Truist Account Security Features: Safeguard Your Finances Today

In today’s digital age, account security is a top priority for everyone. Truist recognizes this need and has implemented robust security features to protect your financial information.

Whether you’re a new customer or a long-time account holder, it’s essential to understand the security measures in place. Truist’s commitment to protecting your data ensures peace of mind as you manage your finances. From automatic upgrades to no overdraft fees, Truist offers a hassle-free banking experience. Learn more about how Truist safeguards your account and why it’s a smart choice for your banking needs. Dive into the details of Truist’s account security features and discover how they keep your financial information secure. For more information, visit Truist.

Introduction To Truist Account Security Features

Truist Bank offers a range of security features to keep your financial information safe. Learn more about the bank and the purpose of these security features below.

Overview Of Truist Bank

Truist Bank, formed by the merger of BB&T and SunTrust, is one of the largest financial institutions in the United States. It provides a variety of banking services, including checking accounts, credit cards, loans, and more. Truist aims to deliver a reliable and secure banking experience for all its customers.

Purpose Of Truist Account Security Features

The primary goal of Truist’s account security features is to protect your personal and financial data. These features include:

- Multi-factor authentication to ensure only authorized access.

- Encryption of sensitive information to prevent data breaches.

- Real-time fraud monitoring to detect and alert suspicious activities.

- Secure online and mobile banking platforms with robust security measures.

These measures help safeguard your account against unauthorized access and fraud, providing peace of mind and a secure banking experience.

Multi-factor Authentication

Truist prioritizes your account security. One of the key features is Multi-Factor Authentication (MFA). This feature adds an extra layer of protection to your account, ensuring that only you can access your personal information.

What Is Multi-factor Authentication?

Multi-Factor Authentication, or MFA, is a security process that requires more than one method of authentication. This typically involves a combination of:

- Something you know (password or PIN)

- Something you have (smartphone or token)

- Something you are (fingerprint or facial recognition)

By using multiple factors, MFA makes it much harder for unauthorized users to gain access.

How Truist Implements Multi-factor Authentication

Truist uses a robust MFA system to protect your Truist One Checking Account. Here is how it works:

- When you log in, you enter your username and password.

- You receive a one-time code on your registered mobile device.

- You enter this code to complete the login process.

This simple yet effective method ensures your account remains secure.

Benefits Of Multi-factor Authentication For Users

Using MFA has several benefits for Truist One Checking Account holders:

| Benefits | Description |

|---|---|

| Enhanced Security | MFA adds an extra layer of protection, reducing the risk of unauthorized access. |

| Peace of Mind | Users can be confident that their account information is secure. |

| Easy to Use | The process is straightforward and does not require technical skills. |

With MFA, Truist ensures that your banking experience is both safe and convenient.

Real-time Fraud Monitoring

Real-time fraud monitoring is a crucial feature of the Truist One Checking Account. It ensures the security of your financial transactions. This feature provides peace of mind by continuously scanning for suspicious activities.

Understanding Real-time Fraud Monitoring

Real-time fraud monitoring is a system that watches your account activities round-the-clock. It detects unusual patterns and transactions instantly. This helps in identifying fraudulent activities as they occur.

How Truist Detects Fraud In Real-time

Truist uses advanced algorithms and machine learning to monitor transactions. The system compares each transaction against your usual banking behavior. If something seems off, it triggers an alert. You are notified immediately. This rapid response helps in preventing unauthorized access and loss of funds.

Advantages Of Real-time Fraud Monitoring For Account Holders

- Immediate Alerts: Stay informed about suspicious activities instantly.

- Enhanced Security: Protects your account from unauthorized access.

- Peace of Mind: You can bank confidently knowing your account is monitored 24/7.

With Truist’s real-time fraud monitoring, your financial security is a top priority. Enjoy hassle-free banking and focus on what matters most to you.

Encrypted Transactions

In today’s digital age, ensuring the security of your financial transactions is crucial. Truist’s One Checking Account offers robust encrypted transactions to safeguard your sensitive information. This section delves into the importance and standards of encryption that Truist employs.

Importance Of Transaction Encryption

Encryption plays a pivotal role in online banking. It protects your data from unauthorized access. When you perform transactions, encryption transforms your information into a secure code. This ensures that only authorized parties can decode and access it.

Without encryption, your financial details would be vulnerable to cyber threats. This includes hacking and identity theft. Therefore, encryption is essential for maintaining the integrity and confidentiality of your data.

Truist’s Encryption Standards

Truist employs industry-leading encryption standards. These standards ensure that your transactions are secure. Truist uses 256-bit encryption for data transmission. This level of encryption is used by governments and financial institutions worldwide.

Additionally, Truist adheres to PCI DSS (Payment Card Industry Data Security Standard) compliance. This ensures that your credit card information is handled securely. Truist’s encryption standards are designed to offer you peace of mind.

Protecting User Data With Encrypted Transactions

Truist’s encrypted transactions protect user data from potential breaches. When you log in to your account or make a transaction, your data is encrypted. This means it is converted into a secure code. This secure code can only be read by authorized systems.

By using encrypted transactions, Truist ensures the privacy and security of your financial activities. This helps in preventing unauthorized access and fraud. With Truist, you can bank online with confidence knowing your data is protected.

| Feature | Details |

|---|---|

| Encryption Level | 256-bit |

| Compliance | PCI DSS |

| Protection | Data and Transactions |

For more information about Truist’s One Checking Account and its security features, visit the official website.

Biometric Verification

Truist offers robust security features for its Truist One Checking Account, including biometric verification. This advanced technology ensures that your account remains secure and accessible only to you.

Types Of Biometric Verification Used By Truist

Truist uses several types of biometric verification to enhance security:

- Fingerprint Recognition: This method uses your unique fingerprint to verify your identity.

- Facial Recognition: Truist employs facial recognition technology to confirm your identity.

- Voice Recognition: Your voice pattern can also be used as a biometric identifier.

Security Benefits Of Biometric Verification

Biometric verification offers numerous security benefits for Truist One Checking Account holders:

- Enhanced Security: Biometric data is unique to you, making it difficult for unauthorized users to access your account.

- Quick Access: Biometric methods provide faster access compared to traditional passwords.

- Reduced Fraud Risk: Biometric verification significantly reduces the risk of fraud and identity theft.

User Experience With Biometric Verification

Truist ensures a seamless user experience with biometric verification:

- Easy Setup: Setting up biometric verification is quick and straightforward.

- Convenient Access: Users can easily access their accounts without remembering complex passwords.

- Reliable Authentication: Biometric verification provides consistent and reliable authentication every time.

Overall, Truist’s biometric verification enhances security and convenience for users of the Truist One Checking Account.

Account Alerts And Notifications

Account alerts and notifications are essential features of the Truist One Checking Account. They provide an extra layer of security and keep you informed about your account activities. Understanding how these alerts work can help you manage your finances effectively.

Types Of Account Alerts Provided By Truist

Truist offers various types of account alerts to keep you updated:

- Balance Alerts: Notifies you when your account balance falls below a specific amount.

- Transaction Alerts: Updates you on any transaction activity, including deposits and withdrawals.

- Bill Payment Alerts: Reminds you of upcoming bill payments and confirms successful payments.

- Security Alerts: Alerts you to any suspicious or unusual activity on your account.

Setting Up Account Alerts

Setting up account alerts is straightforward and can be done through the Truist online banking portal:

- Log in to your Truist online banking account.

- Navigate to the “Alerts” section in the settings menu.

- Select the types of alerts you wish to receive.

- Customize the alert thresholds and delivery methods (email, SMS, or push notifications).

- Save your settings and start receiving alerts immediately.

How Alerts And Notifications Enhance Security

Account alerts and notifications play a crucial role in enhancing the security of your Truist One Checking Account:

- Immediate Awareness: You get instant updates about any suspicious activity, allowing for quick action.

- Fraud Prevention: Early detection of unusual transactions helps prevent fraud and unauthorized access.

- Peace of Mind: Regular updates give you confidence that your account is secure and monitored.

Incorporating these security features into your daily banking routine can provide a hassle-free and safe banking experience with Truist.

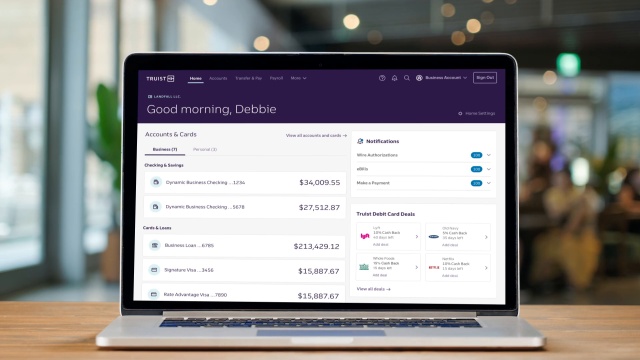

Secure Online And Mobile Banking

In today’s digital age, ensuring your finances are secure is more important than ever. Truist’s online and mobile banking platforms offer robust security features to keep your account safe. Let’s explore the security measures Truist provides and how they benefit users.

Features Of Truist’s Secure Online Banking

Truist offers a variety of features to ensure your online banking experience is secure and seamless. Here are some key features:

- Two-Factor Authentication (2FA): Adds an extra layer of security by requiring a second form of identification.

- Encryption: Ensures that all your data is encrypted, making it difficult for unauthorized users to access your information.

- Automatic Logout: Helps protect your account by automatically logging you out after a period of inactivity.

- Real-Time Alerts: Notifies you of any suspicious activity or changes to your account.

Mobile Banking Security Measures

Truist’s mobile banking is designed to be just as secure as its online banking. Here are some key measures in place:

- Biometric Authentication: Allows you to use fingerprint or facial recognition to access your account.

- Secure Messaging: Provides a safe way to communicate with customer service without exposing your personal information.

- App Lock: Enables you to lock the app with a passcode, adding an extra layer of security.

- Remote Deactivation: Lets you deactivate your mobile banking access if your device is lost or stolen.

User Benefits Of Secure Online And Mobile Banking

Using Truist’s secure online and mobile banking provides several benefits to users:

- Peace of Mind: Knowing your financial information is protected with advanced security features.

- Convenience: Access your account anytime, anywhere with confidence.

- Instant Notifications: Receive real-time alerts to stay informed about your account activity.

- Enhanced Control: Manage your account securely on the go with features like biometric authentication and remote deactivation.

By leveraging these security measures, Truist ensures that your banking experience remains safe and secure, whether you’re online or on the move.

Pricing And Affordability

Truist Retail Checking offers a comprehensive set of security features. This section discusses the costs associated with these features. We will compare them with other banks and assess the value for money.

Cost Of Security Features

The Truist One Checking Account comes with essential security features included in the account. Here are the details:

- Minimum opening deposit: $50

- No overdraft fees: This feature helps avoid unexpected costs.

- Automatic upgrades: Included without additional charges.

These costs are straightforward and help customers easily understand their financial commitments.

Comparative Analysis With Other Banks

Let’s compare Truist’s security features with those offered by other banks:

| Bank | Minimum Deposit | Overdraft Fees | Automatic Upgrades |

|---|---|---|---|

| Truist | $50 | None | Yes |

| Bank A | $100 | $35 per occurrence | No |

| Bank B | $25 | $30 per occurrence | No |

Truist stands out with no overdraft fees and automatic upgrades, unlike many competitors.

Value For Money

The Truist One Checking Account offers significant value for money. Here’s why:

- No overdraft fees: Saves money over time.

- Automatic upgrades: Enhances account benefits without extra costs.

- $400 reward: A great incentive for meeting qualifying activities.

These features make Truist a cost-effective choice for new customers seeking robust account security.

Pros And Cons Of Truist Account Security Features

Truist offers a range of security features to protect your checking account. While these features provide many benefits, there are some limitations. Let’s explore the pros and cons of Truist account security features.

Advantages Of Using Truist Security Features

- Automatic Upgrades: Truist ensures your account benefits from the latest security updates without any effort on your part.

- No Overdraft Fees: Enjoy peace of mind knowing that overdraft fees won’t compromise your account security.

- Online Account Opening: Secure and easy online setup with robust encryption to protect your personal information.

- Fraud Monitoring: Truist employs advanced algorithms to detect and alert you of any suspicious activity on your account.

Limitations And Areas For Improvement

- Account Eligibility: Current or recently closed Truist account holders cannot benefit from some security features.

- Limited Support: Phone assistance is available in Spanish, but other languages may require direct representative contact.

- Reward Forfeiture: Rewards are forfeited if the account balance is zero or negative at verification time, potentially impacting security incentives.

Overall, the Truist One Checking Account provides strong security features, but some areas need improvement to enhance the user experience further.

Ideal Users And Scenarios

The Truist One Checking Account is designed to provide a secure, hassle-free banking experience. With features like automatic upgrades and no overdraft fees, it aims to cater to a wide range of users. Below, we explore the ideal users and scenarios where Truist’s security features excel.

Who Should Use Truist Account Security Features?

- New Customers: Those new to Truist will benefit from secure online account opening.

- Individuals Seeking No Overdraft Fees: Avoid unexpected fees with Truist’s no overdraft policy.

- Tech-Savvy Users: Enjoy automatic upgrades and easy online setup.

- Spanish Speakers: Access phone assistance in Spanish by calling 844-487-8478, option 9.

Scenarios Where Truist Security Features Excel

- Online Account Opening: Open an account securely from the comfort of your home.

- Automatic Upgrades: Enjoy enhanced features without manual intervention.

- Secure Transactions: Perform qualifying direct deposits totaling $1,000 or more within 120 days.

- Reward Processing: Receive a $400 reward within 4 weeks after meeting qualifications, securely deposited into your account.

For additional details or specific scenarios, visit the official Truist website.

Frequently Asked Questions

How Does Truist Protect My Account?

Truist uses advanced encryption and multi-factor authentication to protect your account. They also monitor for suspicious activity 24/7.

What Is Multi-factor Authentication At Truist?

Multi-factor authentication at Truist adds an extra layer of security. It requires a second form of verification, like a code sent to your phone.

Can I Set Up Account Alerts With Truist?

Yes, Truist allows you to set up account alerts. These alerts notify you of any unusual activity or transactions.

How Does Truist Monitor For Fraud?

Truist employs sophisticated fraud detection systems. They continuously monitor your account for any signs of fraudulent activity.

Conclusion

Truist One Checking Account offers robust security features for peace of mind. Enjoy automatic upgrades and no overdraft fees. Open your account online with ease. Earn a $400 reward by completing qualifying activities. Truist ensures a hassle-free banking experience. Protect your finances with Truist One Checking Account. Secure your financial future today with Truist’s trusted features. Simplify your banking with Truist. Enjoy the benefits and stay secure. Ready to take the next step? Learn more about Truist One Checking Account. Start securing your money now.