Square For Startups: Revolutionize Your Small Business Today

Starting a business is hard. Managing it can be tougher.

Square is here to help. This platform simplifies tasks, making them more manageable. For startups, it’s a game-changer. Square offers tools to streamline operations, handle payments, and manage teams. It’s not just about selling; it’s about growing. With Square, startups get a complete solution. This includes hardware, software, and insightful data. Why choose Square? It’s flexible, efficient, and designed for various business types. From restaurants to retail, it has tailored solutions. Want to learn more about how Square can benefit your startup? Visit the official Square website here.

Introduction To Square For Startups

Starting a new business can be challenging. Having the right tools makes a difference. Square offers a comprehensive platform designed to help startups thrive. This section will introduce you to Square for Startups, its purpose, and its key features.

What Is Square For Startups?

Square for Startups is a tailored solution for new businesses. It combines software and hardware to streamline operations and manage finances efficiently. Square supports various business types, including restaurants, retail, and beauty.

| Feature | Description |

|---|---|

| Hardware and POS Systems | Enables secure payments and various fulfillment methods. |

| Custom Solutions | Specific suites for different business types. |

| Operations Management | Streamlines operations across locations and channels. |

| Cash Flow Management | Provides instant or next-day transfers. |

| Team Management | Optimizes shifts and manages teams securely. |

| Customer Engagement | Centralizes customer data to boost loyalty. |

| Advanced Reporting | Delivers data for informed decision-making. |

| Revenue Diversification | Tracks profit margins and supports online orders. |

The Purpose Of Square For Startups

The main purpose of Square for Startups is to help new businesses succeed. It automates tasks to save time and improve efficiency. This allows startup owners to focus on growth and customer satisfaction.

- Efficiency: Automates and streamlines operations.

- Flexibility: Supports various business types with customizable solutions.

- Speed: Facilitates quick and secure payments.

- Insightful Data: Provides comprehensive reports and customer insights.

- Growth Opportunities: Opens new revenue streams.

Square offers startups the tools they need to manage and grow their businesses effectively. With its robust features and tailored solutions, Square for Startups is designed to support entrepreneurs every step of the way.

Key Features Of Square For Startups

Square is designed to help startups streamline their operations and grow efficiently. This section will explore the key features that make Square an ideal choice for new businesses.

Comprehensive Point-of-sale System

Square offers a comprehensive Point-of-Sale (POS) system that enables businesses to sell anywhere. The system supports secure payment options and various fulfillment methods, such as click and collect, online ordering, local delivery, and shipping. This flexibility allows startups to cater to different customer preferences easily.

Integrated Payment Processing

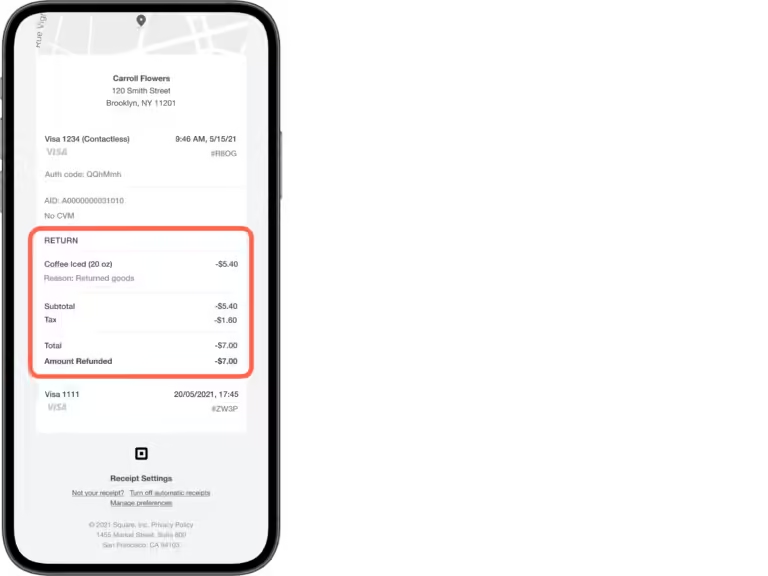

With Square, startups can benefit from integrated payment processing. This feature ensures quick and secure payments, enhancing customer satisfaction. Instant transfers for a small fee or free next-business-day transfers are available, providing businesses with the cash flow they need to operate smoothly.

Inventory Management

Square’s inventory management tools help startups track profit margins and manage stock efficiently. By keeping an eye on inventory levels, businesses can ensure they never run out of popular items and avoid overstocking, which can tie up valuable resources.

Customer Relationship Management (crm)

The Customer Relationship Management (CRM) feature in Square helps startups increase customer loyalty. By centralizing customer data and insights, businesses can create targeted marketing campaigns and personalized offers, improving customer engagement and retention.

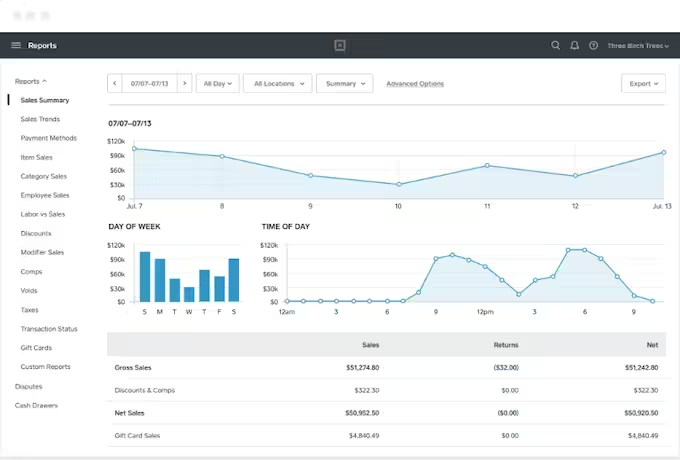

Analytics And Reporting Tools

Square provides advanced reporting and analytics tools that deliver powerful data for informed decision-making. Startups can use these insights to understand their business performance, identify trends, and make strategic decisions to drive growth and profitability.

| Feature | Description |

|---|---|

| Comprehensive POS System | Enables selling anywhere with secure payment options and various fulfillment methods. |

| Integrated Payment Processing | Ensures quick and secure payments, with options for instant transfers or next-business-day transfers. |

| Inventory Management | Helps track profit margins and manage stock efficiently. |

| CRM | Increases customer loyalty with centralized customer data and insights. |

| Analytics and Reporting Tools | Delivers powerful data for informed decision-making. |

These key features make Square an essential tool for startups looking to streamline their operations and grow efficiently.

Pricing And Affordability Of Square For Startups

Square offers a range of pricing plans designed to meet the needs of startups. The platform provides cost-effective solutions that help new businesses manage their finances efficiently. Below, we explore the various subscription plans, cost-effective solutions, and compare the value with competitors.

Subscription Plans Overview

Square provides several subscription plans tailored to different business needs. Each plan includes essential features to help startups grow.

| Plan | Features | Monthly Cost |

|---|---|---|

| Free |

|

Free |

| Plus |

|

$60/month |

| Premium |

|

Contact Sales |

Cost-effective Solutions For Startups

Square understands the budget constraints of startups and offers several cost-effective solutions. The free plan is ideal for new businesses with limited resources, providing essential tools without any monthly fees. For growing startups, the Plus plan offers advanced features at a reasonable cost.

Key benefits of Square for startups include:

- No hidden fees: Transparent pricing with no hidden costs.

- Flexible payment options: Instant transfers for a small fee, or free next-business-day transfers.

- Customizable plans: Tailored solutions to match specific business needs.

Comparing Value With Competitors

When comparing Square with other providers, it stands out due to its comprehensive features and competitive pricing. Here is a comparison of Square with other popular platforms:

| Feature | Square | Competitor A | Competitor B |

|---|---|---|---|

| Monthly Cost | Free – $60 | $50 – $100 | $30 – $70 |

| Basic POS System | Included | Included | Included |

| Instant Transfers | Small Fee | Not Available | Small Fee |

| Advanced Reporting | Included | Extra Cost | Extra Cost |

| Custom-Tailored Solutions | Available | Not Available | Available |

Square provides more value through its comprehensive features and competitive pricing. This makes it an ideal choice for startups looking for a reliable and affordable solution.

Pros And Cons Of Using Square For Startups

Square is a popular choice for startups due to its comprehensive features. It helps businesses operate efficiently, but like any tool, it has its advantages and disadvantages. This section explores the pros and cons of using Square for startups.

Pros: User-friendly Interface

Square offers a user-friendly interface that is easy for beginners to navigate. The setup process is simple and intuitive, allowing startups to quickly start accepting payments. The dashboard provides clear insights into sales and operations, making it easier to manage business activities.

Pros: Scalability

One of the key advantages of Square is its scalability. As your business grows, Square can grow with you. It supports various business types, from small retail shops to larger restaurants. The platform offers custom-tailored solutions and can handle operations across multiple locations and sales channels.

Pros: Robust Support

Square provides 24/7 support and access to a seller community. This robust support system ensures that you can get help whenever you need it. Additionally, Square offers a comprehensive knowledge base and customer engagement tools to help improve customer loyalty.

Cons: Transaction Fees

One downside of using Square is the transaction fees. While the fees are competitive, they can add up, especially for businesses with high transaction volumes. These fees include charges for instant transfers and other payment services.

Cons: Limited Customization

Square may have limited customization options for certain business needs. Although it offers various solutions, some businesses might find it lacks specific features. Customization is essential for businesses with unique requirements or complex operations.

| Pros | Cons |

|---|---|

| Easy to use interface | Transaction fees |

| Scalable solutions | Limited customization |

| Robust support |

Ideal Users And Scenarios For Square For Startups

Square for Startups is ideal for a wide range of businesses. The platform provides tailored solutions to meet the specific needs of different industries. Whether you run a retail store, a food and beverage startup, or a service-based business, Square can help streamline operations and grow your business. Below, we explore the ideal users and scenarios for using Square for Startups.

Best For Retail Businesses

Square offers robust solutions for retail businesses. The platform’s hardware and POS systems enable retailers to sell anywhere. You can accept secure payments and offer various fulfillment methods, such as click and collect, online ordering, local delivery, and shipping.

Key features for retail businesses include:

- Inventory Management: Track stock levels and profit margins.

- Customer Engagement: Use centralized customer data to enhance loyalty.

- Advanced Reporting: Make informed decisions with powerful data insights.

- Operations Management: Streamline operations across multiple locations and sales channels.

Perfect For Food And Beverage Startups

Square is perfect for food and beverage startups. The platform offers custom-tailored solutions for restaurants and cafes, helping them manage orders and payments efficiently.

Key features for food and beverage startups include:

- Online Ordering: Accept orders through a branded website.

- Instant Transfers: Get funds quickly to manage cash flow.

- Team Management: Optimize team shifts and manage staff securely.

- Customer Insights: Leverage data to improve customer experiences.

Suitable For Service-based Businesses

Square is suitable for service-based businesses, providing tools to manage appointments, payments, and customer interactions. The platform supports various service industries, including beauty and wellness.

Key features for service-based businesses include:

- Appointment Scheduling: Manage and book appointments seamlessly.

- Flexible Payment Options: Offer secure payment methods for services.

- Customer Management: Use centralized data to enhance client relationships.

- Comprehensive Reporting: Access detailed reports to drive business decisions.

Overall, Square for Startups provides the tools needed to enhance efficiency, improve customer engagement, and drive growth across various business types.

Conclusion: Is Square For Startups Right For Your Business?

Deciding on the right tools and platforms is crucial for any startup. Square offers a comprehensive suite designed to meet the needs of various business types. Let’s explore if Square is the right fit for your startup.

Summary Of Benefits

Square provides numerous benefits that can help startups thrive:

- Efficiency: Automates and streamlines operations, enhancing overall productivity.

- Flexibility: Supports diverse business types with customizable solutions.

- Speed: Facilitates quick, secure payments, including instant cash transfers.

- Insightful Data: Offers comprehensive reporting and customer insights for better decisions.

- Growth Opportunities: Helps open new revenue streams and supports business expansion.

Final Recommendations

If your startup needs a reliable platform for managing operations and enhancing efficiency, Square could be the ideal solution. Here are some final recommendations:

- Consider your specific business needs and compare them with Square’s offerings.

- Evaluate the cost of instant transfers and how it fits into your cash flow strategy.

- Take advantage of the 24/7 support and seller community for continuous assistance.

- Utilize the advanced reporting features to make informed business decisions.

- Leverage the flexibility and custom solutions for your specific industry.

For businesses in the restaurant, retail, or beauty industry, Square’s tailored solutions can be particularly beneficial. Trust the platform used by millions globally to streamline your startup’s operations and drive growth.

Frequently Asked Questions

What Is Square For Startups?

Square for Startups is a program that offers tools and resources to help new businesses grow. It provides access to funding, mentorship, and a suite of business solutions.

How Does Square For Startups Work?

Square for Startups works by offering tailored business tools and support. Entrepreneurs can access payment solutions, financial services, and expert guidance to scale their startups efficiently.

Who Can Benefit From Square For Startups?

New businesses and entrepreneurs in various industries can benefit from Square for Startups. It is designed to support early-stage companies looking to grow and streamline operations.

What Services Does Square For Startups Offer?

Square for Startups offers payment processing, business loans, point-of-sale systems, and marketing tools. These services help startups manage and grow their businesses effectively.

Conclusion

Square offers a valuable solution for startups. It streamlines operations and enhances efficiency. From secure payments to team management, it covers every need. Square’s custom solutions fit restaurants, retail, and beauty sectors perfectly. Startups can rely on it for growth and customer engagement. Explore more about Square to boost your business operations.