Square Setup Guide: Step-by-Step Instructions for Beginners

Setting up Square for your business is straightforward and efficient. This guide will walk you through the steps to get started.

Square provides a complete platform for managing business operations. From secure payments to inventory tracking, it offers tools tailored for various industries. Whether you run a restaurant, a retail store, or a beauty salon, Square can help streamline your processes and boost your revenue. This guide will cover the essential steps to set up your Square account, configure your hardware, and integrate the software solutions to fit your business needs. With millions of businesses relying on Square, this setup guide will ensure you get the most out of this powerful platform. Ready to dive in? Let’s get started! Visit the Square website for more information.

Introduction To Square And Its Purpose

Square offers a robust platform to help businesses manage operations, streamline processes, and boost revenue. Trusted by millions, Square provides tools tailored for diverse industries such as restaurants, retail, and beauty.

What Is Square?

Square is a comprehensive platform of software and hardware solutions. It includes tools for secure payments, inventory management, team management, and customer loyalty. Square is designed to help businesses of all sizes manage their operations efficiently.

The platform supports various business needs from point of sale (POS) systems to online ordering and delivery. Square also offers advanced reporting and analytics to help businesses make informed decisions. It integrates seamlessly with other business software using APIs and prebuilt app integrations.

Why Choose Square For Your Business?

- Efficiency: Automate operations and manage multiple locations effortlessly.

- Revenue Diversification: Open new revenue streams and track performance easily.

- Customer Loyalty: Enhance customer relationships with centralized data.

- Comprehensive Solutions: Manage everything from payments to team shifts in one platform.

- Scalability: Suitable for businesses of all sizes, including large enterprises and events.

Square’s hardware and POS systems are designed for seamless selling anywhere. Businesses can accept payments securely from any location and access funds quickly with instant or next-business-day transfers. Inventory management features help track profit margins and manage stock effectively. The platform’s advanced reporting tools provide powerful data for confident decision-making.

Square also offers custom-tailored suites for restaurants, retail, and beauty businesses. These suites include solutions for online ordering, local delivery, and shipping options. Team management tools optimize shifts and operations, while customer management features increase loyalty through centralized data and insights.

With Square, businesses can scale efficiently and manage their operations comprehensively. The platform’s APIs and integrations further enhance its flexibility and capability. Whether you are a small business or a large enterprise, Square provides the tools you need to succeed.

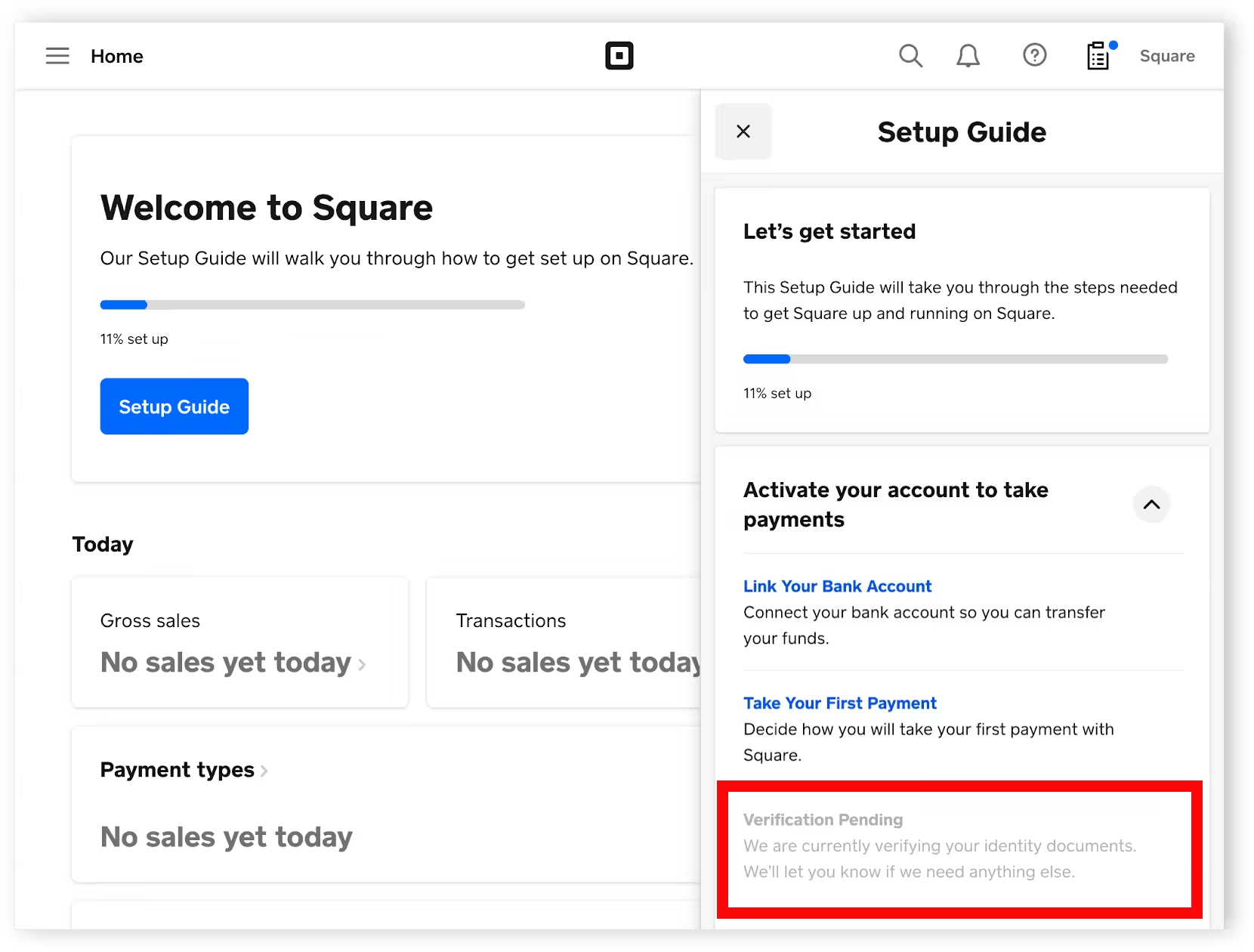

Setting Up Your Square Account

Square offers a comprehensive platform for managing business operations. Setting up your Square account is the first step to streamline processes and increase revenue. Follow these steps to get started.

Creating Your Square Account

To begin, visit the Square website and click on “Get Started”. You will need to provide your email address and create a password. Then, enter your business details, including business name, type, and location.

Verifying Your Information

After creating your account, you will need to verify your information. This step ensures secure payments and compliance with regulations. Square will ask for your legal name, date of birth, and the last four digits of your Social Security Number (SSN). This information is used to verify your identity.

Setting Up Your Business Profile

Next, set up your business profile. This includes adding your business logo, setting up your business hours, and configuring your payment methods. You can also customize your receipts and add your business address for online ordering and delivery.

Configuring Payment Methods

Square allows you to accept payments securely from any location. You can set up credit card payments, contactless payments, and even online payments. Simply navigate to the payment settings in your dashboard and follow the prompts to configure your preferred payment methods.

Adding Team Members

If you have a team, you can add team members to your account. This allows you to manage shifts, track hours, and optimize operations. Go to the team management section in your dashboard, and invite your team members by entering their email addresses.

Setting Up Inventory Management

Square offers robust inventory management features. You can track profit margins, manage stock levels, and set up low-stock alerts. Navigate to the inventory section in your dashboard and start adding your products. You can also categorize products for easier management.

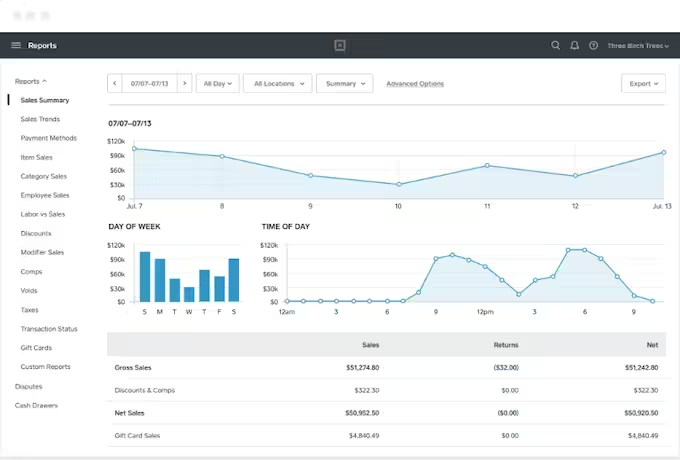

Using Advanced Reporting

Access powerful data with Square’s advanced reporting tools. You can generate sales reports, track performance, and make data-driven decisions. Go to the reporting section in your dashboard and customize your reports to suit your business needs.

Setting up your Square account is simple and ensures efficient management of your business operations. Follow these steps to get started and make the most of Square’s comprehensive solutions.

Understanding Square’s Key Features

Square is a trusted platform that offers a comprehensive suite of tools designed to help businesses manage their operations efficiently. Below, we break down Square’s key features to give you a better understanding of how it can benefit your business.

Overview Of Square Dashboard

The Square Dashboard is the command center for your business. It provides a clear overview of your sales, inventory, and customer interactions. You can access real-time data and insights to make informed decisions.

- Real-time sales tracking

- Inventory management

- Customer insights

- Employee management

Payment Processing Capabilities

Square’s payment processing capabilities allow you to accept secure payments from any location. This feature is designed to make transactions fast and reliable, whether in-store, online, or on the go.

| Feature | Description |

|---|---|

| Secure Payments | Accept payments securely from various sources. |

| Instant Transfers | Access funds quickly with instant or next-business-day transfers. |

| Multiple Payment Options | Support for credit cards, mobile payments, and more. |

Inventory Management

Square’s Inventory Management feature helps you track your profit margins and manage your stock levels effortlessly. This ensures you always have the right products available for your customers.

- Track stock levels in real-time

- Receive alerts for low inventory

- Analyze profit margins

- Manage purchase orders

Customer Directory And Crm Features

The Customer Directory and CRM features allow you to gather and analyze customer data to build stronger relationships. This helps in increasing customer loyalty and improving marketing efforts.

- Centralized customer data

- Insightful customer analytics

- Targeted marketing campaigns

- Customer feedback and reviews

Sales Reporting And Analytics

With Sales Reporting and Analytics, you can access powerful data to make confident business decisions. These insights help you understand your performance and identify growth opportunities.

| Analytics | Description |

|---|---|

| Sales Reports | Detailed reports on daily, weekly, and monthly sales. |

| Customer Insights | Understand customer behavior and preferences. |

| Inventory Reports | Track inventory performance and stock levels. |

| Employee Performance | Analyze employee sales and productivity. |

Square Hardware Setup

Setting up Square hardware is essential for streamlining your business operations. The right equipment ensures seamless transactions and efficient management. This guide will walk you through the setup process for various Square hardware options.

Choosing The Right Hardware For Your Needs

Before setting up, it’s crucial to select the appropriate hardware. Square offers several options tailored to different business needs. Consider your business type, volume of transactions, and space availability. Here are the main Square hardware options:

| Hardware | Description | Best For |

|---|---|---|

| Square Reader | Compact card reader for mobile payments | Small businesses, on-the-go sales |

| Square Stand | iPad stand with built-in card reader | Retail stores, quick-service restaurants |

| Square Terminal | All-in-one device for payments and receipts | Restaurants, pop-up shops |

| Square Register | Full POS system with separate customer display | High-volume retail, full-service restaurants |

Setting Up Square Reader

The Square Reader is perfect for small businesses and on-the-go sales. Follow these steps to set it up:

- Download the Square app on your mobile device.

- Sign in or create a Square account.

- Connect the Square Reader to your device via Bluetooth.

- Follow the in-app instructions to complete the setup.

Setting Up Square Stand

The Square Stand turns an iPad into a powerful POS system. Here’s how to set it up:

- Attach your iPad to the Square Stand.

- Connect the included hardware (Square Reader, printer, etc.) to the stand.

- Download and open the Square app on your iPad.

- Sign in to your Square account and follow the on-screen setup instructions.

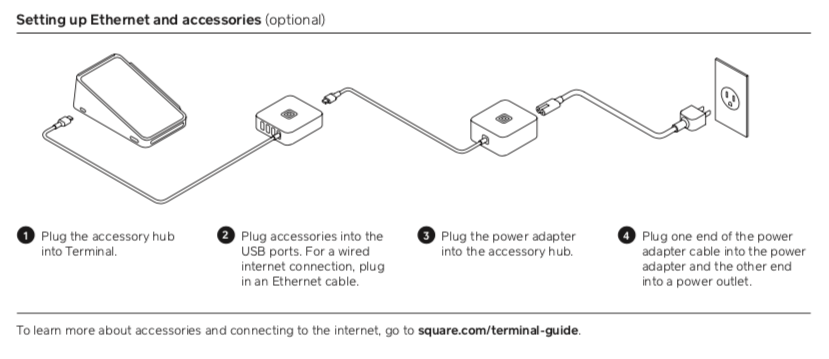

Setting Up Square Terminal

The Square Terminal is an all-in-one device for payments and receipts. Follow these steps for setup:

- Turn on the Square Terminal by pressing the power button.

- Connect to a Wi-Fi network or use the built-in SIM card for mobile data.

- Sign in to your Square account on the Terminal.

- Follow the on-screen instructions to complete the setup.

Setting Up Square Register

The Square Register is a full POS system with separate customer display. Here’s how to set it up:

- Unbox the Square Register and connect the power cable.

- Attach the customer display to the Register.

- Connect any additional hardware (printer, cash drawer, etc.).

- Turn on the Register and connect to a Wi-Fi network.

- Sign in to your Square account and follow the setup prompts.

Configuring Payment Options

Setting up payment options in Square ensures smooth transactions for your business. From linking your bank account to customizing receipts, each step is crucial. Follow this guide to configure payment options effectively.

Linking Your Bank Account

Connecting your bank account with Square is essential for receiving payments. Follow these steps:

- Log in to your Square Dashboard.

- Navigate to the Bank Accounts section.

- Click on Add Bank Account.

- Enter your bank account details.

- Verify your bank account through the small deposits made by Square.

This ensures that your funds are securely deposited into your bank account. Instant Transfers are available for a small fee, allowing funds to be transferred in as little as 20 minutes.

Setting Up Payment Methods

Square supports various payment methods, giving flexibility to your customers. Here’s how to set them up:

- Navigate to the Payments section in your Square Dashboard.

- Enable options such as Credit Cards, Debit Cards, and Mobile Payments.

- Use the Hardware and POS Systems to accept payments anywhere.

- Ensure secure transactions with Secure Payments features.

Offering multiple payment methods can enhance customer satisfaction and increase sales.

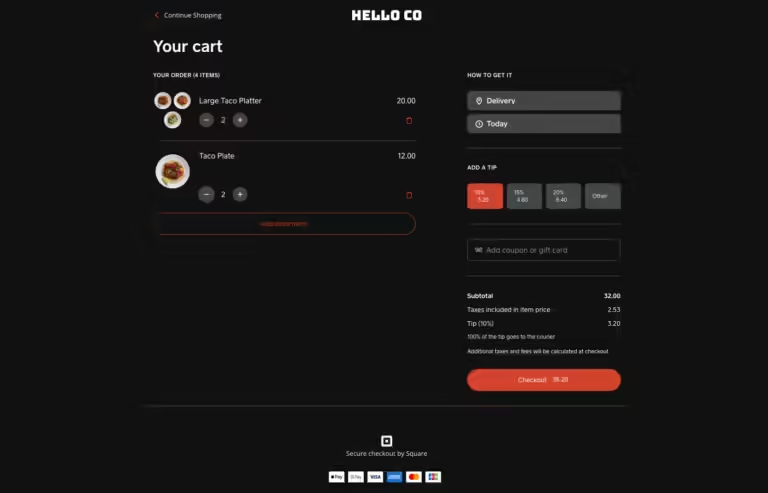

Enabling Tipping Options

Allowing customers to tip can be a significant revenue source, especially in service industries. To enable tipping options:

- Go to the Tipping section in your Square Dashboard.

- Toggle the Enable Tipping option.

- Set up suggested tip amounts, such as 10%, 15%, and 20%.

- Customize the display to show tipping options during the payment process.

Enabling Tipping Options can boost earnings and improve service quality by motivating your staff.

Customizing Receipts

Receipts are the final touchpoint in the transaction process. Customizing them can leave a lasting impression on your customers. Follow these steps:

- Navigate to the Receipts section in your Square Dashboard.

- Add your business logo and contact information.

- Include a personalized message or thank you note.

- Set up digital receipts to be sent via email or SMS.

Customized receipts enhance your brand’s professionalism and can encourage repeat business.

By configuring these payment options, you can ensure a seamless transaction experience for your customers. Square’s comprehensive platform offers everything you need to manage payments efficiently.

Managing Your Products And Services

Efficiently managing your products and services is crucial for any business. Square’s platform offers a user-friendly interface to help you keep track of your inventory, set up variations, and ensure smooth operations. This guide will walk you through the essential steps.

Adding Products And Services

To add new products or services to your Square item library, follow these steps:

- Login to your Square Dashboard.

- Navigate to the Items section.

- Click on Add Item or Add Service.

- Fill in the required details, such as name, price, and description.

- Click Save to add the item to your library.

Ensure the details are accurate and comprehensive for better inventory management.

Organizing Your Item Library

Keep your item library organized to streamline operations. Here are some tips:

- Use categories to group similar products.

- Create tags for easy searching and filtering.

- Regularly update inventory counts to avoid discrepancies.

Maintaining an organized library ensures quick access to any item and smooth transactions.

Setting Up Variations And Modifiers

Customize your products with variations and modifiers:

| Feature | Description |

|---|---|

| Variations | Different sizes, colors, or flavors of a product. |

| Modifiers | Optional add-ons or customizations for a product. |

To set up variations and modifiers:

- Navigate to the Item you want to customize.

- Click on Edit and go to the Variations or Modifiers section.

- Add the necessary details and options.

- Click Save to update the item.

Configuring Taxes

Ensure compliance by setting up taxes correctly:

- Go to the Tax section in your Square Dashboard.

- Click on Create Tax.

- Enter the tax name and rate.

- Select the applicable items or categories.

- Click Save to apply the tax.

Review and update taxes regularly to align with legal requirements.

Running Your First Transaction

Getting started with Square is simple and efficient. This guide will help you run your first transaction smoothly. Here, you will learn how to process a sale, issue refunds, handle discounts and promotions, and manage customer payments.

Processing A Sale

To process a sale with Square, follow these steps:

- Open the Square app on your device.

- Tap the Charge button on the home screen.

- Select the items or enter the amount for the sale.

- Tap Charge again to proceed to payment.

- Choose the payment method: card, cash, or other.

- If paying by card, swipe or insert the card into the reader.

- Complete the transaction and provide the receipt to the customer.

Issuing Refunds

Issuing refunds with Square is straightforward. Follow these steps:

- Navigate to the Transactions tab in the Square app.

- Select the transaction you wish to refund.

- Tap Issue Refund.

- Enter the amount to refund or choose the full amount.

- Confirm the refund, and it will be processed.

Refunds are typically processed within a few business days.

Handling Discounts And Promotions

Square allows you to apply discounts and promotions easily:

- During a sale, tap Discounts on the checkout screen.

- Choose an existing discount or create a new one.

- Apply the discount to the selected items or the entire sale.

- Proceed to payment to complete the sale with the discount applied.

Discounts can be percentage-based or a fixed amount.

Managing Customer Payments

Square offers various options for managing customer payments:

| Payment Method | Description |

|---|---|

| Credit/Debit Card | Accepts all major cards with secure processing. |

| Cash | Record cash transactions easily. |

| Gift Cards | Accept and manage gift card payments. |

| Mobile Payments | Supports Apple Pay, Google Pay, and other mobile wallets. |

Square ensures secure and quick payments, enhancing customer satisfaction.

For more information, visit the Square website or contact their support team at 0800 098 8008.

Square Pricing And Affordability

Understanding the pricing and affordability of Square is crucial for small businesses. This section will delve into Square’s fee structure, compare different pricing plans, and evaluate the affordability for small businesses.

Understanding Square’s Fee Structure

Square offers a straightforward fee structure, making it easy to understand costs. Here’s a breakdown:

- Transaction Fees: Square charges a flat rate for each transaction. This fee is typically 2.6% + 10¢ per swipe, dip, or tap.

- Instant Transfers: A small fee applies for instant transfers, allowing access to funds in as little as 20 minutes. Minimum transfer: £15, Maximum transfer: £3,500 per day.

- Custom-Tailored Suites: Pricing can vary based on the suite chosen, with custom solutions for different industries like restaurants, retail, and beauty.

Comparing Pricing Plans

Square offers several pricing plans to fit different business needs. Below is a comparison of the main plans:

| Plan | Features | Cost |

|---|---|---|

| Free Plan | Basic POS system, secure payments, and customer management | Free |

| Professional Plan | Inventory management, online ordering, and delivery | Custom pricing |

| Premium Plan | Advanced reporting, team management, and APIs | Custom pricing |

Evaluating Affordability For Small Businesses

Square’s pricing is designed to be affordable for small businesses. Here’s why:

- No Monthly Fees: The free plan allows businesses to start without any upfront costs.

- Transparent Pricing: Flat transaction fees help businesses predict costs accurately.

- Scalable Solutions: Customizable plans grow with your business, ensuring you only pay for what you need.

Overall, Square’s pricing structure is tailored to be cost-effective, especially for small businesses aiming to manage operations efficiently and increase revenue.

Pros And Cons Of Using Square

Square is a popular platform for businesses to manage their operations. It offers a mix of software and hardware solutions. Let’s explore the pros and cons of using Square.

Advantages Of Square

Square offers several benefits that can help businesses of all sizes:

- Hardware and POS Systems: Square’s hardware is designed for seamless selling anywhere, making transactions easy and efficient.

- Secure Payments: Accept payments securely from any location, ensuring customer trust and safety.

- Custom-Tailored Suites: Solutions are tailored for industries like restaurants, retail, and beauty, providing specialized tools for different business needs.

- Inventory Management: Track profit margins and manage inventory effortlessly, helping businesses stay organized.

- Online Ordering & Delivery: Offers options for click and collect, local delivery, and shipping, which expands business reach.

- Advanced Reporting: Access powerful data for confident decision-making.

- Team Management: Optimize and manage team shifts and operations, improving overall efficiency.

- Customer Management: Centralized data and insights help increase customer loyalty.

- APIs and Integrations: Integrate with business software using APIs and prebuilt app integrations, ensuring smooth operations.

- Instant Transfers: Access funds quickly with instant or next-business-day transfers, aiding in cash flow management.

Potential Drawbacks And Limitations

While Square has many advantages, there are some limitations to consider:

- Instant Transfer Fees: A small fee applies for instant transfers, which can add up over time.

- Loan Terms: Loans are subject to approval and come with terms that may not suit all businesses.

- Refund Policies: Refund policies for loans require full repayment within 18 months, which can be restrictive.

User Feedback And Reviews

Users generally appreciate the ease and efficiency of Square. Many highlight the following:

- Positive Aspects: Users love the seamless integration of POS systems and secure payment methods.

- Negative Aspects: Some users find the loan terms and instant transfer fees to be less favorable.

Overall, user feedback suggests that Square is a reliable and efficient choice for many businesses.

Recommendations For Ideal Users

Square is a versatile tool that fits various business needs. It’s perfect for managing operations, streamlining processes, and increasing revenue. Below are recommendations for ideal users.

Best Use Cases For Square

- Small Businesses: Ideal for small to medium-sized enterprises needing efficient point-of-sale systems.

- Mobile Vendors: Perfect for food trucks, market stalls, and other mobile businesses.

- Event Planners: Suitable for managing payments at events, fairs, and festivals.

- Personal Finance: Helps freelancers and consultants keep track of payments.

Industries That Benefit Most From Square

| Industry | Benefits |

|---|---|

| Restaurants | Efficient order management, secure payments, and inventory tracking. |

| Retail | Seamless selling, inventory management, and customer loyalty programs. |

| Beauty | Appointment scheduling, customer management, and sales tracking. |

Scenarios Where Square Excels

- High-Volume Sales: Handles large transactions quickly and securely.

- Multiple Locations: Manages operations across different sites efficiently.

- Online and Offline Sales: Integrates online ordering with in-store sales seamlessly.

- Complex Inventory: Tracks and manages detailed inventory data.

Square’s comprehensive platform offers hardware and software solutions for various industries. It is trusted by millions worldwide for its reliability and efficiency.

Conclusion And Next Steps

Setting up Square for your business is a significant step toward streamlined operations and increased efficiency. This guide has covered the essential aspects of Square’s setup process. Now, let’s recap the key points, explore additional resources, and share tips for ongoing success.

Recap Of Key Points

Throughout this guide, we discussed how Square can help manage various business operations. Here are the main takeaways:

- Hardware and POS Systems: Designed for seamless transactions anywhere.

- Secure Payments: Accept payments securely from any location.

- Inventory Management: Track profit margins and manage inventory efficiently.

- Online Ordering & Delivery: Options for click and collect, local delivery, and shipping.

- Advanced Reporting: Access powerful data for better decision-making.

- Team Management: Optimize and manage team shifts and operations.

- Customer Management: Centralized data to enhance customer loyalty.

- APIs and Integrations: Integrate with business software using APIs and prebuilt app integrations.

Additional Resources For Learning

To maximize your experience with Square, consider exploring the following resources:

- Square Help Center: Comprehensive support and troubleshooting articles.

- Square Tutorials: Step-by-step guides and video tutorials.

- Square Developer Documentation: Information on APIs and integrations.

- Square Community: Connect with other users and share experiences.

Tips For Ongoing Success With Square

Here are some tips to ensure long-term success with Square:

- Regularly Update Software: Keep your Square software updated for the latest features and security improvements.

- Monitor Reports: Use advanced reporting tools to track performance and make data-driven decisions.

- Engage Customers: Utilize customer management features to build and maintain strong relationships.

- Train Your Team: Ensure your team is well-trained on using Square’s tools for maximum efficiency.

- Explore New Features: Stay informed about new features and updates to continuously improve your business operations.

Frequently Asked Questions

How Do I Set Up Square For My Business?

To set up Square, create an account on the Square website. Follow the prompts to enter your business information. Then, link your bank account for transactions. Download the Square app and connect your hardware. You’re ready to start accepting payments!

What Equipment Do I Need For Square?

You need a compatible mobile device and the Square Reader or Terminal. The Square Stand is optional but useful. Ensure your device has internet access for smooth transactions. Additional accessories like receipt printers can enhance your setup.

Is Square Free To Use?

Square is free to use, but transaction fees apply. There are no monthly fees for basic usage. Paid plans are available for advanced features. Review the fee structure on Square’s website to understand costs.

How Secure Is Square For Payments?

Square uses industry-standard security measures to protect transactions. Data encryption and fraud prevention tools ensure safety. Regular updates and monitoring keep your information secure. Trust Square for reliable and secure payment processing.

Conclusion

Setting up Square is simple and beneficial for any business. The platform offers secure payments, inventory management, and advanced reporting. It caters to various industries, ensuring efficiency and customer loyalty. With Square, businesses can manage operations and boost revenue. Explore more about Square and its features by visiting their official website. Embrace Square to streamline your business today.