Square Payment Solutions: Revolutionizing Small Business Transactions

In the world of personal finance and business management, choosing the right payment solution is crucial. Square Payment Solutions offers a comprehensive platform that caters to various business needs.

Square is trusted by millions of businesses worldwide. It provides hardware and software designed for seamless transactions and efficient operations. Whether you run a restaurant, retail store, or beauty business, Square has tailored solutions to meet your needs. From secure payment processing to inventory management, Square helps businesses streamline their operations and boost revenue. By integrating advanced reporting and customer engagement tools, Square ensures you make informed decisions and build customer loyalty. Explore the benefits of Square Payment Solutions and discover how it can transform your business operations. Learn more about Square.

Introduction To Square Payment Solutions

Square Payment Solutions offer businesses a comprehensive platform to streamline their operations, manage payments securely, and enhance customer engagement. Trusted by millions globally, Square provides tools for businesses to operate efficiently and grow revenue.

Overview Of Square Inc.

Square Inc. is a leading fintech company providing software and hardware solutions for businesses of all sizes. Founded in 2009, Square has revolutionized the way businesses handle transactions and manage operations. With its wide range of products, Square supports various industries, including retail, hospitality, and beauty.

Purpose And Evolution Of Square Payment Solutions

Square Payment Solutions were designed to simplify payment processes and improve business efficiency. Initially focused on point-of-sale (POS) systems, Square has expanded its offerings to include online ordering, inventory management, and advanced reporting tools. This evolution enables businesses to handle payments, manage operations, and engage customers from a single platform.

| Feature | Description |

|---|---|

| Sell Anywhere | Hardware and POS systems for seamless transactions. |

| Secure Payments | Accept payments anywhere your customers are. |

| Order Options | Click and collect, online ordering, local delivery, and shipping. |

| Custom Solutions | Tailored product suites for restaurants, retail, and beauty businesses. |

| Operations Management | Streamline operations across multiple locations and sales channels. |

| Cash Flow Management | Instant transfers for a small fee or free next-business-day transfers. |

| Team Management | Optimize shifts and manage teams securely. |

| Customer Engagement | Centralized customer data and insights to increase loyalty. |

| Advanced Reporting | Data analytics for confident decision-making. |

| Revenue Diversification | Open new revenue streams and track profit margins. |

| Inventory Management | Sync inventory with online orders and POS systems. |

| Website Creation | Create branded websites for online orders and showcasing products. |

- Efficiency: Automate processes and streamline operations.

- Revenue Growth: Open new revenue streams and manage cash flow efficiently.

- Customer Loyalty: Increase customer engagement and loyalty.

- Data Insights: Make informed decisions with advanced reporting.

- Team Optimization: Manage and optimize team performance.

- Integration: Easily integrate with business software and websites.

Square also offers flexible pricing options, including instant transfers for a small fee and free next-business-day transfers. Customized loan offers are available based on sales, subject to approval and terms.

For more details, visit the Square website or contact their customer support at 0800 098 8008.

Key Features Of Square Payment Solutions

Square Payment Solutions offer various features designed to make transactions simple and efficient. From seamless point-of-sale integration to robust inventory management, businesses benefit greatly. Explore these key features in detail below.

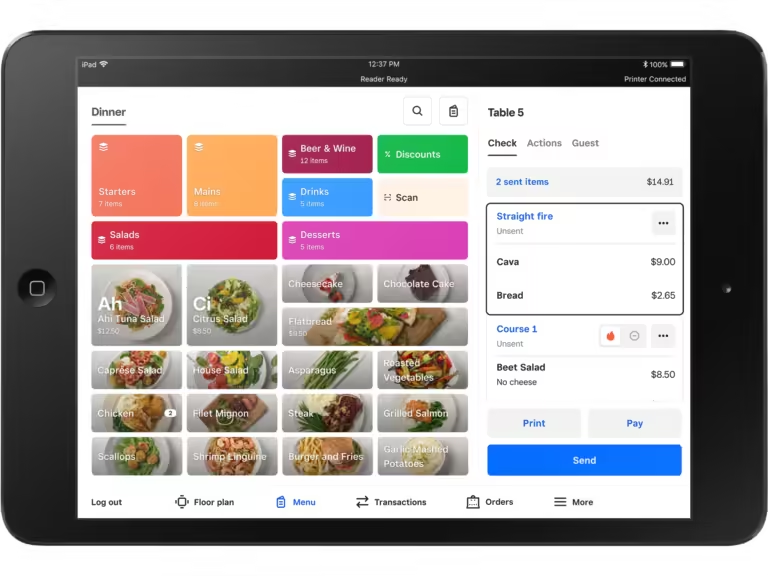

Seamless Point-of-sale Integration

Square provides seamless integration with its point-of-sale (POS) systems. This ensures that transactions are quick and efficient. Businesses can accept payments from various sources, including credit cards and mobile wallets. The POS system also integrates with other business software, making it easy to manage sales, inventory, and customer data all in one place.

Contactless Payment Options

With Square, businesses can accept contactless payments such as Apple Pay, Google Wallet, and NFC-enabled cards. This enhances customer convenience and speeds up the checkout process. The hardware supports these options, ensuring that businesses stay current with payment trends.

Inventory Management

Square’s inventory management feature helps businesses keep track of stock levels effortlessly. It syncs inventory data with online orders and POS systems, providing real-time updates. This minimizes errors and ensures that businesses are always aware of their stock status.

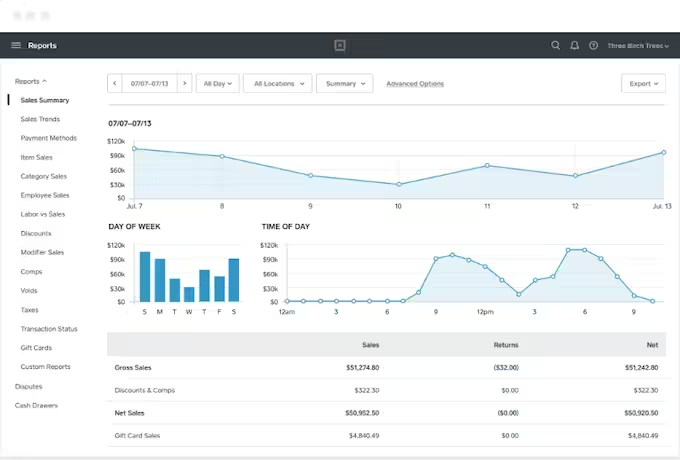

Analytics And Reporting Tools

Square provides advanced analytics and reporting tools that help businesses make informed decisions. These tools offer insights into sales trends, customer behavior, and overall performance. Businesses can use these reports to identify opportunities for growth and areas needing improvement.

Square Invoices And Recurring Payments

Square enables businesses to send invoices and set up recurring payments. This feature is particularly useful for service-based businesses and subscription models. It simplifies the billing process and ensures timely payments, enhancing cash flow management.

For more details, visit the Square website or contact their customer support at 0800 098 8008.

Pricing And Affordability

Square offers a comprehensive suite of payment solutions designed to help businesses operate more efficiently. Understanding the pricing structure is crucial for businesses looking to manage costs effectively. Let’s dive into the details of Square’s pricing and how it compares to competitors.

Transparent Pricing Structure

Square is known for its transparent pricing structure. There are no hidden fees, and all charges are clearly outlined. Here is a breakdown:

| Service | Pricing |

|---|---|

| Transaction Fee | 2.6% + 10¢ per swipe |

| Online Payments | 2.9% + 30¢ per transaction |

| Instant Transfers | 1% fee per transfer |

| Next-Day Transfers | Free |

This clear breakdown allows businesses to plan their expenses without unexpected costs.

Comparing Square To Competitors

When comparing Square to its competitors, it stands out due to its user-friendly pricing and lack of hidden fees. Here are some key points:

- Square’s transaction fees are competitive with other providers like PayPal and Stripe.

- Unlike some competitors, Square does not charge monthly fees for basic services.

- Square offers free next-day transfers, whereas some competitors charge for this service.

This makes Square an attractive option for small to medium-sized businesses that need predictable costs.

Value For Money

Square provides excellent value for money due to its extensive features and reasonable pricing. Here are some of the benefits:

- Comprehensive Solutions: Square offers hardware and POS systems that are designed to work seamlessly.

- Secure Payments: Accept payments anywhere, ensuring customer convenience and security.

- Operational Efficiency: Streamline operations across multiple locations with ease.

- Team Management: Optimize and manage team performance efficiently.

These features, combined with transparent pricing, ensure that businesses get maximum value from their investment in Square’s services.

Pros And Cons Of Square Payment Solutions

Square is a popular payment solution offering a range of services for businesses. From secure transactions to advanced reporting, Square aims to simplify business operations. This section will explore the advantages and drawbacks of using Square Payment Solutions.

Advantages Of Using Square

Square offers several benefits to businesses looking to streamline operations and boost efficiency.

- Sell Anywhere: Square provides hardware and POS systems that support seamless transactions, whether in-store or online.

- Secure Payments: Accept payments from anywhere, ensuring security and convenience for your customers.

- Order Options: Flexible order options including click and collect, online ordering, local delivery, and shipping.

- Custom Solutions: Tailored product suites for various industries like restaurants, retail, and beauty.

- Operations Management: Efficiently manage operations across multiple locations and sales channels.

- Cash Flow Management: Get instant transfers for a small fee or free next-business-day transfers.

- Team Management: Optimize shifts and manage teams securely.

- Customer Engagement: Centralized customer data and insights help increase loyalty.

- Advanced Reporting: Make informed decisions with detailed data analytics.

- Revenue Diversification: Open new revenue streams and track profit margins efficiently.

- Inventory Management: Sync inventory with online orders and POS systems.

- Website Creation: Create branded websites for online orders and showcasing products.

- Integration: Easily integrate with business software and websites.

Drawbacks And Limitations

While Square offers many advantages, there are some limitations to consider.

- Transaction Fees: Square charges a fee per transaction, which can add up for high-volume businesses.

- Limited Loan Offers: Loans are customized based on sales and subject to approval, not guaranteed for all businesses.

- Customer Support: Although support is available, some users report longer response times.

- Advanced Features Cost Extra: Some advanced features and add-ons come at an additional cost.

- Account Stability: There have been reports of accounts being frozen or closed unexpectedly.

| Feature | Pros | Cons |

|---|---|---|

| Transaction Fees | Secure payments anywhere | Fees can add up for high-volume businesses |

| Custom Solutions | Tailored for specific industries | Advanced features may cost extra |

| Customer Support | Available round-the-clock | Some users report longer response times |

| Loans | Customized based on sales | Not guaranteed for all businesses |

| Account Stability | Secure and reliable | Reports of accounts being frozen or closed |

Ideal Users And Scenarios

Square Payment Solutions offer a versatile platform designed to meet diverse business needs. Here, we explore who benefits most from Square and in what scenarios.

Best Fit For Small Businesses

Small businesses thrive with Square’s affordable and user-friendly features. The platform’s secure payments and easy-to-use POS systems make it ideal for shops, cafes, and local services. Instant transfers and next-business-day options ensure cash flow, critical for small operations. Customizable product suites for restaurants, retail, and beauty businesses help streamline operations.

| Feature | Benefit |

|---|---|

| Secure Payments | Accept payments anywhere |

| Instant Transfers | Funds available in 20 minutes |

| Custom Solutions | Tailored for specific industries |

Industry-specific Applications

Square’s versatility shines in various industries. For restaurants, it offers order options like click and collect, online ordering, and local delivery. Retailers benefit from inventory management that syncs with online orders and POS systems. Beauty businesses can optimize appointment scheduling and team management.

- Restaurants: Click and collect, online ordering, local delivery.

- Retail: Inventory management, POS system integration.

- Beauty: Appointment scheduling, team management.

Scalability For Growing Businesses

As businesses grow, so do their needs. Square supports scalability with features like advanced reporting and team management. These tools help businesses make data-driven decisions and optimize team performance. Additionally, Square’s integration capabilities ensure smooth operations across multiple locations.

- Advanced Reporting: Make informed decisions with data analytics.

- Team Management: Optimize shifts and manage team performance.

- Integration: Connect payment hardware to business software using APIs.

For growing businesses, Square offers the flexibility to expand and the tools to manage new challenges effectively.

Frequently Asked Questions

What Is Square Payment Solutions?

Square Payment Solutions offers comprehensive tools for accepting payments. It includes hardware, software, and financial services for businesses. Square helps streamline transactions and manage sales efficiently.

How Does Square Work For Small Businesses?

Square provides a point-of-sale system for small businesses. It includes a card reader, payment processing, and sales tracking. The system is easy to set up and use.

Is Square Secure For Online Payments?

Yes, Square is secure for online payments. It uses encryption and tokenization to protect data. Regular security updates ensure ongoing protection for transactions.

Can Square Integrate With Other Business Tools?

Yes, Square integrates with various business tools. It connects with accounting software, e-commerce platforms, and inventory management systems. This integration helps streamline business operations.

Conclusion

Choosing Square Payment Solutions simplifies managing your business transactions. Square’s secure, reliable platform adapts to various business needs. From seamless transactions to advanced reporting, it ensures efficiency and growth. Optimize team performance and boost customer loyalty with ease. For comprehensive details, visit Square.