Bonus Offer | Minimum Deposit | Overdraft Fees |

|---|---|---|---|

| Truist | $400 | $50 | None |

| Bank of America | $100 | $100 | $35 per item |

| Chase | $200 | $25 | $34 per item |

Truist offers a higher bonus with a reasonable minimum deposit. Additionally, the absence of overdraft fees provides significant savings over time.

Hidden Fees And Charges

Truist One Checking Account stands out by not charging overdraft fees. This can save customers a considerable amount of money. However, it is important to be aware of the following:

- Bonus Forfeiture: The $400 bonus will be forfeited if the account is closed, changed to a non-eligible account type, or has a zero or negative balance before the bonus is deposited.

- IRS Reporting: The $400 bonus will be reported to the IRS as required by law.

Other than these points, the Truist One Checking Account is transparent and free of hidden fees, making it a reliable choice for new customers.

Pros And Cons Of Truist Banking Promotions

Considering Truist Banking Promotions can be a smart move for potential customers. They offer enticing benefits, but it’s crucial to weigh both the pros and cons before making a decision.

Advantages Of Joining Truist Promotions

One of the significant advantages is the $400 bonus offer. New customers can earn this bonus by opening a Truist One Checking Account online and completing qualifying activities.

No overdraft fees is another appealing feature. This ensures customers avoid unexpected charges, making budgeting simpler. Additionally, the automatic upgrades feature means the account evolves as you maintain it, potentially offering more benefits over time.

Managing your account is convenient with the Truist mobile app. It provides quick access and insights into your spending, making financial management easier. The qualification process is straightforward: open an account online and complete two direct deposits totaling $1,000 within 120 days.

| Feature | Details |

|---|---|

| $400 Bonus Offer | Earn by opening an account online and completing qualifying activities. |

| No Overdraft Fees | Avoid unexpected charges and simplify budgeting. |

| Automatic Upgrades | Your account evolves as you maintain it. |

| Truist Mobile App | Manage your account with quick access and spending insights. |

Potential Drawbacks To Consider

While Truist promotions are attractive, there are some potential drawbacks. The bonus forfeiture policy is one. If the account is closed, changed to a non-eligible type, or has a zero or negative balance before the bonus is deposited, you will lose the bonus.

Another potential issue is the requirement to use a promo code during the online account opening process. If you forget to use the promo code DC2425TR1400, you may not qualify for the bonus.

Lastly, the offer is only valid for accounts opened between 10/31/2024 and 4/30/2025. This limited timeframe may not suit everyone.

| Drawback | Details |

|---|---|

| Bonus Forfeiture | Loss of bonus if account conditions are not met. |

| Promo Code Required | Must use promo code during account opening to qualify. |

| Limited Offer Validity | Account must be opened between 10/31/2024 and 4/30/2025. |

Ideal Users For Truist Banking Promotions

The Truist One Checking Account offers many benefits. Automatic upgrades and no overdraft fees stand out. But who benefits the most? Let’s explore the ideal users for Truist banking promotions.

Best Suited For New Customers

New customers can earn a $400 bonus. Simply open an account online and complete qualifying activities. Two direct deposits totaling $1,000 within 120 days are required. This offer is quite attractive. Easy qualification makes it accessible to many.

Additionally, managing the account is simple. Use the Truist mobile app for quick access and spending insights.

Ideal For Business Account Holders

Truist One Checking Account can also benefit business account holders. The automatic upgrades feature is helpful. It ensures the account evolves with your needs. No overdraft fees mean no surprise charges. This is a significant advantage for businesses managing cash flow.

Online account management adds convenience. It allows business owners to monitor finances effortlessly.

Beneficial For Existing Truist Customers

Existing Truist customers can also benefit. The automatic upgrades ensure the account stays relevant. No overdraft fees provide peace of mind. However, existing customers must meet certain criteria. They must not have a recent Truist checking account.

These features make it a beneficial option for many. The Truist mobile app enhances the user experience. It offers easy access and management of your finances.

Conclusion: Should You Opt For Truist Banking Promotions?

Choosing the right bank account can be challenging. Truist One Checking Account offers several attractive features. Let’s explore if these benefits align with your financial goals.

Summary Of Key Benefits

| Feature | Details |

|---|---|

| Automatic Upgrades | The account upgrades automatically as you maintain it. |

| No Overdraft Fees | No fees for overdrafts, saving you money. |

| Online Account Management | Manage your account with the Truist mobile app. |

| $400 Bonus Offer | Earn a $400 bonus by meeting simple qualifications. |

| Easy Qualification | Open an account online and complete two direct deposits totaling $1,000 within 120 days. |

Final Recommendations

Before opting for the Truist One Checking Account, consider these points:

- Automatic Upgrades: Ideal if you prefer an account that grows with you.

- No Overdraft Fees: Suitable if you want to avoid extra charges.

- $400 Bonus: Attractive if you meet the qualifying activities.

- Online Account Management: Convenient for those who like to manage their finances digitally.

Evaluate your personal and financial needs. If these features align with your goals, the Truist One Checking Account might be a great fit for you.

Frequently Asked Questions

What Are Current Truist Banking Promotions?

Truist offers various promotions for new customers, including cash bonuses and rewards. Check their website for the latest deals.

How Do I Qualify For Truist Bonuses?

To qualify for Truist bonuses, meet specific account requirements like minimum deposits and direct deposits. Details vary by promotion.

Are Truist Promotions Available Nationwide?

Yes, Truist promotions are available nationwide. However, specific offers may vary by region. Check their website for details.

Can Existing Customers Get Truist Promotions?

Most Truist promotions target new customers. Existing customers can check for special offers or loyalty programs on the Truist website.

Conclusion

Truist Banking Promotions offer a great opportunity. The Truist One Checking Account stands out. With its automatic upgrades and no overdraft fees, it appeals to many. The $400 bonus is also a significant advantage. To enjoy these benefits, open your account online today. Don’t forget to use promo code DC2425TR1400. Manage your finances easily with the Truist mobile app. Ready to get started? Learn more and sign up here.