Square Refund Policies: What You Need to Know

Understanding Square Refund Policies is crucial for any business. Refunds can impact customer satisfaction and your bottom line.

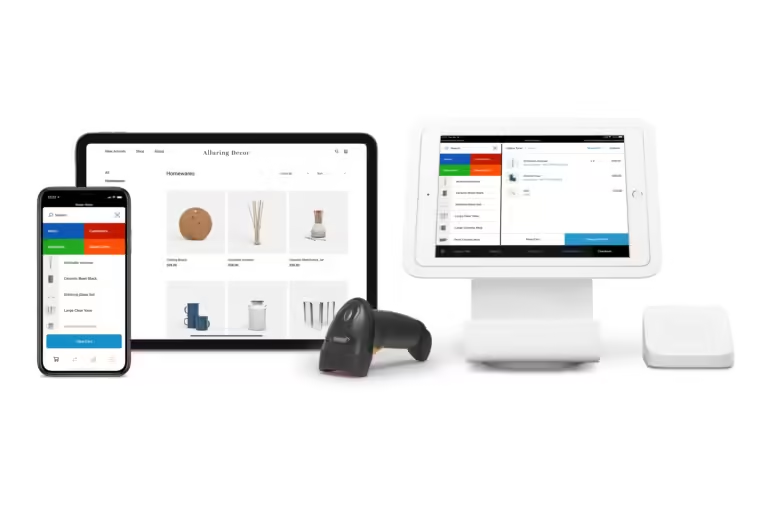

Square offers a comprehensive suite of tools for managing refunds efficiently. As a trusted provider for millions of businesses, Square ensures that their refund policies are clear and supportive. This introduction will guide you through the basics of Square’s refund policies, helping you make informed decisions and maintain smooth operations. Whether you’re handling refunds for online sales, in-person transactions, or managing customer expectations, knowing how Square handles refunds is essential. Dive in to learn more about how Square can support your business needs. For detailed information, visit the official Square website.

Introduction To Square Refund Policies

Square is a trusted platform that helps businesses manage operations, sell products, and automate processes efficiently. Refund policies are crucial for maintaining trust and satisfaction among users. This section will introduce you to Square’s refund policies, their purpose, and how they align with Square’s payment processing services.

Overview Of Square’s Payment Processing Service

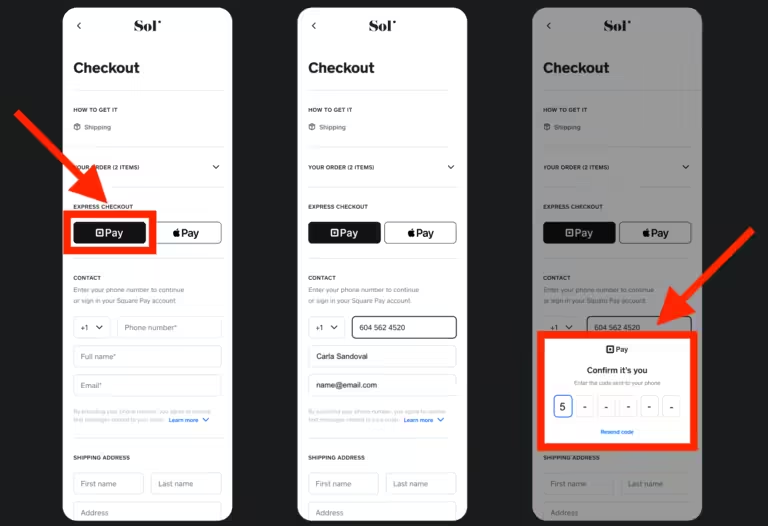

Square provides a comprehensive payment processing service. It allows businesses to accept payments seamlessly through various methods. These include credit cards, debit cards, and mobile payments. Square’s hardware and POS systems are designed to facilitate sales anywhere. They offer secure payment options to ensure safety and reliability for both businesses and customers.

Square also supports instant transfers. Businesses can cash out in minutes for a small fee, or for free with next-business-day transfers. These features highlight the efficiency and flexibility of Square’s payment processing service, making it a preferred choice for businesses of all sizes.

Purpose Of Square’s Refund Policies

Square’s refund policies are designed to protect both businesses and their customers. They ensure that customers can return products or services if they are not satisfied. This builds trust and loyalty, which is vital for any business. The refund policies also help businesses manage returns efficiently, minimizing potential financial loss.

Square’s refund policies are straightforward and easy to understand. They align with the company’s commitment to providing excellent customer support and maintaining transparency. By adhering to these policies, businesses can enhance their reputation and customer satisfaction, leading to long-term success.

Here are some key aspects of Square’s refund policies:

- Refunds are processed quickly and efficiently.

- Customers can request refunds through various channels.

- Businesses can manage refunds through Square’s platform.

- Clear guidelines on refund eligibility and timelines.

Square provides round-the-clock product support and a community for business owners. This ensures that any issues related to refunds can be resolved promptly and effectively.

Key Features Of Square Refund Policies

Square offers a comprehensive platform for businesses, and its refund policies are designed to be clear and user-friendly. Understanding the key features of Square refund policies helps businesses manage returns and customer satisfaction efficiently. Below, we delve into important aspects like flexibility, processing times, and their impact on merchant accounts.

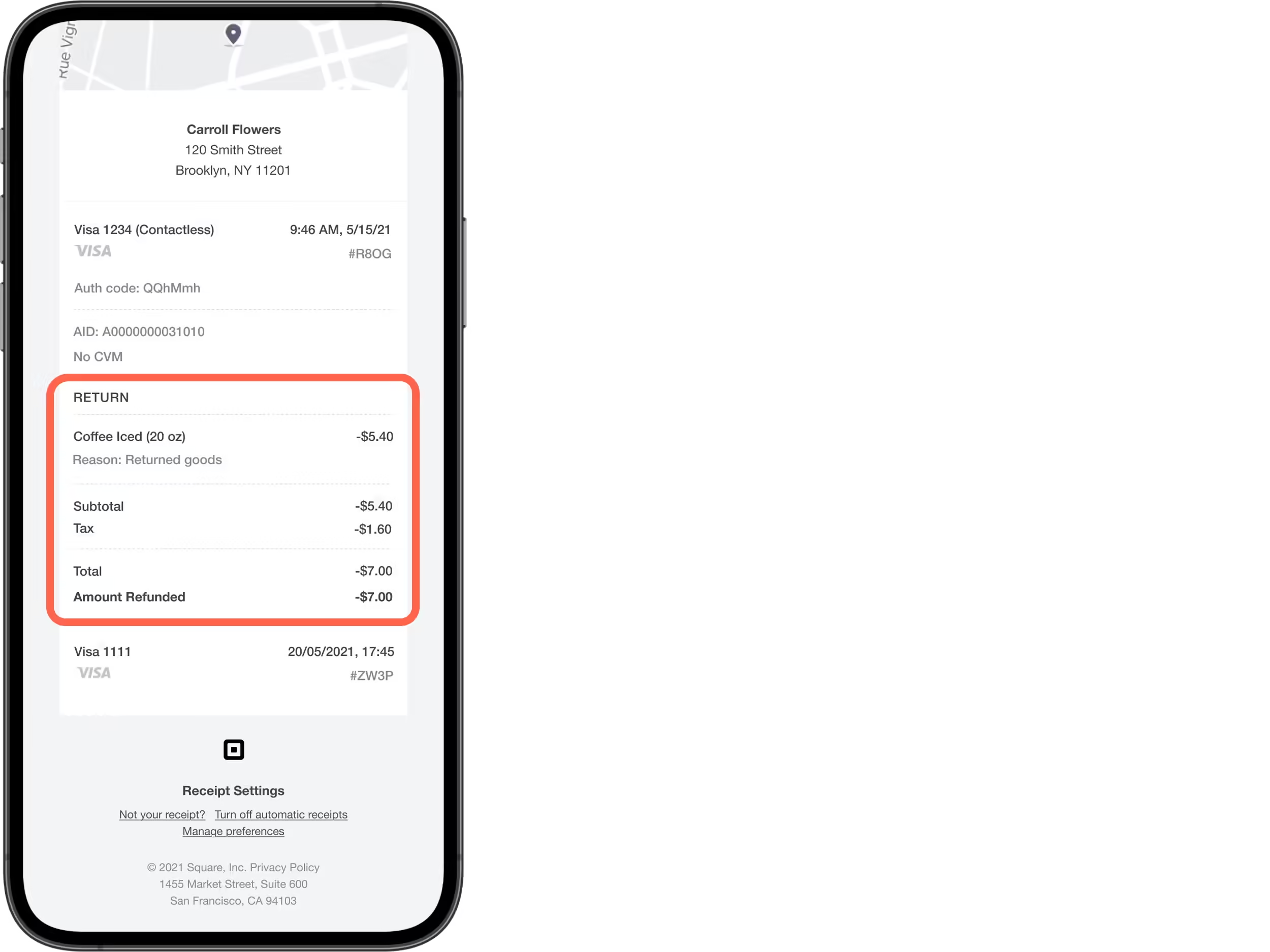

Flexibility In Refund Options

Square provides flexible refund options for merchants and customers. Businesses can offer refunds through the original payment method or via Square gift cards. This flexibility allows businesses to maintain customer satisfaction and handle returns in a way that best suits their operations.

Refunds can be issued for both full and partial amounts. Merchants can also handle refunds directly from the Square dashboard, making the process straightforward and efficient.

Timeframe For Processing Refunds

Square ensures that refunds are processed promptly. Typically, refunds are completed within 2-7 business days, depending on the bank’s policies. This quick turnaround helps maintain customer trust and satisfaction.

For instant transfers, refunds are generally available within 20 minutes, although this is subject to the bank’s availability schedule. Merchants should communicate these timeframes to customers to set proper expectations.

Impact On Merchant Accounts

Issuing refunds through Square has implications for merchant accounts. Refunds are automatically deducted from the merchant’s Square balance. If the balance is insufficient, the amount is deducted from the linked bank account.

Merchants should monitor their accounts to ensure they have sufficient funds to cover potential refunds. This proactive management prevents any disruptions in business operations.

Additionally, Square provides detailed reporting on all transactions, including refunds. This transparency helps businesses track their financial activities and manage their cash flow effectively.

Pricing And Affordability Of Refunds With Square

Square offers flexible refund policies that cater to diverse business needs. Understanding the pricing and affordability of these refunds can help businesses manage their costs effectively. Below, we delve into the aspects of refund fees and charges, and how refunds affect transaction costs.

Refund Fees And Charges

Square’s refund policies include specific fees and charges. These fees are straightforward and transparent, ensuring businesses know what to expect:

- Processing Fee: No additional fee is charged for processing a refund.

- Original Fee Retention: The original transaction fee is not refunded to the business.

For example, if a customer purchases a product for $100 and the transaction fee is 2.6% + $0.10, the business would incur a fee of $2.70. In the event of a refund, the $2.70 fee is not returned to the business.

How Refunds Affect Transaction Costs

Refunds can impact the overall transaction costs for a business. It’s essential to consider these factors:

- Net Revenue Impact: Refunds reduce net revenue as the initial transaction fee is not reimbursed.

- Cash Flow Implications: Immediate refunds can affect cash flow, especially for high-ticket items.

- Customer Experience: Seamless refund processes enhance customer satisfaction and loyalty.

By understanding these elements, businesses can better manage their financial planning and customer relations. Square’s transparent refund policies ensure that businesses remain informed and can plan accordingly.

Pros And Cons Of Square Refund Policies

Square provides a robust platform for managing refunds, but it has its strengths and weaknesses. Understanding these can help businesses decide if Square is the right choice for their refund needs.

Advantages Of Using Square For Refunds

Square’s refund policies come with several benefits that can enhance the customer experience and streamline business operations.

- Efficiency: Square allows businesses to process refunds quickly and easily. This minimizes downtime and keeps customers satisfied.

- Flexibility: The platform supports instant transfers, which means refunds can be processed and credited back to customers almost immediately.

- Comprehensive Support: Round-the-clock support ensures that businesses can resolve refund issues at any time, ensuring smooth operations.

- Advanced Reporting: Square’s advanced reporting features provide detailed insights into refund trends and customer behavior. This helps businesses make data-driven decisions.

- Customer Engagement: Centralized customer data helps increase loyalty by providing personalized experiences even during the refund process.

Limitations And Drawbacks

Despite its advantages, Square’s refund policies have some limitations that businesses need to consider.

- Fee Structure: Instant transfer refunds come with a small fee. Businesses must decide if the cost is worth the convenience.

- Bank Availability: Refunds via instant transfers are subject to the bank’s availability schedule. Delays may occur outside of standard banking hours.

- Loan Repayments: If using Square loans, businesses need to manage repayments within 18 months. This can be a financial strain during slow periods.

- Complex Terms: The terms and conditions for refunds and loans can be complex. Businesses must understand these fully to avoid potential pitfalls.

Overall, Square’s refund policies offer significant benefits but also come with some challenges. Weighing these pros and cons can help businesses make an informed decision.

Ideal Users And Scenarios For Square Refund Policies

The ideal users of Square refund policies are businesses seeking efficient, flexible solutions for customer refunds. Square provides a seamless experience for managing refunds, which is crucial for maintaining customer trust and satisfaction. Different industries can benefit from Square’s refund policies, which cater to various business needs.

Best Practices For Merchants

Merchants should follow best practices to ensure smooth refund processes:

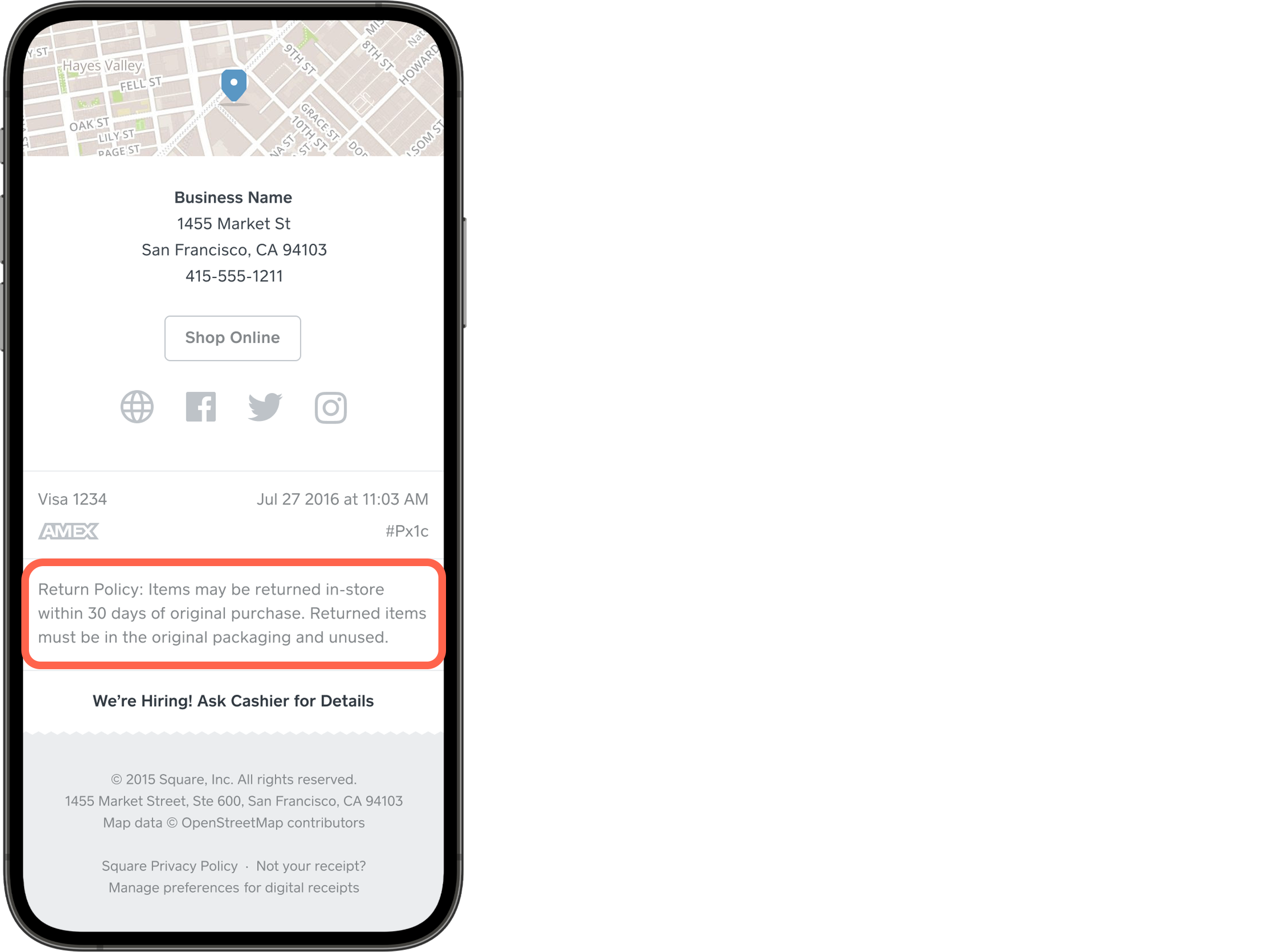

- Clear Refund Policy: Display refund policies prominently on websites and receipts.

- Timely Processing: Process refunds promptly to maintain customer trust.

- Document Transactions: Keep accurate records of all transactions and refunds.

- Customer Communication: Communicate clearly with customers about refund statuses.

These practices help merchants provide excellent customer service and maintain a good reputation.

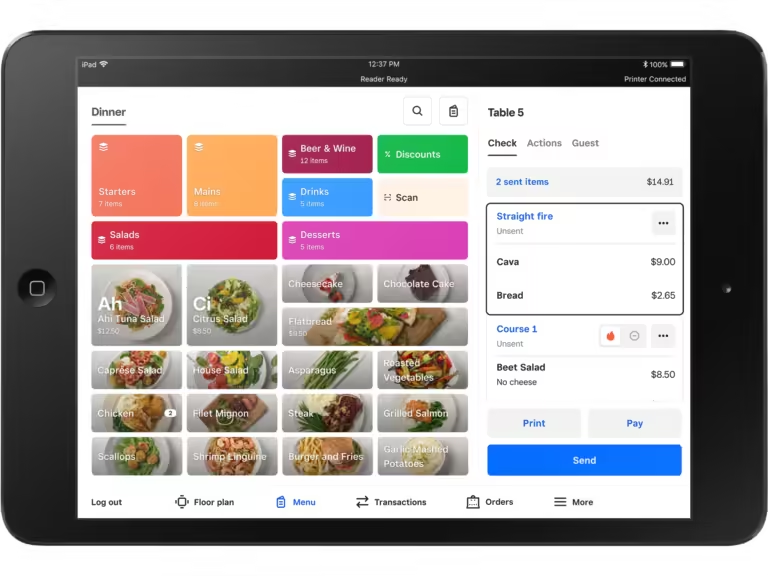

Industries That Benefit The Most

Several industries benefit significantly from Square’s refund policies:

| Industry | Benefits |

|---|---|

| Retail | Efficient handling of returns and exchanges, improving customer satisfaction. |

| Restaurants | Quickly address order issues, enhancing customer experience. |

| Beauty and Wellness | Manage appointment cancellations and refunds effortlessly. |

These industries rely on streamlined operations and customer satisfaction, making Square’s refund policies an ideal fit.

Frequently Asked Questions

What Is Square’s Refund Policy?

Square’s refund policy allows merchants to issue refunds within 120 days of purchase. Refunds are processed to the original payment method.

How Long Do Square Refunds Take?

Square refunds typically take 2-7 business days to process. The exact time may vary depending on the bank.

Can I Cancel A Square Refund?

No, once a refund is issued through Square, it cannot be canceled. Ensure accuracy before processing.

Are Square Refund Fees Refundable?

No, Square’s processing fees are non-refundable. Merchants will still incur the original transaction fees.

Conclusion

Understanding Square’s refund policies can simplify your business transactions. Square ensures secure, fast refunds, enhancing customer satisfaction. Visit Square for more details and resources. Embrace efficient financial management with Square’s trusted platform.