Square For Small Businesses: Boost Sales and Simplify Payments

Square for small businesses can be a game-changer. It offers solutions that streamline operations and enhance customer engagement.

Square is a software and hardware platform designed to help businesses manage their daily operations and process payments efficiently. It caters to a variety of industries, including restaurants, retail, and beauty. Square’s comprehensive suite of tools includes everything from secure payment processing to advanced reporting and inventory management. With the ability to create branded websites and track profit margins, Square enables small businesses to thrive in a competitive market. Trusted by millions of businesses globally, Square provides the tools needed to increase revenue and streamline operations. Discover more about Square and how it can benefit your business here.

Introduction To Square For Small Businesses

Square is a versatile platform designed to support small businesses in managing their operations, processing payments, and boosting revenue. Trusted by millions globally, Square offers customized solutions for various industries, making it an invaluable tool for small business owners.

Overview Of Square

Square combines both software and hardware to create an all-in-one solution for businesses. It includes hardware such as POS systems for secure payment processing and software for managing different aspects of business operations.

The platform is tailored to specific industries such as restaurants, retail, and beauty. This makes it adaptable to a wide range of business needs. With Square, businesses can handle payments, manage inventory, optimize team shifts, and engage customers effectively.

Purpose And Benefits For Small Businesses

Square’s primary purpose is to simplify the management of small businesses. It does this by integrating multiple functions into a single system. Here are some key benefits:

- Instant Transfers: Get cash in minutes for a small fee, or opt for free next-business-day transfers.

- Customized Loan Offers: Eligible businesses receive loan offers based on their sales with Square.

- Efficiency: Manage various software and integrations seamlessly through one platform.

- Revenue Diversification: Explore new revenue streams and keep track of profit margins.

- Ease of Use: Quick staff training and user-friendly interfaces.

- Global Trust: Trusted by over 4 million sellers worldwide.

| Feature | Description |

|---|---|

| Hardware and POS Systems | Designed to sell anywhere with secure payment processing. |

| Custom-Tailored Suites | Specific solutions for restaurants, retail, and beauty businesses. |

| Payment Options | Click and collect, online ordering, local delivery, and shipping. |

| Operational Management | Streamline operations across multiple locations and sales channels. |

| Team Management | Optimize team shifts and manage employees securely. |

| Customer Engagement | Centralized customer data and insights to increase loyalty. |

| Advanced Reporting | Access to powerful data for confident decision-making. |

| Inventory Management | Track profit margins and manage inventory efficiently. |

| Online Presence | Create branded websites for online orders and inventory sync with POS. |

In summary, Square offers comprehensive tools to streamline business operations. With its tailored product suites, advanced reporting, and efficient team management tools, Square empowers businesses to optimize performance and increase revenue.

Key Features Of Square

Square offers a wide range of tools to help small businesses manage their operations and grow their revenue. Below are some key features that make Square an essential platform for small businesses.

The POS system by Square is designed to facilitate secure payment processing and efficient sales management. It supports businesses in various industries such as restaurants, retail, and beauty.

- Secure payment processing

- Custom-tailored solutions for different business types

- User-friendly interfaces for quick staff training

Square allows businesses to integrate online payments easily. This feature enables businesses to offer multiple payment options, including click and collect, online ordering, local delivery, and shipping.

- Multiple payment options

- Easy online ordering and local delivery

- Seamless integration with existing systems

With Square, businesses can manage invoicing and set up recurring payments efficiently. This feature helps businesses maintain a steady cash flow and simplifies the payment process for customers.

- Easy invoicing

- Setup recurring payments

- Maintain a steady cash flow

Square’s inventory management feature helps businesses track profit margins and manage their stock effectively. It ensures that businesses can keep track of their inventory in real-time, preventing stockouts and overstocking.

- Real-time inventory tracking

- Manage stock effectively

- Track profit margins

Square offers a range of customer engagement tools that help businesses increase loyalty and understand their customers better. Centralized customer data and insights are crucial for building strong customer relationships.

- Centralized customer data

- Gain valuable customer insights

- Increase customer loyalty

| Feature | Benefits |

|---|---|

| POS System | Secure payments, custom solutions, user-friendly |

| Online Payments Integration | Multiple payment options, easy integration |

| Invoicing and Recurring Payments | Easy invoicing, steady cash flow |

| Inventory Management | Real-time tracking, manage stock |

| Customer Engagement Tools | Centralized data, valuable insights |

By leveraging these features, small businesses can streamline their operations and enhance their customer experience. Square provides a comprehensive solution to help businesses succeed.

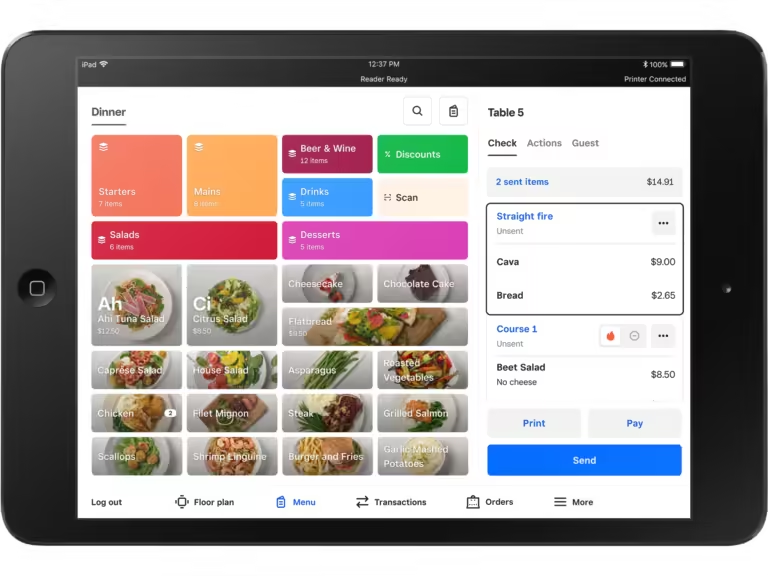

Point Of Sale (pos) System

Square’s Point of Sale (POS) system is a powerful tool for small businesses. It helps manage operations, process payments, and increase revenue seamlessly. Trusted by millions globally, this system offers custom-tailored solutions for various industries.

Ease Of Use And Setup

The Square POS system is incredibly user-friendly. Small business owners can set it up in minutes without any technical expertise. The intuitive interface ensures that staff can be trained in less than 30 minutes. This quick setup and ease of use save valuable time and resources.

Versatile Hardware Options

Square offers a range of versatile hardware options to meet different business needs. Whether it’s a full countertop setup or a mobile solution, Square has the right hardware. The hardware is designed to be secure and reliable, ensuring smooth payment processing.

- Square Stand: Ideal for countertop setups.

- Square Reader: Perfect for mobile payments.

- Square Terminal: All-in-one portable device.

Real-time Sales Tracking

With Square’s POS system, businesses can track sales in real-time. This feature provides insights into sales performance, helping owners make informed decisions. Access detailed reports anytime to monitor revenue, identify trends, and optimize inventory.

| Feature | Benefit |

|---|---|

| Real-time Data | Monitor sales as they happen. |

| Detailed Reports | Access comprehensive sales data. |

| Trend Analysis | Identify and capitalize on trends. |

Square’s POS system is a comprehensive solution for small businesses. It streamlines operations, offers versatile hardware, and provides real-time insights. This makes it an essential tool for managing and growing a business.

Online Payments Integration

Square offers a seamless Online Payments Integration for small businesses. This integration helps manage operations, process payments, and increase revenue effectively. It’s designed to work smoothly across various sales channels, making it a trusted choice for many businesses globally.

Seamless E-commerce Integration

Square’s e-commerce integration ensures that your online store works perfectly with your physical store. With Square, you can:

- Create branded websites for online orders.

- Sync inventory with your POS system.

- Offer multiple payment options including click and collect, online ordering, and local delivery.

- Access centralized customer data and insights to increase loyalty.

This integration simplifies managing different software and ensures a consistent experience for your customers both online and offline.

Mobile Payment Solutions

Square’s mobile payment solutions enable businesses to accept payments on the go. With secure payment processing, businesses can sell anywhere using Square’s hardware and POS systems. Key features include:

- Instant transfers for quick cash flow.

- Easy-to-use interfaces that require minimal training.

- Custom-tailored suites for specific industries like restaurants, retail, and beauty.

These mobile solutions are designed to be user-friendly and efficient, making them ideal for small businesses.

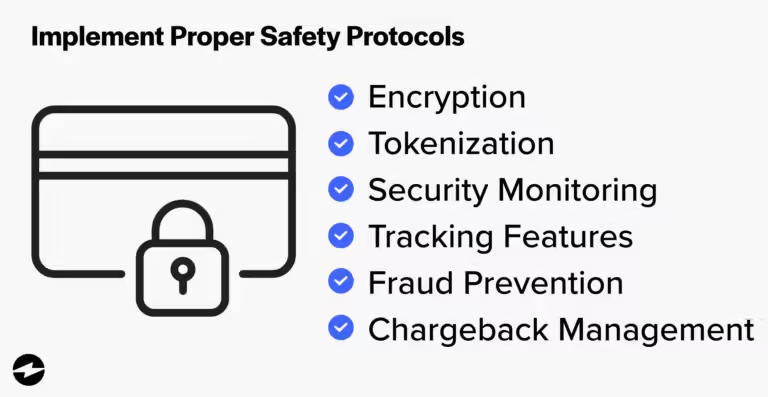

Security And Fraud Prevention

Security is a top priority for Square. Their security and fraud prevention measures ensure that all transactions are safe. Square offers:

- Compliance with Electronic Money Regulations 2011.

- Round-the-clock product support.

- Authorization by the Financial Conduct Authority.

These features help protect your business and provide peace of mind when processing payments.

| Features | Benefits |

|---|---|

| Instant Transfers | Funds available in minutes for a small fee. |

| Custom Loan Offers | Loans based on Square sales for eligible customers. |

| Advanced Reporting | Access powerful data for confident decision-making. |

| APIs and Integrations | Connect with business software or website using APIs. |

Invoicing And Recurring Payments

Square offers comprehensive invoicing and recurring payment solutions for small businesses. These features help businesses streamline payment processes and ensure timely revenue collection. Let’s explore some of the standout features in this area.

Customizable Invoices

Square allows businesses to create customizable invoices that reflect their brand identity. Users can add their logo, choose color schemes, and include personalized messages. This attention to detail helps enhance the customer experience and promotes a professional image.

With Square, you can easily generate invoices for products or services. Businesses can set due dates, itemize charges, and apply discounts as needed. The platform provides flexibility, ensuring each invoice meets specific business requirements.

Automated Payment Reminders

Managing payments can be challenging for small businesses. Square simplifies this with automated payment reminders. These reminders are sent to customers before the invoice due date, reducing the likelihood of late payments.

Businesses can schedule reminders at intervals that suit their needs. This automation saves time and ensures consistent communication with customers. As a result, businesses can focus more on their operations rather than chasing payments.

Subscription Billing

For businesses offering recurring services, Square’s subscription billing is a valuable feature. It allows businesses to set up recurring payments with ease. This is ideal for membership fees, service subscriptions, and other regular payments.

Square provides flexibility in subscription plans. Businesses can choose billing frequencies such as weekly, monthly, or annually. This adaptability makes it easier to cater to different customer preferences.

Square’s subscription billing also includes automatic renewals and notifications. Customers receive timely alerts about upcoming payments, ensuring transparency and trust. This helps maintain a steady cash flow and supports business growth.

Inventory Management

Managing inventory can be a challenging task for small businesses. With Square’s comprehensive Inventory Management system, businesses can efficiently track stock, receive low stock alerts, and access detailed reporting. This leads to a smoother operation and better decision-making.

Automated Stock Tracking

Automated stock tracking ensures your inventory levels are updated in real-time. Square’s system automatically adjusts inventory counts when a sale is made or a return is processed. This reduces the risk of human error and saves valuable time.

- Real-time inventory updates

- Reduces manual data entry

- Minimizes errors

Low Stock Alerts

Square’s inventory management system provides low stock alerts. When your inventory reaches a predefined threshold, you will receive notifications. This ensures you never run out of essential items and can restock them promptly.

- Set custom thresholds for alerts

- Receive notifications via email or app

- Prevents stockouts

Detailed Reporting And Analytics

Detailed reporting and analytics are crucial for understanding your business’s performance. Square offers advanced reporting features that provide insights into sales trends, inventory turnover, and profit margins. These reports help you make informed decisions and optimize inventory management.

| Report Type | Description |

|---|---|

| Sales Trends | Analyzes sales data to identify patterns |

| Inventory Turnover | Measures how quickly inventory is sold |

| Profit Margins | Calculates profit for each item sold |

With these tools, Square empowers small businesses to manage their inventory efficiently, reducing waste and improving profitability.

Customer Engagement Tools

Square offers a comprehensive suite of customer engagement tools designed to help small businesses build strong relationships with their customers. These tools include loyalty programs, customer feedback collection, and email marketing integration.

Loyalty Programs

Square’s loyalty programs are designed to reward repeat customers, encouraging them to return and make more purchases. Businesses can create custom rewards and track customer points. This helps in retaining customers and increasing their spending over time. By providing personalized rewards, businesses can enhance customer satisfaction and loyalty.

Customer Feedback Collection

Collecting customer feedback is crucial for any business to improve its services. Square makes it easy for businesses to gather valuable insights from their customers. Businesses can send surveys directly to customers after a purchase, helping them understand what works and what needs improvement. This real-time feedback enables businesses to make data-driven decisions and enhance the overall customer experience.

Email Marketing Integration

With Square’s email marketing integration, businesses can effortlessly stay connected with their customers. This tool allows businesses to create and send targeted email campaigns. Businesses can segment their audience based on purchase history, preferences, and other criteria. This ensures that the messages are relevant and engaging. This integration helps in promoting new products, special offers, and updates, keeping customers informed and engaged.

By leveraging these customer engagement tools, small businesses can foster strong relationships with their customers, drive repeat business, and ultimately increase their revenue.

Pricing And Affordability

Square offers a comprehensive platform for small businesses to manage operations and process payments. Understanding the pricing and affordability of Square’s services is crucial for businesses looking to optimize their costs. Below, we delve into the transparent pricing structure, different plans available, and the overall cost-effectiveness for small businesses.

Transparent Pricing Structure

Square prides itself on its clear and transparent pricing structure. Business owners know exactly what they are paying for without any hidden fees. The pricing is straightforward, making it easier for small businesses to budget.

- Instant Transfers Fee: A small fee applies for instant transfers, or you can opt for free next-business-day transfers.

- Custom Loan Terms: Loans are available based on payment card processing history and other eligibility factors.

This transparency ensures businesses can plan their finances effectively, avoiding unexpected costs.

Different Plans For Different Needs

Square offers a variety of plans tailored to different business needs, ensuring flexibility and suitability for various industries. These plans cater to the specific requirements of:

- Restaurants: Customized solutions for efficient order and payment processing.

- Retail: Tools for inventory management and customer engagement.

- Beauty Industry: Features to manage appointments and customer data.

This variety ensures that businesses of all types can find a plan that meets their unique demands.

Cost-effectiveness For Small Businesses

Square’s pricing is designed to be cost-effective for small businesses. The platform offers:

- Instant Transfers: Allows businesses to access funds quickly for a small fee.

- Customized Loan Offers: Eligible customers receive loan offers based on their sales, enabling them to invest in growth.

- Operational Efficiency: Simplifies managing different software and integrations, saving time and money.

These features help small businesses manage their finances efficiently and invest in their growth.

With Square, small businesses can benefit from a platform that combines affordability with robust features, enabling them to manage operations effectively while keeping costs under control.

Pros And Cons Of Square

Square is a popular platform for managing business operations and processing payments. It offers many features and tools tailored to various industries. Below, we explore the advantages and disadvantages of using Square for small businesses.

Advantages

- Comprehensive Solutions: Square offers tailored solutions for restaurants, retail, and beauty businesses, ensuring industry-specific needs are met.

- Secure Payment Processing: Secure payment processing with hardware and POS systems designed to sell anywhere.

- Flexible Payment Options: Supports click and collect, online ordering, local delivery, and shipping.

- Operational Management: Streamline operations across multiple locations and sales channels.

- Team Management: Optimize team shifts and manage employees securely.

- Customer Engagement: Centralized customer data and insights to increase loyalty.

- Advanced Reporting: Access to powerful data for confident decision-making.

- Inventory Management: Track profit margins and manage inventory efficiently.

- Online Presence: Create branded websites for online orders and sync with POS.

- Instant Transfers: Cash out in minutes for a small fee or free next-business-day transfers.

- Customized Loan Offers: Eligible customers receive loan offers based on Square sales.

- Easy to Use: Quick staff training and user-friendly interfaces.

- Global Trust: Trusted by over 4 million sellers globally.

Disadvantages

- Instant Transfers Fee: A small fee applies for instant transfers, though next-business-day transfers are free.

- Loan Terms: Loans are subject to approval with specific terms and conditions, which may not suit all businesses.

- Refund and Return Policies: Terms for loans and instant transfers may be restrictive for some users.

- Compliance Requirements: Businesses must adhere to Financial Conduct Authority regulations.

While Square offers many benefits, it is essential to consider its limitations to make an informed decision for your business.

Ideal Users And Scenarios

Square is a versatile platform designed for various business types. Its comprehensive features and easy-to-use interface make it ideal for different business scenarios. Here we explore which businesses benefit the most from using Square and those that might need to consider other options.

Best Fit For Retail Businesses

Retail businesses find Square’s features very beneficial. The inventory management tools help track profit margins and manage stock efficiently. Square’s POS systems are designed to sell anywhere and process payments securely. Retailers can also leverage advanced reporting to make confident decisions based on powerful data.

Having a centralized system to manage both in-store and online sales is a significant advantage. Retailers can create branded websites for online orders that sync seamlessly with their POS systems. This unified approach simplifies operations and enhances the customer shopping experience.

Service-based Business Applications

Service-based businesses, such as beauty salons and restaurants, benefit greatly from Square. The platform offers custom-tailored solutions for these industries. For example, beauty businesses can use Square to streamline appointment bookings and manage customer data effectively.

Restaurants can optimize operations with online ordering and local delivery options. The platform also supports team management, helping businesses schedule shifts and manage staff efficiently. With Square, service-based businesses can enhance customer engagement and ensure smooth operations.

Who Should Look Elsewhere

While Square offers robust solutions, it might not be the best fit for every business. For instance, businesses requiring highly specialized software or those with unique payment processing needs might need to look elsewhere. Some enterprises with complex inventory needs or advanced customization requirements might find Square’s offerings limited.

Additionally, businesses that operate in industries not covered by Square’s tailored solutions might benefit from exploring other platforms. It’s essential to evaluate specific business needs and ensure that Square’s capabilities align with those requirements.

Frequently Asked Questions

What Is Square For Small Businesses?

Square is a comprehensive payment processing solution for small businesses. It offers tools like point-of-sale systems, invoicing, and online payments. The platform helps streamline transactions, making it easier for businesses to manage sales.

How Does Square Help Small Businesses?

Square provides an all-in-one solution for payment processing. It simplifies transactions, offers detailed analytics, and integrates with various business tools. This helps small businesses operate more efficiently and make informed decisions.

Is Square Easy To Set Up?

Yes, Square is user-friendly and easy to set up. The platform offers a straightforward registration process and intuitive interface. Even those with limited technical skills can get started quickly.

What Fees Does Square Charge?

Square charges a flat rate for each transaction. There are no monthly fees or hidden charges. This transparent pricing structure helps small businesses manage their expenses effectively.

Conclusion

Square offers a robust platform for small businesses. It simplifies operations and payments. With custom solutions for various industries, it caters to specific needs. Square enhances customer engagement and team management. Its advanced reporting helps make informed decisions. Trusted by millions globally, it’s a reliable choice. Explore Square’s offerings here to streamline your business today.