Travel Expense Integration: Simplify Your Business Trips Today

Managing travel expenses is a crucial task for businesses of all sizes. It ensures efficient spending and helps maintain financial health.

Travel expense integration can simplify this process significantly. Travel expense integration merges various travel and expense management tasks into a unified system. This approach helps businesses save time, ensure compliance, and gain financial insights. One such solution is Emburse, which offers innovative software designed to streamline travel and expense management. Emburse provides flexible solutions tailored to unique organizational needs, mobile-friendly travel management, and automated accounts payable. These features help control costs and improve cash flow visibility. By integrating these processes, businesses can make data-driven decisions and reduce wasteful spending. Learn more about how Emburse can transform your travel expense management by visiting their website here.

Introduction To Travel Expense Integration

Travel expense integration is an essential component for modern businesses. It ensures seamless financial management and compliance. In this section, we will delve into the core aspects of travel expense integration and its significance.

What Is Travel Expense Integration?

Travel expense integration involves the synchronization of travel and expense data within a unified platform. It enables businesses to manage travel bookings, expense reports, and financial transactions efficiently.

Solutions like Emburse Travel and Expense Management Software offer comprehensive features. These include mobile-friendly travel solutions and flexible expense management tools. They aim to streamline processes and enhance user experience.

Purpose And Importance Of Travel Expense Integration

The primary purpose of travel expense integration is to improve operational efficiency. It helps businesses save time by automating and streamlining processes.

| Benefit | Description |

|---|---|

| Time Efficiency | Automates and streamlines processes to save time. |

| Compliance | Ensures adherence to company policies with user-friendly solutions. |

| Financial Visibility | Provides real-time insights into spending and cash flow. |

| Customization | Offers highly configurable solutions to meet evolving business needs. |

| Security | Ensures robust global security and data processing standards. |

Integrating travel and expense management systems also enhances financial visibility. Businesses gain real-time insights into spending and cash flow, allowing for better financial planning.

Moreover, solutions like Emburse provide tailored vertical expense solutions. These are designed to meet unique organizational needs, ensuring flexibility and customization.

Compliance is another critical aspect. Travel expense integration ensures adherence to company policies, reducing the risk of errors and fraud. User-friendly solutions help employees easily follow guidelines, fostering a culture of compliance.

Lastly, security is paramount. Emburse emphasizes minimizing risk and ensuring data security with robust global standards. This is vital for protecting sensitive financial information.

For more details on Emburse Travel and Expense Management Software, visit their website.

Key Features Of Travel Expense Integration Tools

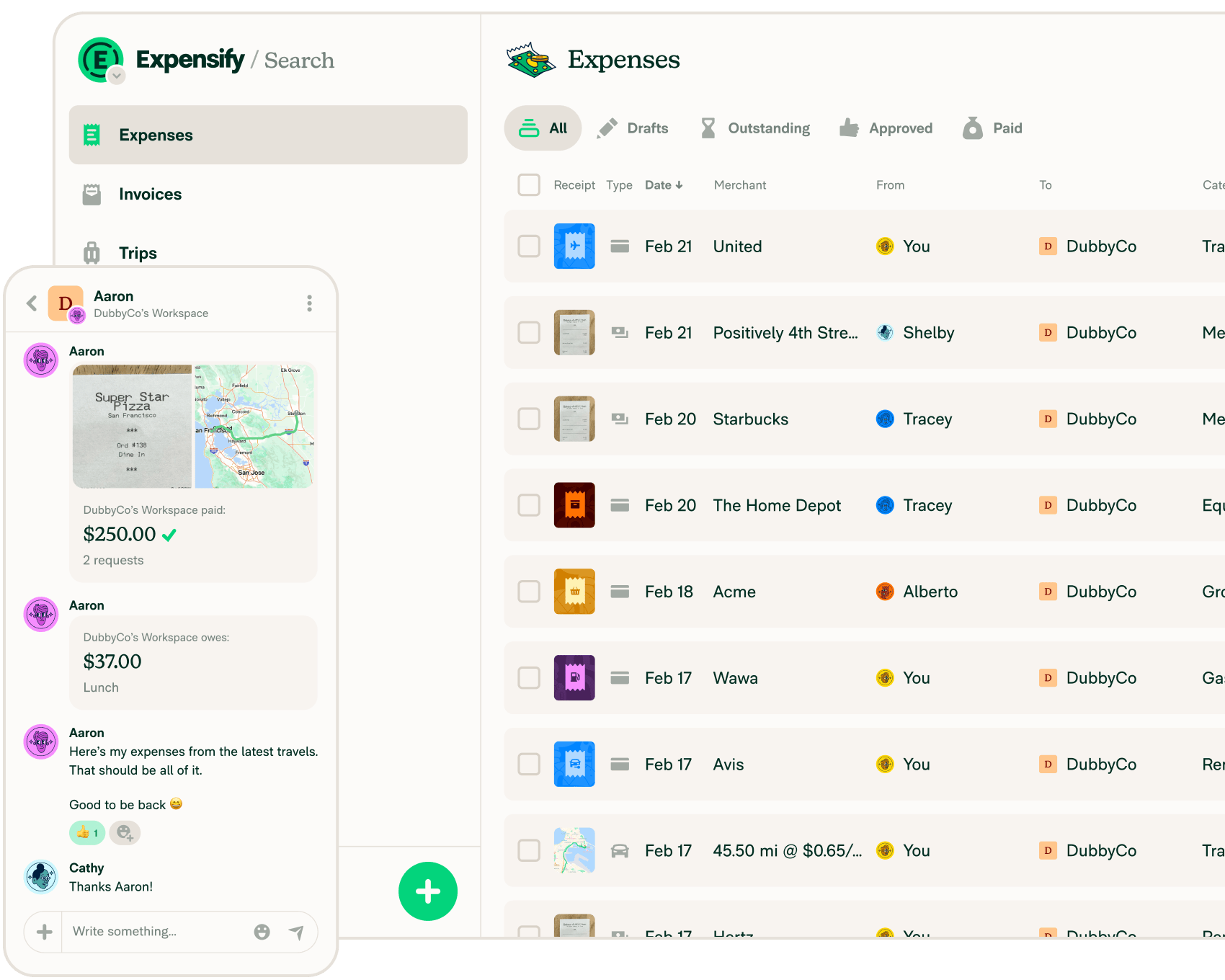

Travel expense integration tools offer significant benefits to businesses. These tools streamline processes, ensure compliance, and provide financial insights. Key features include automated expense tracking, seamless receipt management, real-time expense reporting, integration with financial software, and customizable expense policies.

Automated Expense Tracking

Automated expense tracking eliminates the need for manual data entry. This feature captures expenses directly from credit cards and other sources. It reduces errors and saves time. Emburse’s solution offers proactive controls and insights, making it easier to manage expenses efficiently.

Seamless Receipt Management

Seamless receipt management allows users to capture and store receipts digitally. This feature simplifies the process of matching receipts with expenses. With Emburse, users can snap a photo of their receipt and the software will automatically link it to the corresponding expense. This ensures compliance and makes auditing easier.

Real-time Expense Reporting

Real-time expense reporting provides immediate insights into spending. Businesses can monitor expenses as they occur, allowing for better financial visibility and control. Emburse’s data insights empower users to make data-driven decisions and identify wasteful spending quickly.

Integration With Financial Software

Integration with financial software ensures that all expense data is synced across systems. This feature supports streamlined financial processes and accurate record-keeping. Emburse integrates seamlessly with various financial software, improving overall efficiency and cash flow visibility.

Customizable Expense Policies

Customizable expense policies allow businesses to tailor rules and guidelines to their specific needs. Emburse offers highly configurable solutions that can adapt to evolving business requirements. This ensures adherence to policies and enhances compliance.

| Feature | Benefit |

|---|---|

| Automated Expense Tracking | Reduces errors, saves time |

| Seamless Receipt Management | Ensures compliance, simplifies auditing |

| Real-Time Expense Reporting | Improves financial visibility, control |

| Integration with Financial Software | Supports streamlined processes |

| Customizable Expense Policies | Ensures adherence to policies |

Benefits Of Using Travel Expense Integration

Travel expense integration offers numerous benefits for companies. It streamlines processes, saves time, and improves financial management. Using a tool like Emburse can greatly enhance efficiency and compliance.

Time Savings For Employees

With travel expense integration, employees save significant time. Manual entry and approvals are automated. This allows employees to focus on their core tasks. The mobile-friendly travel solutions from Emburse ensure easy access and use. This drives adoption and policy adherence.

Enhanced Accuracy In Expense Reporting

Automation reduces human errors in expense reporting. Integrated systems like Emburse provide proactive controls and insights. This ensures accurate and reliable data entry. Tailored solutions meet unique organizational needs, further enhancing accuracy.

Improved Financial Oversight

Travel expense integration offers real-time insights into spending. Emburse’s data insights and analytics empower businesses to make data-driven decisions. The tools help identify and reduce wasteful spending. This ensures better control over financial resources.

Reduced Administrative Burden

By automating accounts payable, Emburse simplifies payment and purchasing. This reduces the administrative burden on finance teams. The streamlined process improves cash flow visibility and control costs. Employees no longer need to manage cumbersome paperwork.

Enhanced Compliance With Company Policies

Integrated travel expense solutions ensure adherence to company policies. Emburse provides user-friendly solutions for compliance. The customizable travel management app allows for policy adjustments as needed. This ensures all expenses align with company guidelines.

For more details on Emburse’s travel and expense management software, visit their website.

Pricing And Affordability Breakdown

Understanding the cost of travel and expense management software is crucial. Emburse offers various pricing models that cater to different business needs. Let’s dive into the details to help you make an informed decision.

Overview Of Pricing Models

Emburse does not provide specific pricing details publicly. Interested users should contact Emburse for a quote. This approach allows for tailored solutions that fit unique organizational needs.

| Feature | Details |

|---|---|

| Expense Management | Flexible, proactive controls, tailored solutions. |

| Travel Management | Mobile-friendly, customizable app. |

| Payments & Invoice Management | Automate accounts payable, streamline payments. |

| Insights & Analytics | Data insights, reduce wasteful spending. |

Cost Vs. Benefit Analysis

Cost Efficiency: Emburse helps businesses save time by automating processes. This time efficiency translates into cost savings.

Compliance: Ensuring adherence to policies minimizes risks and potential fines.

Financial Visibility: Real-time insights into spending help manage budgets better.

Customization: Tailored solutions meet evolving business needs, providing long-term value.

Security: Robust security standards protect sensitive data, reducing potential data breach costs.

Free Vs. Paid Versions: What To Consider

Emburse does not offer a free version, but they provide tailored quotes based on specific needs. Key considerations include:

- Features Needed: Identify which features are essential for your business.

- Scalability: Ensure the solution can grow with your business.

- Support: Access to customer support and resources.

- Customization: Ability to tailor the software to your needs.

Contact Emburse for a detailed quote and more information on their pricing models.

Pros And Cons Based On Real-world Usage

Emburse Travel and Expense Management Software Solutions have gained popularity among businesses. Users report various advantages and some challenges. Let’s explore the pros and cons based on real-world usage.

Advantages Experienced By Users

Many users find Emburse beneficial for its time efficiency. Automating and streamlining processes save valuable time. The software ensures compliance with policies through user-friendly solutions. This minimizes errors and improves adherence.

Financial visibility is another advantage. Real-time insights into spending and cash flow help businesses make informed decisions. Emburse’s customization options allow organizations to tailor the software to their evolving needs. The software also boasts robust security features, ensuring data protection.

- Time Efficiency: Saves time by automating processes.

- Compliance: Ensures adherence to policies.

- Financial Visibility: Provides real-time insights into spending.

- Customization: Highly configurable to meet business needs.

- Security: Strong data protection standards.

Common Challenges And Limitations

While users appreciate the benefits, some challenges are noted. One common issue is the lack of specific pricing details. Users need to contact Emburse for quotes, which can be inconvenient.

Another limitation is the absence of detailed refund or return policies. Users must reach out to Emburse for this information. Some users also mention a learning curve when first using the software. However, most find it manageable with the available support.

- Pricing: Lack of specific details.

- Refund Policies: No detailed information provided.

- Learning Curve: Initial setup may require support.

User Feedback And Testimonials

Many users share positive feedback about Emburse. They highlight the significant impact on their businesses. For instance, one user stated, “Emburse has transformed our expense management. We save hours each week.”

Another user praised the financial insights, saying, “The real-time data helps us control spending better.” The customization options also receive compliments. Users appreciate the ability to tailor the software to their needs.

Emburse Champion Awards recognize outstanding users. This further emphasizes the positive user experiences. Overall, the feedback reflects satisfaction with the software’s capabilities.

Testimonials:

“Emburse has transformed our expense management. We save hours each week.” – Satisfied User

“The real-time data helps us control spending better.” – Happy Customer

For more information, visit the Emburse website.

Specific Recommendations For Ideal Users Or Scenarios

Emburse Travel and Expense Management Software Solutions provide a wide array of benefits for various types of users. Understanding the most suitable scenarios can help organizations maximize the advantages of this innovative tool.

Best Suited For Small To Medium-sized Enterprises

Emburse is an excellent fit for small to medium-sized enterprises (SMEs) that need efficient expense management. These businesses often face challenges with limited resources and budget constraints. Emburse offers:

- Flexible solutions with proactive controls

- Tailored expense solutions for unique needs

- Automated accounts payable to control costs

With these features, SMEs can save time and ensure policy compliance without straining their resources.

Perfect For Frequent Business Travelers

For frequent business travelers, Emburse provides mobile-friendly travel solutions. This drives policy adherence and ensures convenience:

- Customizable travel management app

- Real-time insights into travel expenses

- User-friendly interface for quick access

Travelers can manage their expenses on the go, making it easier to stay compliant and efficient.

Ideal For Companies With Complex Expense Policies

Companies with complex expense policies need a robust system to manage their expenses. Emburse offers:

- Highly configurable solutions

- Proactive controls to ensure policy adherence

- Data insights for informed decision-making

These features help organizations streamline their processes and gain financial visibility.

Frequently Asked Questions

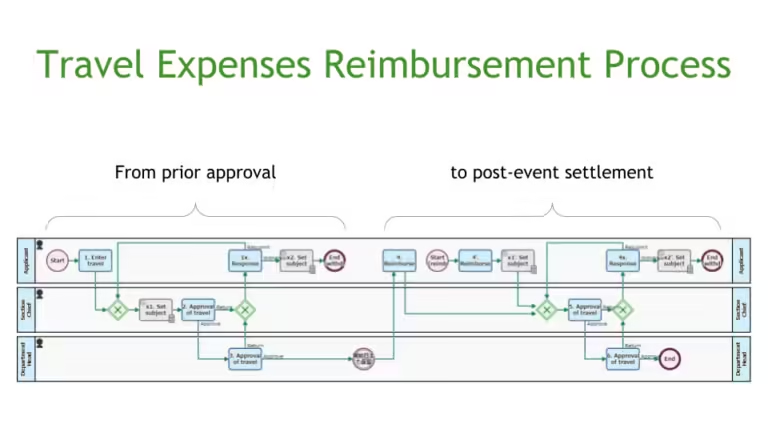

What Is Travel Expense Integration?

Travel expense integration is the process of merging travel expense data with financial systems. This ensures seamless tracking and management of travel-related expenses.

Why Is Travel Expense Integration Important?

Travel expense integration is important because it simplifies expense tracking. It reduces errors and streamlines the reimbursement process, enhancing financial accuracy.

How Does Travel Expense Integration Work?

Travel expense integration works by automatically syncing travel expenses with accounting systems. This ensures real-time updates and accurate financial records.

What Are The Benefits Of Travel Expense Integration?

The benefits of travel expense integration include improved financial accuracy, time savings, reduced manual errors, and enhanced expense visibility.

Conclusion

Wrapping up, travel expense integration can transform your financial management. Embrace Emburse’s robust solutions to streamline processes. Enjoy efficiency and compliance with ease. Gain insights and control over your expenses. Ready to enhance your travel and expense management? Learn more about Emburse today.