Square For Professional Services: Streamline Your Business Today

In the world of professional services, efficiency and seamless operations are crucial. Square offers a comprehensive platform designed to cater to various business needs, from secure payments to advanced reporting.

This blog post will explore how Square can enhance your professional service business, making operations smoother and more profitable. Square provides an all-in-one solution for managing payments, customer interactions, and business operations. Whether you run a beauty salon, retail store, or restaurant, Square’s tools can help streamline your processes. The platform includes hardware and POS systems, secure payment options, team management, and customer insights. With these features, you can focus on growing your business while Square handles the operational complexities. Let’s dive into the benefits and features of using Square for your professional services. For more details, visit Square’s official website.

Introduction To Square For Professional Services

Square is a versatile platform designed to simplify business operations. It is ideal for professional services such as consultancy, legal advice, and accounting. The platform offers tools to manage payments, customer interactions, and operations efficiently.

What Is Square For Professional Services?

Square for Professional Services is a comprehensive solution tailored for businesses offering professional services. This includes legal firms, accounting services, and consulting agencies. The platform integrates hardware and software to streamline business operations and enhance client interactions.

Purpose And Benefits For Businesses

The primary purpose of Square for Professional Services is to enhance operational efficiency. It helps businesses manage payments, operations, and customer interactions seamlessly.

Key benefits include:

- Secure Payments: Accept payments securely from any location.

- Operations Management: Streamline operations across multiple locations and sales channels.

- Team Management: Optimize team shifts and manage staff securely.

- Customer Insights: Centralized data to enhance customer loyalty and value.

- Advanced Reporting: Access powerful data for informed decision-making.

- Revenue Diversification: Open new revenue streams and track profit margins.

- Online Presence: Create a branded website for online orders and inventory synchronization with Square POS.

Square also offers instant transfers for a small fee and customized loan offers based on sales. Trusted by over 4 million sellers globally, Square supports businesses in enhancing efficiency and growth.

Key Features Of Square For Professional Services

Square offers a range of tools and features to help professional services streamline their operations and enhance customer interactions. Here are the key features of Square for professional services:

Integrated Point-of-sale System

Square’s Integrated Point-of-Sale System allows businesses to manage sales, inventory, and payments seamlessly. It supports various payment methods, including credit cards, mobile wallets, and online payments. The system is designed for both in-person and online transactions, making it versatile for any business setting.

Appointment Scheduling And Management

The Appointment Scheduling and Management feature enables businesses to schedule, manage, and track appointments effortlessly. Clients can book services online, and reminders are automatically sent to reduce no-shows. This feature is essential for businesses like beauty services, consulting, and healthcare.

Invoicing And Payment Processing

With Square’s Invoicing and Payment Processing tools, businesses can send professional invoices, accept payments, and manage finances in one place. Invoices can be customized and sent via email, and clients can pay online, making the process quick and efficient.

Customer Relationship Management (crm)

Square’s Customer Relationship Management (CRM) system helps businesses maintain and enhance customer relationships. It centralizes customer data, making it easier to track purchase history, preferences, and interactions. This information can be used to create targeted marketing campaigns and improve customer loyalty.

Analytics And Reporting Tools

The Analytics and Reporting Tools provided by Square offer valuable insights into business performance. Businesses can access detailed reports on sales, customer behavior, and inventory levels. These insights help in making informed decisions and optimizing operations.

Mobile Accessibility

Square’s Mobile Accessibility feature ensures that businesses can manage their operations on the go. The mobile app allows users to access the POS system, manage appointments, send invoices, and view reports from any location. This flexibility is crucial for businesses that need to operate outside traditional office settings.

Pricing And Affordability

Understanding the pricing structure of Square is crucial for businesses considering their services. This section will delve into the different aspects of Square’s pricing and affordability, making it easier for you to decide if it’s the right fit for your business.

Overview Of Pricing Plans

Square offers a variety of pricing plans tailored to different business needs. The main features include:

- Hardware and POS Systems: Designed for seamless sales anywhere, including click and collect, online ordering, local delivery, and shipping options.

- Secure Payments: Accept payments securely from any location.

- Custom-Tailored Product Suites: Available for restaurants, retail, and beauty businesses.

- Operations Management: Streamline operations across multiple locations and sales channels, and manage employees efficiently.

| Plan | Features | Cost |

|---|---|---|

| Basic | Secure payments, basic POS system | Free |

| Plus | Advanced reporting, team management | $60/month |

| Premium | All features, priority support | Custom pricing |

Cost-effectiveness For Small And Medium Businesses

Square’s pricing plans are designed to be cost-effective for small and medium businesses.

- Free Plan: Ideal for startups with basic needs.

- Plus Plan: Suitable for growing businesses needing advanced tools.

- Premium Plan: Best for established businesses requiring comprehensive features.

These options provide flexibility, ensuring that businesses of any size can find a plan that fits their budget and needs.

Additional Fees And Charges

While Square’s pricing plans are straightforward, there are additional fees and charges to consider:

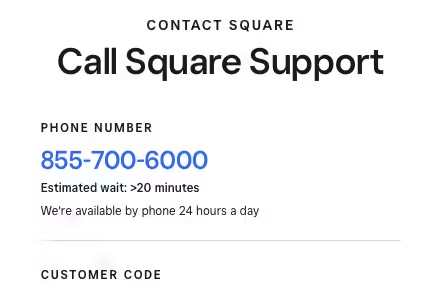

- Instant Transfers: Subject to a small fee, with funds generally available within 20 minutes.

- Loans: Terms and conditions apply, with a minimum payment requirement and full repayment within 18 months. Fees depend on card processing history, loan amount, and other factors.

These fees are designed to be transparent, allowing you to understand all costs involved in using Square’s services.

With this detailed breakdown of Square’s pricing and affordability, you can now make a more informed decision for your business needs.

Pros And Cons Of Using Square For Professional Services

Square is a versatile platform designed to help businesses, including professional services, streamline their operations. It offers a range of features tailored to different business needs. Here, we discuss the pros and cons of using Square for professional services based on real-world usage and common drawbacks.

Advantages Based On Real-world Usage

- Seamless Payments: Square allows secure payments from any location, enhancing convenience for both businesses and clients.

- Operations Management: Streamline operations across multiple locations and sales channels, making it easier to manage employees and inventory.

- Advanced Reporting: Access powerful data for informed decision-making, helping businesses understand their performance and areas for improvement.

- Customer Insights: Centralized data helps enhance customer loyalty and value, providing businesses with valuable insights into customer behavior.

- Revenue Diversification: Tools for inventory management and reporting capabilities allow businesses to explore new revenue streams.

- Instant Transfers: Businesses can cash out in minutes for a small fee, or use next-business-day transfers for free, improving cash flow management.

- Ease of Use: Simplified management of different software and integrations through one system, making it user-friendly for businesses of all sizes.

Common Drawbacks And Limitations

- Transaction Fees: Square charges a fee for each transaction, which can add up for businesses with high transaction volumes.

- Loan Terms: Loans offered by Square come with specific terms and conditions, including a minimum payment requirement and full repayment within 18 months.

- Hardware Costs: While Square offers comprehensive hardware solutions, the initial cost can be high for small businesses.

- Limited Customization: Although Square provides custom-tailored suites, some businesses may find the customization options limited compared to other platforms.

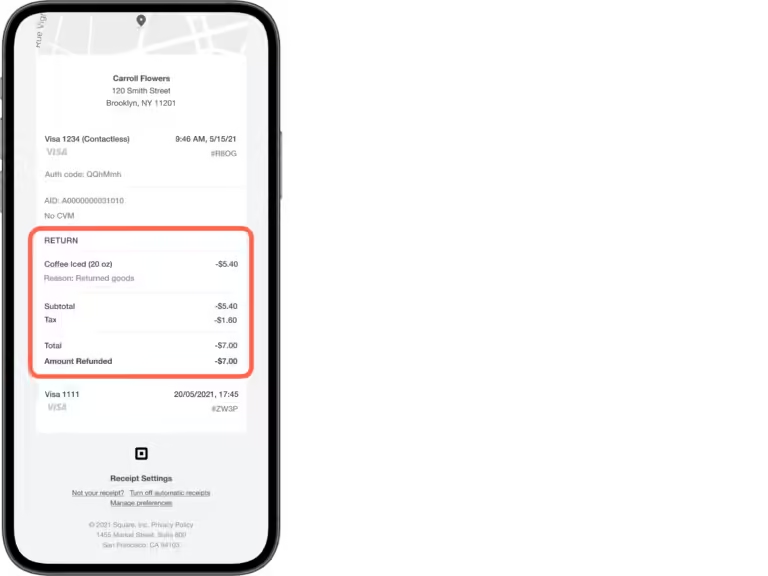

- Refund Policies: Loans are subject to approval and terms, which may not be suitable for all businesses.

| Feature | Pros | Cons |

|---|---|---|

| Secure Payments | Convenient and reliable | Transaction fees |

| Operations Management | Streamlined across locations | Initial hardware cost |

| Advanced Reporting | Informed decision-making | Learning curve |

| Customer Insights | Enhances loyalty | Limited customization |

| Instant Transfers | Improves cash flow | Small fee for instant transfers |

Square’s features offer significant benefits for professional services, but it is important to weigh these against potential drawbacks to determine if it is the right fit for your business.

Ideal Users And Scenarios For Square

Square is a versatile platform designed to cater to a wide range of business types. Its comprehensive tools make it an excellent choice for businesses seeking to streamline operations, manage payments, and enhance customer interactions. Below, we explore the best-suited business types and specific scenarios where Square excels.

Best-suited Business Types

Square is particularly beneficial for the following types of businesses:

- Restaurants: Square’s POS systems support online ordering, local delivery, and click and collect services. It simplifies operations and enhances customer experience.

- Retail: Retail businesses benefit from inventory management and advanced reporting features. These tools help track profit margins and manage stock efficiently.

- Beauty Services: Square Appointments and team management tools are perfect for beauty businesses. They help manage appointments, staff shifts, and secure payments seamlessly.

Specific Scenarios Where Square Excels

Square shines in various scenarios, ensuring businesses operate smoothly and efficiently:

- Multi-Location Operations: Businesses with multiple locations can streamline operations across all sites. Square provides centralized data and management tools for consistency and efficiency.

- Online and Offline Integration: Square’s platform allows businesses to create a branded website for online orders. Inventory synchronization with Square POS ensures accurate stock tracking.

- Employee Management: Optimize team shifts and manage staff securely. Square’s team management tools help businesses maintain smooth operations and staff productivity.

- Revenue Diversification: Businesses can open new revenue streams with Square’s inventory management and reporting capabilities. This feature helps track profit margins and make informed decisions.

- Secure Payments: Square supports secure payment processing from any location, ensuring customer transactions are safe and reliable.

Conclusion: Streamline Your Business With Square

Square offers a robust platform that helps professional services streamline their operations. With its comprehensive tools and secure payment solutions, Square is designed to support businesses in various niches. Let’s take a closer look at the key benefits and final recommendations for using Square.

Summary Of Key Benefits

- Hardware and POS Systems: Seamless sales anywhere, including click and collect, online ordering, local delivery, and shipping options.

- Secure Payments: Accept payments securely from any location.

- Custom-Tailored Product Suites: Available for restaurants, retail, and beauty businesses.

- Operations Management: Streamline operations across multiple locations and sales channels, and manage employees efficiently.

- Team Management: Optimize team shifts and manage staff securely.

- Customer Insights: Centralized data to enhance customer loyalty and value.

- Advanced Reporting: Access powerful data for informed decision-making.

- Revenue Diversification: Open new revenue streams and track profit margins with inventory management and reporting capabilities.

- Online Presence: Create a branded website for online orders and inventory synchronization with Square POS.

Final Recommendations

For businesses seeking efficiency and growth, Square provides excellent tools. Consider the following:

- Use Square Appointments to free up time for growth tasks.

- Leverage Square’s APIs to integrate with your business software.

- Take advantage of customized loan offers based on your sales.

- Maintain an online presence with a branded website.

Square supports over 4 million sellers globally. Its tools can help streamline your professional services and open new revenue streams. Visit Square’s official website for more information.

Frequently Asked Questions

What Is Square For Professional Services?

Square for Professional Services is a comprehensive platform that helps professionals manage appointments, payments, and client relationships seamlessly.

How Does Square Help Manage Appointments?

Square offers an easy-to-use scheduling system that allows clients to book appointments online, reducing administrative tasks.

Can Square Handle Online Payments?

Yes, Square supports secure online payment processing, making transactions smooth and convenient for both clients and service providers.

Is Square Suitable For Small Businesses?

Absolutely, Square is designed to cater to small businesses by providing scalable tools that grow with their needs.

Conclusion

Square offers professional services with efficiency and ease. It enhances business operations and opens new revenue streams. The platform provides secure payments, advanced reporting, and team management. Square supports various business types, including restaurants, retail, and beauty services. It is trusted globally for its reliability and comprehensive features. Discover more about Square’s offerings by visiting their official website today. Embrace the benefits and streamline your business operations with Square.