Square Checkout Process: Streamline Your Sales Effortlessly

Efficient payment processing is crucial for any business. Square offers a streamlined checkout process that enhances the customer experience and boosts operational efficiency.

Understanding the Square checkout process can transform how you manage transactions. Whether you run a retail store, a restaurant, or a beauty salon, Square’s comprehensive platform provides secure payment options, seamless point-of-sale systems, and various business management tools. Trusted by millions globally, Square helps businesses handle payments anywhere, manage orders, and engage customers better. With features like instant transfers, advanced reporting, and team management, Square ensures you have everything needed to run your business smoothly. Dive into the details of the Square checkout process to see how it can simplify your operations and support your growth. For more information, visit Square.

Introduction To Square Checkout Process

The Square Checkout Process is a comprehensive solution for businesses looking to streamline their payment and operational needs. With a focus on efficiency, security, and ease of use, Square Checkout offers a seamless experience for both businesses and their customers.

Overview Of Square Checkout

Square Checkout is a part of the Square platform, which includes a range of tools designed to help businesses manage their operations. Trusted by millions globally, Square Checkout supports secure payments, Point of Sale (POS) systems, and various business management tools. The hardware and software are designed to integrate seamlessly, making sales quick and easy.

Square’s Payment Solutions allow businesses to process payments securely, no matter where their customers are. This includes options for click and collect, online ordering, local delivery, and shipping. The platform is versatile, catering to restaurants, retail, and beauty businesses with custom solutions.

Purpose And Benefits Of Using Square Checkout

The primary purpose of Square Checkout is to streamline business operations and enhance efficiency. By integrating various functions into one platform, businesses can manage their sales, inventory, and customer data more effectively.

Key Benefits include:

- Efficiency and Automation: Improve the bottom line through streamlined operations and automation.

- Customization: Tailored solutions for different types of businesses.

- Ease of Use: Manage various software through a single system.

- Financial Flexibility: Quick access to funds with instant transfers and personalized loan options.

- Enhanced Customer Engagement: Centralized data to boost customer loyalty.

- Comprehensive Support: Round-the-clock product support and a community of business owners.

Additionally, Square offers advanced reporting tools to help businesses make confident decisions based on powerful data insights. This can lead to new revenue streams and better inventory and profit margin management.

Key Features Of Square Checkout

Square Checkout offers a range of features designed to enhance the payment experience for both businesses and their customers. These features help streamline operations, ensure secure transactions, and provide flexibility in payment options.

The Square Checkout interface is designed for simplicity and ease of use. Businesses can set up the system quickly and start accepting payments without a steep learning curve. The intuitive design ensures that both staff and customers can navigate the checkout process effortlessly.

Square Checkout is optimized for mobile devices, allowing businesses to accept payments on-the-go. Whether you are at a pop-up shop, a farmer’s market, or a customer’s home, you can process transactions seamlessly using a smartphone or tablet. This flexibility helps businesses cater to customers wherever they are.

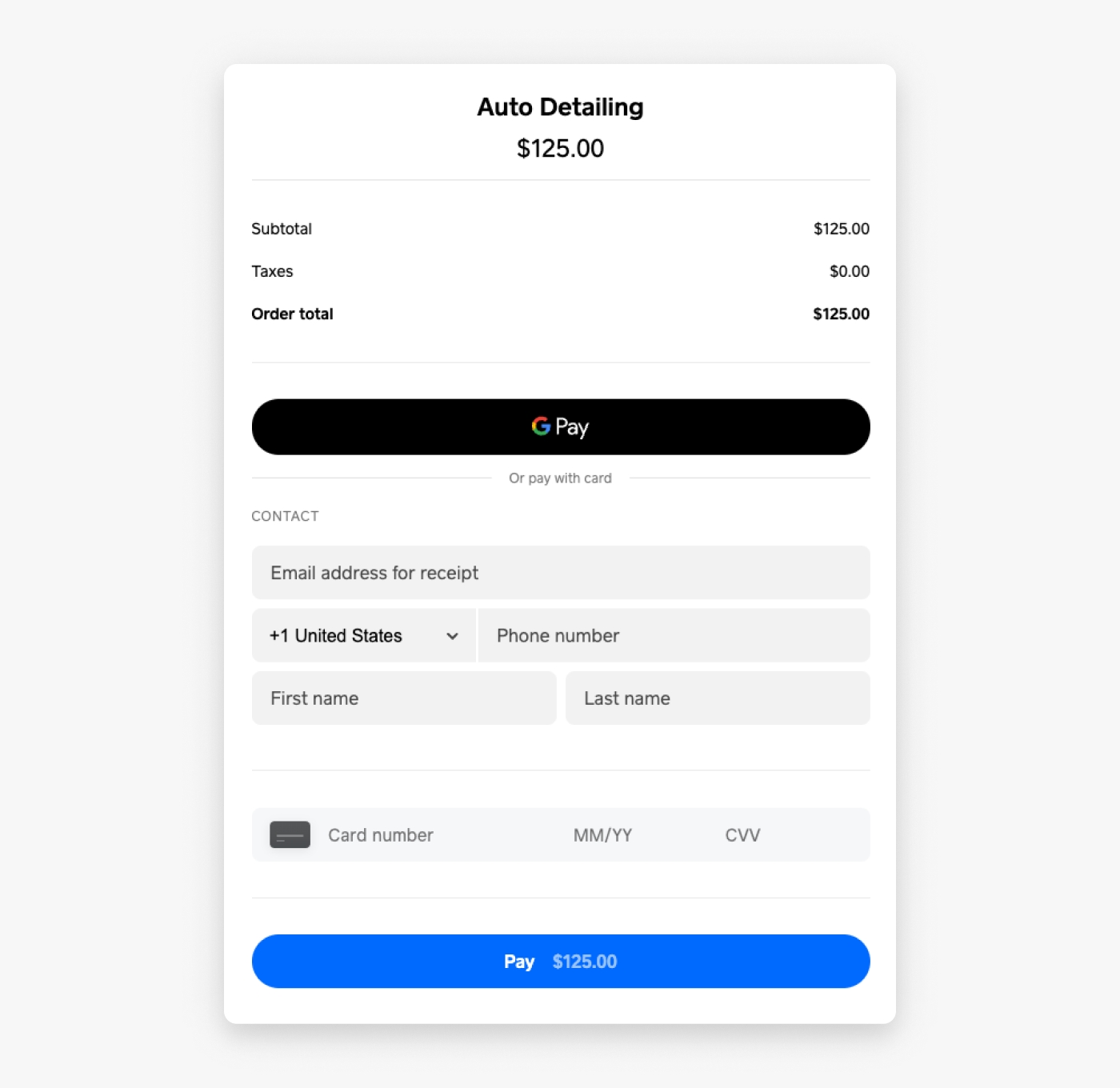

Square Checkout supports a variety of payment methods to meet customer preferences. Businesses can accept credit and debit cards, mobile payments, and even gift cards. The system also allows for customizable payment flows, enabling businesses to create a checkout experience that fits their unique needs.

Security is a top priority for Square. The platform uses advanced encryption and tokenization to protect sensitive payment information. Regular security updates ensure that transactions remain secure, giving both businesses and customers peace of mind.

Square Checkout seamlessly integrates with other Square tools, creating a unified system for managing various aspects of a business. From POS systems to team management and advanced reporting, businesses can streamline their operations and enhance efficiency. This integration helps businesses keep all their data centralized and easily accessible.

For more information, visit Square’s official website.

User-friendly Interface

The Square checkout process is renowned for its user-friendly interface. It is designed to be simple and efficient, making it easy for businesses of all types to navigate and use. Whether you are a small business owner or managing a large enterprise, the intuitive design and ease of use ensure a seamless experience.

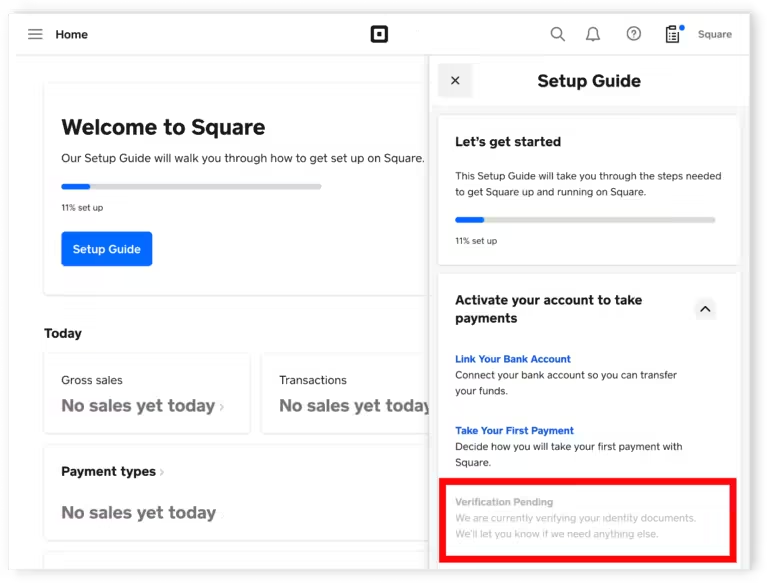

Ease Of Setup And Navigation

Setting up Square is incredibly straightforward. Here’s what you need to know:

- Quick Installation: The hardware and POS systems are designed for fast and easy installation.

- Guided Instructions: Step-by-step guides make the setup process foolproof.

- Seamless Integration: Easily integrate with other business software using Square’s APIs.

Navigation is equally simple, with a clear and logical layout that allows users to find what they need quickly. The menus are intuitive, and the user interface is designed to minimize the learning curve.

Intuitive Design For Quick Transactions

The design of Square’s checkout process focuses on speed and efficiency. Key features include:

- Streamlined Interface: The interface is clean and uncluttered, making it easy to process transactions quickly.

- Quick Access: Frequently used functions are easily accessible, reducing the time spent on each transaction.

- Responsive Design: The system works seamlessly across different devices, ensuring a consistent experience.

This intuitive design ensures that transactions are processed swiftly, enhancing the overall customer experience and allowing businesses to serve more customers efficiently.

Mobile Compatibility

Square ensures that its checkout process is fully compatible with mobile devices. This feature is essential for businesses that want to provide a seamless customer experience, no matter where the transaction takes place.

Seamless Functionality On Mobile Devices

Square’s mobile compatibility ensures that the checkout process is smooth and quick on any device. Whether using a smartphone or tablet, customers can easily navigate through the payment steps.

Key Features:

- Responsive Design: The interface adapts to any screen size.

- Quick Access: Fast load times ensure minimal wait for customers.

- Secure Payments: End-to-end encryption keeps transactions safe.

Businesses benefit from this adaptability, ensuring sales are not missed due to device limitations. Square’s mobile checkout is designed to be user-friendly, making it easy for customers to complete their purchases.

Benefits Of Mobile Checkout For On-the-go Sales

Mobile checkout provides several advantages for businesses that operate in various environments. Here are some key benefits:

- Increased Sales: Customers can make purchases anytime, anywhere.

- Convenience: Simplifies transactions for both customers and staff.

- Flexibility: Suitable for events, pop-up shops, and mobile businesses.

- Enhanced Customer Experience: Reduces wait times and improves satisfaction.

With Square’s mobile compatibility, businesses can manage sales effectively on the go. This feature helps in capturing sales opportunities that might otherwise be lost.

Square also offers other benefits such as:

| Benefit | Description |

|---|---|

| Efficiency and Automation | Streamline operations and automate tasks to improve efficiency. |

| Financial Flexibility | Quick access to funds and personalized loan options. |

| Comprehensive Support | Round-the-clock support and a community of business owners. |

These features make Square an ideal choice for businesses looking to enhance their mobile checkout capabilities and overall efficiency.

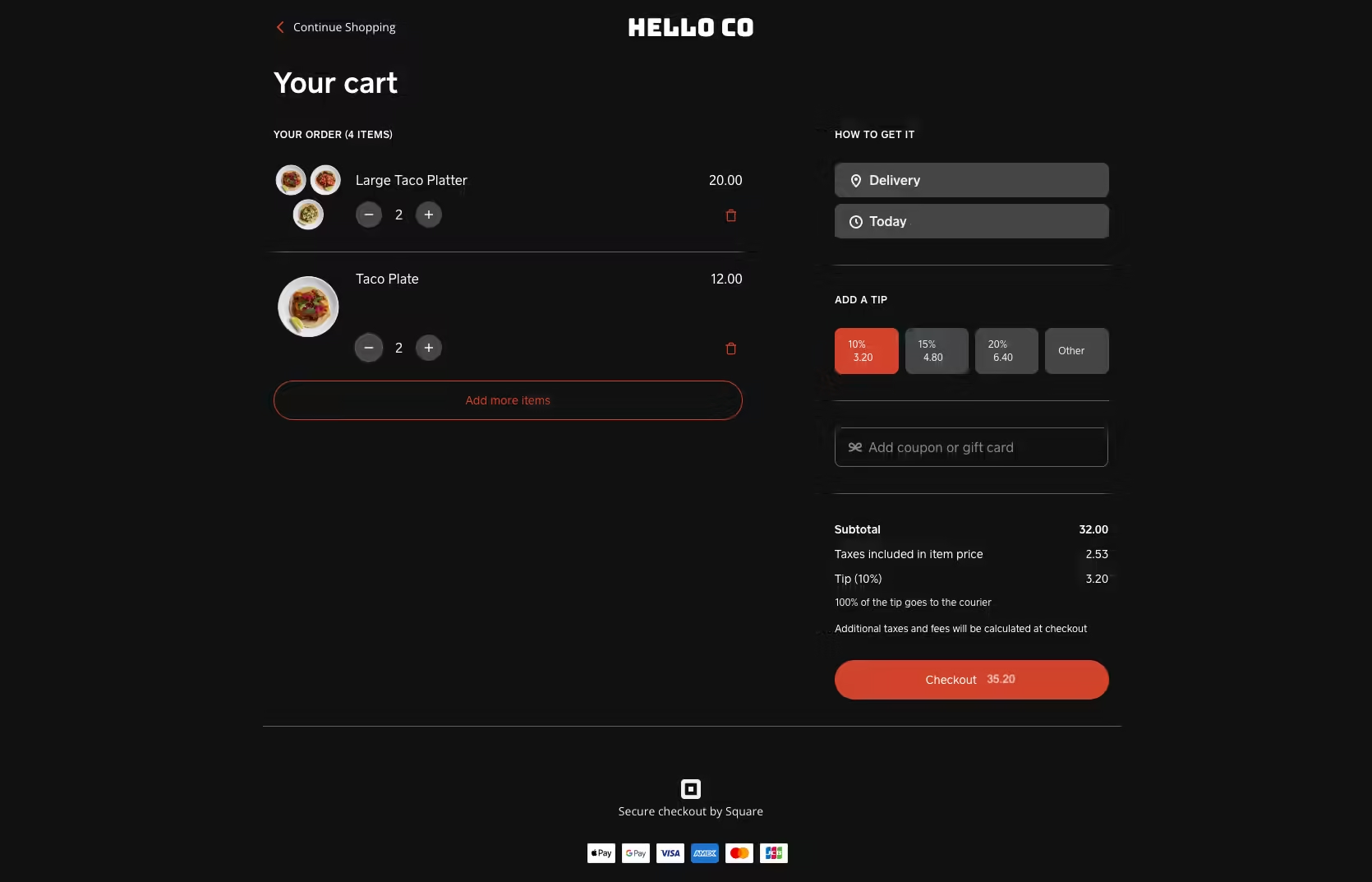

Customizable Payment Options

Square offers a variety of customizable payment options designed to suit the needs of any business. These options enhance user experience and ensure businesses can cater to their customers’ preferences. Whether you run a restaurant, retail shop, or beauty salon, Square’s payment solutions are tailored to fit your needs.

Multiple Payment Methods Supported

Square supports an array of payment methods, making it easy for customers to pay the way they prefer. The system accepts:

- Credit and Debit Cards

- Contactless Payments (Apple Pay, Google Pay)

- Gift Cards

- Bank Transfers

- Installment Payments

This flexibility ensures that no sale is lost due to payment method limitations. By supporting multiple payment methods, businesses can enhance customer satisfaction and boost sales.

Personalizing The Checkout Experience

Square allows businesses to personalize the checkout experience, making transactions smooth and engaging for customers. Here are some ways to customize:

- Branded Receipts: Add your business logo and custom messages to receipts.

- Custom Fields: Collect additional customer information during checkout.

- Flexible Discounts: Apply discounts and promotions directly at checkout.

- Tip Options: Enable tipping for services with customizable tip amounts.

- Multi-language Support: Offer checkout in different languages for a better customer experience.

These personalized touches not only enhance the customer experience but also provide valuable insights for the business. With Square, each transaction becomes an opportunity to connect with customers and build loyalty.

Secure Transactions

Ensuring the security of transactions is crucial for any business. With Square, you can trust that your payments are processed securely. This system incorporates advanced security features, protects customer data, and ensures payment information remains confidential.

Advanced Security Features

Square employs cutting-edge technology to keep transactions secure. Here are some key features:

- End-to-End Encryption: Data is encrypted from the moment it is entered.

- EMV Chip Card Compliance: Support for chip cards to prevent fraud.

- Tokenization: Replaces sensitive data with unique identifiers.

- PCI Compliance: Adheres to industry standards for secure transactions.

Protecting Customer Data And Payment Information

Square takes the protection of customer data very seriously. Here’s how:

- Secure Storage: Customer data is stored securely and encrypted.

- Access Controls: Only authorized personnel can access sensitive information.

- Regular Audits: Conducts regular security audits to ensure compliance.

- Fraud Prevention Tools: Monitors transactions for suspicious activity and potential fraud.

By utilizing these advanced features, Square ensures that both businesses and customers can trust their transactions are safe. This commitment to security helps build trust and protects the integrity of your business.

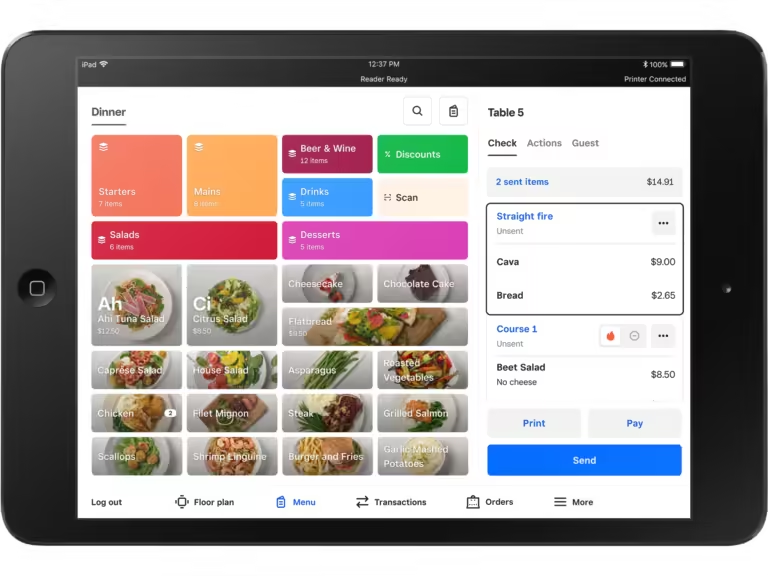

Integration With Other Square Tools

Square’s checkout process seamlessly integrates with other Square tools, creating a unified and efficient system for businesses. This integration allows businesses to streamline operations, manage tools efficiently, and enhance overall performance.

Streamlined Operations With Square Ecosystem

The Square ecosystem offers a comprehensive suite of tools that work together effortlessly. This integration ensures that all aspects of the business, from point of sale systems to order management, operate smoothly.

- Hardware and POS Systems: Quick and seamless sales.

- Payment Solutions: Secure processing, anywhere customers are.

- Order Management: Options for click and collect, online ordering, local delivery, and shipping.

Integrating these tools allows businesses to handle multiple locations and sales channels without hassle. This ensures operational efficiency and a better customer experience.

Benefits Of Unified Tool Management

A unified tool management system offers numerous benefits. Businesses can integrate and manage different software through one system, which simplifies processes and enhances efficiency.

| Benefit | Description |

|---|---|

| Efficiency and Automation | Improves business efficiency through streamlined operations and automation. |

| Customization | Custom solutions for various business types. |

| Financial Flexibility | Quick access to funds and personalized loan options. |

| Enhanced Customer Engagement | Centralized customer insights to boost loyalty and value. |

With advanced reporting, businesses can access powerful data for confident decision-making. This helps in managing inventory, profit margins, and opening new revenue streams.

Square also offers round-the-clock support and a community of business owners, ensuring businesses have access to help whenever needed.

Overall, the integration of Square tools provides a seamless and efficient solution for businesses, enhancing their ability to operate smoothly and effectively.

Pricing And Affordability

Understanding the pricing and affordability of Square’s checkout process is essential for businesses. Square offers a transparent and competitive pricing structure designed to fit various business needs. Let’s dive into the specifics to see how Square compares to its competitors.

Cost Breakdown Of Square Checkout Services

Square’s pricing model is straightforward with no hidden fees. Here’s a detailed breakdown:

| Service | Cost |

|---|---|

| Instant Transfers | Small fee applies, funds available within 20 minutes, minimum £15 and maximum £3,500 per day |

| Loans | Custom loan offers based on Square sales, with repayment terms and conditions |

Square offers instant transfers for a small fee, making funds available within 20 minutes. The minimum amount for instant transfers is £15, and the maximum is £3,500 per day. For businesses needing financial flexibility, Square provides custom loan offers based on sales, with specific repayment terms.

Comparing Value With Competitors

When comparing Square’s pricing with competitors, several factors stand out. Here’s a comparison:

- Transparent Pricing: Square’s fees are clear with no hidden charges.

- Instant Transfers: Available for a small fee, providing quick access to funds.

- Custom Loans: Tailored offers based on sales, with flexible repayment terms.

- Comprehensive Features: Includes hardware, POS systems, and various business management tools.

Unlike many competitors, Square offers a comprehensive suite of services, including hardware and POS systems, payment solutions, and order management. This all-in-one approach can save businesses time and money, making Square a valuable choice.

Square’s cash flow management options, such as instant transfers and custom loans, provide businesses with the financial flexibility they need. Additionally, the team management and customer engagement tools enhance operational efficiency and customer loyalty.

Overall, Square offers a cost-effective and feature-rich solution for businesses looking to streamline their operations and enhance their checkout process. For more details, visit Square’s website.

Pros And Cons Of Square Checkout

Square Checkout is a well-rounded platform offering secure payment solutions, POS systems, and business management tools. Trusted by millions of businesses globally, it supports a wide range of operations. However, like any platform, it has its strengths and weaknesses. Let’s explore the advantages and potential drawbacks of using Square Checkout.

Advantages Of Using Square Checkout

Square Checkout offers several key advantages for businesses of all sizes:

- Ease of Use: The system is designed to be user-friendly and easy to integrate with other software, making it simple for businesses to start using it quickly.

- Comprehensive Support: Round-the-clock product support and a community of business owners ensure that help is always available.

- Secure Payments: Square provides secure payment processing options, ensuring the safety of customer transactions.

- Custom Solutions: Tailored product suites are available for specific business types like restaurants, retail, and beauty businesses.

- Financial Flexibility: Quick access to funds through instant transfers and personalized loan options helps businesses manage cash flow effectively.

- Enhanced Customer Engagement: Centralized customer insights boost loyalty and customer value.

- Advanced Reporting: Access to powerful data helps businesses make confident decisions.

- Diverse Revenue Streams: Square helps businesses open new revenue streams and manage inventory and profit margins efficiently.

Potential Drawbacks And Limitations

While Square Checkout has many benefits, there are also some limitations to consider:

- Transaction Fees: Square charges a small fee for instant transfers, which may add up for businesses with high transaction volumes.

- Loan Eligibility: Custom loan offers are based on Square sales, and eligibility is not guaranteed, depending on various factors.

- Hardware Costs: The initial cost of purchasing hardware and POS systems can be a significant investment for small businesses.

- Refund Policies: Loan terms and conditions are strict, with specific repayment requirements that may not suit all businesses.

Despite these limitations, Square Checkout remains a popular choice for its comprehensive features and ease of use.

Recommendations For Ideal Users

Square is an excellent choice for businesses seeking a robust platform for payment processing and operations management. It supports a wide range of businesses, from small retail stores to large restaurants. With its ease of use, customization options, and comprehensive support, Square is a valuable asset for enhancing business efficiency and customer engagement.

Best Use Cases For Small Businesses

Small businesses can benefit significantly from Square’s versatile tools. Here are some ideal scenarios:

- Retail Shops: Manage sales, inventory, and customer data seamlessly.

- Restaurants: Streamline orders, reservations, and deliveries.

- Beauty Salons: Book appointments, manage team schedules, and process payments.

Square’s hardware and POS systems are designed for quick and easy sales, making it perfect for businesses with a high customer turnover.

Scenarios Where Square Checkout Excels

Square Checkout shines in various scenarios due to its comprehensive features:

- Mobile Payments: Securely process payments on the go.

- Multi-location Management: Streamline operations across different locations.

- Custom Loan Offers: Access funds quickly to support business growth.

Businesses can also benefit from advanced reporting tools that provide powerful data for better decision-making. The centralized customer insights help boost loyalty and value, further enhancing the customer experience.

For more details, visit the Square website or contact their customer support.

Frequently Asked Questions

What Is Square Checkout?

Square Checkout is a streamlined payment solution. It helps businesses process transactions quickly and securely, both online and in-store.

How To Set Up Square Checkout?

To set up Square Checkout, create an account on Square’s website. Follow the prompts to link your bank account.

Is Square Checkout Secure?

Yes, Square Checkout is secure. It uses encryption and tokenization to protect sensitive customer data during transactions.

Does Square Checkout Support Multiple Payment Methods?

Yes, Square Checkout supports various payment methods. These include credit cards, debit cards, and mobile payments like Apple Pay.

Conclusion

Square makes checkout smooth and simple for businesses of all sizes. It’s trusted globally for secure payments and efficient operations. With Square, businesses can manage orders, streamline operations, and engage customers. It offers a range of hardware, POS systems, and custom solutions for various industries. Financial flexibility and advanced reporting are key benefits. Interested in learning more? Visit Square for details. Enhance your business with Square’s comprehensive platform today!