Square Payment Gateway: Revolutionize Your Business Transactions

Managing payments is crucial for any business. Square Payment Gateway offers a comprehensive solution.

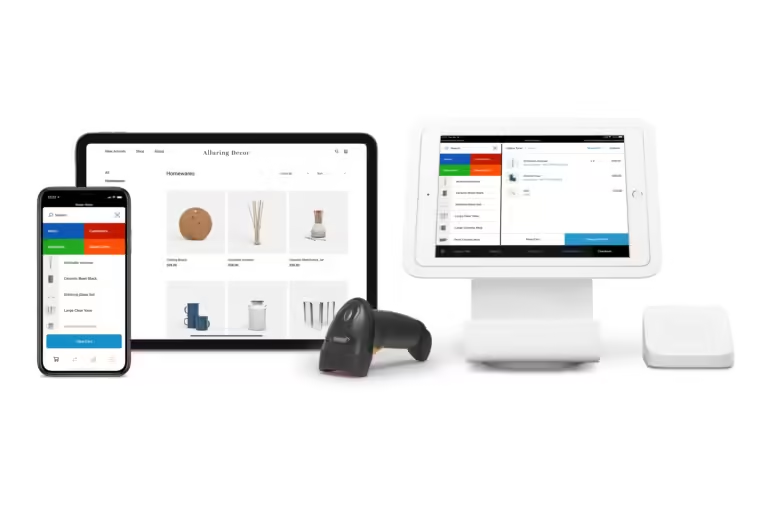

Square is designed for businesses of all sizes. It provides secure payment options, inventory management, and customer insights. Square helps streamline operations across multiple locations. It also supports various sales channels, enhancing efficiency. With Square, businesses can automate processes and open new revenue streams. Trusted by millions, Square is a powerful tool for modern business management. Whether you need a robust POS system, custom solutions for your industry, or quick access to funds, Square has you covered. Interested in learning more about how Square can benefit your business? Check out their official website here. Stay tuned as we dive deeper into what makes Square a top choice for many businesses.

Introduction To Square Payment Gateway

Square is a popular choice for businesses looking to streamline their payment processes. It provides a comprehensive solution that helps businesses manage transactions efficiently and securely.

What Is Square Payment Gateway?

Square Payment Gateway is a service that allows businesses to accept payments online or in-person. It integrates with Square’s POS systems and other business tools to provide a seamless transaction experience.

Main Features include:

- Hardware and POS Systems: Designed to sell anywhere with secure payment options.

- Operational Management: Streamline operations across multiple locations, sales channels, and employees.

- Instant Transfers: Cash out in minutes for a small fee or for free with next-business-day transfers.

- Custom-Tailored Suites: Specific products for restaurants, retail, and beauty businesses.

- Inventory Management: Track profit margins and manage inventory seamlessly.

- Online Presence: Create branded websites for online orders and inventory sync with Square POS.

- Customer Management: Increase customer loyalty and value with centralized data and insights.

- Advanced Reporting: Access powerful data for confident decision-making.

- Revenue Diversification: Open new revenue streams and manage them efficiently.

The Purpose And Importance Of Square Payment Gateway For Businesses

The purpose of Square Payment Gateway is to simplify payment processing for businesses. It provides a secure and efficient way to handle transactions, both online and offline.

Benefits for Businesses include:

- Efficiency: Automates processes to save time and improve business efficiency.

- Scalability: Supports multi-location businesses and diverse sales channels.

- Quick Access to Funds: Instant transfers available within 20 minutes.

- Custom Solutions: Tailored products for specific industries.

- Customer Insights: Centralized data helps in understanding and retaining customers.

- Comprehensive Reporting: Provides detailed reports for better business decisions.

Square’s Payment Gateway is trusted by millions of businesses worldwide. It helps businesses work smarter and open new revenue streams. With features like instant transfers and advanced reporting, it empowers businesses to grow and manage operations effectively.

Key Features Of Square Payment Gateway

Square Payment Gateway offers numerous features that make it a reliable choice for businesses. These features are designed to enhance efficiency, security, and overall business management. Below are some key features of Square Payment Gateway.

User-friendly Interface

Square Payment Gateway boasts a user-friendly interface that simplifies the payment process. Both customers and businesses find it easy to use. This ease of use helps in reducing transaction times and enhances customer experience. The interface is intuitive, ensuring even non-tech-savvy users can navigate it with ease.

Versatile Payment Options

Square supports versatile payment options. Businesses can accept credit and debit cards, mobile payments, and online transactions. This flexibility ensures customers have multiple ways to pay, which can increase sales. Square also offers instant transfers for a small fee, or free next-business-day transfers.

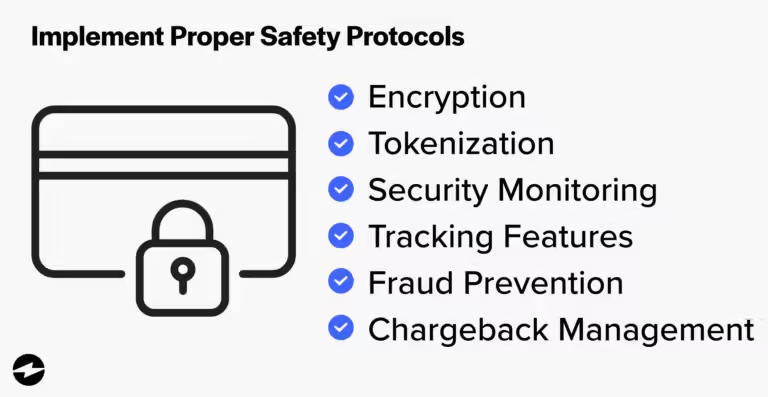

Robust Security Measures

Security is a top priority for Square. It employs robust security measures to protect transaction data. Encryption and secure servers are used to keep data safe. This security ensures that businesses and customers can trust their information is protected.

Real-time Analytics And Reporting

Square provides real-time analytics and reporting. Businesses can access detailed reports on sales, inventory, and customer data. This information helps in making informed decisions. The advanced reporting tools are designed to provide insights that can drive business growth.

Integration With Other Tools And Platforms

Square integrates seamlessly with various tools and platforms. This includes APIs and integrations that allow businesses to connect Square with their websites or business software. This integration capability helps in creating a cohesive business environment where all tools work together efficiently.

| Feature | Description |

|---|---|

| User-Friendly Interface | Intuitive interface that simplifies payment processing. |

| Versatile Payment Options | Accepts multiple payment types including cards and mobile payments. |

| Robust Security Measures | Encryption and secure servers to protect transaction data. |

| Real-Time Analytics and Reporting | Detailed reports on sales, inventory, and customer data. |

| Integration with Other Tools and Platforms | APIs and integrations with business software or websites. |

Pricing And Affordability

Square offers a range of services that cater to businesses of all sizes. Understanding the pricing and affordability of these services is crucial. Below, we dive into the pricing structure, compare it with competitors, and analyze the cost-effectiveness for small and large businesses.

Transparent Pricing Structure

Square is known for its transparent pricing structure. Here are the key points:

- No monthly fees for basic services

- 2.6% + 10¢ per swipe, dip, or tap for in-person transactions

- 2.9% + 30¢ per transaction for online sales

- Instant transfers available for a 1.5% fee

This straightforward approach allows businesses to predict costs easily, avoiding surprises.

Comparison With Competitors

How does Square compare with other payment gateways like PayPal and Stripe?

| Service | In-Person Transaction Fee | Online Transaction Fee | Monthly Fees |

|---|---|---|---|

| Square | 2.6% + 10¢ | 2.9% + 30¢ | None |

| PayPal | 2.7% | 2.9% + 30¢ | None |

| Stripe | 2.7% + 5¢ | 2.9% + 30¢ | None |

Square’s pricing is competitive, especially for businesses with high in-person sales.

Cost-effectiveness For Small And Large Businesses

Square’s pricing model is beneficial for both small and large businesses:

- Small Businesses: No monthly fees mean lower overhead costs. Predictable transaction fees help with budgeting.

- Large Businesses: Square supports multi-location operations. Advanced reporting and centralized customer data add value.

Additionally, Square offers custom-tailored suites for specific industries, providing tools that fit unique business needs.

Overall, Square’s pricing structure provides clear, predictable costs. This transparency makes it easier for businesses to manage finances efficiently.

Pros And Cons Of Square Payment Gateway

Square Payment Gateway is popular among businesses for its comprehensive features. It offers a range of solutions for efficient operations and secure payments. Below, we explore the pros and cons of using Square Payment Gateway.

Pros: User Experience, Security, And Customer Support

User Experience: Square provides a user-friendly interface that is easy to navigate. Businesses can quickly set up their accounts and start accepting payments. The platform supports various devices, allowing sales from anywhere. The inventory management feature is seamless, making it easier to track profit margins.

Security: Square ensures secure transactions with robust encryption. It complies with industry standards to protect sensitive data. Instant transfers add another layer of security by reducing the risk of payment delays.

Customer Support: Square offers round-the-clock support, ensuring help is available when needed. The Seller Community provides additional resources, allowing users to share experiences and solutions.

Cons: Limitations And Areas For Improvement

Limitations: While Square is versatile, it may not suit very large enterprises with complex needs. The platform charges a fee for instant transfers, which can add up for frequent users.

Areas for Improvement: Some users find the reporting features limited compared to other platforms. Enhanced customization options for reports could benefit businesses with specific needs.

Real-world User Feedback And Reviews

User feedback for Square is generally positive. Many appreciate its ease of use and comprehensive features. The instant transfer option is particularly valued by small businesses for quick access to funds.

Some users, however, express concerns about the fees associated with certain services. They suggest more flexible pricing options to cater to diverse business models.

| Feature | Pros | Cons |

|---|---|---|

| User Experience | Easy to navigate, quick setup | May not suit very large enterprises |

| Security | Robust encryption, industry compliance | N/A |

| Customer Support | 24/7 support, Seller Community | N/A |

| Instant Transfers | Quick access to funds | Associated fees |

| Reporting | Detailed insights | Limited customization |

For more information, visit Square’s official website.

Ideal Users And Scenarios For Square Payment Gateway

Square is a versatile payment solution trusted by millions worldwide. It offers a range of features that cater to various business types and scenarios. Understanding the ideal users and situations where Square excels can help businesses make an informed decision.

Best Fit For Small And Medium Enterprises

Square is particularly well-suited for small and medium enterprises (SMEs). Its hardware and POS systems are designed to support businesses of various sizes, allowing them to sell anywhere with secure payment options.

- Automates processes for efficiency.

- Supports multi-location operations.

- Offers tailored solutions for specific industries.

SMEs can benefit from Square’s inventory management and advanced reporting features. These tools help track profit margins and provide insights for confident decision-making.

Suitability For E-commerce And Brick-and-mortar Stores

Square is ideal for both e-commerce and brick-and-mortar stores. It offers a unified solution to manage sales across different channels.

| Feature | Benefit |

|---|---|

| Online Presence | Create branded websites for online orders |

| Inventory Sync | Sync inventory with Square POS |

| Customer Management | Centralize data to increase loyalty |

For e-commerce businesses, Square provides the ability to create branded websites. This feature ensures seamless online ordering and inventory management. Brick-and-mortar stores can leverage Square’s POS systems to streamline operations.

Scenarios Where Square Payment Gateway Excels

Square excels in scenarios where businesses need quick access to funds. With instant transfers available within 20 minutes, businesses can maintain cash flow efficiently.

It is also highly effective for businesses that require custom-tailored solutions. Square offers specific products for restaurants, retail, and beauty businesses.

- Instant transfers for quick access to funds.

- Custom solutions for industry-specific needs.

- Comprehensive reporting for better decision-making.

Square’s advanced reporting provides detailed insights, making it easier to make data-driven decisions. This feature is valuable for businesses aiming to improve efficiency and profitability.

Frequently Asked Questions

What Is Square Payment Gateway?

Square Payment Gateway is an online payment processing service. It allows businesses to accept payments securely. It supports various payment methods, including credit cards.

How Does Square Payment Gateway Work?

Square Payment Gateway processes transactions through secure servers. It encrypts payment data for safety. Transactions are completed in real-time.

Is Square Payment Gateway Secure?

Yes, Square Payment Gateway is secure. It uses advanced encryption to protect payment information. PCI compliance ensures high security standards.

Can I Integrate Square Payment Gateway With My Website?

Yes, you can integrate Square Payment Gateway with your website. It offers APIs and plugins for easy integration. It supports various e-commerce platforms.

Conclusion

Square is a versatile solution for businesses of all sizes. It offers reliable hardware, efficient management tools, and instant transfers. With features tailored for various industries, Square helps streamline operations and boost efficiency. Access to customer insights and advanced reporting aids in making informed decisions. Explore Square’s comprehensive offerings to elevate your business operations. Visit Square for more information and start enhancing your business today.