Square Reviews: Unbiased Insights and Comprehensive Analysis

Square has become a trusted name in credit card processing and personal finance. Its all-in-one platform offers businesses an efficient way to manage payments, operations, and customer engagement.

Square provides a range of features designed to streamline business processes. From secure payments and point-of-sale systems to advanced reporting and customer loyalty tools, Square supports various business needs. Whether you’re in retail, hospitality, or beauty services, Square’s customizable solutions can help you enhance your operations and grow your business. Read on to discover in-depth reviews of Square’s features, benefits, and how it can transform your business operations. For more information, visit the official Square website.

Introduction To Square

Square is a versatile platform designed to streamline business operations and facilitate secure payments. It is trusted by millions of businesses worldwide. This comprehensive solution is tailored for restaurants, retail, and beauty businesses. It offers a range of features to optimize every aspect of a business.

What Is Square?

Square is a software and hardware platform that helps businesses manage their operations efficiently. It includes hardware such as POS systems, and software for payment processing and operational management. Square is designed to handle secure payments and provide advanced reporting for confident decision-making.

Purpose And Use Cases

Square serves various purposes and is used across different business types. Here are some key use cases:

- Payment Processing: Square’s POS systems are designed to handle payments securely, whether in-person or online.

- Operational Management: Businesses can streamline operations across multiple locations and sales channels.

- Customer Engagement: Square offers tools to centralize customer data, helping businesses increase loyalty.

- Team Management: Manage staff shifts and optimize team performance securely.

- Revenue Diversification: Open new revenue streams and manage inventory effectively.

- E-commerce: Create branded websites for online orders with inventory syncing with POS systems.

Square is flexible and can be customized for various business needs, whether it’s a small shop or a large enterprise. It also offers financial management tools like instant transfers and customized loan offers based on sales.

Key Features Of Square

Square offers a comprehensive suite of features designed to streamline business operations and facilitate secure payments. Trusted by millions worldwide, Square provides custom-tailored solutions for various business types, including restaurants, retail, and beauty services.

Ease Of Use

Square is known for its user-friendly interface. The platform is intuitive and easy to navigate, making it simple for business owners and staff to use. The setup process is straightforward, ensuring that businesses can start accepting payments quickly. The hardware is also designed for ease of use, with simple, clean designs that integrate seamlessly into any business environment.

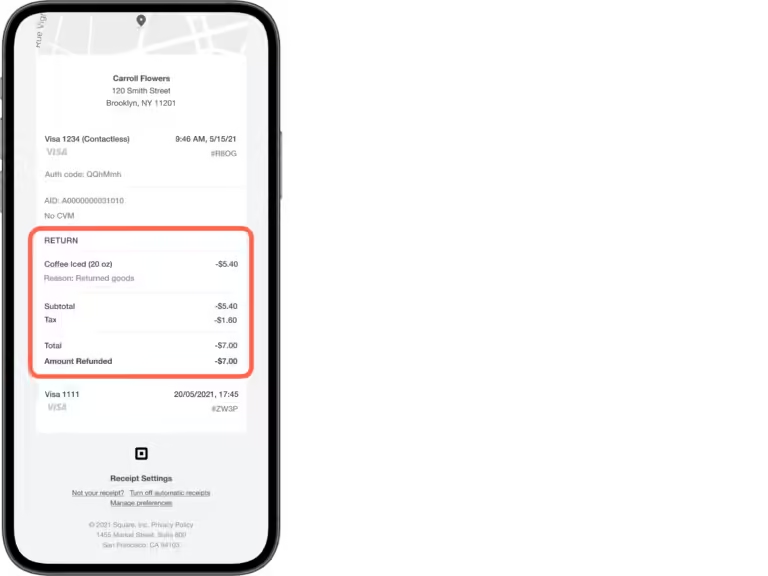

Versatile Payment Options

Square supports a wide range of payment methods. Businesses can accept payments through click and collect, online ordering, local delivery, and shipping. This versatility allows businesses to cater to different customer preferences, enhancing the overall shopping experience. Square’s payment options are secure, ensuring that customer data is protected at all times.

Invoicing And Reporting Tools

Square provides robust invoicing and reporting tools. Businesses can easily create and send professional invoices, track payments, and manage their cash flow. The advanced reporting features offer detailed insights into sales performance, helping businesses make informed decisions. The reports are customizable, allowing businesses to focus on the data that matters most to them.

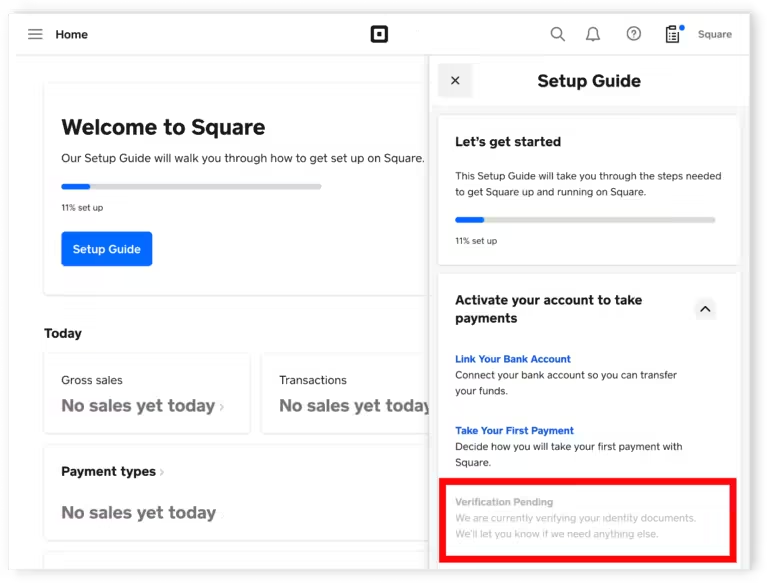

Square Dashboard

The Square Dashboard is a powerful tool that centralizes all business operations. From the dashboard, businesses can manage sales, inventory, employees, and customer data. The dashboard provides real-time updates, ensuring that businesses have the latest information at their fingertips. This feature is essential for businesses looking to streamline their operations and improve efficiency.

Integrations And Compatibility

Square offers a wide range of integrations and compatibility options. The platform can integrate with various business software, enhancing its functionality. This includes accounting software, e-commerce platforms, and CRM systems. The APIs provided by Square make it easy for developers to create custom solutions, ensuring that businesses can tailor the platform to their specific needs.

Pricing And Affordability

Square is a popular choice for businesses of all sizes due to its transparent pricing and affordability. Understanding the costs associated with using Square can help you make an informed decision. Let’s break down the pricing structure into three main sections: transaction fees, subscription plans, and value for money.

Transaction Fees

Square charges a standard fee for each transaction. This fee varies based on the type of payment processed:

- Swiped/Dipped/Tapped Transactions: 2.6% + 10¢ per transaction.

- Online Transactions: 2.9% + 30¢ per transaction.

- Invoice Payments: 2.9% + 30¢ per transaction.

- Keyed-in Transactions: 3.5% + 15¢ per transaction.

These fees are competitive within the industry, ensuring that businesses can handle payments without excessive costs.

Subscription Plans

Square offers several subscription plans tailored to different business needs:

| Plan | Monthly Fee | Features |

|---|---|---|

| Free Plan | $0 | Basic features including payment processing and basic reporting. |

| Plus Plan | $60 | Advanced features including detailed reporting, team management, and customer engagement tools. |

| Premium Plan | Custom Pricing | All features with personalized support and additional integrations. |

Value For Money

Square provides significant value for money through its comprehensive feature set. Businesses benefit from:

- Efficiency: Automation of operations saves time and improves efficiency.

- Flexibility: Customizable solutions for various business types.

- Financial Management: Instant transfers and customized loan offers.

- Customer Loyalty: Enhanced engagement through centralized data.

- Scalability: Support for small to large enterprises.

Overall, Square’s pricing structure is designed to be affordable while providing robust tools to help businesses thrive.

Pros Of Using Square

Square offers numerous advantages that cater to various business needs. Its blend of user-friendly features, robust ecosystem, and strong security measures make it a preferred choice for many businesses. Below are some of the key benefits of using Square.

User-friendly Interface

Square boasts a user-friendly interface that simplifies business operations. Its platform is intuitive, making it easy for even non-tech-savvy users to navigate.

With a focus on ease of use, Square allows businesses to quickly set up and start accepting payments. The straightforward design ensures that all essential functions are accessible without unnecessary complexity.

Comprehensive Ecosystem

Square provides a comprehensive ecosystem that supports various business activities. It includes hardware and POS systems designed to sell anywhere and handle secure payments.

Other key features include:

- Payment Options: Click and collect, online ordering, local delivery, and shipping

- Operational Management: Streamlines operations across multiple locations, sales channels, and employees

- Cash Flow Management: Instant transfers for a fee or free next-business-day transfers

- Team Management: Optimizes team shifts and manages staff securely

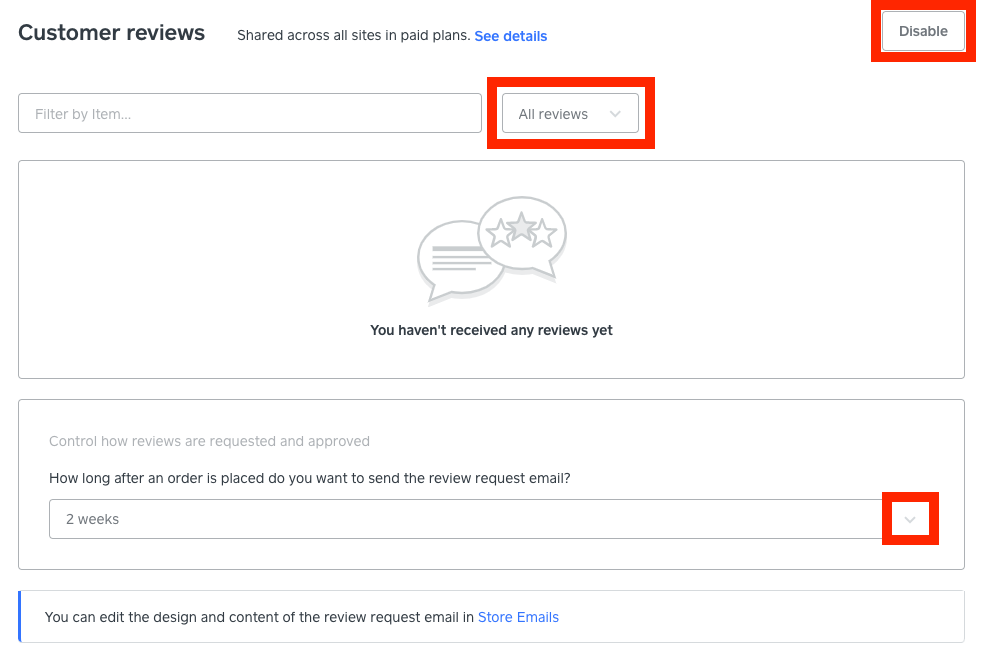

- Customer Engagement: Centralized customer data and insights to increase loyalty

- Advanced Reporting: Provides powerful data for confident decision-making

- Revenue Diversification: Opens new revenue streams and manages inventory and profit margins

- E-commerce: Creates branded websites for online orders and inventory syncing with POS

These integrated tools make Square a versatile solution for businesses of all sizes.

Strong Security Measures

Square is known for its strong security measures. It ensures that all transactions are secure, giving business owners peace of mind.

Squareup Europe Ltd is authorized by the Financial Conduct Authority, adhering to strict privacy and compliance policies. This level of security helps protect sensitive customer information and minimizes fraud risks.

Square’s commitment to security extends to its hardware, software, and processes, ensuring a safe environment for both businesses and their customers.

Cons Of Using Square

While Square offers many benefits, there are some downsides to consider. Below, we will explore some of the main cons of using Square.

Potential Hidden Fees

Despite Square’s competitive pricing, users have reported encountering hidden fees. For example, instant transfers come with a fee, and there are additional charges for advanced features. These fees can add up, affecting your overall budget.

Here is a quick overview of some potential fees:

| Feature | Fee |

|---|---|

| Instant Transfers | Small fee per transfer |

| Advanced Reporting | Possible additional charges |

| Payment Processing | Varies based on transaction |

Customer Support Issues

Another common complaint is customer support. Users have experienced long wait times and unhelpful responses. This can be frustrating, especially when dealing with urgent issues. Here are some common support issues:

- Long wait times

- Unresolved queries

- Lack of personalized support

Limited Customization

Square’s platform is not highly customizable. Businesses seeking unique branding might find this limiting. The limited customization can affect the user experience and brand identity. Consider these limitations:

- Standardized templates

- Restricted design options

- Limited integration flexibility

While Square has much to offer, it is important to weigh these cons against its benefits to determine if it is the right fit for your business.

Ideal Users And Scenarios

Square is a versatile platform that fits various business types. Its powerful features make it suitable for different users and scenarios. Let’s explore who benefits the most from using Square.

Small Business Owners

Small business owners benefit greatly from Square’s flexibility and customization. Square’s hardware and POS systems are designed to handle secure payments and sell anywhere. This is ideal for small shops needing reliable payment solutions.

- Payment Options: Click and collect, online ordering, and local delivery.

- Operational Management: Streamlines operations across multiple locations.

- Advanced Reporting: Provides data for confident decision-making.

Freelancers And Contractors

Freelancers and contractors need efficient cash flow management. Square offers instant transfers for a fee or free next-business-day transfers. This ensures they get paid quickly and manage their finances smoothly.

- Team Management: Optimizes team shifts and manages staff securely.

- Financial Management: Customized loan offers based on sales.

- Customer Engagement: Centralized customer data to increase loyalty.

Retail And Food Service Businesses

Retail and food service businesses find Square’s e-commerce and inventory syncing invaluable. They can create branded websites for online orders, enhancing their reach and sales.

- Hardware and POS Systems: Designed for secure and flexible payments.

- Revenue Diversification: Manages inventory and profit margins.

- Scalability: Supports businesses of different sizes.

Square is trusted by millions of businesses worldwide. It offers efficiency, flexibility, and scalability to meet the needs of various users.

Frequently Asked Questions

What Is Square?

Square is a popular payment processing platform. It offers tools for small businesses. These include point-of-sale systems and online payment solutions.

How Does Square Work?

Square works by providing businesses with payment solutions. They offer hardware for in-person payments. They also offer software for online transactions.

Is Square Secure?

Yes, Square is secure. It uses advanced encryption to protect data. It also complies with industry security standards.

What Are Square’s Fees?

Square charges a small fee per transaction. The fee varies by payment method. There are no monthly fees.

Conclusion

Square is an excellent choice for businesses needing streamlined operations and secure payments. Its comprehensive tools suit various industries like retail, restaurants, and beauty services. From hardware to customer engagement, Square offers reliable solutions. With customizable features and efficient cash flow management, it supports business growth. Trust millions of businesses already using Square. To learn more, visit Square and explore its benefits.