Square Invoicing: Simplify Your Billing Process Today

Square Invoicing is a powerful tool for businesses. It simplifies billing and payment processes.

With Square Invoicing, you can send professional invoices quickly and securely. This tool supports various payment options, making it easier for customers to pay. Whether you’re a small business owner or a freelancer, Square Invoicing can help you manage your finances efficiently. Designed to streamline operations, it integrates seamlessly with other Square products. This makes it a comprehensive solution for managing business transactions. Let’s explore how Square Invoicing can benefit your business and improve your cash flow. For more information, visit the Square website.

Introduction To Square Invoicing

Square Invoicing is a feature of the Square platform that helps businesses manage their billing process efficiently. This tool offers a simple way to send invoices, track payments, and streamline cash flow. With Square Invoicing, businesses can focus more on growth and less on paperwork.

What Is Square Invoicing?

Square Invoicing is a digital solution for sending invoices and receiving payments. It is part of the Square platform, trusted by millions of businesses worldwide. This tool allows users to create and send professional invoices via email or text. It also enables customers to pay securely online.

Purpose And Benefits Of Using Square Invoicing

The main purpose of Square Invoicing is to simplify the billing process. Here are some key benefits:

- Efficiency: Automate the invoicing process to save time.

- Instant Payments: Receive payments quickly with instant transfer options.

- Professional Invoices: Create customized invoices that reflect your brand.

- Payment Tracking: Keep track of all payments in one place.

- Customer Convenience: Offer various payment options to your customers.

Additionally, Square Invoicing integrates seamlessly with other Square products. This ensures a cohesive experience for managing business operations.

Key Features Of Square Invoicing

Square Invoicing offers businesses a powerful tool to manage their billing processes efficiently. It provides several key features that simplify invoicing, ensure timely payments, and streamline financial tracking. Below, we explore these features in detail.

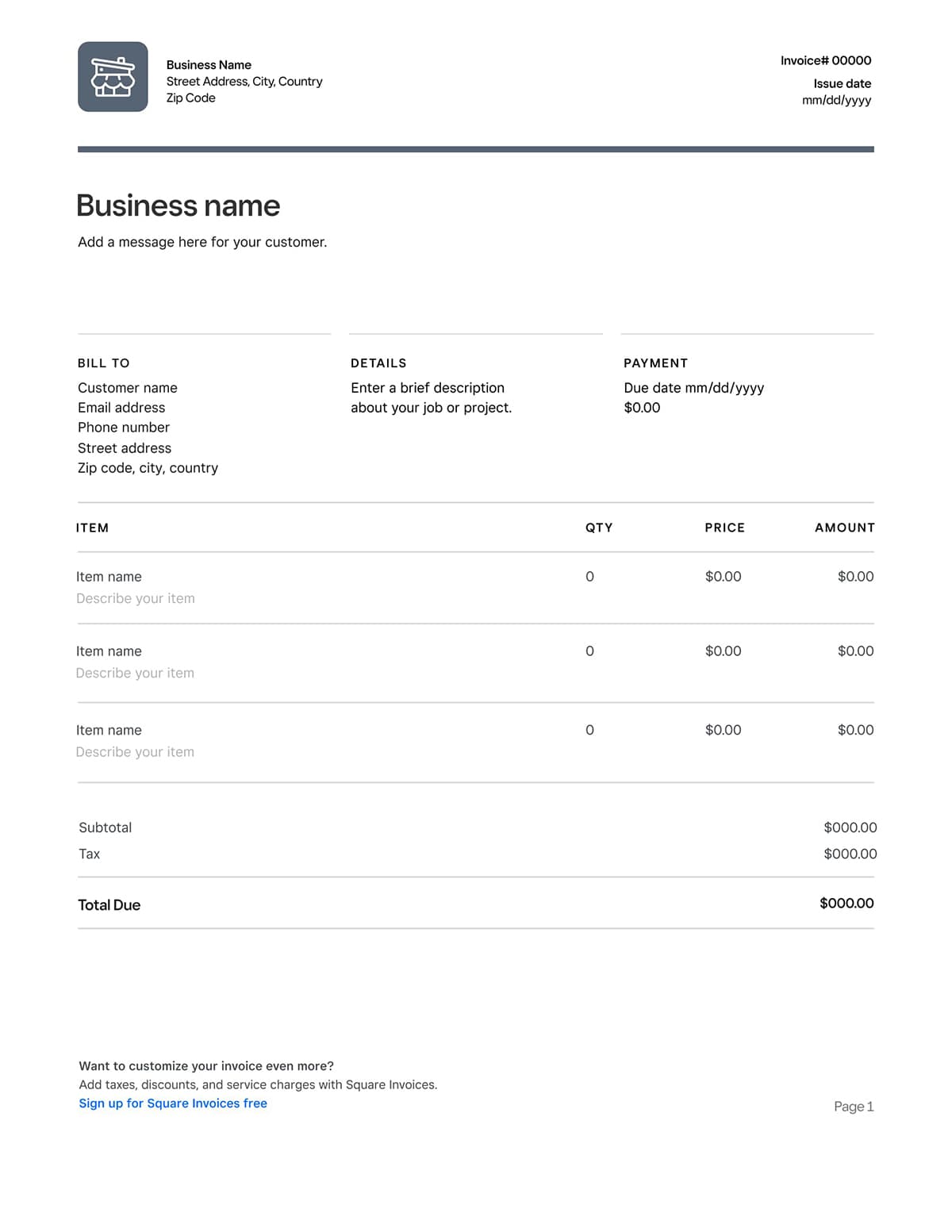

Customizable Invoice Templates

With Square Invoicing, you can create customizable invoice templates that reflect your brand’s identity. You can add your logo, choose different colors, and customize the layout to make your invoices look professional. This helps in leaving a lasting impression on clients and ensures brand consistency.

Automated Reminders And Follow-ups

Businesses often struggle with late payments. Square Invoicing addresses this by providing automated reminders and follow-ups. Set up reminders that automatically notify clients about due dates, reducing the need for manual follow-up. This feature helps in maintaining cash flow and ensuring timely payments.

Multi-channel Payment Options

Square Invoicing supports multi-channel payment options. Clients can pay directly from the invoice using credit cards, debit cards, or other payment methods. This flexibility makes it convenient for clients to pay, leading to faster payment processing and an improved cash flow for your business.

Real-time Tracking And Reporting

Stay on top of your finances with Square’s real-time tracking and reporting feature. Monitor the status of your invoices, see which ones are paid and which are pending. Generate detailed reports to analyze your invoicing trends and make informed business decisions. This helps in maintaining transparency and financial clarity.

Integration With Other Square Tools

Square Invoicing seamlessly integrates with other Square tools, such as POS systems and customer management. This integration allows for a unified business management experience. Track sales, manage customer data, and oversee team productivity, all within the Square ecosystem. This integration ensures a cohesive and efficient business operation.

To explore these features and see how Square Invoicing can benefit your business, visit the official Square website.

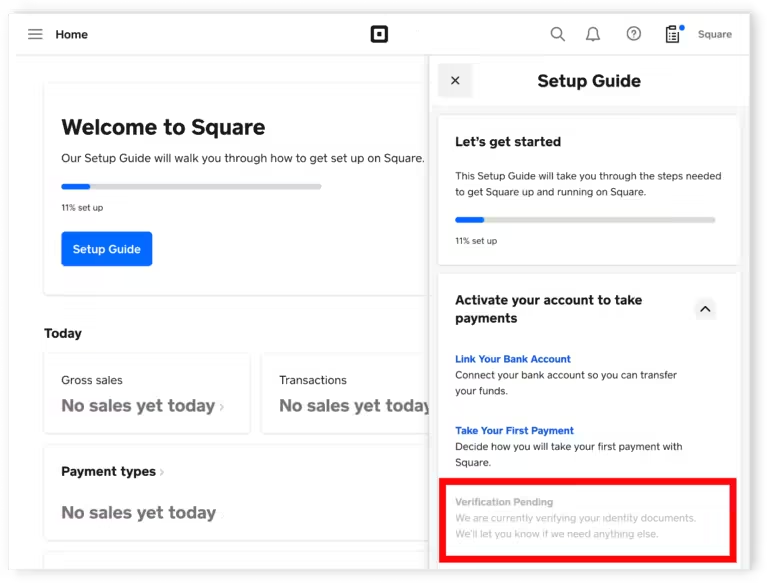

Pricing And Affordability

Square Invoicing offers a range of pricing options to suit different business needs. Understanding the pricing structure and affordability is crucial for businesses looking to manage their finances efficiently.

Breakdown Of Pricing Tiers

Square provides flexible pricing tiers to cater to various businesses:

| Service | Cost |

|---|---|

| Instant Transfers | Small fee |

| Next-Business-Day Transfers | Free |

| Customised Loans | Based on eligibility |

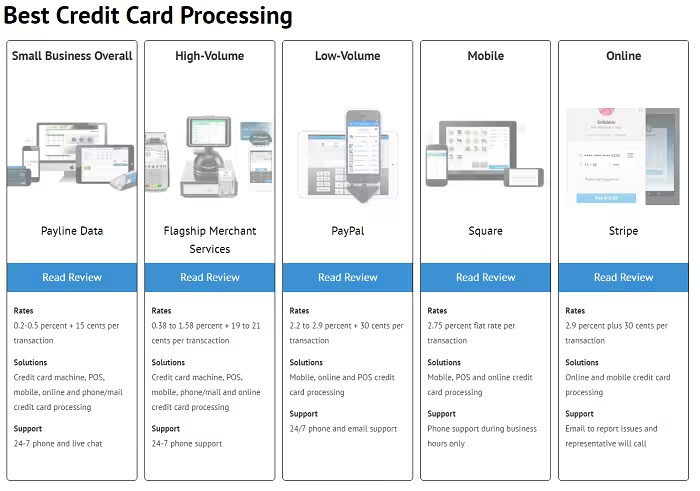

Comparing Costs With Other Invoicing Tools

When comparing Square with other invoicing tools, consider:

- Instant Transfers: Small fee for quick access to funds.

- Next-Business-Day Transfers: Free, reliable option for regular transfers.

- Loans: Custom offers based on sales, with transparent terms.

Many competitors charge higher fees for similar services, making Square an affordable choice for small and medium-sized businesses.

Value For Money Analysis

Square offers significant value for its pricing:

- Efficiency: Automates processes, reducing manual work.

- Revenue Growth: New sales channels and customer engagement.

- Data-Driven Decisions: Advanced reporting for better planning.

Square’s pricing aligns with its benefits, making it a cost-effective solution for businesses seeking to streamline operations and improve financial management.

Pros And Cons Of Square Invoicing

Square Invoicing offers a range of features that can streamline business operations. It has both advantages and some limitations. This section explores both aspects to help you decide if Square Invoicing is the right choice for your business.

Advantages Of Using Square Invoicing

- Ease of Use: The platform is user-friendly, making it easy to create and send invoices.

- Multiple Payment Options: Customers can pay via credit card, online ordering, or local delivery.

- Instant Transfers: For a small fee, you can get your funds instantly.

- Advanced Reporting: Detailed data helps you make informed decisions.

- Team Management: Optimize shifts and manage your team securely.

- Customer Engagement: Centralized data helps increase customer loyalty.

- Revenue Diversification: Manage inventory and maintain an online presence to open new revenue streams.

Limitations And Drawbacks

- Transfer Fees: Instant transfers incur a small fee.

- Eligibility for Loans: Loans are subject to eligibility and approval.

- Transfer Limits: Instant transfers have a maximum limit of £3,500 per day.

- Repayment Terms: Loans must be fully repaid within 18 months, with a minimum payment every 60 days.

- Complexity for Large Businesses: May not be sufficient for large enterprises with complex needs.

Square Invoicing is a robust tool for businesses looking to streamline their invoicing processes. While it offers many benefits, it also has some limitations that you should consider.

Ideal Users And Scenarios

Square Invoicing offers a robust solution for various users, enhancing efficiency and simplifying financial processes. This section delves into who benefits most from Square Invoicing and the scenarios where it truly stands out.

Best For Small Businesses And Freelancers

Small businesses and freelancers benefit greatly from Square Invoicing. The platform’s user-friendly interface and comprehensive features make it perfect for managing financial transactions seamlessly.

- Small businesses can manage operations across multiple locations and sales channels efficiently.

- Freelancers can easily send invoices, track payments, and manage cash flow with instant transfers.

With tools like team management and customer engagement, businesses can enhance productivity and foster customer loyalty.

Scenarios Where Square Invoicing Shines

Square Invoicing is ideal in scenarios where efficient financial management and streamlined operations are crucial.

| Scenario | Benefits |

|---|---|

| Managing multiple sales channels | Unified management for online and offline sales |

| Need for instant cash flow | Instant transfers available for a fee |

| Customer engagement and loyalty | Centralised customer data to enhance relationships |

| Detailed business insights | Advanced reporting for informed decisions |

User Testimonials And Case Studies

Real-world applications highlight the effectiveness of Square Invoicing. Here are some testimonials and case studies from users:

John’s Bakery: “Square Invoicing helped us manage our multiple locations effortlessly. The instant transfer feature is a lifesaver for our cash flow.”

Emily, Freelance Designer: “Sending invoices and tracking payments has never been easier. Square Invoicing streamlined my financial management.”

Mike’s Auto Repair: “The customer engagement tools allowed us to build strong relationships with our clients. The detailed reports helped us make better business decisions.”

These testimonials underscore the platform’s versatility and its positive impact on various businesses.

Frequently Asked Questions

What Is Square Invoicing?

Square Invoicing is a tool that helps businesses send digital invoices. It simplifies billing and payment collection. It’s user-friendly and efficient.

How Does Square Invoicing Work?

Square Invoicing allows you to create and send invoices online. Recipients can pay directly through the invoice. It tracks payments automatically.

Is Square Invoicing Free?

Square Invoicing offers a free basic plan. There are fees for processing payments. Additional features may require a paid subscription.

Can I Customize Square Invoices?

Yes, you can customize Square Invoices. Add your logo, business details, and personalized messages. Tailor the invoice to fit your brand.

Conclusion

Square Invoicing simplifies your business processes and boosts efficiency. Its features cover payment processing, business management, and customer engagement. These tools help you grow revenue and make data-driven decisions. Square’s comprehensive platform supports team productivity and customer loyalty. With options for instant and next-day transfers, managing cash flow becomes easy. Explore more about Square and start enhancing your business operations today. Visit their official site here: Square.