Square Financial Services: Transforming Modern Business Finances

Square Financial Services is transforming the way businesses handle payments and operations. Millions of businesses globally trust Square for its reliability and efficiency.

For those unfamiliar with Square, it’s a comprehensive platform offering both software and hardware solutions. Whether you’re running a restaurant, a retail store, or a beauty salon, Square provides tailored suites to meet your specific needs. From secure payment solutions to advanced reporting and team management, Square helps streamline operations and boost productivity. It also offers quick cash flow options and custom loans based on sales. With Square, businesses can track inventory, manage employees, and gain valuable customer insights. Discover how Square can help your business thrive by visiting their website today. Learn more here.

Introduction To Square Financial Services

Square Financial Services is a key part of the Square ecosystem, designed to provide a range of financial solutions for businesses. This service aims to simplify financial management and offer innovative tools to support business growth.

Overview Of Square Financial Services

Square Financial Services offers a variety of financial solutions tailored to meet the needs of different businesses. These include:

- Custom Loans: Based on sales data, providing businesses with the capital they need to grow.

- Instant Transfers: For a small fee, businesses can access their funds within 20 minutes.

- Secure Payment Solutions: Including click and collect, online ordering, local delivery, and shipping.

These services are integrated into the Square platform, making it easier for businesses to manage their finances and operations seamlessly.

Purpose And Mission

The primary purpose of Square Financial Services is to streamline financial management for businesses. The mission is clear:

- Provide businesses with access to capital through custom loans.

- Ensure quick access to funds via instant transfers.

- Offer secure and versatile payment solutions to facilitate smooth transactions.

By achieving these goals, Square Financial Services helps businesses save time, improve productivity, and increase revenue.

For more detailed information, visit the Square website.

Key Features Of Square Financial Services

Square Financial Services offers a wide range of features to help businesses grow and thrive. From integrated payment solutions to comprehensive business analytics, Square provides the tools needed to streamline operations and increase revenue. Below are the key features that make Square Financial Services stand out.

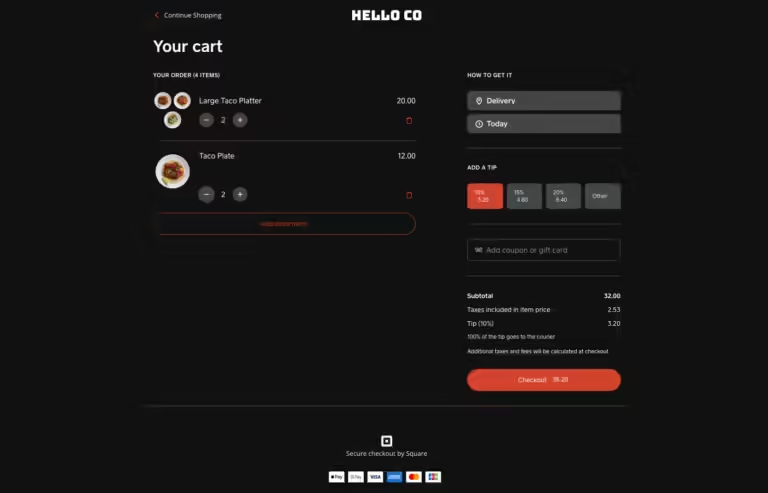

Square provides secure payment solutions designed to fit any business model. These include:

- Online Ordering: Accept payments for online orders seamlessly.

- Local Delivery: Facilitate local deliveries with integrated payment options.

- Click and Collect: Enable customers to pay online and pick up in-store.

- Shipping: Manage shipping payments effortlessly.

Square offers advanced reporting features that provide powerful data for decision-making. Key analytics tools include:

- Sales Insights: Track sales performance across various channels.

- Customer Insights: Understand customer behaviors to enhance loyalty.

- Inventory Management: Monitor inventory levels and profit margins.

Square offers custom loan solutions tailored to your business needs. Benefits include:

- Custom Loans: Receive loans based on your sales performance.

- Quick Cash Flow: Access instant transfers for a small fee, or free next-business-day transfers.

Loan repayment terms are straightforward, requiring a minimum payment every 60 days with full repayment within 18 months.

Square’s POS systems are designed to sell anywhere, making them ideal for various business types. Features include:

- Custom-Tailored Suites: Specific products for restaurants, retail, and beauty businesses.

- Operations Management: Streamline operations across multiple locations and sales channels.

- Team Management: Optimize team shifts and manage employees securely.

Square’s POS systems also integrate easily with existing business software and websites using APIs.

Integrated Payment Solutions

Square offers integrated payment solutions designed to simplify transactions for businesses. These solutions provide a seamless experience for accepting payments both online and offline. Explore the key benefits of Square’s payment solutions below.

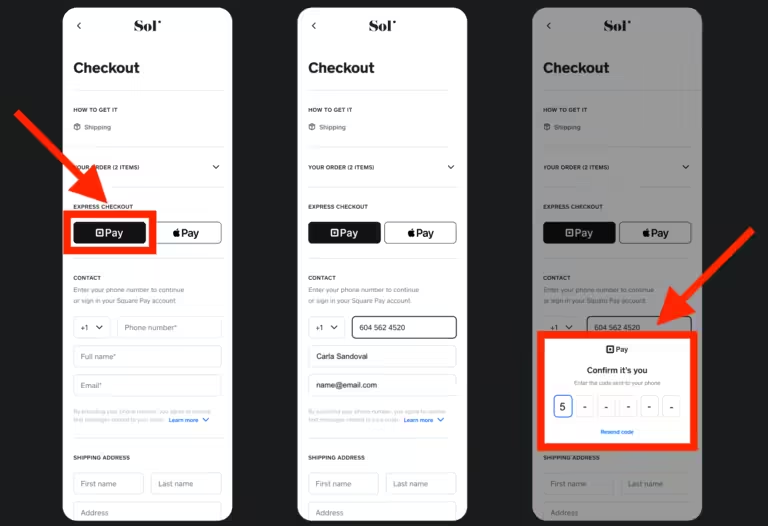

Ease Of Use For Businesses

Square’s payment solutions are designed with user-friendliness in mind. Businesses can easily set up and start accepting payments. The platform integrates smoothly with existing business software and websites using APIs. This feature reduces the learning curve for business owners and employees.

Square provides hardware and POS systems that allow businesses to sell anywhere. Whether in-store or on the go, Square ensures a smooth transaction process. The system also supports online ordering, local delivery, and shipping options, offering flexibility to businesses.

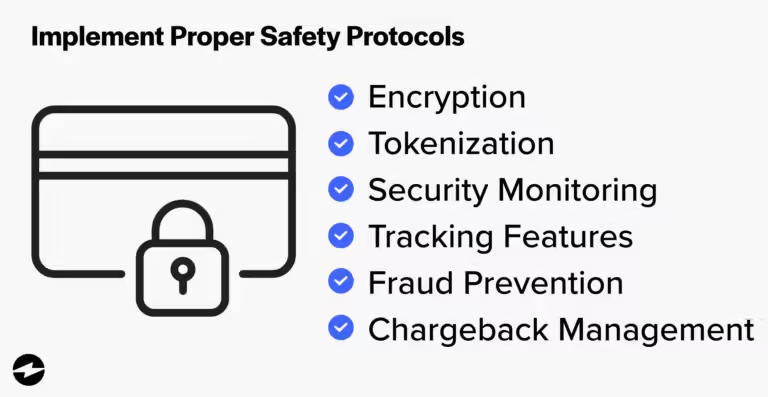

Security And Compliance

Security is a top priority for Square. The platform uses advanced security measures to protect transactions. This includes encryption and fraud detection to safeguard sensitive information.

Square complies with industry standards and regulations. This ensures that businesses meet legal requirements while using the platform. With Square, businesses can trust that their payments are secure and compliant.

Support For Multiple Payment Methods

Square supports a variety of payment methods to cater to diverse customer preferences. Businesses can accept credit cards, debit cards, and contactless payments like Apple Pay and Google Pay. This flexibility enhances the customer experience and can lead to increased sales.

Square’s payment solutions also include click and collect options. Customers can order online and pick up in-store, providing a convenient shopping experience. This feature is especially beneficial for retail and restaurant businesses.

| Main Features | Description |

|---|---|

| Hardware and POS Systems | Designed to sell anywhere, including online and offline. |

| Payment Solutions | Includes secure payments, click and collect, online ordering, local delivery, and shipping. |

| Custom-Tailored Suites | Specific products for restaurants, retail, and beauty businesses. |

| Operations Management | Streamline operations across multiple locations, sales channels, and employees. |

| Advanced Reporting | Provides powerful data for decision-making. |

| Team Management | Optimize team shifts and manage employees securely. |

| Customer Insights | Increase customer loyalty with centralized data. |

| Inventory Management | Track profit margins and sync inventory with POS. |

| Online Presence | Create branded websites for online orders. |

For more details, visit the Square website or contact their customer support.

Comprehensive Business Analytics

Square Financial Services offers comprehensive business analytics to help businesses grow. With advanced reporting tools, businesses can gain insights from their data. This helps in making informed decisions that drive success.

Real-time Data Insights

Square provides real-time data insights that allow businesses to monitor their performance instantly. This feature helps in tracking sales, customer behavior, and market trends as they happen.

- Monitor sales instantly

- Track customer behavior

- Analyze market trends

By accessing real-time data, businesses can quickly adapt to changes. This ensures they remain competitive and responsive to market demands.

Customizable Reporting

Square’s customizable reporting feature allows businesses to create reports that suit their specific needs. Users can tailor reports based on various metrics, such as sales channels, locations, and employee performance.

Features of customizable reporting include:

- Sales channel analysis

- Location-based reports

- Employee performance tracking

Customizable reports provide valuable insights that help businesses optimize their operations and improve efficiency.

Enhanced Decision-making

With Square’s business analytics, businesses can enhance their decision-making process. The advanced reporting tools provide detailed insights that guide strategic decisions.

Key benefits of enhanced decision-making include:

- Identifying profitable products and services

- Optimizing inventory management

- Improving customer satisfaction

By making informed decisions, businesses can boost their profitability and ensure long-term success.

Flexible Loan And Credit Options

Square Financial Services offers a wide range of flexible loan and credit options designed to meet the diverse needs of businesses. These options are tailored to help businesses grow, ensure quick approval, and provide the financial support needed to thrive in a competitive market.

Tailored Financial Solutions

Square provides custom loans based on business sales, making it easier for businesses to get the funds they need. Eligible customers receive personalized loan offers that are designed to fit their unique financial situations. This approach ensures that businesses can access the right amount of capital without overextending themselves.

With options like instant transfers for a small fee or free next-business-day transfers, businesses can manage their cash flow more efficiently. Square’s tailored financial solutions are ideal for businesses looking to expand, purchase new equipment, or manage day-to-day operations more effectively.

Quick Approval Process

One of the most significant advantages of Square’s loan and credit options is the quick approval process. Businesses can apply for a loan and receive approval in a matter of hours, not days. This rapid turnaround is crucial for businesses that need immediate financial support.

Square uses advanced algorithms and data analytics to assess loan applications, ensuring a smooth and efficient approval process. This means less paperwork and faster access to funds, allowing businesses to focus on their growth and operations.

Helping Businesses Grow

Square’s flexible loan and credit options are designed to help businesses grow. By providing the necessary financial support, Square enables businesses to invest in new opportunities, improve their operations, and ultimately increase their revenue.

With features like advanced reporting and inventory management, businesses can make informed decisions about how to allocate their funds. This comprehensive approach ensures that businesses can not only survive but thrive in today’s competitive market.

In summary, Square Financial Services offers a range of flexible loan and credit options tailored to meet the needs of businesses. With a quick approval process and a focus on helping businesses grow, Square provides the financial support necessary for success.

Seamless Point-of-sale Systems

Square provides seamless point-of-sale systems that cater to various business needs. These systems combine ease of use with powerful features to streamline operations and boost productivity. Businesses can manage sales, track inventory, and enhance customer relationships effortlessly.

User-friendly Interface

The user-friendly interface of Square’s POS systems ensures that even those with limited technical expertise can operate them efficiently. The intuitive design allows for quick navigation, minimizing the learning curve for new users. This ease of use ensures that staff can focus more on customer service and less on system management.

Inventory Management

Square’s POS systems come equipped with robust inventory management features. These tools help businesses track stock levels, manage orders, and monitor sales trends. Users can easily sync inventory across multiple locations and sales channels. This ensures accurate stock levels and helps in making informed purchasing decisions.

| Feature | Description |

|---|---|

| Stock Tracking | Keep track of stock levels in real-time. |

| Order Management | Manage orders from multiple sales channels. |

| Sales Trends | Monitor and analyze sales trends effortlessly. |

Customer Relationship Management

Square’s POS systems offer integrated customer relationship management (CRM) tools. These tools help businesses build and maintain strong relationships with their customers. By centralizing customer data, businesses can gain valuable insights into customer preferences and behaviors. This information can be used to tailor marketing efforts and improve customer loyalty.

- Centralized Customer Data

- Insightful Customer Analytics

- Enhanced Customer Loyalty Programs

With these features, Square’s POS systems provide a comprehensive solution for businesses seeking to optimize their operations, manage inventory effectively, and foster strong customer relationships. For more information, visit the Square website.

Pricing And Affordability Of Square Financial Services

Square Financial Services offers a range of financial solutions for businesses. Understanding their pricing and affordability is crucial for making informed decisions. This section will cover Square’s transparent pricing structure, compare it with competitors, and assess its value for money.

Transparent Pricing Structure

Square provides a transparent pricing structure that helps businesses manage costs effectively. Here are some key points:

- Instant Transfers: Available for a small fee, generally within 20 minutes.

- Custom Loans: Terms based on sales, with specific conditions.

- No hidden fees or long-term contracts.

Square’s clear pricing ensures businesses know what they are paying for. This transparency builds trust and simplifies financial planning.

Comparative Analysis With Competitors

Comparing Square with other financial services can highlight its affordability. Here’s a brief comparison:

| Feature | Square | Competitor A | Competitor B |

|---|---|---|---|

| Instant Transfers | Small Fee | Higher Fee | Limited Availability |

| Custom Loans | Based on Sales | Fixed Terms | Higher Interest Rates |

| Customer Support | 24/7 | Business Hours | Limited Support |

Square’s competitive pricing and support make it a strong contender in the market.

Value For Money

Square offers significant value for money through its diverse features and services. Here’s why:

- Efficiency: Automates processes, saving time and improving productivity.

- Revenue Diversification: Opens new revenue streams and tracks profit margins.

- Quick Cash Flow: Provides instant transfers for a small fee or free next-business-day transfers.

Square’s comprehensive platform is designed to meet various business needs. Its features and services provide excellent value at a reasonable cost.

Pros And Cons Of Square Financial Services

Square Financial Services offers a range of features designed to help businesses streamline operations and boost revenue. Like any service, it comes with its own set of advantages and limitations. Understanding these can help you make an informed decision.

Advantages Based On Real-world Usage

Square is highly trusted by millions of businesses globally for its comprehensive features.

- Efficiency: Automates processes to save time and improve productivity.

- Payment Solutions: Secure payments, including click and collect, online ordering, local delivery, and shipping.

- Revenue Diversification: Offers multiple revenue streams and tracks profit margins.

- Custom Loans: Eligible customers receive customized loan offers based on sales.

- Team Management: Optimize team shifts and manage employees securely.

- Customer Insights: Centralized data increases customer loyalty and value.

Businesses can also benefit from instant transfers for quick cash flow. For a small fee, funds can be transferred within 20 minutes, or next-business-day transfers are available for free.

Square’s hardware and POS systems are designed to sell anywhere, making it easy for businesses to adapt and grow.

Potential Drawbacks And Limitations

While Square offers many benefits, there are also some limitations to consider.

- Fee for Instant Transfers: Though convenient, the fee for instant transfers can add up over time.

- Loan Repayment Terms: Minimum payment of 1/18th of the initial loan balance is required every 60 days, with full repayment within 18 months.

- Integration Complexity: Connecting Square with existing business software might require technical expertise.

Some businesses may find the fees associated with certain features to be a drawback. Additionally, while Square offers custom loans, the repayment terms and conditions may not be suitable for all businesses.

Overall, Square Financial Services provides a robust set of tools for businesses, but it is essential to weigh the pros and cons based on your specific needs.

Ideal Users And Scenarios For Square Financial Services

Square Financial Services offers tools that cater to various business needs. Understanding the ideal users and scenarios for this platform can help you leverage its features effectively. From small to medium-sized businesses to e-commerce and retail, as well as service-based industries, Square has customized solutions for all.

Small To Medium-sized Businesses

Square is perfect for small to medium-sized businesses. It helps streamline operations and improve efficiency. Here are some key features:

- Hardware and POS Systems: Designed to sell anywhere.

- Payment Solutions: Secure payments with various options.

- Operations Management: Manage multiple locations easily.

These features help businesses save time and enhance productivity. Square’s team management tools also optimize shifts and manage employees securely.

E-commerce And Retail Businesses

For e-commerce and retail businesses, Square offers extensive tools to manage online and offline sales. The platform includes:

- Inventory Management: Track profit margins and sync inventory with POS.

- Online Presence: Create branded websites for online orders.

- Advanced Reporting: Gain powerful insights for decision-making.

These features ensure seamless integration of online and physical stores, enhancing customer experience and increasing sales.

Service-based Industries

Service-based industries benefit from Square’s specialized solutions. Square provides:

- Custom-Tailored Suites: Specific products for restaurants, retail, and beauty businesses.

- Customer Insights: Increase loyalty with centralized data.

- Quick Cash Flow: Instant transfers or next-day transfers.

These tools help service providers manage bookings, track customer preferences, and ensure prompt payment processing.

Frequently Asked Questions

What Is Square Financial Services?

Square Financial Services is the banking arm of Square, Inc. It provides financial services like business loans and deposit accounts to small businesses.

How Does Square Financial Services Work?

Square Financial Services offers tailored financial products to small businesses. They evaluate business performance and offer loans, banking services, and other financial products.

Is Square Financial Services Reliable?

Yes, Square Financial Services is reliable. It’s regulated by the FDIC and offers secure and transparent financial services to businesses.

What Are The Benefits Of Using Square Financial Services?

Square Financial Services offers quick access to business loans, seamless integration with Square products, and transparent banking services for small businesses.

Conclusion

Square Financial Services offers a comprehensive solution for businesses. With features like secure payments, operations management, and customer insights, it helps streamline your business. By using Square, you can save time and improve productivity. It also offers custom loans and efficient cash flow management. Trusted by millions, Square is a solid choice for business growth. Visit the Square website for more details.