Truist Account Minimum Balance: Everything You Need to Know

Understanding the minimum balance requirements for a checking account is crucial. It helps you avoid unnecessary fees and manage your finances better.

The Truist One Checking Account is a popular choice among many due to its attractive features and benefits. Opening a Truist One Checking Account not only offers you an opportunity to earn a $400 bonus but also ensures you never worry about overdraft fees. With a minimum opening deposit of $50 and the requirement to maintain an account balance of at least $0.01, it’s an accessible option for many. Additionally, automatic upgrades enhance the account features over time, making banking more convenient. For more details, visit the Truist website. Dive in to learn more about how you can make the most of your checking account with Truist.

Introduction To Truist Account Minimum Balance

Understanding the minimum balance requirements for a checking account is crucial. It helps in avoiding fees and maintaining the benefits associated with the account. The Truist One Checking Account offers several advantages, but it’s important to be aware of its minimum balance requirements to fully leverage its features.

Overview Of Truist Bank

Truist Bank is a leading financial institution in the US, formed from the merger of BB&T and SunTrust Banks. It offers a wide range of banking services, including checking and savings accounts, loans, and credit cards. Truist is known for its customer-centric approach and innovative banking solutions. The Truist One Checking Account is one of its flagship products, designed to provide flexibility and convenience to its customers.

Purpose And Importance Of Minimum Balance Requirements

Minimum balance requirements serve several purposes for both the bank and the customer. For the bank, it ensures a certain level of deposits, which can be used for lending and other financial activities. For customers, maintaining a minimum balance helps avoid fees and qualifies them for certain account benefits.

The Truist One Checking Account requires a minimum opening deposit of $50. To earn the $400 bonus, customers must complete at least two qualifying direct deposits totaling $1,000 or more within 120 days of opening the account and maintain the account in good standing with a balance of at least $0.01. This means that as long as your account balance does not drop to zero or below, you can enjoy the benefits and avoid forfeiting the bonus.

Understanding and adhering to these requirements is essential. It ensures you make the most out of your Truist One Checking Account and avoid any potential penalties. For more detailed information, visit the Truist website or contact their customer service.

Understanding Truist Account Minimum Balance Requirements

Understanding the minimum balance requirements for a Truist account can help you avoid fees and enjoy the full benefits of your banking experience. Here, we break down what a minimum balance is and the specific requirements for different types of accounts at Truist.

Definition Of Minimum Balance

A minimum balance is the smallest amount of money you must keep in your bank account to avoid fees or to receive certain benefits. Banks set these requirements to ensure customers maintain a certain level of account activity and funds.

Types Of Accounts And Their Minimum Balance

Truist offers several types of accounts, each with its own minimum balance requirements. Below is a summary of the minimum balance requirements for a few popular accounts:

| Account Type | Minimum Opening Deposit | Minimum Balance Requirement |

|---|---|---|

| Truist One Checking Account | $50 | $0.01 |

| Truist Savings Account | $50 | $300 |

| Truist Money Market Account | $100 | $1,000 |

The Truist One Checking Account is a popular option with a low minimum balance requirement of just $0.01. New customers can earn a $400 bonus by completing qualifying activities, such as making at least two direct deposits totaling $1,000 or more within 120 days of opening the account.

For those looking for a savings option, the Truist Savings Account requires a minimum opening deposit of $50 and a minimum balance of $300 to avoid fees.

The Truist Money Market Account offers higher interest rates and requires a minimum opening deposit of $100 and a minimum balance of $1,000.

Keeping track of these requirements helps you manage your finances effectively and avoid unnecessary fees. Always check with Truist for the most up-to-date information and details on all their accounts.

Key Features Of Truist Account Minimum Balance

The Truist One Checking Account offers various features that make managing your account simple and convenient. Here are some of the key features of the Truist Account Minimum Balance.

Flexible Minimum Balance Options

The Truist One Checking Account provides flexible minimum balance options to suit different financial needs. For instance, you can open an account with a minimum deposit of just $50. Additionally, to maintain the account in good standing, you only need to keep a balance of at least $0.01. These options ensure that a wide range of customers can access and benefit from the account.

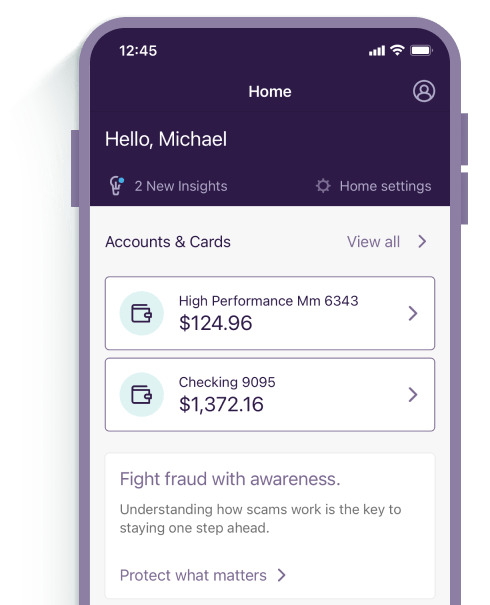

Automatic Balance Alerts

With the Truist One Checking Account, you can set up automatic balance alerts to stay informed about your account status. These alerts can notify you of low balances, large transactions, or any other account activity you choose to monitor. This feature helps you avoid overdrafts and manage your finances more effectively.

Fee Waiver Opportunities

The Truist One Checking Account offers several opportunities to waive fees. One of the most notable features is the absence of overdraft fees, which can save you money and reduce financial stress. Additionally, by maintaining the account in good standing and meeting other requirements, you can avoid various other fees that might apply to other accounts.

These key features make the Truist One Checking Account an attractive option for individuals seeking a flexible and convenient banking solution. For more detailed terms and conditions, visit the Truist website or contact customer service at 800.709.8700.

Benefits Of Maintaining The Minimum Balance

Maintaining the minimum balance in a Truist account helps avoid monthly fees. It also improves your financial discipline and ensures uninterrupted access to banking services.

Maintaining the minimum balance in your Truist One Checking Account offers several advantages. By ensuring your account balance stays above the required threshold, you can enjoy numerous benefits, which enhance your banking experience.Avoiding Account Fees

One of the primary benefits of maintaining the minimum balance is avoiding account fees. Truist One Checking Account has no overdraft fees, which means you won’t incur additional costs for overdrawing your account. Keeping a minimum balance helps ensure that your account remains in good standing, preventing any unnecessary charges.Eligibility For Interest Earnings

Maintaining the minimum balance also makes you eligible for interest earnings. Although the Truist One Checking Account doesn’t explicitly mention interest earnings, many banks offer interest on balances that meet certain criteria. By keeping your account above the minimum balance, you may earn interest, contributing to your savings over time.Access To Additional Banking Services

Another significant advantage is gaining access to additional banking services. With a minimum balance, you may qualify for automatic upgrades and enhanced account features. These upgrades can include better customer service, access to exclusive banking products, and more convenient banking options.Here’s a quick overview of the benefits:

| Benefit | Details |

|---|---|

| Avoiding Account Fees | No overdraft fees and avoiding unnecessary charges. |

| Eligibility for Interest Earnings | Potential to earn interest on your balance. |

| Access to Additional Banking Services | Automatic upgrades and enhanced features. |

Maintaining the minimum balance in your Truist One Checking Account ensures a more efficient and cost-effective banking experience. Stay on top of your finances by keeping your account balance healthy and enjoy the perks that come with it.

Consequences Of Not Meeting The Minimum Balance

Not maintaining the minimum balance in your Truist One Checking Account can lead to several issues. These consequences can affect your finances and account status, and even your credit score. Let’s explore the potential outcomes of failing to meet the minimum balance requirement.

Potential Fees And Penalties

If your Truist One Checking Account balance drops below the required minimum, you may incur fees. Truist may impose a monthly maintenance fee, which can reduce your account balance further. This can lead to additional financial strain.

| Consequence | Details |

|---|---|

| Monthly Maintenance Fee | Charged if the balance falls below the minimum. |

Impact On Account Status

Failing to maintain the required balance may affect your account status. Truist may downgrade your account, resulting in the loss of certain benefits. For example, you might lose the ability to earn the $400 bonus or enjoy automatic upgrades.

- Loss of bonus eligibility

- Downgrade of account features

Effect On Credit Score

Your credit score could be impacted if your Truist account falls below the minimum balance. Negative balances or account closures can be reported to credit bureaus. This could result in a lower credit score, affecting your ability to secure loans or credit cards in the future.

- Negative balance impacts

- Potential account closure

- Credit report notifications

Maintaining the minimum balance in your Truist One Checking Account is crucial. It helps you avoid fees, maintain account status, and protect your credit score.

Strategies To Maintain The Minimum Balance

Maintaining the minimum balance in your Truist One Checking Account ensures you reap the benefits of the account, including no overdraft fees and potential bonuses. Here are practical strategies to help keep your balance above the required threshold.

Setting Up Direct Deposits

One of the most effective strategies is to set up direct deposits. With direct deposits, your paycheck is automatically deposited into your account. This method ensures regular inflows of cash, keeping your balance above the minimum required.

- Speak to your employer about setting up direct deposits.

- Ensure that at least two qualifying direct deposits totaling $1,000 or more are made within 120 days of account opening.

Regularly Monitoring Account Balance

Keeping an eye on your account balance is crucial. Regular monitoring helps you stay aware of your financial status and avoid falling below the minimum balance.

- Log into your online account frequently to check your balance.

- Set up alerts to notify you when your balance is low.

Utilizing Automatic Transfers

Automatic transfers can be a lifesaver. Set up recurring transfers from another account to your Truist One Checking Account to ensure a steady flow of funds.

- Schedule monthly transfers that align with your pay dates or other income sources.

- Ensure the transfer amount is sufficient to maintain the minimum balance.

By implementing these strategies, you can effectively maintain the minimum balance required for your Truist One Checking Account, ensuring you continue to enjoy the account’s benefits.

Pricing And Affordability Of Truist Accounts

The Truist One Checking Account provides a blend of affordability and convenience. This account is designed to cater to your banking needs with a variety of cost-effective features. Whether you are a new customer or looking to switch, Truist offers competitive pricing and benefits that enhance your banking experience.

Comparison Of Account Maintenance Fees

Understanding the maintenance fees associated with your checking account is crucial. Truist One Checking Account offers no overdraft fees, ensuring you save money. Below is a table comparing the maintenance fees for different Truist accounts.

| Account Type | Monthly Maintenance Fee | Overdraft Fees | Minimum Balance Requirement |

|---|---|---|---|

| Truist One Checking | $0 | $0 | $0.01 |

| Truist Premier Checking | $25 | $36 | $25,000 |

| Truist Student Checking | $0 | $0 | $0 |

Cost-effective Account Options

Truist offers several cost-effective account options to suit various financial needs. The Truist One Checking Account stands out for its low-cost benefits:

- No minimum balance required beyond $0.01

- No overdraft fees, saving you unexpected charges

- Low opening deposit of $50

By choosing Truist One Checking, you can manage your finances efficiently without worrying about excessive fees.

Special Offers And Discounts

Truist provides special offers and discounts to attract new customers. One such offer includes a $400 bonus upon meeting certain criteria:

- Open a new Truist One Checking account online using promo code DC2425TR1400.

- Complete at least 2 qualifying direct deposits totaling $1,000 or more within 120 days.

- Maintain the account with a balance of at least $0.01.

Eligible customers will receive the $400 bonus within 4 weeks after fulfilling the requirements. This special offer makes Truist One Checking a lucrative option for new customers.

Pros And Cons Of Truist Account Minimum Balance

The Truist One Checking Account is a popular choice for many. Understanding the pros and cons of its minimum balance requirements can help you decide if it’s right for you.

Advantages Of Minimum Balance Requirements

The minimum balance requirements come with several benefits. Here are some key advantages:

- Financial Incentive: Meeting the minimum balance can make you eligible for a $400 bonus.

- No Overdraft Fees: By maintaining the minimum balance, you avoid potential overdraft fees.

- Account Upgrades: The account offers automatic upgrades, improving your banking experience over time.

These advantages make the Truist One Checking Account an attractive option for many.

Disadvantages And Potential Drawbacks

While there are many benefits, there are also some potential drawbacks to consider:

- Minimum Opening Deposit: You need $50 to open the account.

- Qualification Requirements: You must complete at least two direct deposits totaling $1,000 within 120 days.

- Potential Bonus Forfeiture: If the account balance drops below $0.01, you could forfeit the $400 bonus.

These factors can be challenging for some customers. It’s important to weigh these pros and cons carefully.

For detailed terms and conditions, visit the Truist website or contact customer service at 800.709.8700.

Recommendations For Ideal Users

The Truist One Checking Account is ideal for individuals who seek a simple and rewarding banking experience. Its financial incentives, such as the $400 bonus and no overdraft fees, make it attractive for new customers. Below are recommendations for new and long-term account holders.

Best Practices For New Account Holders

New account holders should follow these steps to maximize their benefits:

- Open an account online: Use the promo code DC2425TR1400 during the process.

- Complete qualifying activities: Make at least two direct deposits totaling $1,000 within 120 days.

- Maintain a positive balance: Ensure your balance stays above $0.01 to qualify for the bonus.

- Monitor account status: Keep track of your account to avoid any issues that may lead to forfeiture of the $400 bonus.

Following these best practices will help new customers fully benefit from their Truist One Checking Account.

Suggestions For Long-term Account Management

Long-term users should focus on maintaining their account efficiently:

- Regularly check your balance: Ensure it stays positive to avoid any penalties.

- Utilize automatic upgrades: Take advantage of the enhanced features over time.

- Avoid overdrafts: With no overdraft fees, it is easy to manage your spending.

- Stay informed: Regularly visit the Truist website or contact customer service for updates and additional offers.

These suggestions will help users maximize the benefits and convenience of their Truist One Checking Account over the long term.

Frequently Asked Questions

What Is The Minimum Balance For A Truist Account?

The minimum balance for a Truist account varies by account type. Checking accounts may have different requirements than savings accounts. Please check Truist’s official website for specific details.

Does Truist Charge Fees For Low Balances?

Yes, Truist may charge fees if your account balance falls below the required minimum. It’s important to maintain the minimum balance to avoid these fees.

How To Avoid Truist Account Minimum Balance Fees?

To avoid minimum balance fees, maintain the required minimum balance or set up direct deposits. Some accounts also waive fees if you meet certain conditions.

Can I Open A Truist Account With Zero Balance?

Some Truist accounts may allow you to open with a zero balance. However, you need to meet the minimum balance requirement soon after to avoid fees.

Conclusion

Understanding the Truist One Checking Account’s minimum balance requirements is crucial. This account offers a $400 bonus for new customers. It also includes automatic upgrades and no overdraft fees. With a minimum opening deposit of $50, it’s accessible to many. For more information, visit the Truist website. Keep your balance positive and enjoy the benefits. Happy banking!