Square Finance Tools: Streamline Your Business Finances Today

Running a business requires robust tools that streamline operations and boost efficiency. Square Finance Tools is designed to do just that.

Square offers a comprehensive software and hardware platform that supports various business needs. Trusted by millions globally, Square helps businesses work smarter and automate tasks. Whether you run a restaurant, retail store, or beauty salon, Square has custom solutions to fit your needs. With features like secure payments, advanced reporting, and team management, Square ensures your business runs smoothly. Discover how Square can simplify your operations and enhance growth with seamless and secure financial tools. Visit Square to learn more and see how it can benefit your business today.

Introduction To Square Finance Tools

Square offers a comprehensive suite of finance tools designed to help businesses streamline operations and optimize revenue. These tools are trusted by millions of businesses globally. They offer secure payment solutions, operational management, and advanced reporting.

Overview And Purpose

The purpose of Square Finance Tools is to provide businesses with a robust platform to manage all aspects of their operations efficiently. Square’s tools include hardware and POS systems for seamless sales, secure payment processing, team management, and customer insights. They also offer instant transfers and custom loans.

| Main Features | Description |

|---|---|

| Hardware and POS Systems | Enable sales anywhere, securely and efficiently. |

| Secure Payments | Accept payments both in-person and online. |

| Operational Management | Manage multiple locations, sales channels, and employees. |

| Instant Transfers | Transfer funds instantly for a small fee or for free the next business day. |

| Custom Loans | Offer customized loan options based on sales data. |

| Team Management | Optimize and manage team shifts securely. |

| Customer Insights | Centralize data to increase customer loyalty. |

| Advanced Reporting | Access powerful data for decision-making. |

Target Audience

Square Finance Tools are designed for small to medium-sized businesses. They cater to various industries, including restaurants, retail, and beauty businesses. These tools are ideal for business owners who seek efficient operations, secure payment options, and avenues for growth.

Businesses that benefit most from Square include:

- Restaurants needing specialized solutions.

- Retail stores requiring operational management.

- Beauty businesses seeking customer insights and loyalty programs.

With 24/7 support and a community of business owners, Square provides the tools and assistance needed for business success.

Key Features Of Square Finance Tools

Square offers a wide range of finance tools designed to simplify business operations. These tools help businesses manage their finances efficiently and securely. Here are the key features of Square Finance Tools:

Integrated Payment Processing

Square’s Integrated Payment Processing enables businesses to accept payments securely, whether in-person or online. The system supports various payment methods, including credit cards, debit cards, and mobile payments. This feature ensures seamless transactions, helping businesses get paid faster.

| Payment Methods | Security | Speed |

|---|---|---|

| Credit Cards, Debit Cards, Mobile Payments | High-Level Encryption | Instant Transfers Available |

Automated Invoicing

With Automated Invoicing, Square allows businesses to create and send invoices quickly. The system can schedule recurring invoices and send reminders for overdue payments. This feature saves time and reduces manual invoicing errors.

- Create and send invoices easily

- Schedule recurring invoices

- Send payment reminders

Expense Tracking

Expense Tracking in Square helps businesses keep track of their spending. Users can categorize expenses, attach receipts, and monitor their budget. This feature provides a clear view of financial health, making it easier to manage cash flow.

- Categorize expenses

- Attach receipts

- Monitor budget

Financial Reporting

Square’s Financial Reporting offers advanced reporting tools. Businesses can access detailed reports on sales, expenses, and profits. These insights help in making informed decisions and optimizing business operations.

- Sales Reports

- Expense Reports

- Profit Analysis

Mobile Accessibility

With Mobile Accessibility, Square allows businesses to manage their finances on-the-go. The Square app provides access to all the features from a mobile device. This ensures that business owners can stay connected and in control, no matter where they are.

- Access features from mobile devices

- Manage finances on-the-go

- Stay connected and in control

Square Finance Tools offer a comprehensive solution for businesses. They provide secure and efficient ways to manage payments, invoicing, expenses, and reporting, all with the convenience of mobile accessibility.

Pricing And Affordability

Square Finance Tools offer various pricing plans that cater to different business needs. Understanding the cost and value of these tools is crucial. Let’s explore the Subscription Plans, Cost vs. Value Analysis, and the Free vs. Paid Features.

Subscription Plans

Square offers several subscription plans designed to fit businesses of all sizes. Below is a table summarizing the available plans:

| Plan | Features | Price |

|---|---|---|

| Free Plan |

|

$0/month |

| Professional Plan |

|

$20/month |

| Premium Plan |

|

$50/month |

Cost Vs. Value Analysis

When choosing a plan, it’s important to consider the cost vs. value. For instance, the Free Plan is great for small businesses starting out. It offers essential features like secure payments and basic reporting at no cost.

The Professional Plan adds advanced reporting and team management. These features can help businesses optimize operations and make informed decisions. The additional $20 per month is a small investment for the value provided.

For larger businesses, the Premium Plan offers custom loans and instant transfers. These features can significantly improve cash flow and financial management. The $50 per month is justified by the comprehensive benefits.

Free Vs. Paid Features

Understanding the difference between free and paid features can help businesses decide which plan is right for them.

- Free Features: Secure payments, basic reporting, customer insights.

- Paid Features: Advanced reporting, team management, custom loans, instant transfers.

Businesses can start with the Free Plan and upgrade as their needs grow. This flexibility ensures that they only pay for the features they need.

Pros And Cons Of Using Square Finance Tools

Square Finance Tools offers a comprehensive suite of features that can benefit many businesses. It’s crucial to understand the pros and cons before integrating these tools into your operations. Below, we delve into the advantages and potential drawbacks of using Square Finance Tools.

Advantages For Small Businesses

Square Finance Tools provides several benefits for small businesses. Here are some key advantages:

- Efficiency: Streamline operations and improve your bottom line with advanced reporting and operational management.

- Flexibility: Sell anywhere, anytime with secure and versatile payment options including hardware and POS systems.

- Growth: Increase revenue through new sales channels and optimized operations, with tools like inventory management and revenue diversification.

- Support: Access 24/7 product support and a community of business owners for shared insights and advice.

- Customization: Tailored solutions to meet specific business needs, such as custom loans and team management.

Square also offers specialized solutions for restaurants, retail, and beauty businesses, ensuring that your specific industry needs are met.

Potential Drawbacks

While Square Finance Tools offers many benefits, there are some potential drawbacks to consider:

- Cost: Instant transfers come with a fee, although next-business-day transfers are free.

- Loan Terms: Custom loan offers come with specific terms and conditions that may not suit all businesses.

- Complexity: The comprehensive suite of features may be overwhelming for some users, requiring time to fully understand and utilize.

Additionally, integrating Square Finance Tools with existing business software or websites might require technical expertise, which could be a challenge for some business owners.

Ideal Users And Use Cases

Square offers a comprehensive suite of tools designed to meet the diverse needs of businesses. From small business owners to freelancers and e-commerce enterprises, Square has something for everyone. Below, we explore the ideal users and specific use cases for Square’s versatile financial tools.

Small Business Owners

Square is a perfect fit for small business owners who need reliable and scalable solutions. Whether you’re running a retail store, a restaurant, or a beauty salon, Square has you covered. The hardware and POS systems allow seamless sales both in-person and online.

- Secure Payments: Accept payments securely.

- Operational Management: Manage multiple locations and sales channels.

- Instant Transfers: Receive funds instantly for a small fee.

- Team Management: Optimize and manage team shifts securely.

These features ensure that small business owners can focus on growing their business while Square handles the operational complexities.

Freelancers And Contractors

Freelancers and contractors need flexible financial tools, and Square delivers just that. The platform offers custom loans based on Square sales, which can be a lifesaver for independent workers.

- Secure Payments: Accept payments from anywhere.

- Instant Transfers: Get paid instantly.

- Advanced Reporting: Access detailed financial reports.

These features make it easier for freelancers and contractors to manage their finances and focus on their work.

E-commerce Businesses

For e-commerce businesses, Square provides a range of solutions to streamline operations. The platform supports secure online payments and offers advanced inventory management and reporting tools.

- Secure Payments: Ensure secure online transactions.

- Customer Insights: Increase customer loyalty with data and insights.

- Revenue Diversification: Open new sales channels.

These tools help e-commerce businesses grow their revenue and improve operational efficiency.

Frequently Asked Questions

What Are Square Finance Tools?

Square Finance Tools are a suite of financial management tools. They help businesses manage invoicing, payroll, and payments efficiently.

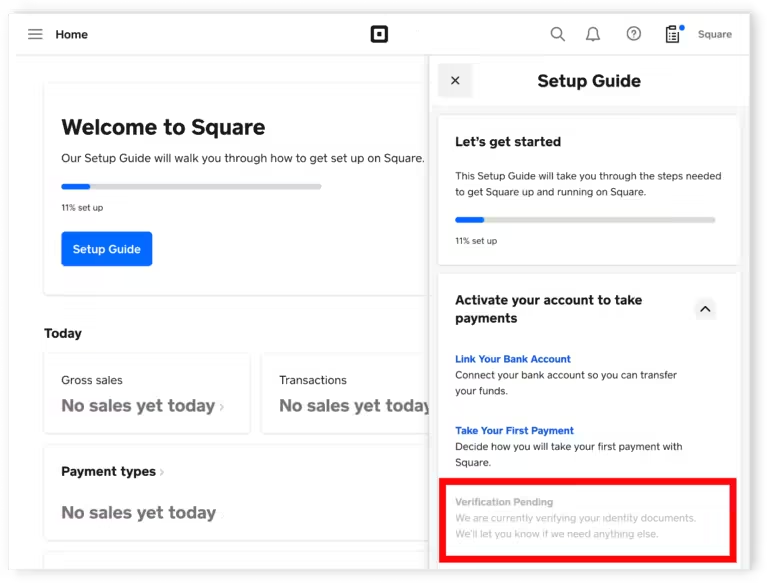

How Can I Use Square Finance Tools?

You can use Square Finance Tools by signing up on their website. Once registered, you can access various tools to streamline your finances.

Are Square Finance Tools Free To Use?

Square Finance Tools offer both free and paid options. Free tools include basic invoicing and payment processing. Advanced features require a subscription.

Can Square Finance Tools Help With Payroll?

Yes, Square Finance Tools include payroll management. This feature helps businesses manage employee payments and tax filings.

Conclusion

Square offers versatile tools to streamline your business operations. From secure payments to advanced reporting, Square provides solutions to boost efficiency and growth. Manage sales, inventory, and teams effortlessly. Optimize your business with tailored tools designed for success. Explore more at Square.