Square Transaction Fees: Everything You Need to Know

Square Transaction Fees Understanding Square transaction fees is crucial for business owners. These fees can impact your bottom line significantly.

Square is a trusted platform for businesses worldwide. It offers POS systems, secure payments, order management, and more. One key aspect to consider is the transaction fees. These fees apply whenever you process a payment using Square’s services. They are essential for maintaining the platform’s operations and security. Knowing these fees helps you manage costs better and plan your pricing strategy effectively. In this blog post, we’ll explore everything you need to know about Square transaction fees. This will help you make informed decisions for your business. For more details, visit the Square website.

Introduction To Square Transaction Fees

Square is a popular payment processor known for its simplicity and reliability. Understanding Square’s transaction fees is crucial for businesses aiming to manage their finances effectively.

Overview Of Square As A Payment Processor

Square is a comprehensive platform designed to help businesses run smoothly. It supports secure payments, order management, and team management.

| Feature | Description |

|---|---|

| Point of Sale (POS) Systems | Facilitates seamless sales anywhere. |

| Order Management | Supports click and collect, online ordering, local delivery, and shipping options. |

| Custom-Tailored Suites | Specialized for restaurants, retail, and beauty businesses. |

Millions of businesses globally trust Square for its advanced features. These include operational management, cash flow management, and customer data insights.

Purpose Of Square Transaction Fees

Square charges transaction fees to maintain its secure and efficient payment processing services. These fees allow Square to offer advanced features and support to businesses.

- Instant Transfers: Available for a small fee.

- Next-Business-Day Transfers: Free of charge.

- Loans: Customized based on sales, with specific terms and conditions.

By understanding these fees, businesses can better manage their finances and leverage Square’s tools for growth.

Understanding Square’s Fee Structure

Square offers a versatile platform for businesses to manage sales and payments. To use Square effectively, you need to understand its fee structure. This knowledge helps you manage costs and optimize your business operations.

Types Of Fees Charged By Square

Square charges several types of fees for its services. Here are the most common fees:

- Transaction Fees: These are fees applied to each sale processed through Square.

- Instant Transfer Fees: Fees for transferring funds instantly to your bank account.

- Custom-Tailored Suites Fees: Specialized product suites for specific business types, such as restaurants or retail.

How Square Calculates Transaction Fees

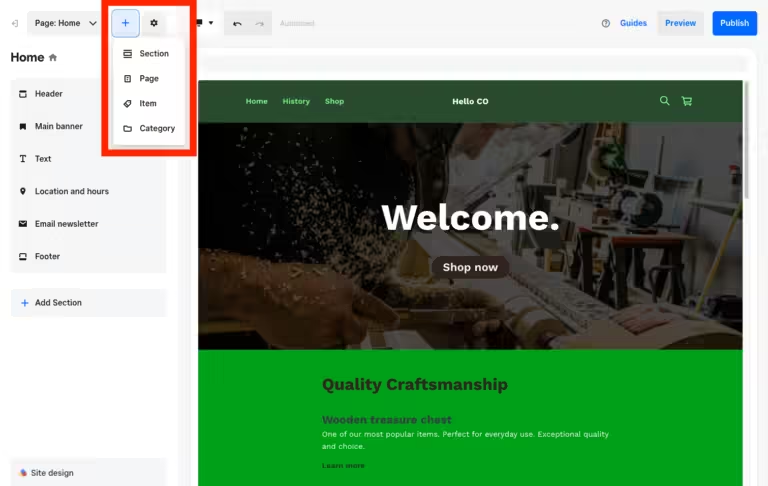

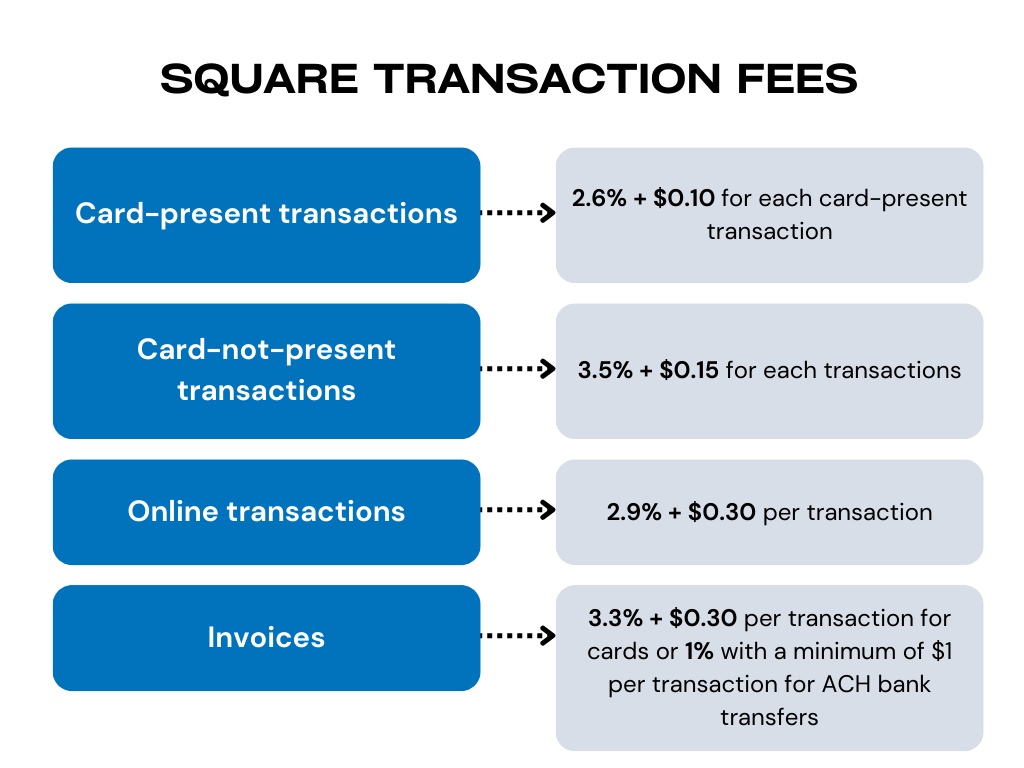

Square’s transaction fees depend on the type of payment processed. Here is a breakdown:

| Payment Type | Fee |

|---|---|

| In-Person Payments | 2.6% + 10¢ per transaction |

| Online Payments | 2.9% + 30¢ per transaction |

| Manual Keyed-in Payments | 3.5% + 15¢ per transaction |

For instance, if you process a $100 in-person payment, the fee would be $2.70 (2.6% of $100 + 10¢).

Understanding these fees helps you plan your pricing strategy. It ensures you cover the costs and maintain profitability.

Key Features Of Square’s Transaction Fees

Square offers a comprehensive platform for businesses to streamline their operations. One of the key aspects that make Square attractive to businesses is its transaction fee structure. Below are some key features of Square’s transaction fees:

Flat Rate Pricing Model

Square uses a flat rate pricing model for its transaction fees. This means you pay a consistent fee percentage for every transaction, regardless of the type or amount. This model simplifies budgeting and eliminates the need to calculate different fees for various types of payments.

| Transaction Type | Fee Percentage |

|---|---|

| In-Person Payments | 2.6% + 10¢ per swipe |

| Online Payments | 2.9% + 30¢ per transaction |

| Invoice Payments | 2.9% + 30¢ per transaction |

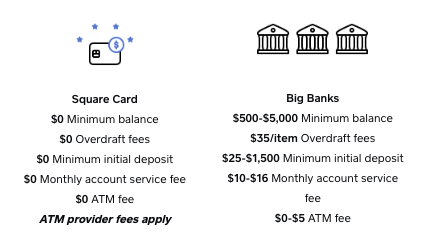

No Hidden Fees

Square prides itself on having no hidden fees. You won’t find any monthly fees, statement fees, or PCI compliance fees. This transparency ensures that what you see is what you get, making it easier to manage your business finances.

- No monthly fees

- No statement fees

- No PCI compliance fees

Transparent Fee Disclosure

Square provides transparent fee disclosure. You can easily view and understand all the fees associated with your transactions. This clarity helps you make informed decisions and keeps you aware of the costs involved in processing payments.

- Detailed fee breakdown available in your account

- Easy-to-read statements

- Clear and upfront communication about fees

Square’s transaction fees are designed to be straightforward and predictable, helping businesses manage their finances more effectively. Visit their official website for more details.

Pricing And Affordability Breakdown

Understanding the pricing of Square is crucial for business owners. This section breaks down the transaction fees and other associated costs. This information helps users gauge affordability and plan their finances better.

In-person Transaction Fees

Square charges a straightforward fee for in-person transactions. For every sale processed through the Square Point of Sale (POS) system, businesses pay a fee of 2.6% + 10¢ per transaction. This fee covers the cost of secure payment processing and operational support.

Online Transaction Fees

Online transactions incur a slightly higher fee due to additional processing requirements. For online payments, Square charges 2.9% + 30¢ per transaction. This applies to payments made through e-commerce websites, online invoices, and virtual terminals.

Additional Costs To Consider

Besides transaction fees, there are other costs businesses should be aware of:

- Instant Transfers: A small fee applies for instant transfers. While next-business-day transfers are free, instant transfers help manage cash flow more effectively.

- Custom-Tailored Suites: Specialized product suites for restaurants, retail, and beauty businesses might have additional costs based on the features and services included.

- Hardware Costs: Purchasing Square’s POS hardware incurs a one-time cost. The prices vary depending on the hardware chosen, from simple card readers to full POS systems.

Understanding these fees helps businesses manage their finances and ensures smooth operations.

Pros And Cons Of Square Transaction Fees

Square is a well-known platform for businesses to manage payments and sales. Its transaction fees have both benefits and downsides for users. Understanding these can help businesses decide if Square is the right choice for them.

Advantages Of Using Square

Square offers many advantages that make it a popular choice for businesses:

- Ease of Use: The platform is user-friendly, suitable even for non-tech-savvy users.

- Secure Payments: Square ensures secure transactions, building trust with customers.

- Instant Transfers: For a small fee, businesses can access funds instantly.

- Comprehensive Tools: Offers point of sale systems, order management, and advanced reporting.

- Versatility: Suitable for various business types including restaurants, retail, and beauty services.

| Feature | Details |

|---|---|

| Point of Sale (POS) Systems | Facilitates seamless sales anywhere |

| Secure Payments | Supports secure payments wherever customers are located |

| Instant Transfers | Available for a small fee |

| Order Management | Click and collect, online ordering, local delivery, and shipping options |

| Team Management | Optimize and manage team shifts securely |

Drawbacks To Consider

While Square has many benefits, there are drawbacks to consider:

- Transaction Fees: Fees can add up, impacting the bottom line.

- Instant Transfer Fees: Though convenient, the fee for instant transfers can be a downside.

- Loan Eligibility: Customized loans depend on Square sales and are subject to approval.

- Transfer Limits: Instant transfers have a maximum limit of £3,500 per day.

- Complex Fee Structure: Understanding the fee structure can be challenging for some users.

Considering both advantages and drawbacks can help businesses decide if Square fits their needs. For more information, visit the Square website.

Ideal Users For Square

Square is a versatile platform designed to support a variety of business needs. Its comprehensive features make it ideal for small businesses, retail and e-commerce merchants, and service-based businesses. Here’s a closer look at how Square benefits these specific users.

Small Businesses And Startups

Small businesses and startups benefit immensely from Square’s easy-to-use Point of Sale (POS) systems and secure payment options. These tools help streamline transactions, which is crucial for businesses with limited staff. The platform’s operational management tools allow owners to manage multiple locations and sales channels efficiently.

Additionally, Square offers instant transfers for a small fee, ensuring that cash flow remains uninterrupted. This feature is particularly useful for new businesses needing immediate access to funds.

Retail And E-commerce Merchants

Retail and e-commerce merchants find Square invaluable due to its robust order management capabilities. The platform supports click and collect, online ordering, and local delivery, which are essential for modern retail businesses. Square’s e-commerce integration allows merchants to create branded websites that sync seamlessly with their POS systems, ensuring a unified inventory and sales process.

Square also provides advanced reporting, enabling retailers to make data-driven decisions to boost their bottom line. This powerful reporting helps track profit margins and optimize inventory management.

Service-based Businesses

Service-based businesses, such as beauty salons and restaurants, benefit from Square’s custom-tailored suites. These specialized tools are designed to meet the unique needs of service-oriented businesses. For example, restaurant owners can manage orders, reservations, and deliveries all in one place.

Square’s team management features help optimize staff scheduling and shift management. Securely managing team shifts is crucial for maintaining a high level of service. Additionally, the platform’s customer data insights allow businesses to enhance customer loyalty and value through personalized experiences.

How To Optimize Costs When Using Square

Managing transaction fees is crucial for businesses using Square. While Square offers numerous tools and features to streamline operations, it’s essential to understand how to optimize costs effectively.

Tips For Reducing Transaction Fees

- Choose the Right Plan: Evaluate Square’s pricing plans and select the one that best fits your business needs. This helps avoid unnecessary charges.

- Encourage Debit Payments: Debit card transactions usually have lower fees compared to credit cards. Encourage customers to use debit cards.

- Minimize Manual Entry: Transactions manually entered often incur higher fees. Use Square’s POS systems to reduce these costs.

- Batch Transactions: Group transactions into batches to potentially reduce fees. This is beneficial for businesses processing many small transactions.

Leveraging Square’s Tools For Cost Efficiency

Square provides various tools to help businesses manage costs and improve efficiency.

- Advanced Reporting: Use Square’s advanced reporting tools to analyze transaction data. Identify patterns and optimize pricing strategies.

- Customer Data Insights: Utilize centralized data to understand customer behavior. Tailor marketing strategies to increase sales and reduce costs.

- Operational Management: Manage operations across multiple locations and sales channels efficiently. This reduces overhead costs and improves productivity.

- Cash Flow Management: Take advantage of instant transfers for a small fee or use next-business-day transfers for free. This helps manage cash flow effectively.

By implementing these strategies, businesses can effectively reduce transaction fees and leverage Square’s tools to achieve cost efficiency.

Frequently Asked Questions

What Are Square Transaction Fees?

Square charges 2. 6% + 10¢ per swipe, dip, or tap. For online transactions, it’s 2. 9% + 30¢. Rates may vary.

How Do Square Fees Work?

Square deducts fees before depositing funds. Fees are based on transaction type. It’s automatic and transparent.

Are Square Fees Competitive?

Yes, Square offers competitive rates. Their fees are comparable to other payment processors. It’s suitable for small businesses.

Can I Reduce Square Transaction Fees?

You can’t reduce standard fees. However, higher volume sellers may negotiate lower rates. Explore Square’s custom pricing options.

Conclusion

Understanding Square transaction fees helps in managing your business finances better. Square offers versatile and secure payment solutions for various business needs. It provides efficient tools for sales, cash flow, and team management. Using Square can streamline operations and enhance customer engagement. For more details, check out Square.